Back to July 2025 Industry Update

July 2025 Industry Update: Reefer

Reefer activity declined despite peak produce season in full bloom, causing average rates to register lower in June.

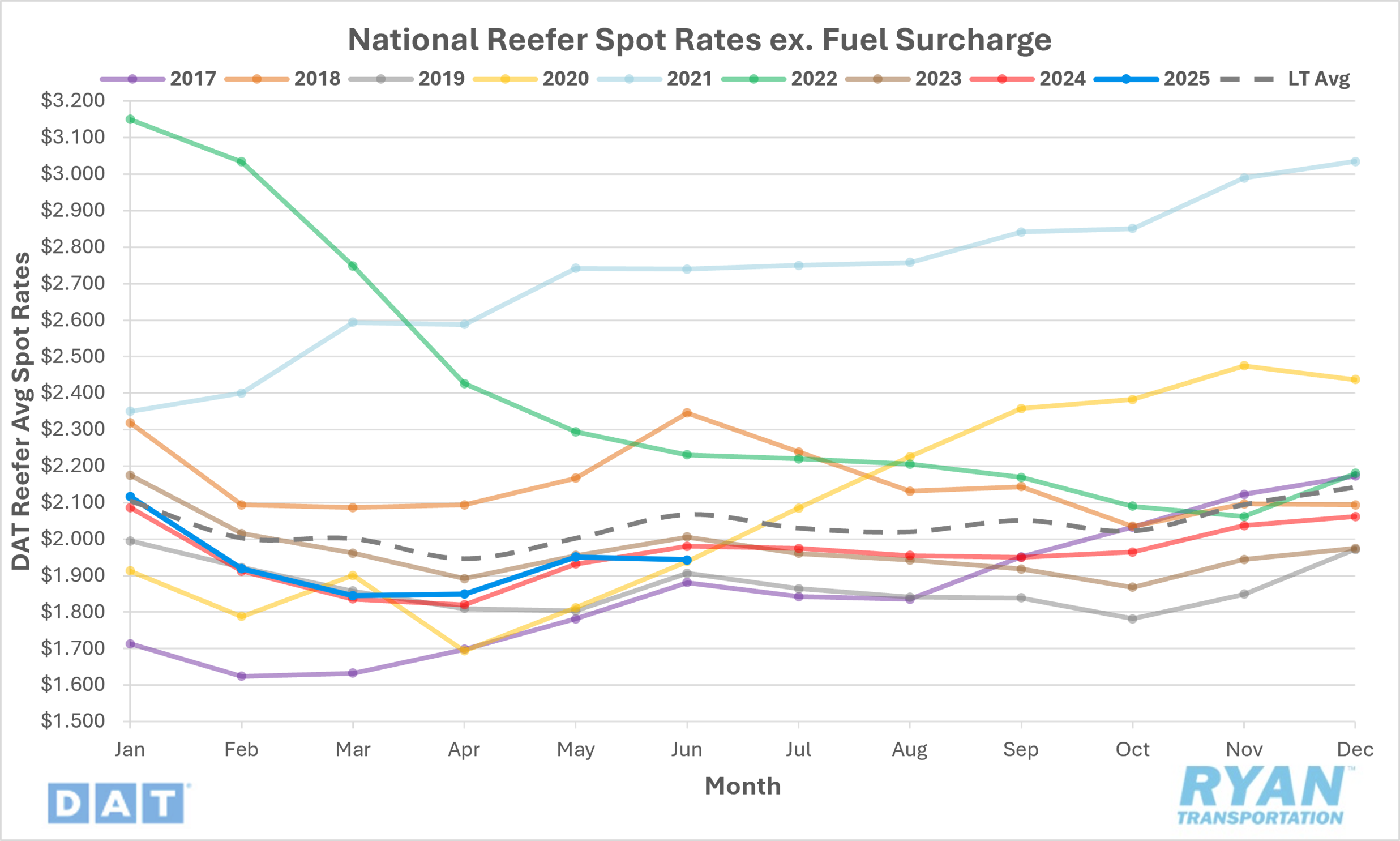

Spot Rates

Key Points

The national average reefer spot rate, excluding fuel, declined by 0.4% MoM in June, or roughly $0.01 to $1.94.

