Back to July 2025 Industry Update

July 2025 Industry Update: Truckload Capacity Outlook

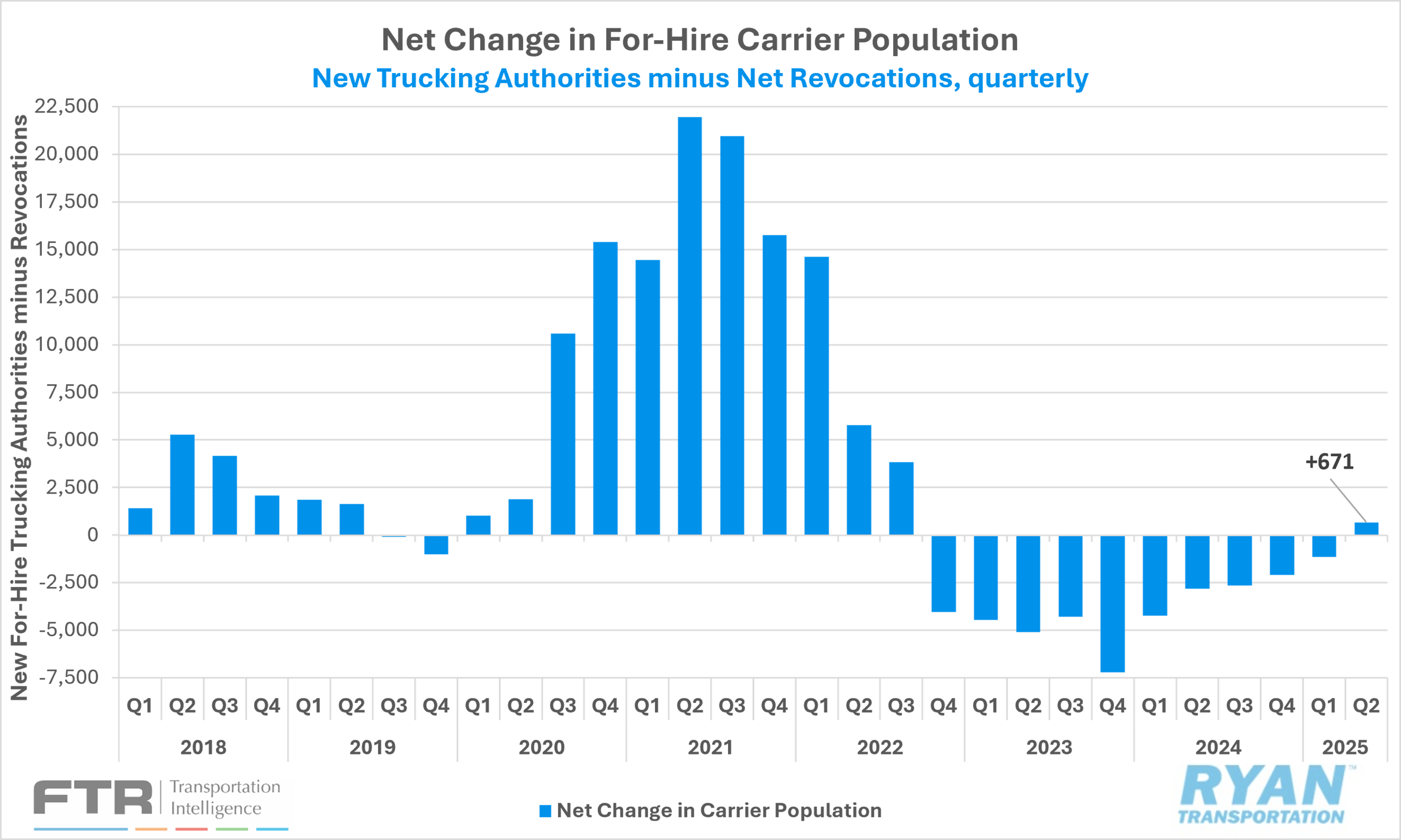

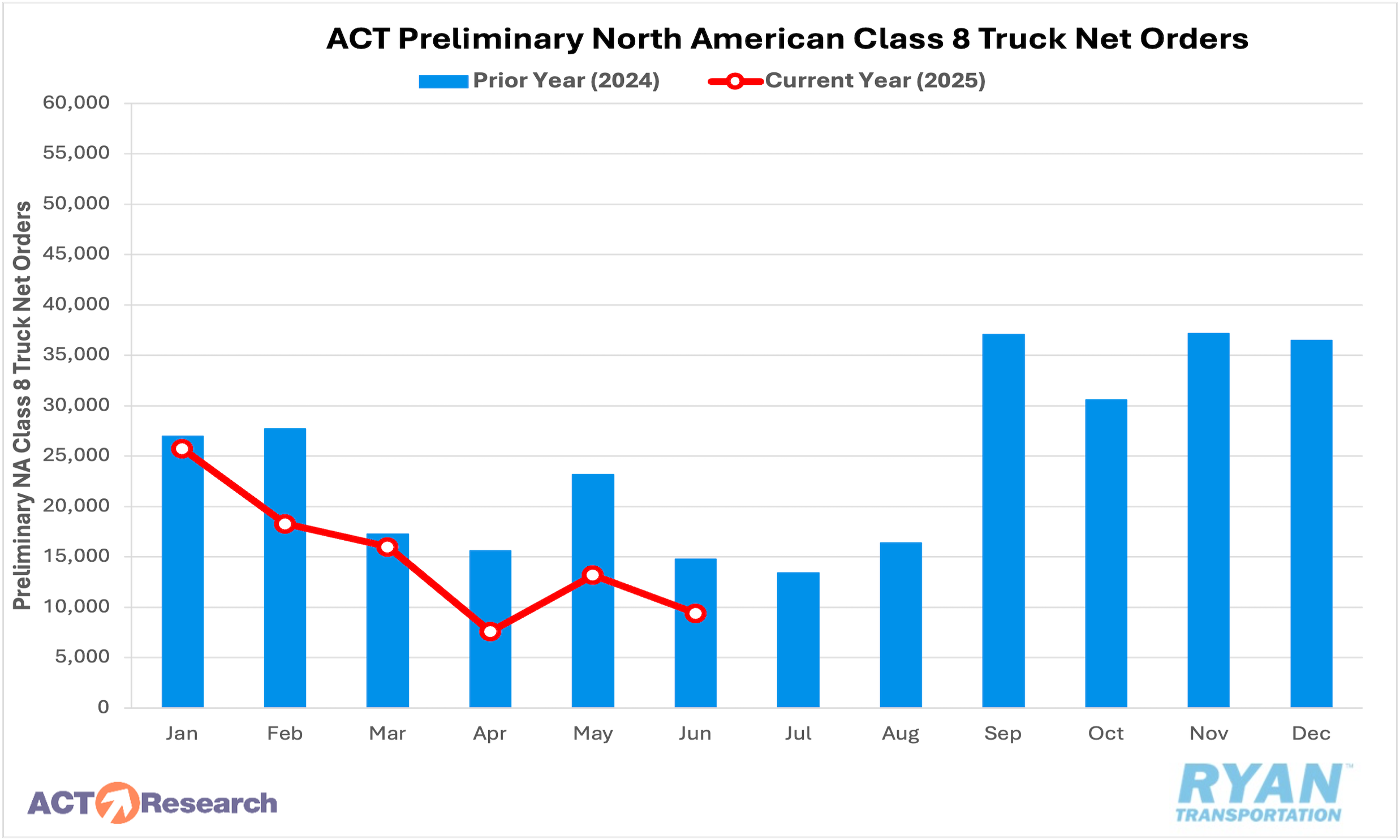

The for-hire carrier population contracted in June, driven by a surge in net revocations, while equipment orders fell to a 15-year low.

Key Points

Total net revocations, a measure of total authority rejections minus reinstatements, rose by just under 1,100 carriers MoM in June, increasing from 4,413 total revocations in May to 5,502, according to FTR’s preliminary analysis of the Federal Motor Carrier Safety Administration (FMCSA).

Per FTR, the number of newly authorized for-hire trucking firms barely changed in June with the FMCSA authorizing 5,008 new for-hire carriers, 12 less than the 5,020 new authorizations recorded in May.

