Back to July 2025 Industry Update

July 2025 Industry Update: Truckload Rates

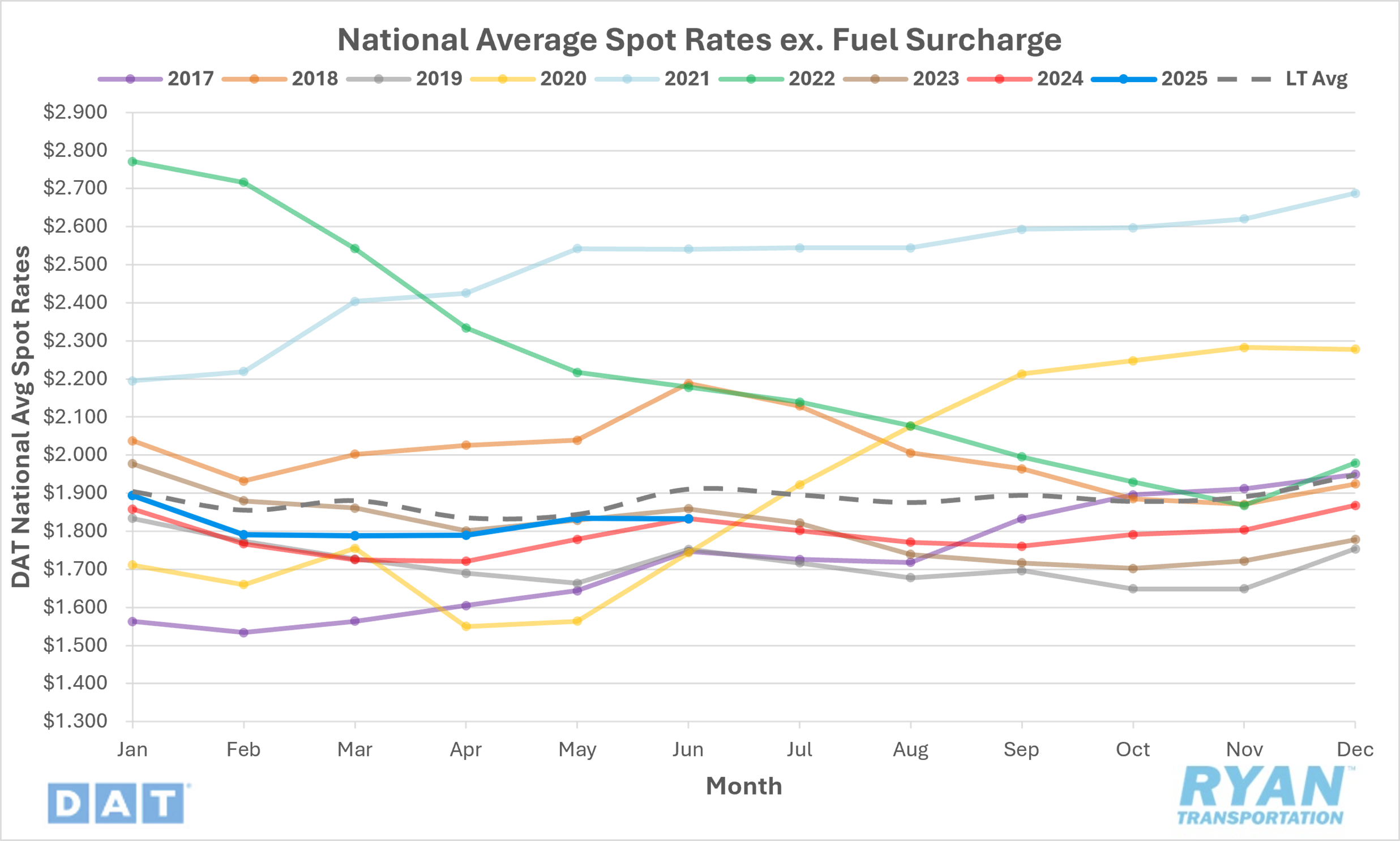

Average spot rates registered minimal change on a monthly basis and dropped back in line with previous year’s levels.

