Back to October 2025 Industry Update

October 2025 Industry Update: Flatbed

Flatbed conditions improved slightly in September following months of continuous deterioration.

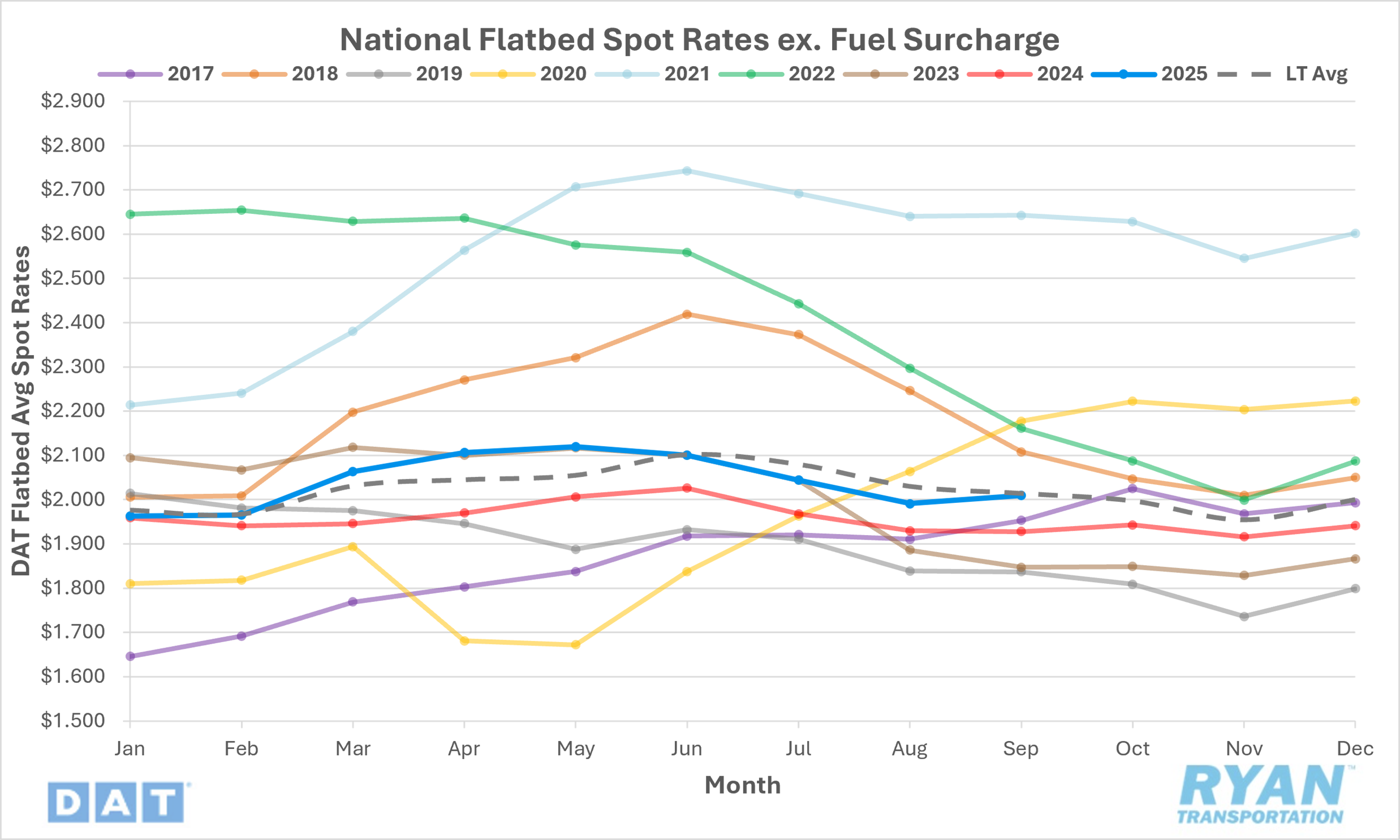

Spot Rates

Key Points

- The national average flatbed spot rate, excluding fuel, rose 1.0% MoM, or just under $0.02, in September to $2.01.

- Compared to September 2024, average flatbed linehaul rates are up 4.3% YoY but 0.2% below the LT average.

- Initially reported average flatbed contract linehaul rates, excluding a fuel surcharge, registered 0.8% lower MoM in September but remained 0.9% higher YoY compared to September 2024.