Preliminary North American Class 8 net orders fell in June after rebounding in May with estimates ranging from 8,900 units as reported by FTR and 9,400 units according to ACT Research.

Summary

Following consecutive monthly increases in April and May, the for-hire carrier population resumed its downward trajectory in June, declining by 494 carriers MoM, according to FTR’s latest analysis. The decrease was primarily driven by a surge in net revocations, which reached their highest level since December. Compared to the same month last year, revocations net of reinstatements were higher by over 250 carriers but were still below the monthly average for all of 2024.

Simultaneously, new for-hire authority approvals declined for the third consecutive month in June, though the decrease was marginal. The FMCSA granted 5,008 new authorities during the month, a figure that remains elevated relative to the first quarter of the year and approximately 8% higher than both June 2024 and the 2024 monthly average.

On a quarterly basis, the gains recorded in April and May contributed to a net increase of 671 carriers in Q2. While modest, this marks the first quarterly increase in the for-hire carrier population since Q3 2022. New authority issuances totaled 15,501 in Q2, the highest quarterly figure since Q2 2023 and roughly 2,675 above Q1 totals—representing the largest q/q gain since Q2 2021. In contrast, Q2 revocations totaled 14,830, slightly exceeding Q1 levels but still marking the lowest quarterly revocation count since Q1 2022.

On the equipment side, preliminary North American Class 8 truck orders declined again in June, following a rebound in May. ACT Research reported a 28% MoM decrease, while FTR recorded a 25% MoM decline. On a YoY basis, both firms reported a 36% drop compared to June 2024. According to FTR, June’s order volume was well below the 10-year average of 19,213 units and represented the weakest June performance since 2009. For the 2025 order cycle to date (September 2024 through June 2025), net orders total 255,265 units—down 15% YoY.

Why It Matters:

The resumed decline in the for-hire carrier population in June was likely viewed as a welcomed shift, following two consecutive months of expansion despite continued stagnation in overall trucking market conditions. While the resurgence in net revocations may appear straightforward on the surface, a closer examination suggests a more nuanced interpretation. According to FTR’s analysis, the elevated revocation total in June may be partly attributed to a calendar-related anomaly. Because more than half of FMCSA’s weekly authority revocations are processed on Mondays—and June included five Mondays—the increase does not necessarily indicate a significant shift in trend when adjusted for this timing irregularity.

It is also important to recognize that changes in the number of operating authorities are not always reflective of meaningful changes in total capacity. The vast majority of motor carriers are small fleets or independent owner-operators, and many newly authorized carriers were previously leased operators or company drivers. As such, a net increase in carrier population does not inherently translate to a change in the driver pool.

That said, fluctuations in the carrier population remain a valuable barometer for assessing structural and behavioral shifts in the trucking market—particularly among smaller operators and independent drivers. Still, they represent only a subset of broader supply-side dynamics. According to the latest BLS report, for-hire trucking companies eliminated 2,700 jobs in June on a seasonally adjusted basis. This decline followed downward revisions to April and May payroll estimates, which were reduced by a combined 1,800 jobs. On an annual basis, payroll employment in the trucking sector increased 0.2% YoY in June, slightly above the 0.1% YoY gain reported in May, marking the first positive annual comparisons since April 2023.

More detailed data, available through May, shows a stronger labor performance within long-distance general freight truckload operations. Seasonally adjusted employment in this segment rose by 3,700 jobs in May, representing the largest MoM gain since October 2022. Truckload employment overall also reached its highest seasonally adjusted level since March 2023.

Looking ahead, the degree of contraction in available capacity remains uncertain, with several factors expected to influence future supply conditions. One widely discussed development is the potential impact of the executive order signed on April 28 by President Trump, directing the FMCSA and CVSA to reinstate the English Language Proficiency (ELP) rule as an out-of-service (OOS) violation. Another commonly cited concern is the continued rise in commercial insurance premiums, which could disproportionately affect smaller carriers and potentially accelerate market exits. While both of these developments may have meaningful implications, their impact will likely take time to materialize. In the interim, the equipment cycle appears to be setting the stage for a tightening in capacity, as Class 8 truck orders have remained below replacement levels for several consecutive months.