Back to September 2025 Industry Update

September 2025 Industry Update: Intermodal

Rail volumes rebounded slightly in August following declines in July, while rates remain historically low.

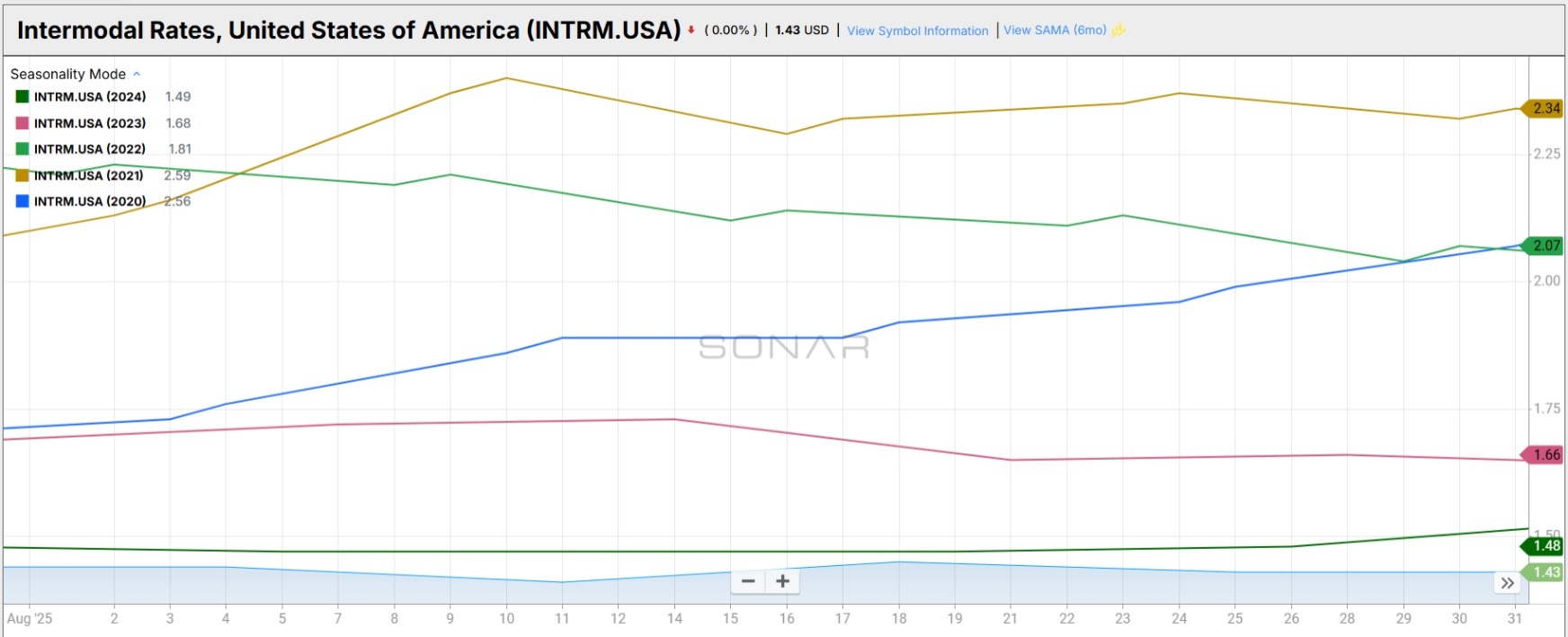

Spot Rates

Key Points

- The FreightWaves SONAR Intermodal Rates Index (INTRM.USA), which measures the average weekly all-in door-to-door spot rate for 53’ dry vans across most origin-destination pairings, declined 3.3% MoM, or $0.05, to $1.43 in August.

- Compared to August 2024, average intermodal spot rates were down 2.7% and were 24.7% below the 5-year average.