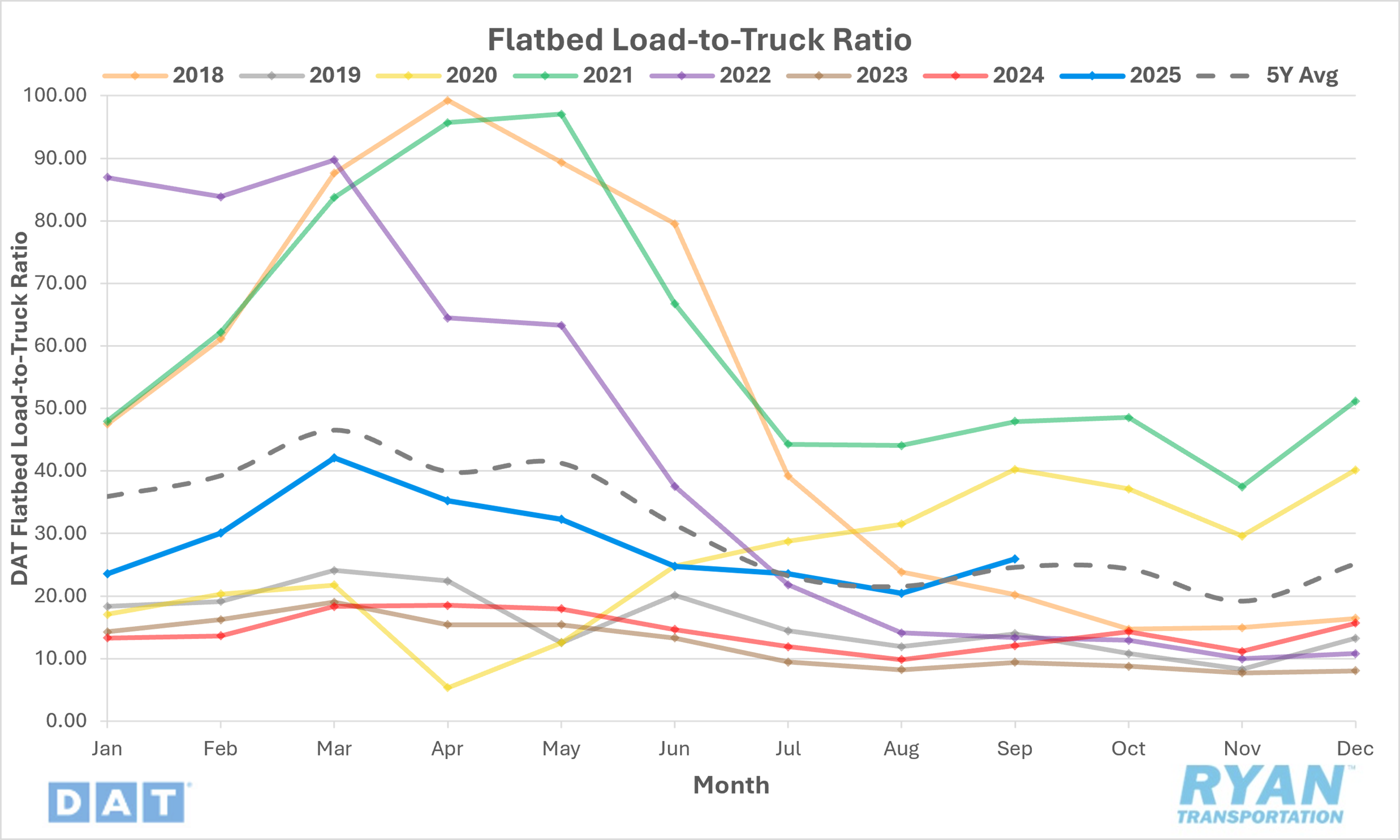

Load-to-Truck Ratio

Key Points

- The flatbed LTR turned positive in September, rising 26.8% from 20.45 in August to 25.93.

- Compared to September 2024, the flatbed LTR continues to trend well above year-ago levels, registering 114.7% higher YoY and is 5.4% above the 5-year average.

- According to DAT, flatbed load posts surged 25.8% MoM in September while equipment posts were down 0.8% MoM.

Market Conditions

Flatbed Summary

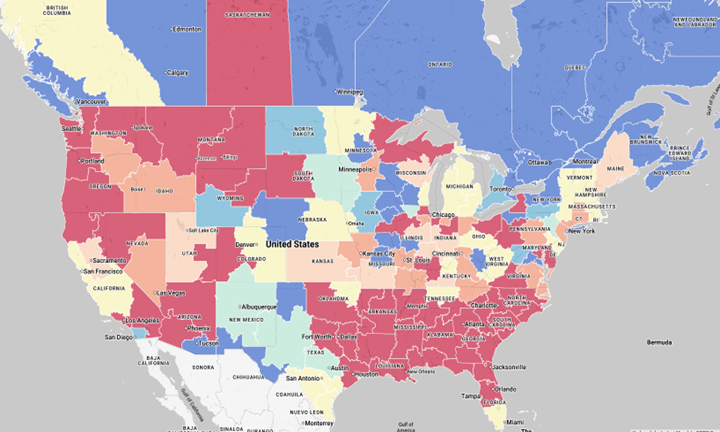

Single-family residential construction showed modest improvement in July 2025, with housing starts rising to 939,000 SAAR, a 2.8% increase from June and 7.8% higher than last year. Permits edged up slightly, while completions surged 11.6% as builders cleared existing backlogs. Growth was concentrated in the South, while the Midwest, Northeast and West experienced declines. For truckload carriers, this translates to incremental increases in hauling building materials, appliances and finished goods, providing steady but not dramatic demand growth. Overall, residential construction offers a baseline of support for freight activity, particularly in construction-related lanes. However, the modest gains suggest that broader market momentum remains limited.

Meanwhile, large-scale projects, such as Meta Platforms’ investment in AI data centers, are creating high-value opportunities for specialized flatbed carriers. These projects require transporting oversized and delicate equipment such as servers and cooling systems, boosting demand in regions with active construction. Conversely, the agricultural sector faces headwinds from declining commodity prices and tariffs, exemplified by Deere & Co.’s layoffs and financial losses. These challenges are dampening freight flows in farm equipment and related industrial lanes. Lumber markets also reflect reduced demand, with major producers cutting output, which translates to fewer flatbed truckloads, particularly in the U.S. South, Pacific Northwest and Eastern Canada. These mixed conditions highlight that while some niches are growing, others are contracting.

The energy sector, especially in West Texas, has seen a decline in drilling rig activity, reducing demand for flatbed transport of drill pipe and oilfield steel by about 6% in 2025. Spot rates remain slightly higher than last year, but overall capacity is readily available, and freight volumes are constrained by slower construction, weak industrial demand and tariff-driven cost volatility. Flatbed carriers are expected to focus on yield protection, cost management and tactical deployment of capacity, with little pricing upside anticipated until mid-2026. Recovery will likely depend on infrastructure funding and stabilization in industrial output.