Back to May 2025 Industry Update

May 2025 Industry Update: Truckload Capacity Outlook

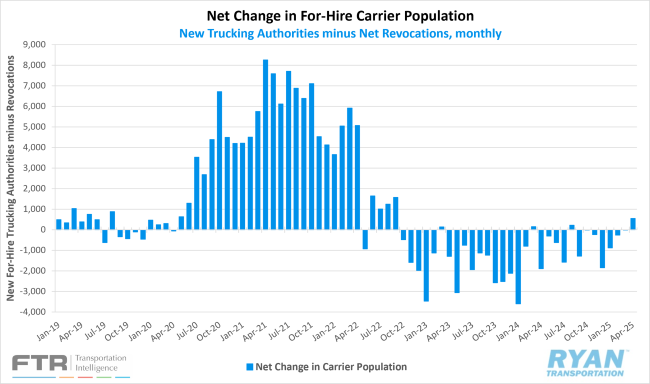

An increase in new entries outpaced carrier exits resulting in the for-hire carrier population expanding in April.

Key Points

- Total net revocations, a measure of total authority rejections minus reinstatements, registered slightly lower in April. Totals dropped by just 77 carriers from 4,995 in March to 4,918, according to FTR’s preliminary analysis of data collected by the Federal Motor Carrier Safety Administration (FMCSA).

- Newly authorized for-hire trucking operations rose by 489 carriers in April, increasing from 4,984 new authorities in March to 5,473 in April, per the FMCSA data.

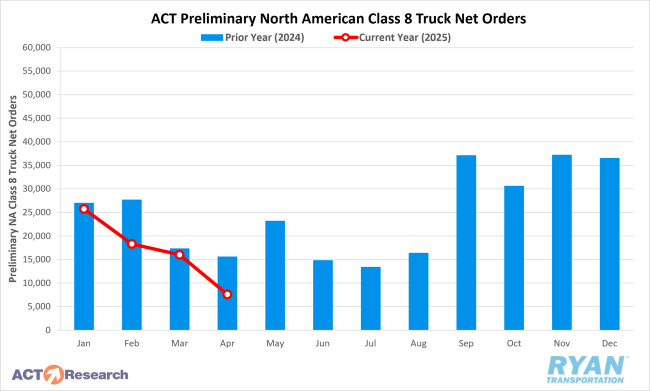

- Preliminary North American Class 8 net orders plummeted in April. Estimates range from 7,400 units per FTR and 7,600 as reported by ACT Research, both registering lower compared to last year by 54% and 52%, respectively.

Summary

Following several months of relative stability, the for-hire carrier population experienced a notable increase in April, with a net gain of 555 carriers compared to March. This marked the largest monthly increase since September 2022—when the population rose by 1,577 carriers—and only the third instance of net growth in the past 31 months.

April’s gain was primarily driven by a continued rise in newly authorized for-hire operating authorities, marking the fourth consecutive month of growth. The FMCSA reported 5,473 new entrants in April, the highest level since June 2023 when newly granted authorities approached 6,000.

Simultaneously, net revocations—which have moderated over the past year—declined modestly in April, down 77 carriers MoM. Despite this monthly decline, total net revocations minus reinstatements remained consistent with the six-month average and were approximately 260 carriers above the average observed in Q1 2025. Still, on a YoY basis, net revocations in April were significantly lower compared to the same month last year by over 1,900 carriers. FTR analysis indicates that the for-hire trucking firm population remains approximately 89,000 carriers—or nearly 35%—above pre-pandemic levels.

On the equipment side, heightened market uncertainty and the imposition of reciprocal tariffs contributed to a sharp decline in North American Class 8 truck orders in April, which fell to their lowest levels since May 2020.

According to ACT Research, preliminary Class 8 orders dropped by approximately 54% MoM from the 16,500 units recorded in March and were 52% lower YoY relative to April 2024. This marked the ninth instance in the past twelve months in which Class 8 orders lagged prior-year levels.

FTR reported comparable figures, also noting a 54% decline both MoM and YoY. April’s total fell significantly short of the seven-year average for the month, which stands at 18,963 units.

As of April, FTR reported that net Class 8 truck orders for the 2025 model year are down 30% YoY. Cumulative net orders for the 2025 order cycle (spanning September 2024 through April 2025) are currently tracking 11% below the prior year’s levels.

Why It Matters:

Over the past 14 months, the for-hire carrier population has exhibited resilience, with carrier exits decelerating and new entrants gradually increasing. This has resulted in a relatively stable capacity environment despite persistent market weakness. April’s net increase in carrier registrations continues to challenge conventional expectations. A prevailing theory suggests that prospective owner-operators have been more influenced by recent industry developments than by forward-looking market projections.

According to FTR, the observed uptick in April’s new carrier authorities is likely attributable to the typical 30-to-60-day lag between the submission of applications and the granting of authority. This timing coincides with a spike in flatbed and specialized freight volumes and rates observed in February and March—segments that outperformed the sluggish activity in the dry van and reefer markets early in the year. FTR noted that much of the first quarter’s volume strength was driven by tariff avoidance, a trend unlikely to sustain the current rate of new carrier entries. As a result, net revocations are expected to rise in the coming months.

While changes in for-hire operating authorities provide useful insight into shifts in carrier capacity, they reflect only a portion of broader supply dynamics. According to the most recent Bureau of Labor Statistics (BLS) employment report, the for-hire trucking sector added 1,400 seasonally adjusted jobs in April. This followed downward revisions of 2,800 jobs combined for February and March. Despite the revisions, March’s updated gain of 7,000 jobs still marks the largest MoM increase since October 2022. Between November and April, the sector added a net total of 10,000 jobs, with job growth occurring in four of the six months.

More detailed employment data through March indicates that local general freight trucking experienced the largest gains, adding 2,300 jobs, closely followed by local specialized trucking, which added 2,000 jobs. In contrast, long-distance general freight and specialized trucking both registered modest employment declines during the same period.

Looking ahead, regulatory changes may further influence capacity. On April 28, President Trump signed an executive order mandating English language proficiency for all commercial drivers. The order directs the FMCSA to classify a failure to sufficiently understand and communicate in English as an out-of-service (OOS) violation.

FTR’s analysis highlights that the Commercial Vehicle Safety Alliance (CVSA) had removed English language proficiency (ELP) as an OOS violation in 2015, although it remained a reportable infraction. A 2016 FMCSA decision allowed the use of translation tools and applications to aid driver communication with enforcement officers—an allowance that the new executive order eliminates. Based on 2014 citation data, prior to CVSA’s policy change, FTR estimates that the executive order could sideline over 100,000 drivers, significantly impacting available capacity.