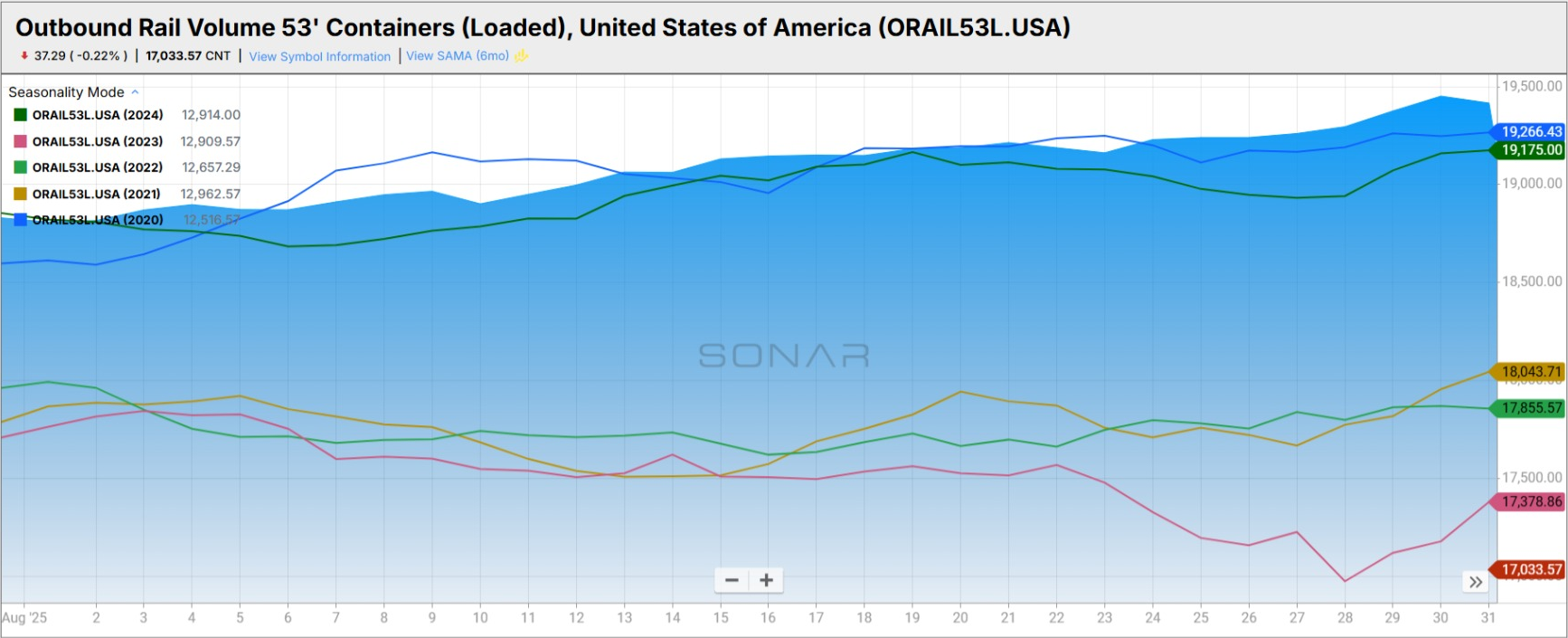

Volumes

Key Points

- Total average loaded volumes for 53’ containers for all domestic markets, measured by the FreightWaves SONAR Loaded Outbound Rail Volume Index (ORAIL53L.USA), increased 7.4% MoM, rising from 17,777.33 in July to 19,095.14 in August.

- Average loaded domestic rail volumes for 53’ containers in August were up 0.8% YoY compared to August 2024 and were 4.9% above the 5-year average.

Intermodal Summary

Following a mixed performance in June and an overall decline in July, rail activity regained momentum in August, with both intermodal and carload volumes posting modest gains. According to the latest Rail Industry Overview from the Association of American Railroads (AAR), intermodal shipments rose 0.5% YoY compared with August 2024. While the annual increase was modest, average weekly intermodal originations totaled 286,316 containers and trailers — the highest monthly level since May 2021 and the strongest August performance since 2018. YTD shipments through August reached 9.47 million units, up 4.1% YoY, ranking as the third-highest total on record behind the first eight months of 2021 and 2018.

Carload activity also improved, with U.S. rail carloads rising 0.7% YoY in August, marking the sixth consecutive month of annual growth. Eleven of the 20 major carload categories tracked by the AAR recorded increases, led by steel, coal and grain mills. Average weekly carload originations totaled 230,184 units, the highest for any month since October 2022. YTD carload volumes were up 2.5% YoY, or nearly 192,000 units, compared with the same period in 2024.

Despite the rebound in volumes, rail pricing continued to trend near historically low levels. Intermodal spot rates declined sharply in August relative to July, while contract rates edged higher but remained within the narrow $1.50–$1.75 range that has prevailed for most of the past two years. At $1.60, average intermodal contract rates were up $0.03 MoM and $0.05 YoY compared to August 2024. However, spot rates remained 3.8% below the five-year average, underscoring continued weakness in transactional pricing. The sustained softness in spot rates indicates little incentive for carriers to actively protect contracted capacity, despite the moderate recovery in demand.