Back to May 2025 Industry Update

May 2025 Industry Update: Reefer

Early produce activity led to higher volumes and a slight increase in rates in the refrigerated sector.

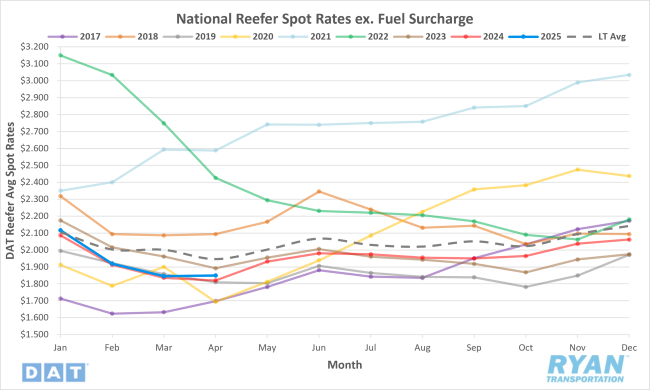

Spot Rates

Key Points

- The national average reefer spot rate, excluding fuel, increased by 0.2% MoM, or $0.01, in April to $1.85.

- On an annual basis, average reefer spot linehaul rates were up 1.6% YoY compared to April 2024 but were 5.2% below the 5-year average.

- Initially reported average reefer contract linehaul rates increased 0.7% MoM and were virtually flat compared to previous year’s levels.

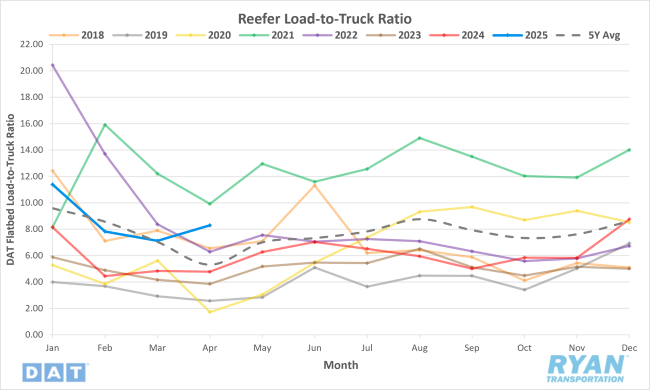

Load-to-Truck Ratio

Key Points

- The reefer LTR rose 16.4% MoM in April from 7.12 in March to 8.29.

- Compared to April 2024, the reefer LTR was up 73.4% YoY and 56.0% above the 5-year average.

- Both refrigerated load posts and truck posts, as recorded from the DAT Analytics load boards, were higher MoM in April by 20.5% and 3.5%, respectively.

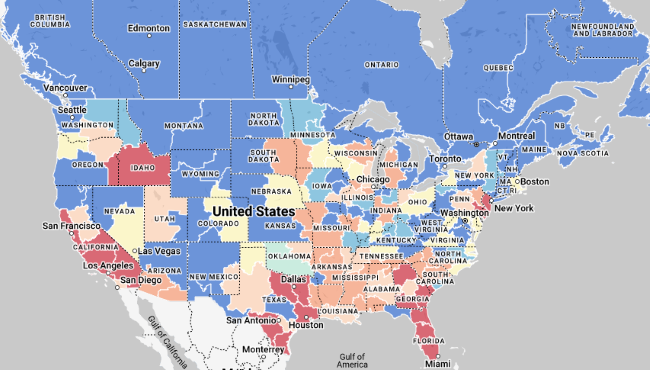

Market Conditions

Reefer Summary

The 2025 Vidalia onion season officially kicked off on April 15, signaling the start of the broader U.S. produce season. As reefer volumes rise with spring temperatures, freight capacity begins to tighten, particularly in southeastern states like Georgia and Florida. Early-season volume spikes are driven by Florida crops like strawberries and winter vegetables, before shifting northward to Georgia and South Carolina for onions and peaches. This transition typically increases reefer demand through early July, especially around the Fourth of July holiday. The Vidalia onion’s nationwide popularity further amplifies this surge in outbound freight demand.

Port Miami, a major logistics hub, sees significant inbound traffic tied to both produce and the cruise industry. As the fifth largest East Coast port by containerized import volume and the global leader in cruise passenger traffic, Port Miami handles high volumes of perishables like fruits, vegetables, seafood, and beverages—especially from Latin America and the Caribbean. Cruise ship provisioning days are major events, requiring up to 100 tractor-trailers to deliver food and supplies to as many as 10 ships simultaneously. The scale of these restocking efforts underscores the vital role of reefers and just-in-time logistics in supporting both leisure and supply chain demands in the region. Food safety, rapid handling and secure screening are integral to this weekly process.

Holiday surcharges are being implemented by major carriers to manage peak season pressures. From April 24 to May 7, a 10% surcharge applies to outbound Florida shipments, while California freight faces a 20% hike. This coincides with Mother's Day-related floral imports and peak strawberry season, especially in California’s Salinas-Watsonville, Santa Maria and Oxnard regions. Florida dominates winter strawberry production, but California drives spring through fall, accounting for 90% of total U.S. strawberry output. Cross-border imports from Mexico supplement domestic production, with major entry points at Otay Mesa, CA, and Pharr, TX, creating additional load volume in key freight markets.