Back to July 2025 Industry Update

July 2025 Industry Update: Fuel Prices

Average diesel prices increased in June as demand increased from the summer driving season while escalating geopolitical tensions heightened supply concerns.

Key Points

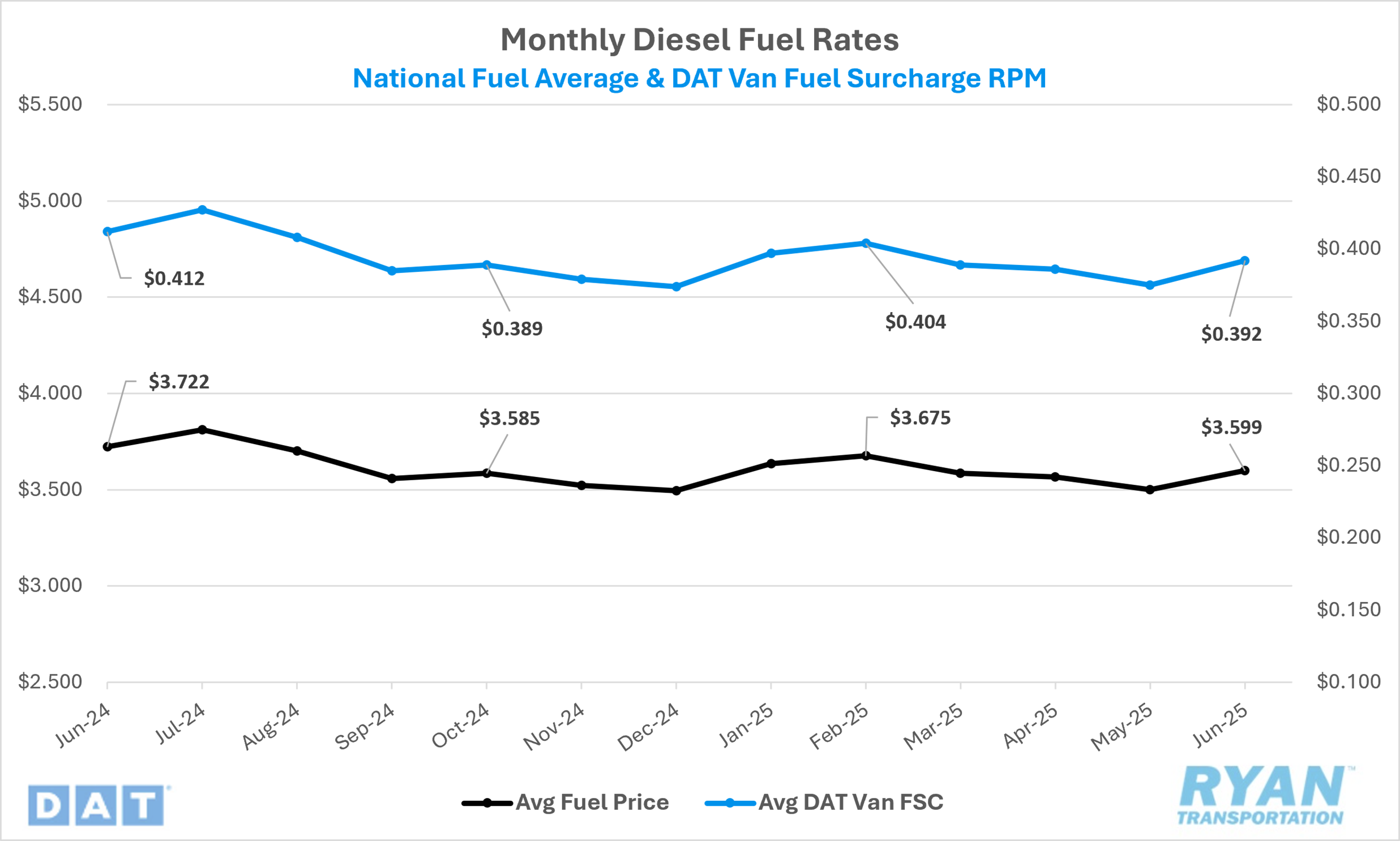

The national average price of diesel rebounded in June, rising 2.9% MoM, or $0.10, to $3.599.

