Back to June 2025 Industry Update

June 2025 Industry Update: Truckload Rates

Average spot rates turned positive for the first time in 3 months in May, though the increase wasn’t driven by traditional seasonal factors.

Spot Rates

Key Points

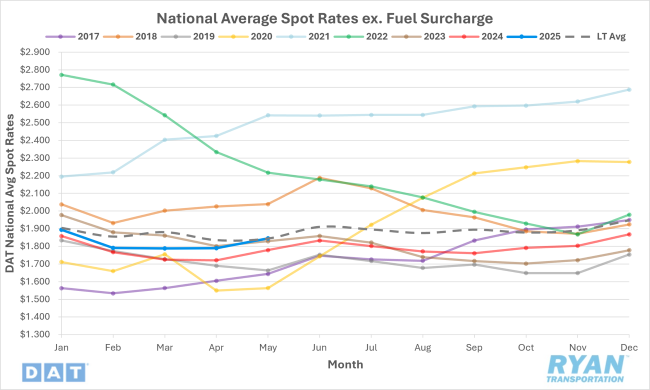

- In May, the national average spot rate, excluding fuel, increased 3.1% MoM, or roughly $0.06, to $1.85.

- Compared to May 2024, the national average spot linehaul rate was up 3.7% YoY and sits just 0.5% below the long-term (LT) average.

Contract Rates

Key Points

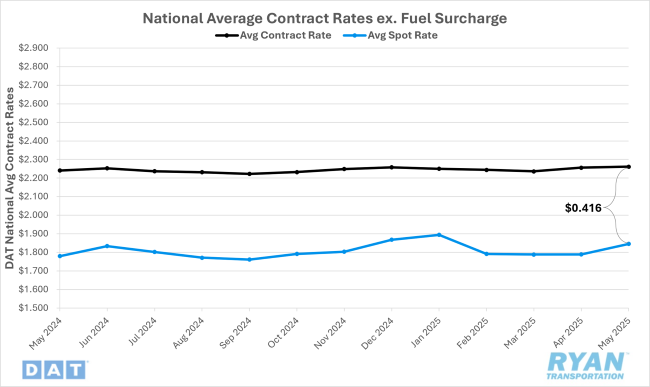

- Initially reported national average contract rates, excluding a fuel surcharge, rose by 0.2% MoM, or just under $0.01, in May.

- On an annual basis, initially reported contract linehaul rates are up 0.9% YoY compared to May 2024.

- The contract-to-spot spread declined from $0.467 in April to $0.416 in May.

Summary

Following two months of relative stagnation after February’s $0.10 MoM decline, the national average spot rate, excluding fuel, rebounded in May, recording its largest monthly increase since December and outperforming typical seasonal patterns. The nearly $0.06 MoM rise in spot rates fell just shy of the monthly gains recorded in May of last year by just 0.3% yet remains significant when compared to the historical seasonal average increase of just over $0.01 for May.

Despite the favorable monthly gain, weekly data from the DAT 7-Day Average Spot Linehaul Rate Index presented a more nuanced view. After starting the month $0.02 lower WoW, the index surged nearly $0.10 WoW during the second week, coinciding with the Commercial Vehicle Safety Alliance’s (CVSA) International Roadcheck. However, that mid-month spike proved to be the only WoW increase, as rates declined over the subsequent weeks, ultimately falling by roughly a total of $0.03 by the end of the month.

In the contract market, initially reported average linehaul rates showed minimal movement in May following a modest $0.02 MoM increase in April. Rates rose by less than a penny per mile MoM, reflecting the stability typically seen after the implementation of new pricing from recent bid cycles in April. This marginal change is consistent with the broader trend observed over the past year, in which contract rates have remained within a relatively tight range. On a YoY basis, May marked the second consecutive month—and only the third occurrence in the past 32 months—of annual growth in average contract linehaul rates.

Why It Matters:

While the rebound in spot rates during May provided a welcome reprieve following two underwhelming months in March and April, available data suggests that the increase was not driven by typical seasonal factors.

Historically, it is not uncommon for spot rates to rise in May, supported by the onset of seasonal produce shipments and the movement of summer merchandise. However, the gains observed last month appear to have been driven more by temporary capacity disruptions than by underlying demand. Specifically, the CVSA International Roadcheck—commonly referred to as “Blitz Week”—was a primary driver of the rate spike, raising mixed implications for the near-term outlook of the truckload market.

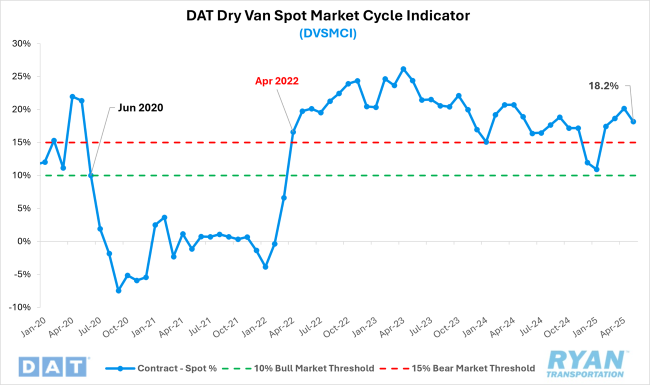

In pre-pandemic years, and particularly during the 2020–2022 freight boom, Blitz Week had a pronounced impact as carriers frequently removed capacity from the market to avoid inspections and potential penalties, despite strong demand. That influence had diminished in recent years, as prolonged market softness left many smaller operators unable to forgo revenue opportunities. This year, however, the pronounced $0.10 WoW increase in spot rates during the week of the CVSA Roadcheck suggests a renewed sensitivity to such events. The response indicates that the cumulative impact of carrier exits over the past two years has tightened available capacity, making the market more susceptible to short-term shocks.

Conversely, the steady WoW declines in average spot rates throughout the remainder of May—particularly the just over $0.01 WoW drop ahead of the

Memorial Day holiday—suggest that demand remains relatively subdued. This raises concerns about the sustainability and magnitude of any rate momentum as the industry moves deeper into the typically busier summer shipping season. While some analysts have pointed to the temporary 90-day suspension of tariffs on Chinese goods as a potential catalyst for increased freight volumes, others caution that the market still holds excess capacity, which may limit any upward pressure on rates or prevent meaningful gains altogether.