Back to July 2025 Industry Update

July 2025 Industry Update: Intermodal

Rail activity remained mixed as intermodal volumes were tempered by broader uncertainties impacting global supply chains and consumer spending. Carload volumes continued to record gains from steady, though relatively subdued, support from the industrial sector.

Spot Rates

Key Points

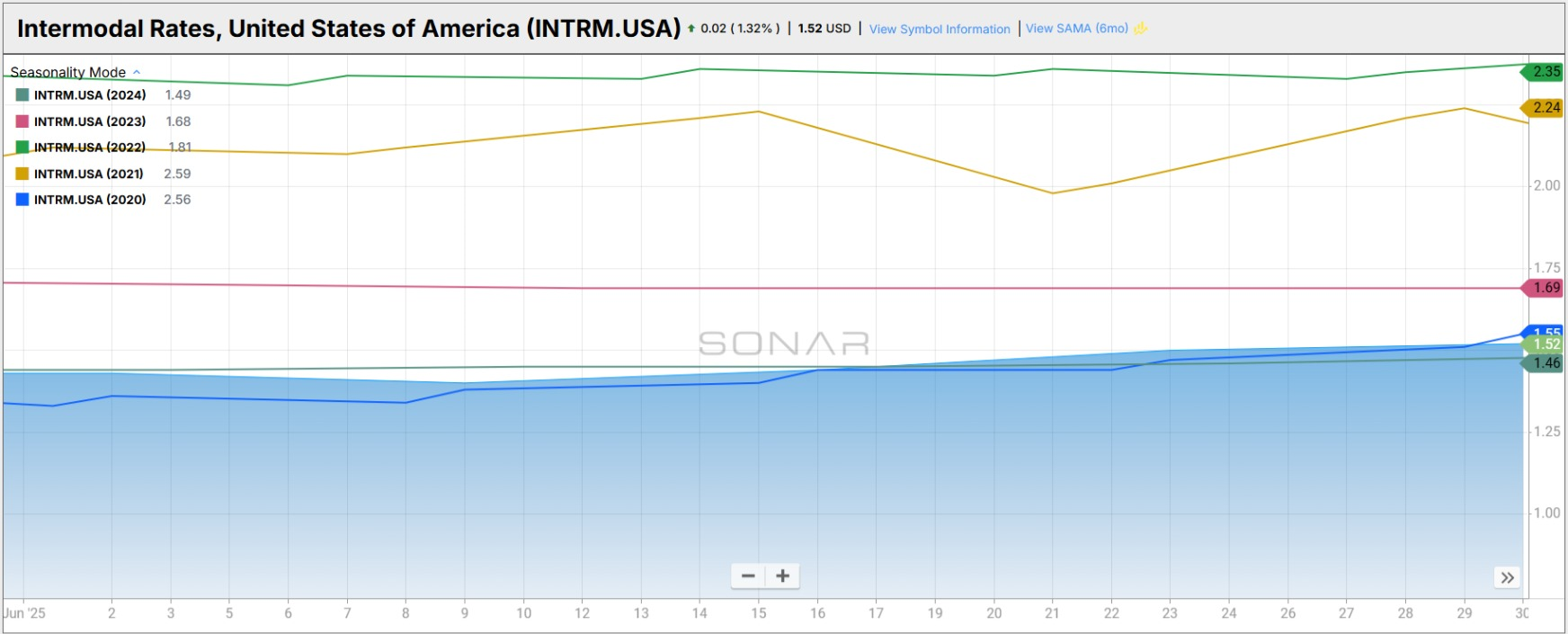

The FreightWaves SONAR Intermodal Rates Index (INTRM.USA), which measures the average weekly all-in door-to-door spot rate for 53’ dry vans across most origin-destination pairings, jumped in June to $1.52 (by $0.09, or 6.3% MoM).

Compared to June 2024, intermodal spot rates were up 4.1% YoY but were 18.2% below the 5-year average.