Spot Rates

Key Points

The national average spot rate in June, excluding fuel, remained unchanged from May at $1.83.

The national average linehaul rate was identical to the same month last year and dropped to 4.4% below the long-term (LT) average.

Contract Rates

Key Points

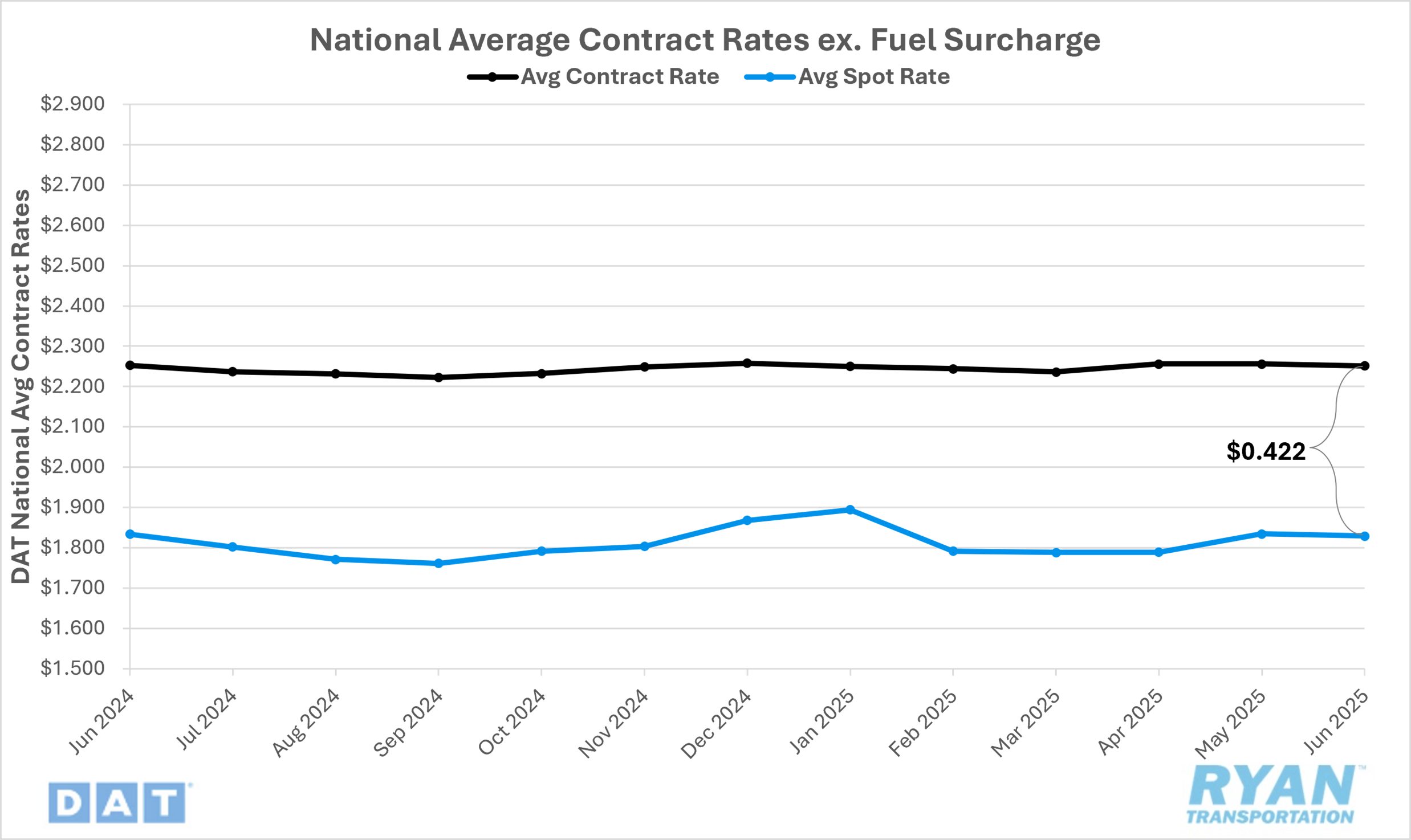

Initially reported national average contract rates, excluding a fuel surcharge, were flat in June from May.

