Back to October 2025 Industry Update

October 2025 Industry Update: Truckload Capacity Outlook

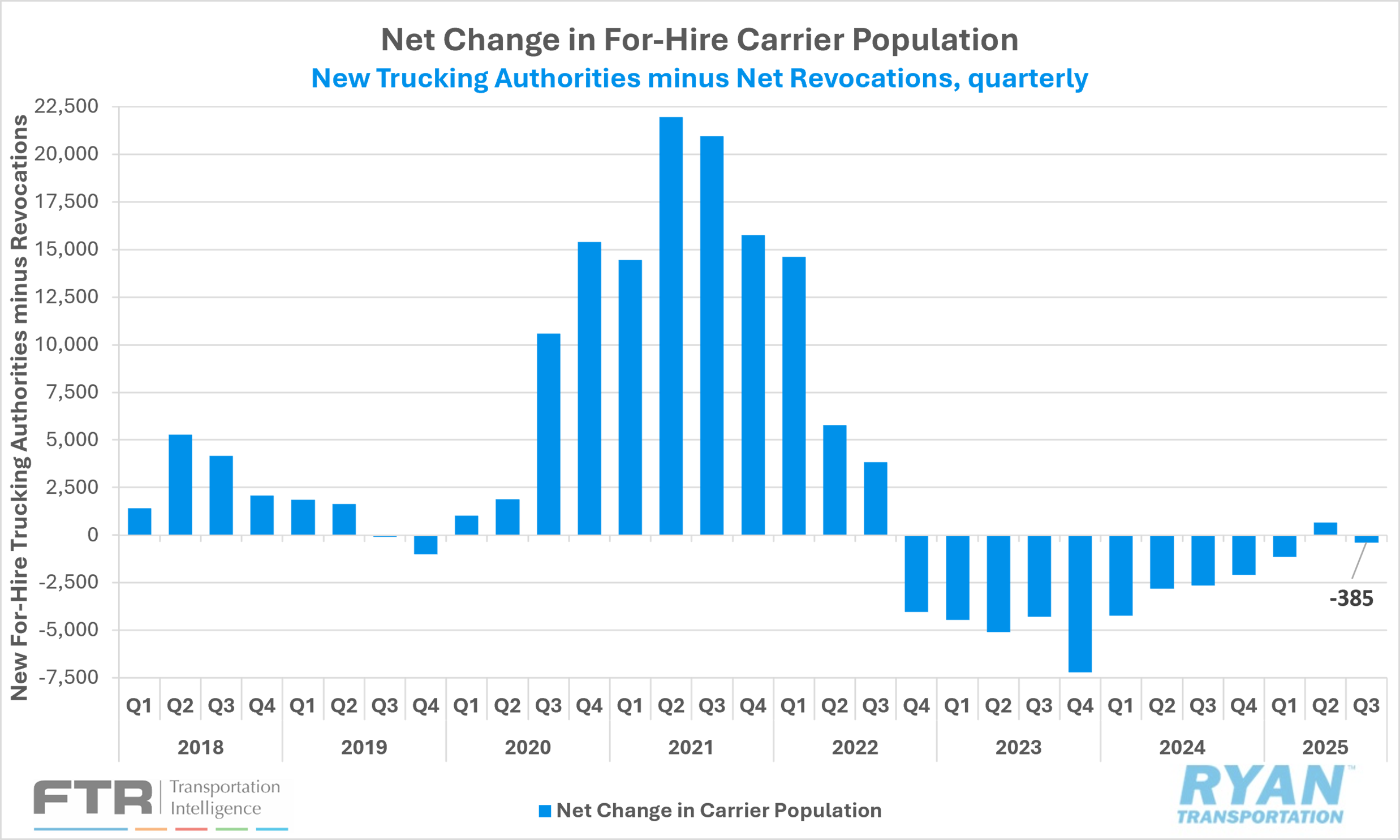

The for-hire carrier population declined sharply in September as net revocations surged while new entrants fell.

