Back to May 2025 Industry Update

May 2025 Industry Update: Truckload Rates

Spot rates remained flat while contract rates are showing early signs of growth.

Spot Rates

Key Points

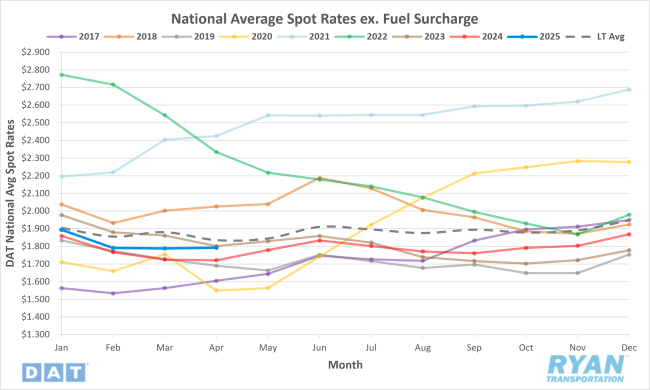

- The national average spot rate, excluding fuel, was essentially flat in April, rising just 0.1% MoM but remained at $1.79.

- Compared to April 2024, the national average spot linehaul rate was 4.0% higher YoY and remained 2.8% below the long-term (LT) average.

Contract Rates

Key Points

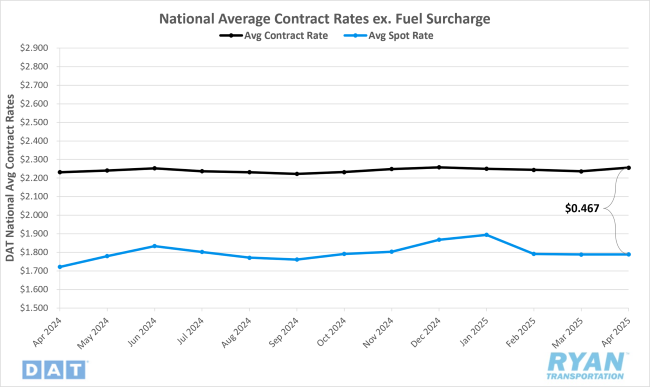

- Initially reported average contract rates excluding a fuel surcharge increased by 0.9% MoM, or $0.02, in April.

- On an annual basis, initially reported contract linehaul rates were up 1.1% YoY compared to April 2024.

- The contract-to-spot spread increased from $0.448 in March to $0.467 in April.

Summary

Following a modest decline of just over $0.10 MoM in February, the national average spot linehaul rate, excluding fuel, remained largely stable over the subsequent two months. April saw only a marginal increase—less than a penny MoM—reflecting a continuation of this flat trend. Despite the minimal change, the slight uptick in average linehaul rates outperformed the typical seasonal decline of approximately $0.04 MoM and aligned with pre-pandemic seasonal patterns.

The limited movement in April’s average spot rates was also evident in weekly pricing dynamics, as reported by the DAT 7-Day Average Spot Linehaul Rate Index. After fluctuating by less than a penny WoW through March, the index rose by $0.026 WoW in the first week of April, the largest weekly increase since mid-January. However, this gain was quickly reversed, with the index falling $0.03 WoW in the second week. The decline continued into the third week, with a further $0.01 WoW drop, before a modest recovery of $0.012 in the final week of April. As a result, the index ended the month just $0.002 below where it began.

In contrast to the subdued activity in the spot market, average contract rates excluding fuel recorded their first MoM increase of 2025 in April. The $0.02 MoM rise represented the strongest monthly gain since November 2023, when rates increased by $0.04 MoM. On an annual basis, following nearly three years of annual declines, average contract linehaul rates registered higher in April compared to the same month last year. The increase of just over $0.02 YoY marked the first month of annual rate growth since July 2022, when rates were roughly $0.08 higher YoY compared to 2021.

Why It Matters:

While the minimal change in rates from March to April was largely in line with typical seasonal patterns, the absence of a meaningful rebound from February’s low levels raises concerns. Following essentially flat MoM movement in March, many industry observers had anticipated that April would serve as a springboard for stronger pricing momentum entering the second quarter. That anticipated foundation, however, failed to materialize. Nevertheless, some analysts remain cautiously optimistic, suggesting that a pricing floor may have been established as the industry approaches the traditional summer peak season. In contrast, other experts argue that early inventory restocking and ongoing tariff-related disruptions could create significant headwinds, potentially resulting in a subdued peak season with limited rate growth, if any.

Despite persistent overcapacity and tariff-related uncertainty dampening any sustained upward pressure on spot rates, recent developments in the latest bid cycle have offered early signs of improvement in contract pricing. Although shippers continue to maintain pricing leverage and spot market rates have yet to exert upward pressure, the modest monthly and annual gains in initially reported contract rates for April suggest that contract pricing may be gradually recovering from its floor. This sentiment was echoed in first-quarter earnings calls from several major publicly traded truckload carriers, where executives commonly projected low- to mid-single-digit percentage point increases in contract rates for 2025.

Supporting this outlook, FTR’s latest monthly forecast projects total truckload rates to rise by 1.6% YoY in 2025, comprising a 1.3% increase in spot rates and a 1.8% increase in contract rates. However, these figures represent a downward revision from the previous forecast, which had projected total rates to grow 2.5% YoY, with spot and contract rates expected to increase by 3.2% and 2.1%, respectively. The reduction in projections is largely attributed to uncertainty stemming from evolving trade policies and tariff implications.

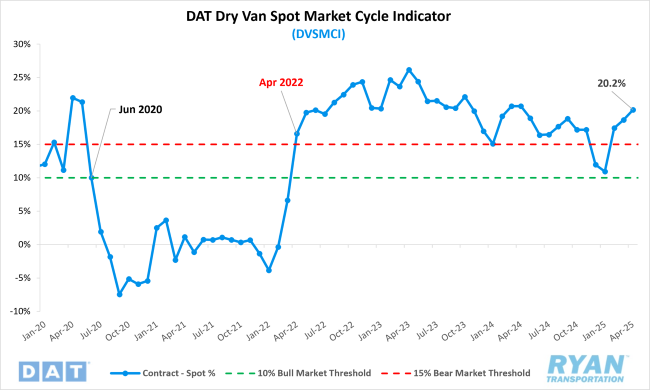

Meanwhile, the DAT Dry Van Spot Market Cycle Indicator (DVSMCI)—which tracks the spread between spot and contract rates relative to their average—continued to reflect bearish conditions. The index rose 1.5 percentage points MoM to 20.2% in April, remaining well within bear market territory. According to Dr. Jason Miller, Eli Broad Endowed Professor of Supply Chain Management at Michigan State University and developer of the index, sustained readings above 15% are indicative of bearish market conditions, while levels below 10% typically signal a more bullish environment.