On an annual basis, average reefer spot linehaul rates were down 1.9% YoY and were 6.2% below the LT average.

Initially reported average reefer contract linehaul rates rose 0.1% MoM in June and were 0.8% lower YoY compared to June 2024.

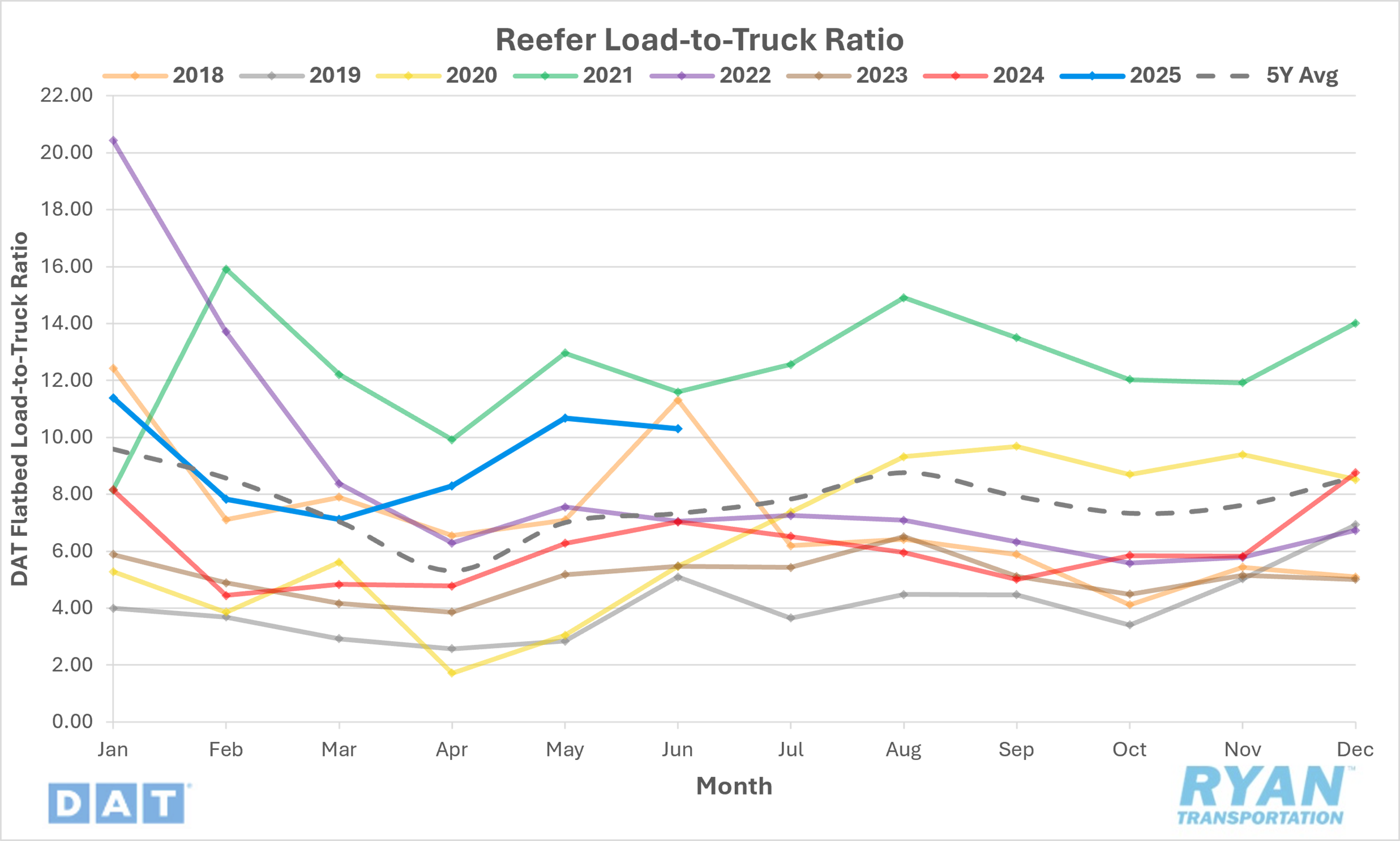

Load-to-Truck Ratio

Key Points

The reefer LTR fell 3.5% MoM from 10.67 recorded in May to 10.30 in June.

