Back to May 2025 Industry Update

May 2025 Industry Update: Truckload Demand

A slowdown in shipping activity has led to a weaker outlook heading into the peak summer shipping season.

Key Points

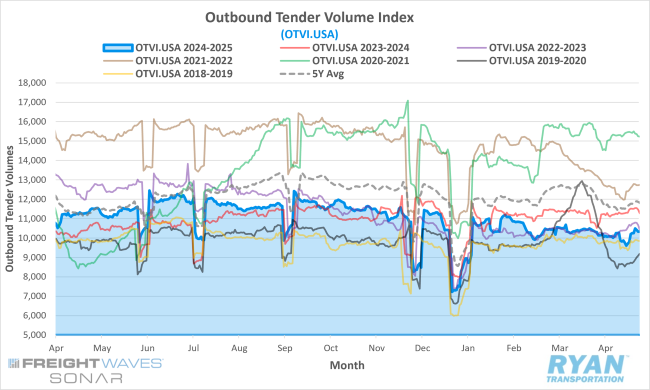

- The FreightWaves SONAR Outbound Tender Volumes Index (OTVI.USA), a measure of contracted tender volumes across modes, declined slightly in April by 0.4% MoM, dropping from 10,371.96 at the end of March to 10,331.98 in April.

- The monthly average of daily tender volumes in April fell 3.1% MoM compared to March, falling from 10,428.39 to 10,104.24.

- Compared to April 2024, average daily tender volumes were down 10% YoY and registered 13.8% below the 5-year average.

- Spot market activity continued to gain market share in April compared to March, rising 3.0% MoM and 17.0% higher YoY compared to April 2024.

- The Cass Freight Index Report, which analyzes the number of freight shipments across North America and the total dollar value spent on those shipments, reflected virtually no change MoM in shipments while expenditures rose 2.5% MoM with both registering lower YoY by 5.3% and 2.0%, respectively.

Summary

With the pull-forward in inventories ahead of anticipated tariffs nearing an end, freight demand remained subdued in April, as truckload volumes trended unseasonably lower throughout the month. This deviation from typical seasonal patterns, combined with intensifying global trade tensions and continued uncertainty regarding tariff policies, has contributed to a more cautious outlook on the timing of the long-anticipated recovery in freight demand and rates.

Weekly data from FreightWaves SONAR’s OTVI indicated relatively steady declines throughout April. During the first half of the month, tender volumes fell by a cumulative 3.4%, followed by a modest 1.4% WoW increase leading into the Easter holiday. However, a typical post-holiday slowdown in shipping activity resulted in a 6.4% WoW drop in outbound volumes, before rebounding with an 8.4% WoW increase in the final week of the month.

At a more detailed level, April saw a 3.1% MoM decline in average tender volumes, though this trend varied significantly by equipment type. All three truckload segments experienced weakening demand, with flatbed volumes registering the sharpest decline—down 14.3% MoM—compared to decreases of 3.4% and 5.4% for dry vans and reefers, respectively. Despite the steep monthly drop, flatbed tender volumes remained elevated on a YoY basis, up 14.5% compared to April 2024, while dry van and reefer volumes declined 12.1% and 2.0% YoY, respectively.

Similar disparities were observed across length of haul categories, as evolving inventory management and supply chain strategies continue to impact freight dynamics. Over the past year, short-haul truckload demand (within 100 miles) increased by 24.4% YoY, while long-haul demand (over 800 miles) contracted by 10.2% YoY. Despite both distant categories registering weaker last month compared to March, average short-haul tender volumes YTD were up 7.0% in April, while average long-haul volumes were 15.2% lower YTD.

Why it Matters:

The decline in freight volumes observed in April relative to March is not entirely unexpected from a seasonal standpoint. Historically, tender volumes decrease by an average of 6.0% MoM in April, as the industry shifts from a March surge in construction-related shipments to preparations for produce season and summer inventory restocking in May. However, when this seasonal downturn is coupled with stagnant growth levels from Q1 and an already fragile market outlook, the April trend appears significantly more concerning.

Signs indicate that the recent inventory frontloading cycle may be reaching its end. This is evident from the April 2025 Logistics Managers’ Index, which reported a 4.1% MoM decline in the Inventory Levels index to 57.1%, marking a reversion toward more typical seasonal inventory trends. Notably, inventory growth in Q1 mirrored the accelerated buildup usually seen from August through October, intended for holiday sales. Unlike that period, however, the current elevated inventory levels are likely to be drawn down at a slower pace. This lack of urgency is expected to favor intermodal providers, as shippers delay final delivery, thereby limiting truckload market participation in the recent wave of import activity.

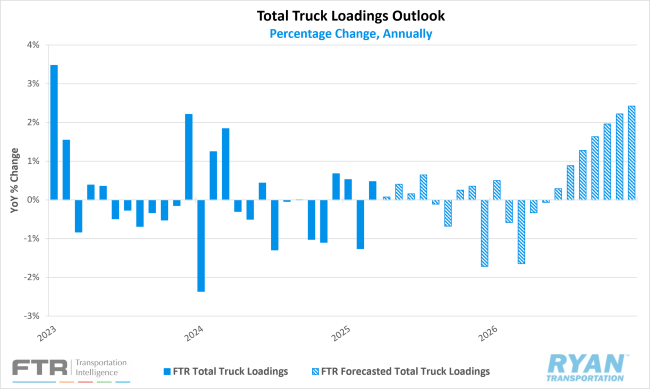

The outlook for freight demand growth has weakened further amid continued macroeconomic uncertainty and the looming effects of tariffs and potential retaliatory measures. FTR’s latest forecast now projects total truck loadings to decline 0.1% YoY in 2025, a notable downward revision from the previous estimate of +1.1% growth. Dry van loadings are expected to fare the worst, with a projected 0.4% YoY decline, while reefer and flatbed segments are forecasted to experience modest growth of +0.6% and +2.4% YoY, respectively. According to FTR, the full impact of tariffs and frontloaded imports is not expected to materialize until Q3, given that May 27th serves as the critical cutoff date for tariff-exempt inbound shipments.