On an annual basis, initially reported contract linehaul rates are at nearly the same level as the same month in 2024, registering just 0.1% higher YoY.

The contract-to-spot spread was unchanged MoM in June, registering $0.422, the same level recorded in May.

Summary

Following a rebound in May driven by capacity disruptions associated with the Commercial Vehicle Safety Alliance’s (CVSA) International Roadcheck (“Blitz Week”) and the Memorial Day holiday, national average spot rates stabilized in June, remaining flat MoM. From a seasonal perspective, this lack of change significantly underperformed the historical average increase of approximately $0.06 typically observed in June. While spot rates remained above the levels recorded at the start of Q2, the flat MoM trend brought YoY comparisons back to parity after maintaining positive annual growth for 10 consecutive months.

Weekly pricing trends from the DAT 7-Day Average Spot Linehaul Rate Index mirrored the stagnation observed in monthly averages. After remaining flat during the first half of the month, spot rates experienced their largest weekly decline—just over $0.02—since early April. The downward trend continued into the third week, falling an additional $0.01 WoW before rebounding ahead of the Fourth of July holiday, when rates rose by approximately $0.04 WoW, fully offsetting the prior two weeks of declines.

In the contract market, initially reported average contract linehaul rates were unchanged for the second consecutive month in June, following a modest $0.02 increase in April. This continued a broader trend of stability, with contract rates having remained within a narrow range over the past 12 months, averaging just $0.001 in monthly changes. The lack of movement in June resulted in contract rates aligning almost exactly with levels recorded in June 2024, following YoY gains of approximately $0.02 in both April and May. Despite the flat performance, initially reported contract linehaul rates were still 0.1% higher YoY, or $0.002, marking only the fourth instance in the past 33 months of positive annual growth in contract rates.

Why It Matters:

Depending on perspective, the minimal change in average spot rates during June can be interpreted as either a cautiously optimistic signal or a continued cause for concern, given the ongoing challenges in the truckload industry.

From a negative standpoint, June traditionally marks a period of seasonal strength for spot rates, as the peak summer shipping season intensifies. The significant underperformance relative to historical seasonal norms last month underscores the persistent imbalance between soft demand and surplus capacity. Additionally, the narrowing of the YoY gap in spot rates—driven by a lack of sequential gains—returned June’s average to par with 2024 levels after ten consecutive months of annual increases. Should this seasonal underperformance persist, it raises the possibility that spot rates could begin to fall below prior-year levels, further delaying the long-anticipated recovery in truckload pricing.

While this “glass-half-empty” interpretation appears most intuitive—particularly given the prolonged rate deterioration over the past three years that has strained carrier margins—there is also a cautiously optimistic view. The stability in average spot rates during June occurred despite continued weakening in freight demand. This suggests that ongoing capacity attrition is gradually correcting the oversupply issue that has been at the core of the industry’s recession. The industry’s growing sensitivity to external disruptions—such as weather events and holiday-related surges—further supports this narrative. For example, the DAT 7-Day Average Spot Linehaul Rate Index recorded a $0.05 increase during the final week of the month ahead of month-end and quarter-end, indicating a more immediate market response to short-term shifts in supply and demand.