Volumes

Key Points

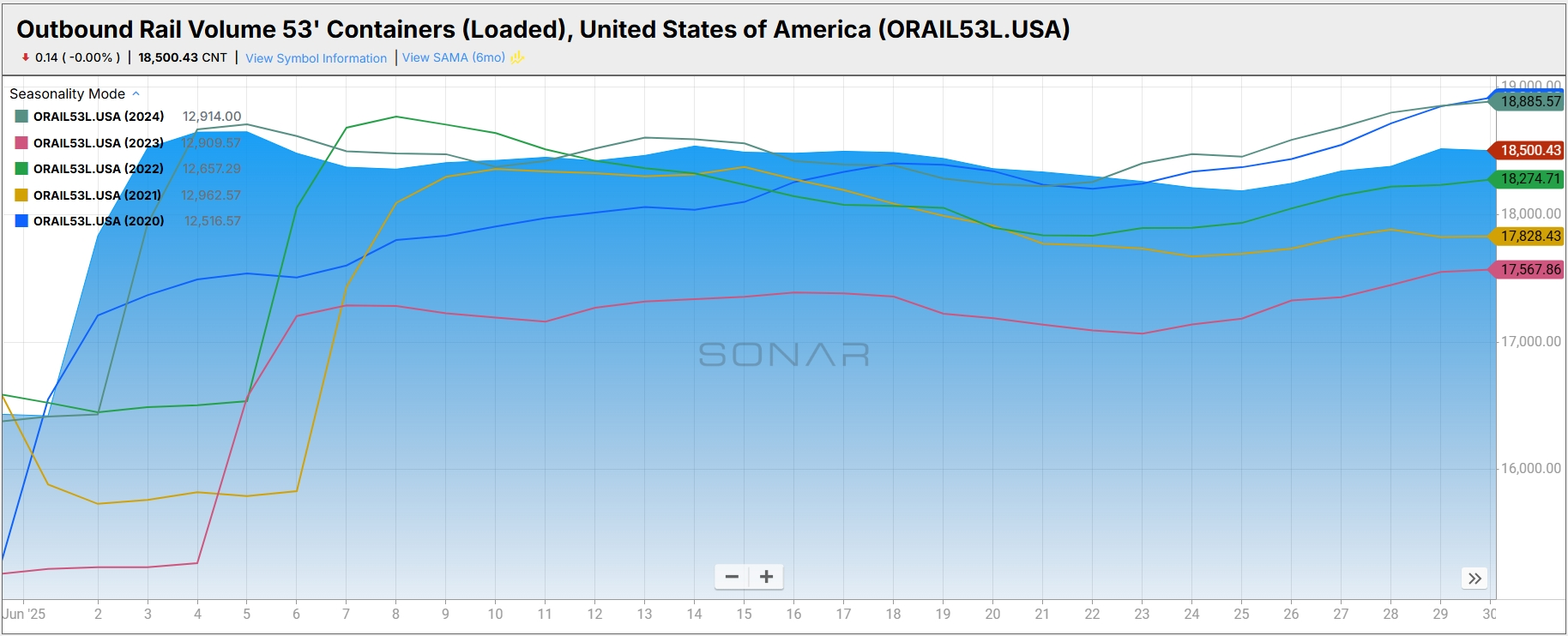

Total loaded volumes for 53’ containers for all domestic markets, measured by the FreightWaves SONAR Loaded Outbound Rail Volume Index (ORAIL53L.USA), increased 12.6% MoM, rising from 16,433.57 at the end of May to 18,500.57 in June.

Loaded domestic rail volumes for 53’ containers in June were down 2.0% YoY compared to June 2024 but are 1.1% higher than the 5-year average.

Intermodal Summary

Following several months of resilient performance and strengthening volumes, rail activity exhibited a more mixed profile in June, as uncertainties surrounding the broader economy and global supply chains weighed on international shipments. According to the latest Rail Industry Overview published by the Association of American Railroads (AAR), intermodal and carload trends diverged, reflecting shifting demand patterns across the freight transportation sector.

U.S. intermodal originations declined 2.9% YoY in June—approximately 31,000 fewer units compared to June 2024—marking the first annual decline in 22 months. Weekly intermodal volumes averaged 260,834 units, or 1.2% below the 10-year average of 263,991 units for the month. However, despite the softening in June, intermodal volumes in Q2 2025 increased 2.0% YoY, and year-to-date volumes through the first half of 2025 were up 5.1% YoY, reflecting underlying strength earlier in the year.

Conversely, carload volumes—historically a lagging component of total rail activity—continued to gain momentum, posting a fourth consecutive YoY increase. Total U.S. carload originations rose 2.1% YoY in June, an increase of approximately 19,000 units compared to the same month in 2024. Of the 20 carload commodity groups tracked by the AAR, half recorded annual gains. Average weekly carload originations in June reached 226,259 units, the highest level for the month since June 2021. On a quarterly basis, Q2 carload volumes rose 4.8% YoY, the strongest quarterly percentage increase since Q3 2021. Through the first six months of 2025, total carload volumes were up 2.4% YoY—or 136,000 units—compared to the same period last year.

Despite the mixed volume performance, intermodal spot rates rose by $0.09 MoM in June and ended the month $0.04 higher YoY versus June 2024. Intermodal spot rates are commonly used by rail carriers to protect contracted capacity, and after remaining mostly flat at historically low levels for several months, the June increase suggests a sudden influx of time-sensitive shipments. This spike likely reflects shippers accelerating downstream movements from ports to clear warehouse space, following the temporary suspension of tariffs on select Chinese goods. Nevertheless, average intermodal spot rates remain well below long-term historical averages, indicating that rail capacity continues to outpace demand.