Back to May 2025 Industry Update

May 2025 Industry Update: Flatbed

Despite lower demand compared to March, average spot rates continued to climb in April for flatbed carriers.

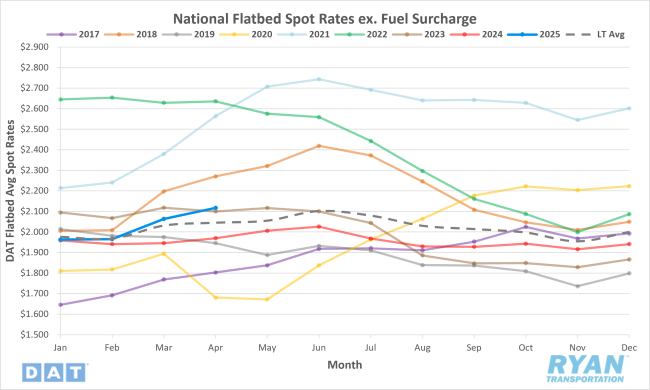

Spot Rates

Key Points

- The national average flatbed spot rate, excluding fuel, increased 2.1% MoM in April, or roughly $0.04, to just under $2.11.

- Average flatbed spot linehaul rates in April were up 7.0% YoY compared to April 2024 and 2.3% above the LT average.

- Initially reported flatbed contract rates excluding any surcharges rose 1.7% MoM in April and were 1.8% higher YoY compared to the same time last year.

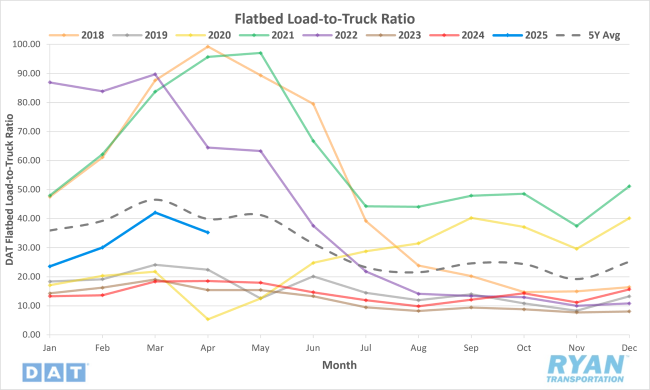

Load-to-Truck Ratio

Key Points

- The flatbed LTR registered 35.28 in April, 16.2% lower than levels recorded in March of 42.10.

- On an annual basis, the flatbed LTR remained well above the previous year’s levels in April, registering 90.7% higher YoY but 11.6% below the 5-year average.

- Flatbed load post volumes fell 5.3% MoM in April, while equipment posts were up 13.0% MoM, according to data collected by DAT.

Market Conditions

Flatbed Summary

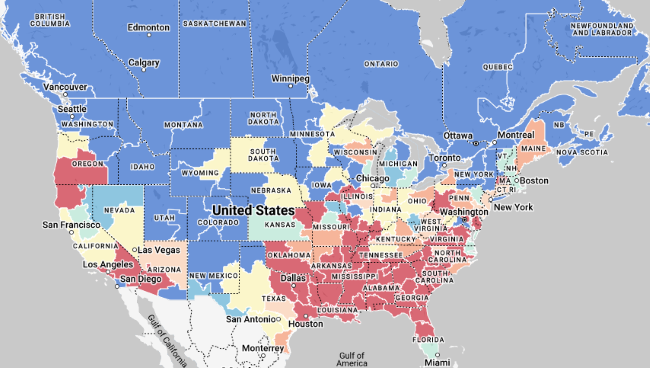

U.S. flatbed truckload demand is being shaped by declines in agricultural and manufacturing activity. Sales of agricultural tractors and combines dropped sharply in February 2025, signaling weak farm sector demand—traditionally a key driver of flatbed freight. At the same time, manufacturing output fell back into contraction, ending a short-lived expansion and reflecting reductions in new and export orders. These downturns affect shipments of industrial and agricultural machinery, commonly hauled on flatbeds. Canadian tractor sales provided a small bright spot, but the broader North American market remains sluggish.

The energy and housing sectors continue to significantly impact flatbed dynamics. In Texas, activity in the Permian Basin is down slightly, with fewer drilling rigs and lower oil prices resulting in decreased movement of equipment such as drill pipe. Meanwhile, housing starts dropped 11.4% in March, the largest decline in a year, driven by high mortgage rates and home prices. Builders are hesitant to start new projects, although regions like the Southeast still account for most of the activity. Despite this, there’s an uptick in shipments of materials related to home improvement and storm recovery, fueling demand in construction-heavy regions.

Open-deck freight is tightening due to both seasonal and unplanned industrial activity. Warm weather is driving demand for building materials, while retailers stock up for peak remodeling season. Additionally, insurance-funded repairs and industrial plant maintenance cycles have spurred urgent demand for heavy goods like steel, piping and concrete. These trends are particularly strong in the Southeast and Midwest, where severe weather damage and refinery activity are most concentrated. Spot rates are increasing, and capacity is constrained on several key flatbed lanes as a result.