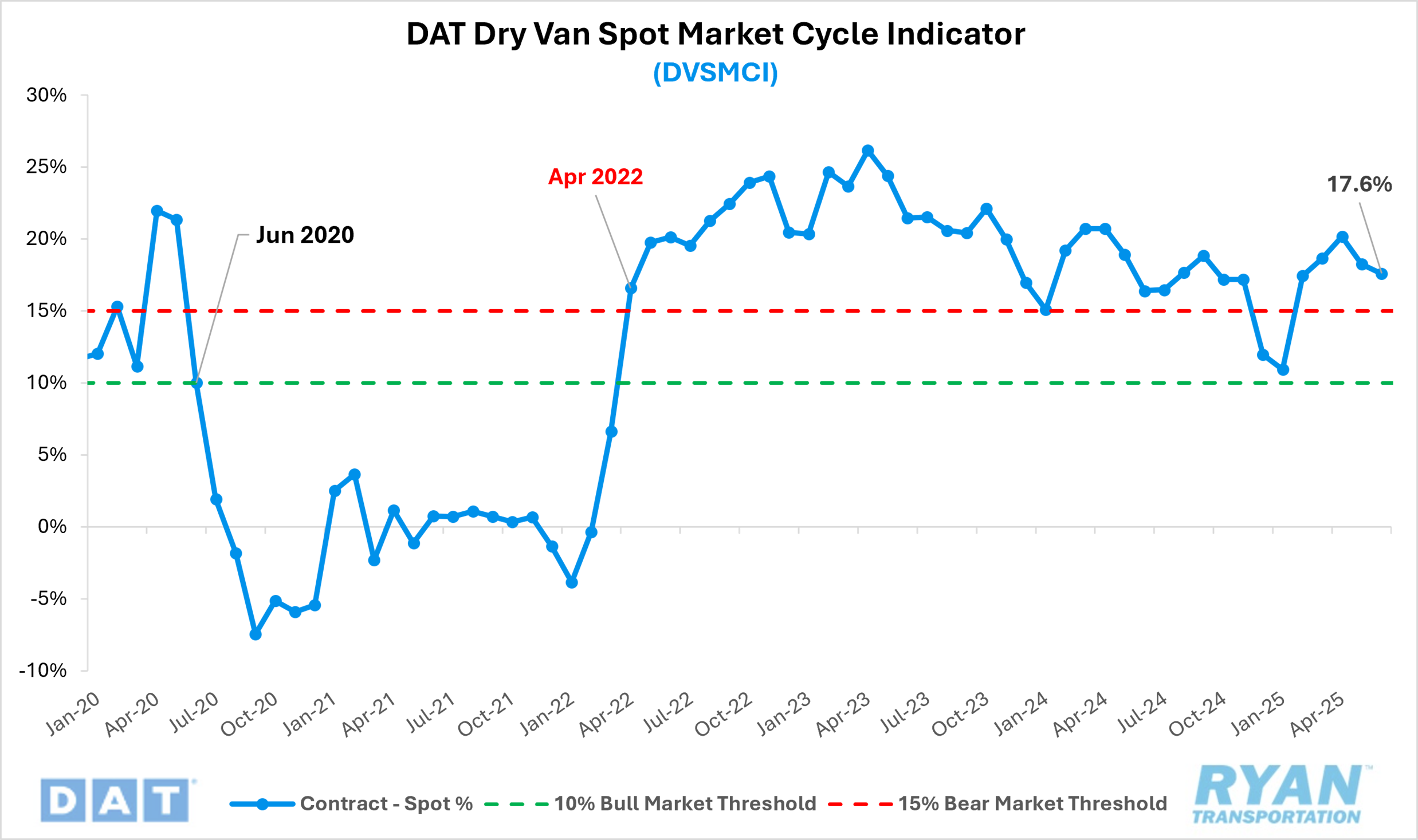

Another encouraging data point came from the DAT Dry Van Spot Market Cycle Indicator (DVSMCI), which tracks the spread between spot and contract rates relative to historical averages. The index declined from 18.3% in May to 17.6% in June. While this movement is modest and the indicator remains firmly in bearish territory, it represents progress. According to Dr. Jason Miller, Eli Broad Endowed Professor of Supply Chain at Michigan State University and developer of the index, sustained readings above 15% are consistent with bearish market conditions, while levels below 10% are generally indicative of a more bullish environment.