Back to June 2025 Industry Update

June 2025 Industry Update: Economy

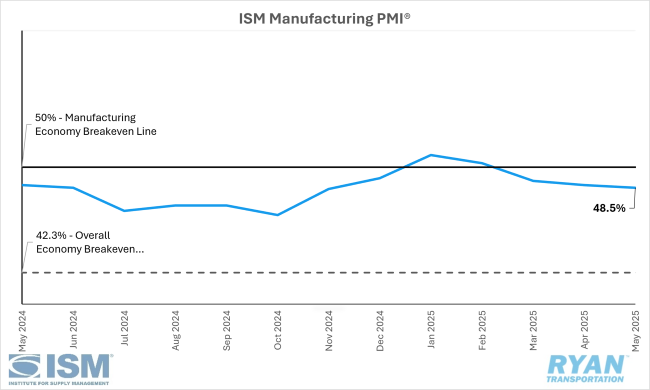

Domestic manufacturing activity contracted at a faster rate in May compared to April as demand and output remained weak amidst declining inventory levels.

United States ISM Manufacturing PMI

Key Points

- The Institute of Supply Management® (ISM®) Manufacturing PMI® contracted in May, registering 48.5%, 0.2% lower than April’s reading of 48.7%.

- The New Orders Index remained in contraction territory at 47.6% in May, 0.4% higher than April’s reading of 47.2%.

- The Production Index rose 1.4% to 45.4%, up from the 44.0% recorded in April.

- The Employment Index registered 46.8% in May, 0.3% higher than April’s reading of 46.5%.

- The Supplier Deliveries Index rose 0.9% to 56.1%, up from April’s reading of 55.2%

- The Inventories Index moved into contraction territory, registering 4.1% lower than April’s figure of 50.8% to 46.7% recorded in May.

Summary

U.S. manufacturing activity contracted for the third consecutive month in May, with the pace of contraction accelerating compared to April. According to the latest report from the Institute for Supply Management® (ISM®), the Manufacturing PMI® declined by 0.2 percentage points, indicating further deterioration in sector conditions. Consistent with the previous two reports, demand and output both continued to soften. However, new signs of weakness emerged on the input side, suggesting broader underlying challenges.

Despite ongoing contraction in manufacturing, the overall U.S. economy maintained its expansion trajectory in May, marking the 61st consecutive month of growth since the brief recession in April 2020. (Historically, a Manufacturing PMI® reading above 42.3% over time is consistent with growth in the overall economy.)

Demand indicators remained soft but showed mixed signals in May. Both the New Orders and Backlog of Orders indices contracted at a slower rate than in April, while the New Export Orders and Customers’ Inventories indices registered sharper contractions. May marked the fourth straight month of decline in new orders, with survey respondents citing weaker demand at a ratio of 1 to 1.5 in favor of negative sentiment. The moderation in backlog contraction was attributed in part to slower production levels and growing trade and geopolitical uncertainty. The steep contraction in customers’ inventories pushed that index into “too low” territory—a development that ISM® typically views as supportive of future production increases.

On the output side, the Production and Employment indices contributed a modest positive 0.3 percentage point impact to the overall Manufacturing PMI®—the first such contribution since January. While production improved from April’s particularly weak reading, factory output still declined further in May, as many firms scaled back operations in response to mounting economic uncertainty. According to ISM®, survey commentary showed a 3-to-1 ratio of negative to positive remarks related to production levels. Employment conditions showed a slight improvement for the second consecutive month, though the index remained in contraction territory. Companies reported continued headcount reductions, with ISM® citing an approximate 1-to-1.4 ratio of hiring to layoffs. The nature of the reductions—largely through layoffs—suggests a heightened sense of urgency among employers.

On the input side of the Manufacturing PMI®—which includes supplier deliveries, inventories, prices and imports—weakness was driven primarily by a sharp decline in inventory levels, following the completion of pre-tariff pull-forward activity. Imports also contracted significantly, reversing a three-month expansion streak. The Import Index fell to 39.9%, its lowest level since February 2009, when it registered 33.0%, signaling a steep drop in inbound supply chain activity. Further evidence of weakening inputs stemmed from the slowing, albeit slightly, tariff-induced growth in prices in May. Despite the slowing expansion in May, the Prices Index is still up 16.9% since January.

Among the six largest manufacturing industries—Chemical Products; Transportation Equipment; Computer & Electronic Products; Food, Beverage & Tobacco Products; Machinery; and Petroleum & Coal Products—only two, Petroleum & Coal Products and Machinery, reported growth in May, down from four industries in April.

Why it Matters:

Following a notably concerning report in April, the May ISM® Manufacturing PMI® report offered only marginal improvement, leaving overall sentiment around U.S. manufacturing little changed. According to Susan Spence, MBA, the newly appointed Chair of the ISM® Manufacturing Business Survey Committee, the latest data provides limited encouragement regarding the sector’s near-term outlook. Spence emphasized that the May report clearly reflected the mounting impact of the Trump administration’s continual shifts in trade policy. This was most evident by the considerable volume of respondent commentary focused on tariff-related disruptions as well as both the New Export Orders and Import indices falling to their lowest levels since the Great Recession.

Amid continued weakness in domestic factory activity, lead times have lengthened further, as reflected in the increase of the Supplier Deliveries Index to 56.1% in May. However, the ISM® report clarified that the slowdown in supplier deliveries is not a result of rising demand but rather logistical congestion at key ports of entry. The disruption in trade flows has also intensified contractual disputes between buyers and sellers regarding tariff liabilities, compounding uncertainty and further dampening demand. These conditions have been exacerbated by retaliatory tariffs on U.S. exports and are likely to persist following President Trump’s recent decision to double tariffs on aluminum and steel imports.

Despite the report’s generally negative tone—consistent with recent months—it was not without modest signs of potential relief. Spence highlighted the sharp contraction in the Customers’ Inventories Index, which shifted from the low end of the “about right” range to the upper bounds of “too low.” This development, while still tentative, may indicate a need for replenishment in future production cycles and marks the second consecutive month of potential upside for output. Nonetheless, this signal was largely overshadowed by ongoing contractions in imports, weakening order backlogs and steep inventory declines—factors that collectively suggest a challenging near-term outlook for manufacturing output.