Back to September 2025 Industry Update

September 2025 Industry Update: Flatbed

Marginal boosts in industrial-related shipping activity were insufficient to prevent further deterioration in flatbed conditions, due to ongoing weakness in residential construction and agricultural commodities.

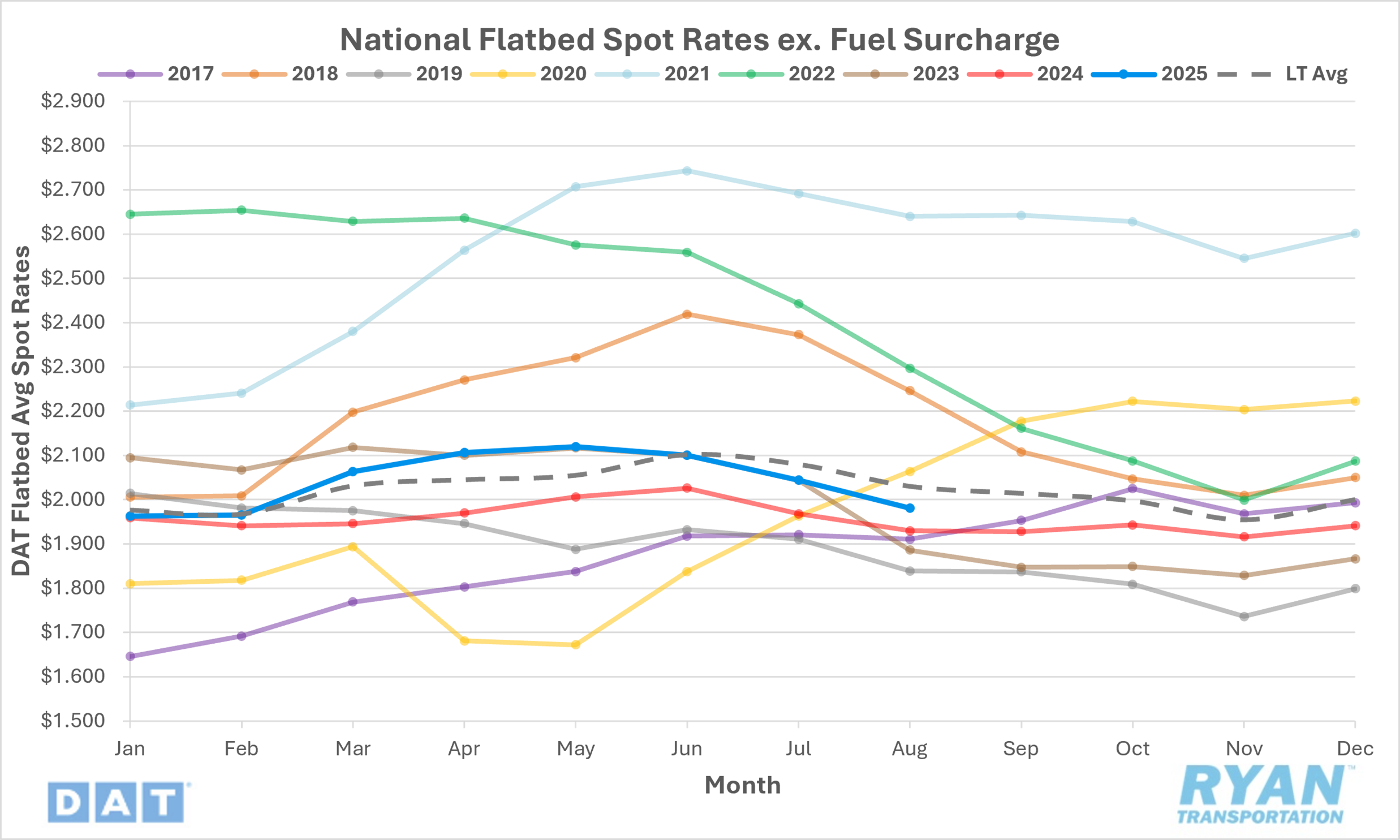

Spot Rates

Key Points

- The national average flatbed spot rate, excluding fuel, declined 3.1% MoM, or just over $0.06, to $1.98 in August.

- Annual comparisons of average flatbed spot linehaul rates reflected a 2.6% increase YoY compared to August 2024 but remained below the LT average by 2.5%.

- Initially reported average flatbed contract rates, exclusive of a fuel surcharge, registered a 0.3% MoM increase in August and were flat YoY with levels recorded during the same month in 2024.