Key Points

- Total net revocations, a measure of total authority rejections minus reinstatements, surged by 1,108 carriers MoM in September, increasing from 4,498 in August to 5,606 in September, according to FTR’s preliminary analysis of the Federal Motor Carrier Safety Administration (FMCSA) data.

- Per FTR, the number of newly authorized for-hire trucking firms declined further in September, with the FMCSA authorizing 4,473 new carriers compared to the 4,930 new authorizations in August.

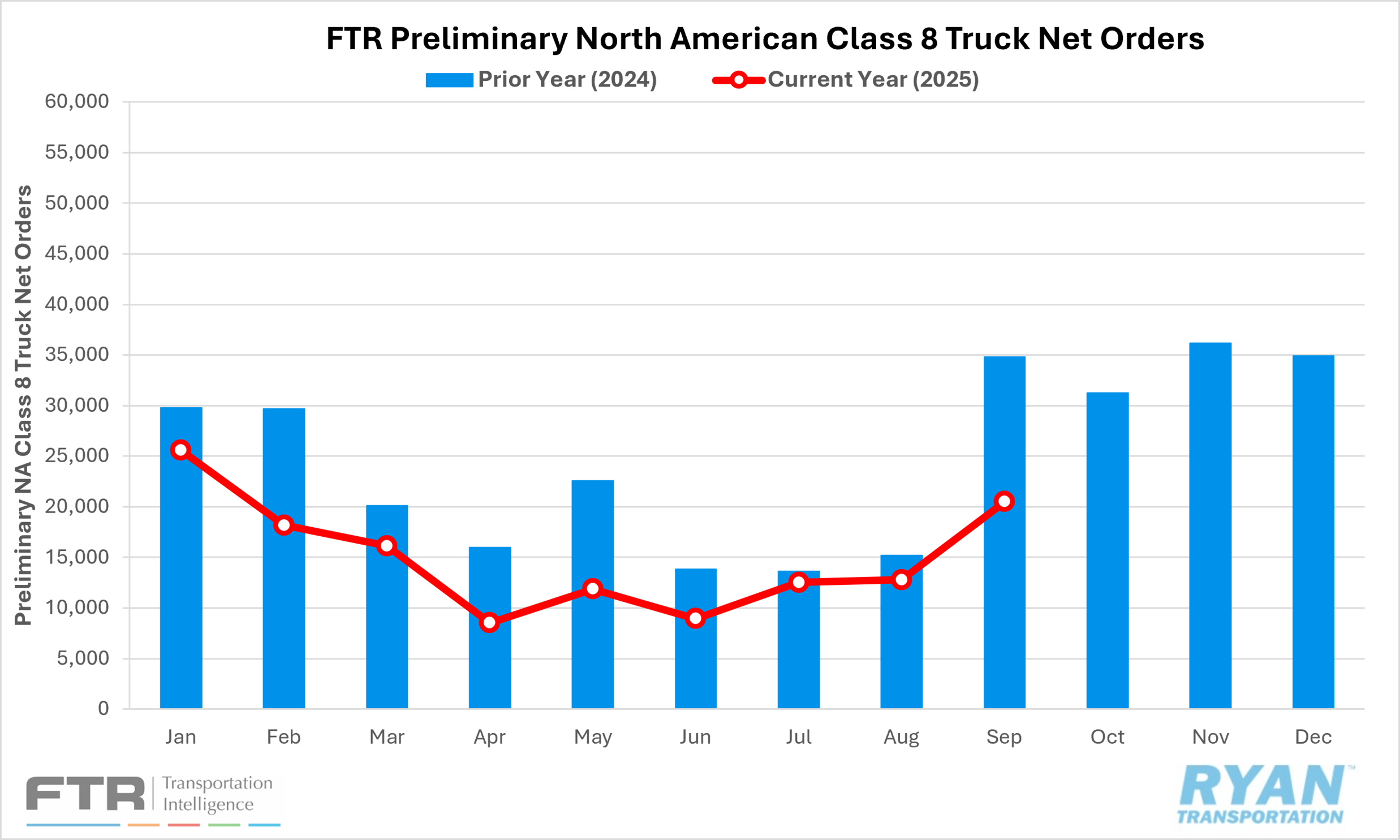

Preliminary North American Class 8 net orders estimates ranged from 20,500 units, as reported by FTR, and 20,800 units per ACT Research in September, with both estimates lower YoY by 41.1% and 43.9%, respectively.

