Back to May 2025 Industry Update

May 2025 Industry Update: Fuel Prices

Global demand concerns amidst rising supply levels led to further declines in fuel prices.

Key Points

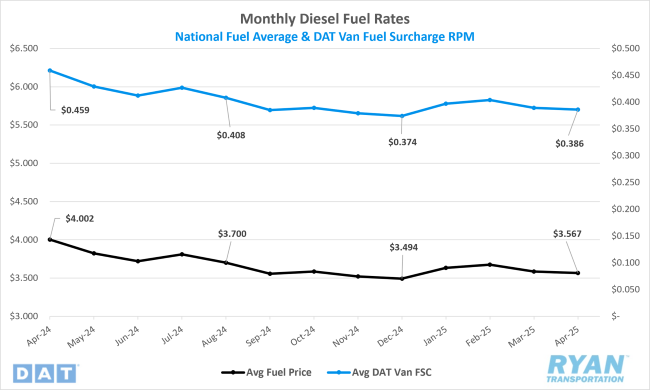

- The national average price of diesel declined further in April, dropping 0.5% MoM, or just under $0.02, to $3.567.

- Compared to April 2024, diesel prices in April were down 10.9% YoY, or roughly $0.44.

- Builds on U.S. Commercial Crude Inventories outpaced draws in April by +2.3M barrels (bbls) and was higher than the consensus of -1.7M bbls.

Summary

The national average price of diesel declined further in April, marking the second consecutive monthly decrease following notable sequential increases in January and February. Although April’s month-over-month decline was less pronounced compared to the significant price fluctuations experienced during the first quarter, both retail and futures markets exhibited ongoing volatility throughout the month.

On a weekly basis, the Department of Energy (DOE)/Energy Information Administration (EIA) benchmark diesel price posted an initial increase of $0.047 per gallon during the first week of April. However, this early gain was quickly reversed in the second week as diesel prices fell by $0.06 per gallon—the second-largest weekly decline in 2025, narrowly behind the $0.062 per gallon drop recorded in the first week of March. The remaining weeks of April saw more moderate price decreases, with cumulative declines totaling an additional $0.065 per gallon. By month-end, the national diesel average had reached its lowest level of the year, just slightly above the closing value of 2024.

The broader fuel market was also impacted by shifts in trade policy, which contributed to an unexpected build in U.S. commercial crude oil inventories. In April, crude imports rose while exports declined, driven in part by geopolitical and trade developments. Weekly data from the EIA indicated that net crude imports increased significantly during the month, peaking at nearly 3 million barrels per day (bpd) in the first week—matching levels last seen in early January. By the third week, imports surged by 1.14 million bpd to reach 2 million bpd, marking the largest weekly increase since November 2024.

Despite stronger refinery activity—refinery runs increased by 325,000 bpd and utilization rates rose to 88.1%—crude exports weakened. This decline was primarily attributed to retaliatory tariffs imposed by China following the administration’s announcement of new reciprocal trade measures. These developments underscore the sensitivity of global energy markets to shifts in trade policy and international relations.

Why It Matters:

The continued decline in average diesel prices throughout April was primarily driven by expectations of weaker global demand amid heightened trade uncertainty, even as global crude supply continued to expand.

Compared to the significant price movements observed during the first quarter, April’s retail diesel price decline was relatively modest. This moderation was largely influenced by the same market volatility that weakened futures prices, which also helped limit the extent of retail price decreases during the month. The initial WoW increase in the national diesel price, as reported by the EIA, appeared counterintuitive given the concurrent sharp decline in crude oil prices. However, retail fuel prices typically lag futures market movements, and the early April increase reflected a late-March surge in ultra-low sulfur diesel (ULSD) prices on the CME commodity exchange.

According to CME data, ULSD futures settled at $2.314 per gallon at the end of March—up sharply from $2.1622 on March 16. Prices reached a short-term high of $2.322 in early April before falling by more than $0.27 over the next six trading sessions, reaching a low of $2.0464 per gallon. ULSD prices then stabilized somewhat but ultimately closed April at $2.00 per gallon—the lowest settlement since May 21, 2021.

Overall market sentiment remained bearish during the month, influenced heavily by the decision of OPEC+, led by Saudi Arabia, to proceed with a phased rollback of production cuts beginning April 1, despite prevailing demand concerns. Prior to the announcement, Brent crude—the global benchmark—was trading around $75 per barrel but fell swiftly to just above $60 per barrel in the days that followed.

According to Reuters, the OPEC+ group is set to increase output by a combined 960,000 bpd across April, May and June, reversing approximately 44% of the 2.2 million bpd in production cuts that had been in effect since 2022. Analysts remain divided on the rationale behind this shift. Some suggest the move reflects growing frustration among compliant members, such as Saudi Arabia, with those consistently exceeding their quotas, notably Kazakhstan. Others speculate that Saudi Arabia may be strategically positioning itself to align with the policy priorities of President Trump, who has repeatedly urged the group to lower oil prices.