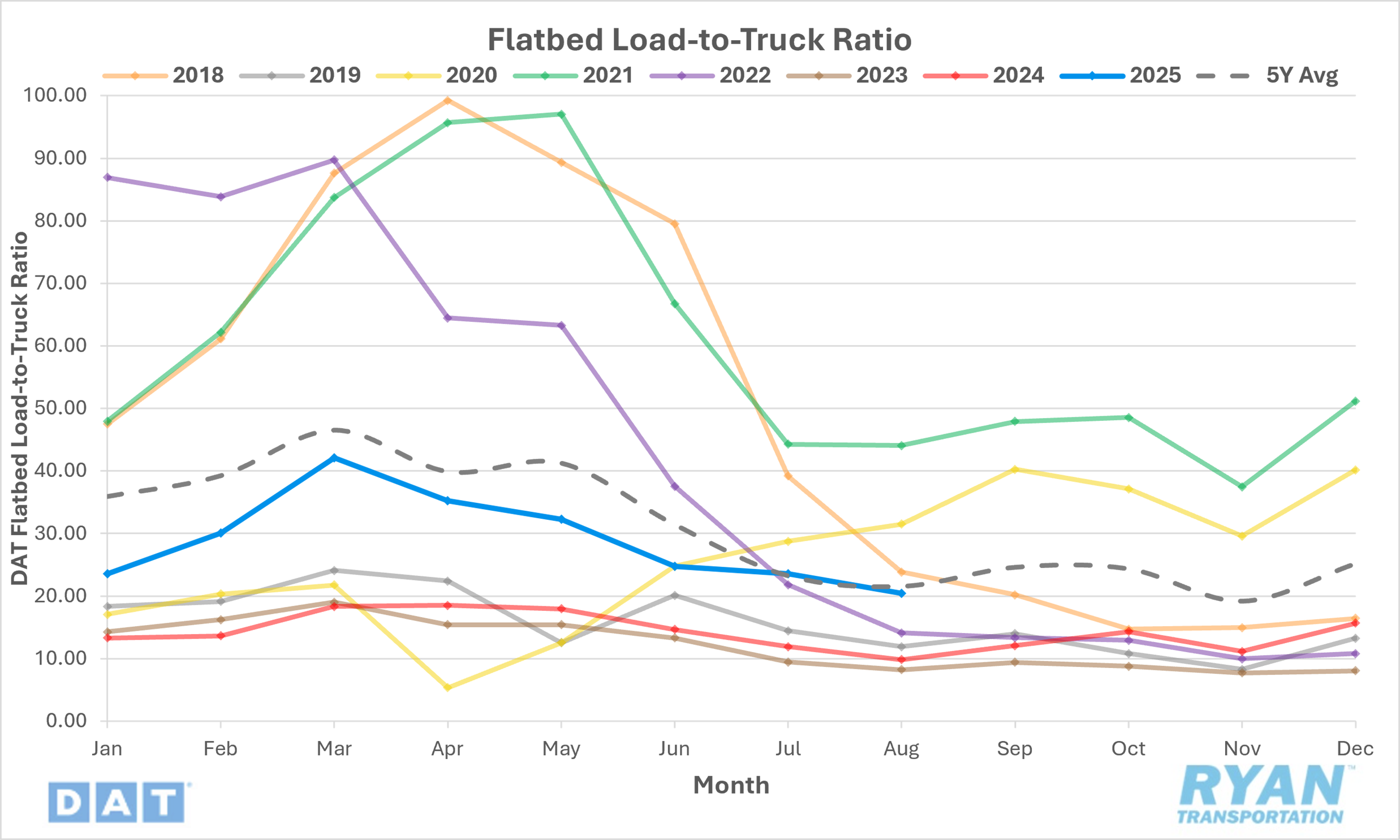

Load-to-Truck Ratio

Key Points

- The flatbed LTR continued to decline for the fifth consecutive month in August, dropping 13.2% from the 23.55 recorded in July to 20.45.

- Compared to August 2024, the flatbed LTR is still significantly higher by 108.0% YoY but is 5.1% below the 5-year average.

- According to DAT, flatbed load post volumes registered a 14.4% MoM decline in August compared to July, while equipment posts were down 1.5% MoM.

Market Conditions

Flatbed Summary

Flatbed market conditions in August reflected both ongoing structural headwinds and selective areas of strength tied to construction and industrial projects. According to the American Trucking Associations’ For-Hire Truck Tonnage Index, overall truck freight activity declined for the second consecutive month in June, slipping 0.4% MoM after a 0.1% decrease in May. On a quarterly basis, tonnage was effectively flat, rising just 0.2% from Q1 but falling 0.2% YoY. Weakness in residential construction — particularly in single-family housing — has been a drag on flatbed volumes, even as incremental gains in factory output and retail sales offered modest support. Meanwhile, demand for new equipment remains muted as fleets focus on cost containment. North American Class 5–8 truck orders totaled 26,200 units in July, down 10% YoY, with Class 8 orders hovering near replacement levels and medium-duty orders declining 17% YoY. Elevated truck prices, high input costs and inflationary pressures have further constrained expansion, especially for smaller operators.

Despite broad weakness, pockets of demand continue to support flatbed carriers. U.S. single-family housing starts rose 2.8% MoM in July to a seasonally adjusted annual rate of 939,000 units, with completions up 11.6% MoM as builders pushed to clear backlogs. While gains were concentrated in the South, they provided incremental support to freight demand for building materials and finished goods. More significantly, large-scale industrial construction is creating meaningful opportunities in the flatbed sector. Meta Platforms’ announcement of multi-billion-dollar data center projects — including $10 billion in Louisiana and $800 million in Indiana — is driving specialized freight needs for heavy, oversized and sensitive equipment such as servers and cooling systems. These projects, with timelines extending 18 months or more, are expected to generate sustained volumes for flatbed carriers while stimulating localized freight activity around construction hubs. Together, housing completions and major industrial builds are helping to partially offset softness in agriculture and other traditional flatbed segments, though not enough to materially alter the broader supply-demand imbalance.