Summary

The for-hire trucking population contracted sharply in September, declining by 1,133 carriers and marking just the second reduction in total operating authorities in the past six months. The steep drop was primarily driven by a surge in net revocations, which rose by just over 1,100 carriers compared to August, reaching their highest level since September of last year. A simultaneous decline in new entrants compounded the contraction, as newly authorized for-hire carriers fell by nearly 460 MoM, the largest decrease since December 2024, when new authorities dropped by more than 580 carriers.

On a quarterly basis, overall for-hire capacity showed relative stability compared to earlier in the year. Net revocations in the third quarter rose by just 21 carriers QoQ compared to Q2, while new for-hire authorities declined by 1,035 over the same period. As a result, the total for-hire carrier population fell by only 385 carriers in Q3, representing the smallest quarterly change since Q3 2019. Compared to the same period last year, the net decline in Q3 2025 was more moderate, totaling over 2,250 fewer carrier exits.

On the equipment side, preliminary North American Class 8 truck orders registered a substantial rebound from August levels but continued to trail historical norms. According to FTR, net orders increased 60.5% MoM in September, while ACT Research reported a similar 57.6% gain. Despite the sequential improvement, orders recorded their ninth consecutive YoY decline and remained well below the 10-year September average of 29,499 units, indicating that fleets remain cautious about expanding capacity amid ongoing economic and freight-market uncertainty.

Why It Matters

Although the sharp increase in net revocations in September led to the largest MoM contraction in the for-hire carrier population YTD, the decline was not without caveats. According to FTR, much of the drop — similar to what occurred in June, the only other month this year to record a net decrease — was influenced by a calendar irregularity. The Federal Motor Carrier Safety Administration (FMCSA) processes most carrier revocations on Mondays (or Tuesdays following a federal holiday), and with five Mondays in September, the additional processing cycle artificially inflated revocation counts by just over 100 compared to June. When analyzed on a quarterly basis, the broader trend continues to reflect an overall stabilization in the for-hire carrier population rather than a renewed wave of capacity exits.

As highlighted in previous updates, fluctuations in the number of active operating authorities do not necessarily translate into meaningful shifts in overall trucking capacity. Because the majority of motor carriers are small fleets or independent owner-operators, many newly authorized carriers may have previously operated under lease or as company drivers. Consequently, changes in carrier counts often represent administrative shifts rather than genuine expansions or contractions in the driver pool. Payroll employment data typically provides a more reliable measure of labor-side capacity; however, the current federal government shutdown has delayed the release of those figures.

While signs of stabilization have emerged in recent months, several headwinds persist that could add renewed pressure to excess capacity levels. Previously discussed challenges — ranging from rising insurance premiums in 2026 to stricter enforcement of the English Language Proficiency (ELP) rule — have yet to materially alter market balance. However, a new FMCSA ruling announced on September 26 could represent a potential inflection point. The agency issued a rule imposing stringent restrictions on the issuance and renewal of non-domiciled commercial driver’s licenses (CDLs), which are granted to foreign nationals not legally present or without a verified employment-based need. The FMCSA estimates that approximately 200,000 drivers currently hold such licenses and that the new rule could result in as many as 194,000 exiting the market over the next two years.

While those estimates remain difficult to verify, FTR has modeled several potential outcomes. Under its “full impact” and “50% impact” scenarios, active truck utilization would climb to roughly 97–98% by late 2026 or early 2027, driving a substantially tighter market and freight rates approaching the levels seen during the 2020–2021 cycle. Conversely, a “limited impact” scenario — if FMCSA’s assumptions prove overstated — would result in minimal changes to current conditions. At this stage, it remains too early to determine which trajectory the market will follow, though the ruling adds a new variable to an already complex capacity landscape.