Back to September 2025 Industry Update

September 2025 Industry Update: Fuel Prices

Average fuel prices declined as concerns of excess global supply outweigh any potential near-term demand shocks.

Key Points

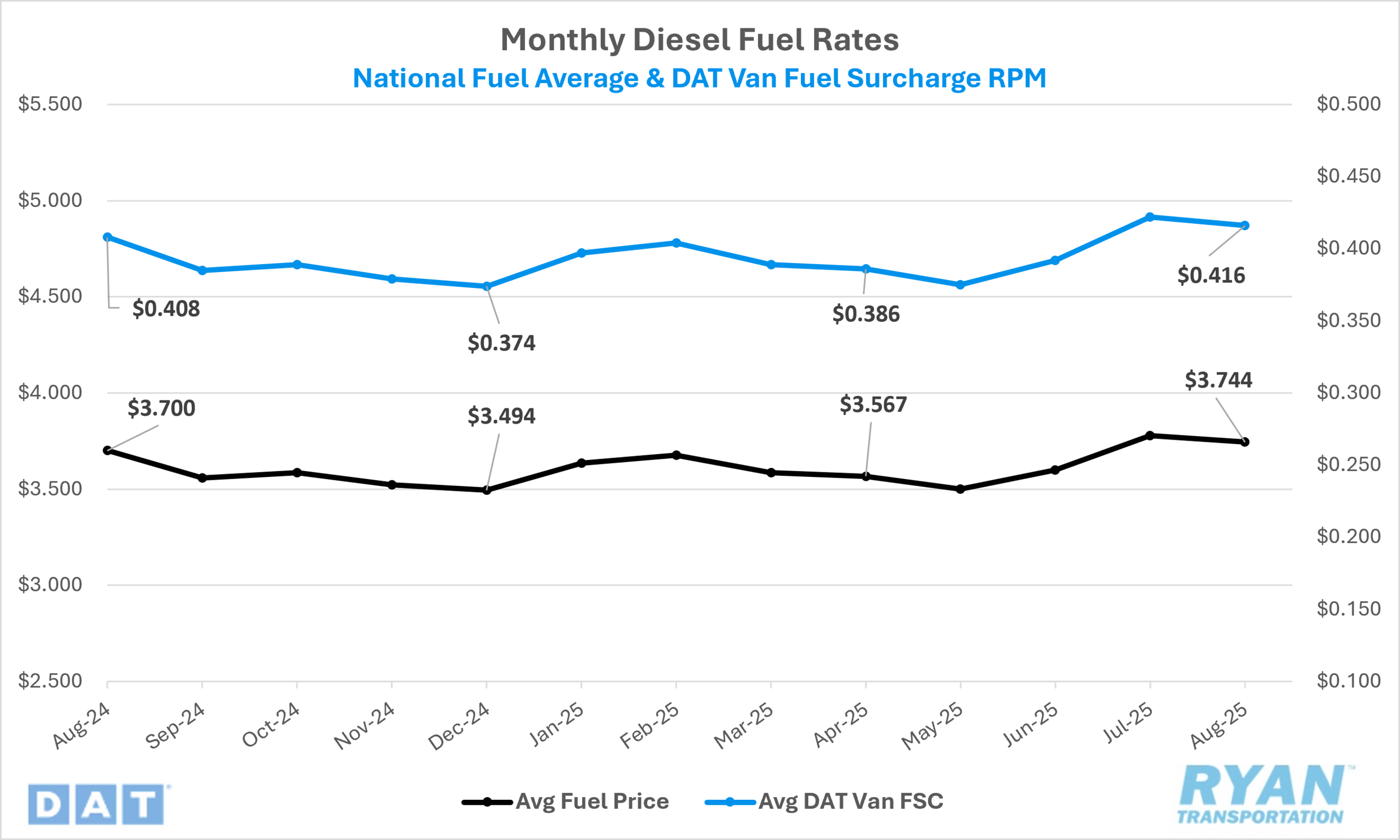

- The national average price of diesel fell in August by 0.9% MoM, or $0.035, to $3.744.

- Compared to August 2024, diesel prices were up 1.2% YoY, or just over $0.04.

- Draws on U.S. Commercial Crude Inventories outpaced builds in August, with inventories falling by just shy of 6.0M bbls and outpaced the -5.2M bbls consensus for the weeks ending August 1 and August 29.

Summary

After rising in June and July and breaking a three-month streak of declines, the national average price of diesel retreated in August, falling by just under $0.04 MoM. Despite the decline, annual comparisons turned positive for the first time since February 2023, with prices averaging just over $0.04 higher YoY.

On a weekly basis, the Department of Energy (DOE)/Energy Information Administration (EIA) benchmark diesel price posted consistent declines throughout the month. Following steady increases in July — before closing the month just 0.7 cents lower WoW — average diesel prices registered five consecutive weekly declines in August, dropping a cumulative $0.10 to end the month at $3.708 per gallon. The bulk of the decline occurred during the second and third weeks, when prices fell a combined $0.087.

Despite the pullback, retail diesel prices remain elevated compared to levels observed earlier in the year. Excluding the more than $0.20 WoW spike in mid-June that pushed prices to $3.775 per gallon, the late-August average was the highest since January 20, when prices reached $3.715.

Why It Matters

The steady decline in diesel prices in August reflected a return to the underlying weakness in global oil market fundamentals. Similar to July, price movements were driven less by swings in crude benchmarks and more by diesel-specific market dynamics. In July, ultra-low sulfur diesel (ULSD) prices on the CME Commodity Exchange surged nearly 23% between June 2 and July 21, compared with a 7% gain in benchmark crude. Much of that strength stemmed from concerns over tightening global diesel inventories, which pushed futures into backwardation — a structure in which near-term prices trade higher than deferred contracts. Toward the end of June and through most of July, the first-month ULSD contract traded $0.06–$0.07 above the second month. By early August, however, that spread had narrowed to just $0.007 following reports that U.S. stockpiles of non-jet distillates had risen by nearly 11M bbls over three weeks, reaching their highest level since March.

Additional downward pressure on fuel prices came from signals of oversupply. In a letter to shareholders, the CEO of Diamondback Energy, one of the largest producers in the Permian Basin, suggested that the likelihood of a demand shock had largely dissipated, leaving the market facing a considerable supply glut. This sentiment was reinforced by OPEC+ announcing it would raise production by 547,000 barrels per day beginning in August, the latest step in unwinding the more than 2 million barrels per day of cuts implemented since 2023. While concerns of oversupply have grown, the anticipated influx of crude from OPEC+ has yet to fully materialize in reported data, helping keep fuel prices relatively stable despite the broader bearish backdrop.