Compared to June 2024, the reefer LTR was 46.5% higher YoY but remained below the 5-year average by 7.2%.

DAT load board data for June recorded an 8.4% MoM decline in refrigerated load posts while equipment posts were down 5.2% MoM.

Market Conditions

Summary

The U.S. imported $213B in agricultural products in 2024, with 70% being ready-to-consume items like fruits and vegetables. Agricultural imports are critical to year-round reefer freight demand. Tariffs and trade tensions could reduce volumes, shift port patterns and disrupt route planning in the second half of 2025. Cherry season peaks in June – July and fresh cherry consumption is strong, with approximately 23,000 reefer truckloads estimated from the harvest in 2024. The produce market is highly sensitive to weather and season timing and carriers are watching changes in volumes, pricing and distribution center demand that impact capacity and rate volatility.

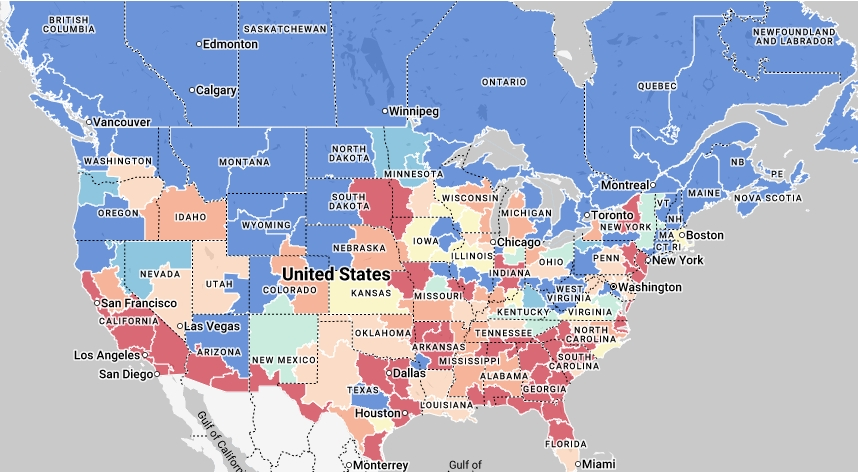

Sysco cut its 2025 forecast by nearly 30%, citing wildfires, bad weather and weak consumer confidence. The Restaurant Performance Index fell in its latest release pointing to declining foodservice volumes. Carriers are focusing on high-value, time sensitive produce loads, but balanced reefer capacity across most produce regions (CA, FL, ID, WA, TX) suggest soft market conditions and widespread capacity availability. Several markets (Columbia Basin, Yakima Valley, and Central Florida) have surplus capacity according USDA reporting indicating weak outbound demand. However, peak grilling season (May – September) is helping support reefer freight with high demand for beef, chicken, and fresh produce. Despite inflation, consumer enthusiasm for barbecues remains strong.

Reefer freight volumes—particularly in food and pharmaceutical shipments—are providing some degree of stability to the broader freight market. However, rate growth remains constrained by macroeconomic uncertainty, delayed harvests and persistent overcapacity. Even during what is typically the peak produce season, reefer rates continue to decline, pushing some carriers below breakeven levels. This dynamic is expected to accelerate carrier attrition within the reefer segment; however, the prevailing weakness in demand continues to extend the duration of the for-hire freight recession. That said, if the subdued produce season triggers a meaningful contraction in reefer capacity, the resulting supply-side tightening could place upward pressure on rates in the fourth quarter as colder weather heightens demand for temperature-sensitive commodities.