Back to October 2025 Industry Update

October 2025 Industry Update: Economy

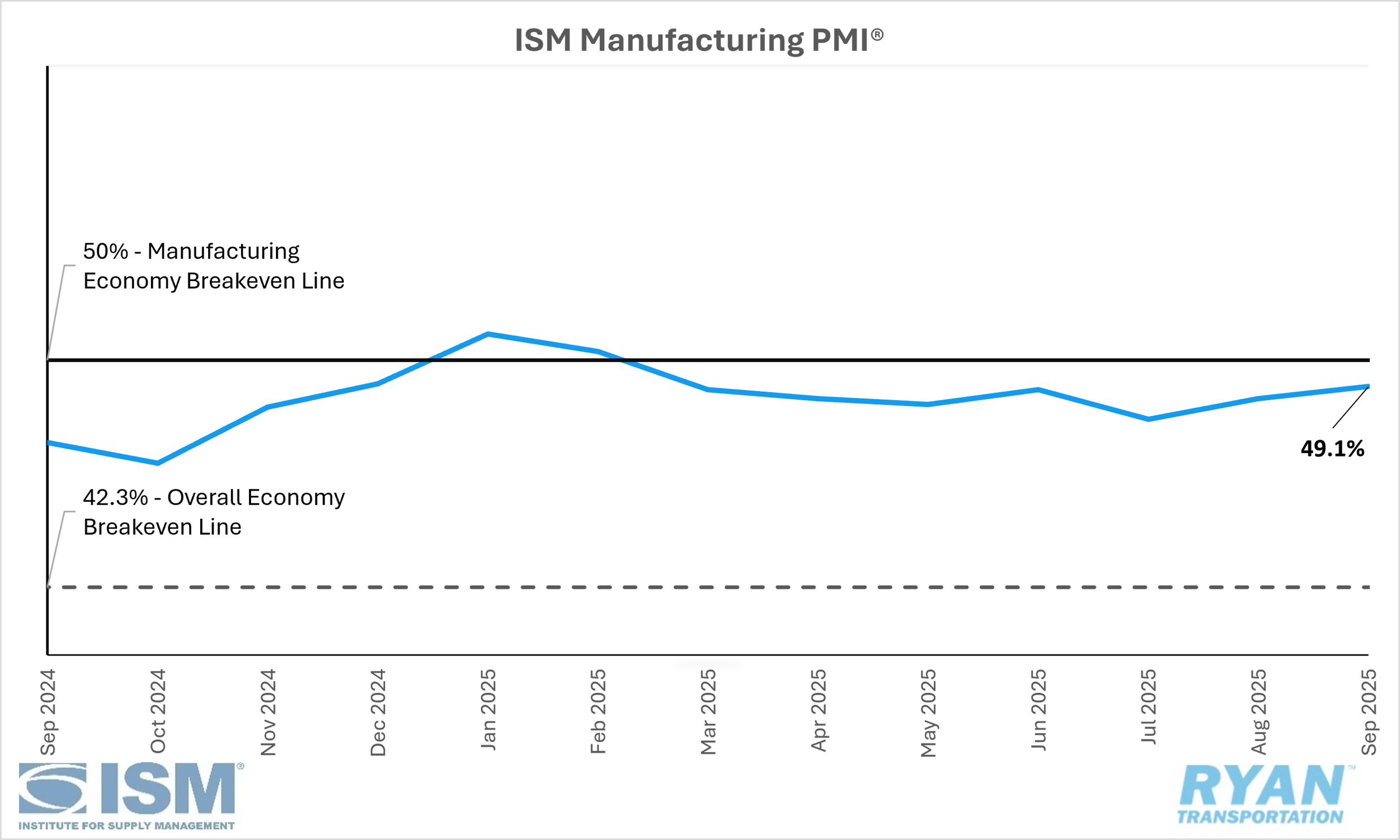

Domestic manufacturing activity contracted at a slower rate in September compared to August, driven by an uptick in production despite further softening in demand.

United States ISM Manufacturing PMI

Key Points

The Institute for Supply Management® (ISM®) Manufacturing PMI® registered 49.1% in September, 0.4% higher than August’s reading of 48.7% and remains in contraction territory.