Compared to June 2024, diesel prices were down 3.3%, or just over $0.12.

Draws on U.S. Commercial Crude Inventories outpaced builds in June by 17.1M barrels (bbls) as well as the consensus of -9.4M bbls for the weeks ending June 6 through June 27.

Summary

Following three consecutive months of declines, the national average diesel price rebounded in June, rising by $0.10 MoM, marking the second-largest MoM increase in the past 15 months. The resurgence in fuel prices was driven in part by escalating geopolitical tensions in the Middle East, particularly between Iran and Israel, which contributed to tighter market sentiment and pushed annual diesel price comparisons to their lowest level since July 2023.

On a weekly basis, diesel prices continued their downward trend into early June after registering consistent declines throughout May. In the first week of June, the Department of Energy (DOE)/Energy Information Administration (EIA) benchmark diesel price dropped $0.04 WoW—its eighth decline in nine weeks—bringing the national average to $3.451 per gallon, the lowest since September 27, 2021, when prices stood at $3.406. This downward momentum was reversed in the second week, as prices edged up $0.02 WoW to $3.471. The upward trend accelerated thereafter: diesel prices spiked by $0.10 WoW in the third week—the largest weekly gain since January 20—and surged again by $0.204 WoW in the fourth week, the most significant increase since mid-February 2023. This rally pushed average diesel prices to their highest level in nearly a year. However, the momentum faded in the final week of June, with prices declining $0.05 WoW to close out the month.

Concurrently, domestic commercial crude inventories declined throughout June as the summer driving season intensified. The largest drawdown occurred in the second week of the month, when the EIA reported a 11.5M decrease in U.S. crude oil stockpiles, the largest weekly decline in nearly a year. Contributing to the drawdown was a sharp increase in refinery utilization, which rose to 94.9% by the end of the month—the highest level since July 2024—driven by elevated gasoline demand. Additionally, U.S. net crude imports fell during June, as exports rose by 1.1 million barrels per day (bpd) MoM while imports declined by approximately 700,000 bpd.

Why It Matters:

After three consecutive months of declines driven primarily by expectations of weaker global demand, the sharp increase in fuel prices observed in June was largely attributed to renewed supply-side risks stemming from escalating tensions between Israel and Iran. Although the demand outlook continued to soften—according to the June 2025 Oil Market Report by the International Energy Agency (IEA), global oil demand is now forecast to rise by 720,000 bpd in 2025, down from a previous forecast of 740,000 bpd—the geopolitical developments introduced a significant risk premium across global commodity markets. This premium was driven not only by concerns over potential disruptions to Iran’s crude output, which averaged approximately 3.25 million bpd in May, but also by the possibility of Iran attempting to block the Strait of Hormuz, a critical maritime chokepoint through which roughly 20% of global petroleum consumption is transported, according to the latest Short-Term Energy Outlook from the EIA.

Shortly following the Israeli airstrikes, the Iranian Parliament voted in favor of closing the Strait of Hormuz. However, any decision to take such a drastic step would ultimately rest with Iran's senior leadership. While fears surrounding the closure of the Strait have periodically surfaced in oil markets, such a move has yet to materialize given the significant impact it would have on Iran’s own export revenues, the bulk of which rely on passage through the Gulf.

Although geopolitical tensions subsided somewhat by the end of June, a growing divergence has emerged between strengthening ultra-low sulfur diesel (ULSD) prices and weakening crude benchmarks. Diesel markets remain under pressure from persistently tight global inventories. This tightness is reflected in the futures curve, where the price spread between the first- and second-month ULSD contracts has widened, a clear sign of backwardation. When markets are in backwardation, near-term barrels carry a premium due to immediate supply constraints, incentivizing rapid delivery. With diesel futures currently in backwardation, upward pressure on retail diesel prices is expected to persist until inventories rebuild and the market reverts to a more balanced structure, otherwise known as contango. Prolonged increases in diesel prices could pose an additional cost burden on smaller carriers, potentially accelerating capacity exits from an already strained segment of the industry.