The New Orders Index registered 48.9% in September, 2.5% lower than August’s reading of 51.4% and into moderate contraction territory.

The Production Index registered 51.0% in September, a 3.2% increase from the 47.8% recorded in August and a return to expansion territory.

The Employment Index registered 45.3% in September, 1.5% higher compared to August’s reading of 43.8%.

The Supplier Deliveries Index registered 52.6% in September, 1.3% higher compared to August’s reading of 51.3%.

The Inventories Index registered 47.7% in September, 1.7% lower than the 49.4% recorded in August.

Summary

U.S. manufacturing activity contracted for the seventh consecutive month in September, though at a marginally slower pace compared to August. According to the latest ISM® Manufacturing PMI® Report, the headline index increased by 0.4 percentage points, led primarily by gains in production. However, combined declines in the New Orders and Inventories indices — totaling 4.2 percentage points — outpaced the 3.2-point improvement in the Production Index, leaving the overall change in the Manufacturing PMI® largely inconsequential. From a broader perspective, September marked the 65th consecutive month of expansion for the U.S. economy following a single month of contraction in April 2020, as a PMI® reading above 42.3% over time is generally consistent with sustained economic growth.

Within the report’s demand components, only the Backlog of Orders Index showed improvement, rising 1.5 percentage points MoM to 46.2%, though it remained firmly in contraction territory. The New Orders, New Export Orders and Customers’ Inventories indexes all contracted at faster rates compared to August, highlighting persistent demand weakness. Tariff-related cost pressures and trade uncertainty continued to weigh on new order activity, with survey panelists reporting a 1-to-1.6 ratio of positive to negative sentiment regarding near-term demand. Despite this softness, the Customers’ Inventories Index remained in “too low” territory, typically a favorable signal for future production levels.

On the output side, both the Production and Employment indexes posted modest gains, combining for a net positive contribution to the overall PMI®. Production recorded the largest increase among the five primary subindexes and returned to expansion territory after one month of contraction. Nevertheless, manufacturers expressed cautious optimism, with a 1-to-2 ratio of positive to negative comments on future output. The Employment Index, meanwhile, contracted for the eighth consecutive month despite a minor improvement from August, as companies remained focused on managing labor costs through attrition. Survey responses reflected a 1-to-3 ratio of hiring to headcount reductions, with layoffs and hiring freezes cited as the primary workforce management strategies.

Among the six largest manufacturing industries — Chemical Products; Transportation Equipment; Computer & Electronic Products; Food, Beverage & Tobacco Products; Machinery; and Petroleum & Coal Products — only Petroleum & Coal Products reported growth in September, down from two industries in August.

Why It Matters

Despite registering a second consecutive month of modest improvement and aligning with the consensus estimate of 49.0%, the latest ISM® Manufacturing PMI® Report continues to highlight persistent structural challenges within the sector. As in prior months, survey respondents’ commentary pointed overwhelmingly to weakening demand conditions compounded by the uncertainty surrounding tariff policies. These factors remain key headwinds to both order activity and broader industrial momentum.

The most notable cautionary signal in September’s report stemmed from the temporary boost in production that accounted for the marginal improvement in the headline index relative to August. Under typical circumstances, this would be viewed as a positive development; however, the simultaneous contractions in both new orders and backlogs suggest the production gains are likely transitory. According to Susan Spence, MBA, Chair of the ISM® Manufacturing Business Survey Committee, the rise in production primarily reflected the short-lived uptick in new orders observed in August. Absent a sustained pipeline of new business, along with continued contraction in backlogs and inventories, production levels are expected to remain subdued.

Uncertainty surrounding trade policy has also weighed heavily on manufacturers’ capital spending plans despite the Federal Reserve’s decision to cut interest rates by 25 basis points at its September meeting. While the rate adjustment is unlikely to meaningfully stimulate investment in the near term, ongoing ambiguity around tariffs and pricing has led many firms to continue deferring major capital projects. Elevated commodity costs further constrain investment, as input prices remain historically high. Although the Prices Index edged slightly lower in September compared to August, its 12-month moving average remains at the highest level since February 2023, reflecting persistent cost pressures cited across nearly all major manufacturing industries.