Back to July 2025 Industry Update

July 2025 Industry Update: Flatbed

The flatbed industry continued to perform the worst of the three major modes in June as rates fell slightly while volumes weakened considerably.

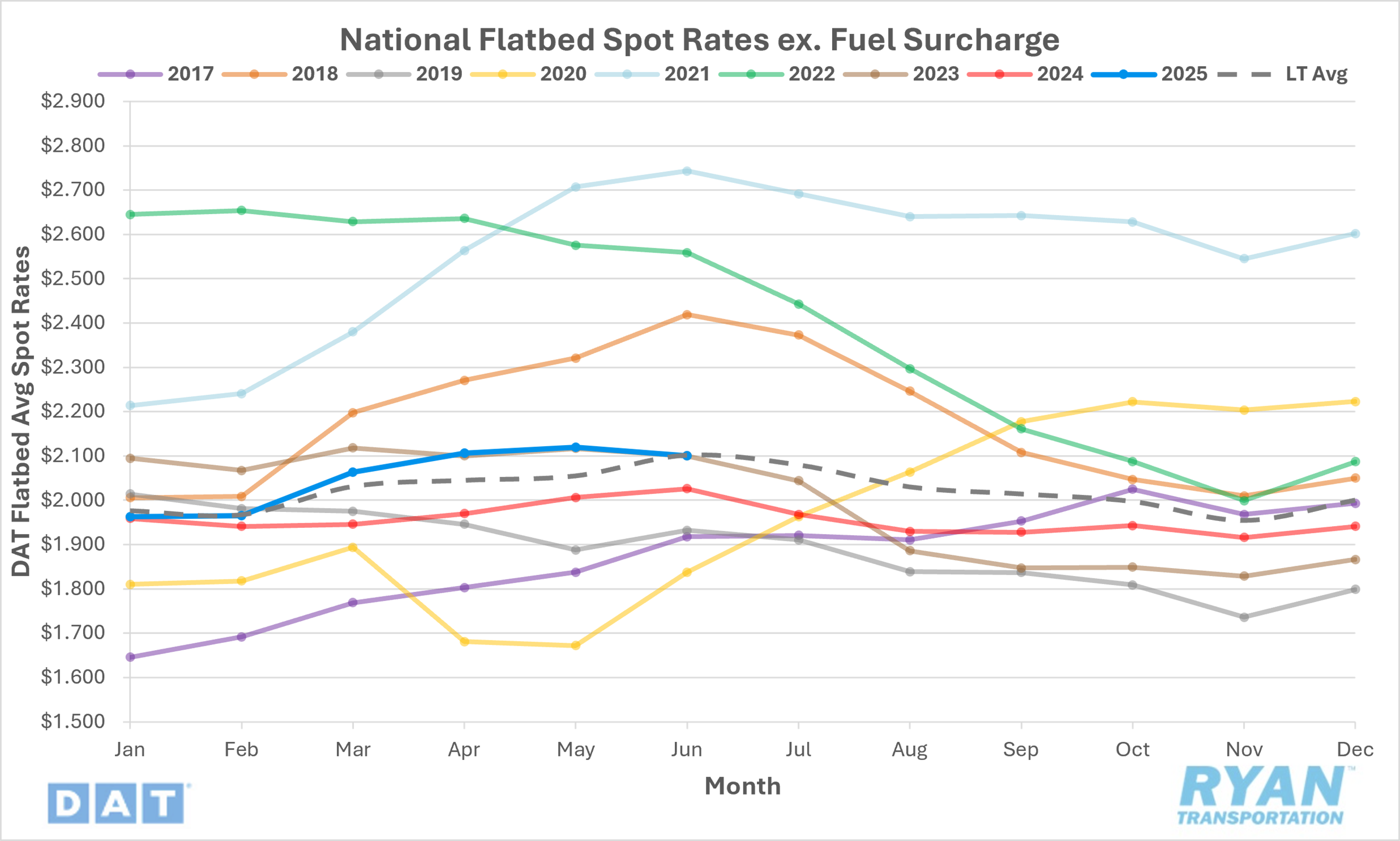

Spot Rates

Key Points

The national average flatbed spot rate, excluding fuel, registered 0.9% lower MoM in June, or $0.02, to $2.10.

Annual comparisons of average flatbed spot linehaul rates reflected a 3.7% increase YoY compared to June 2024, but dropped below the LT average by 0.7%.

Initially reported average flatbed contract linehaul rates declined 0.4% MoM in June, but were up 1.3% YoY compared to June 2024 levels.

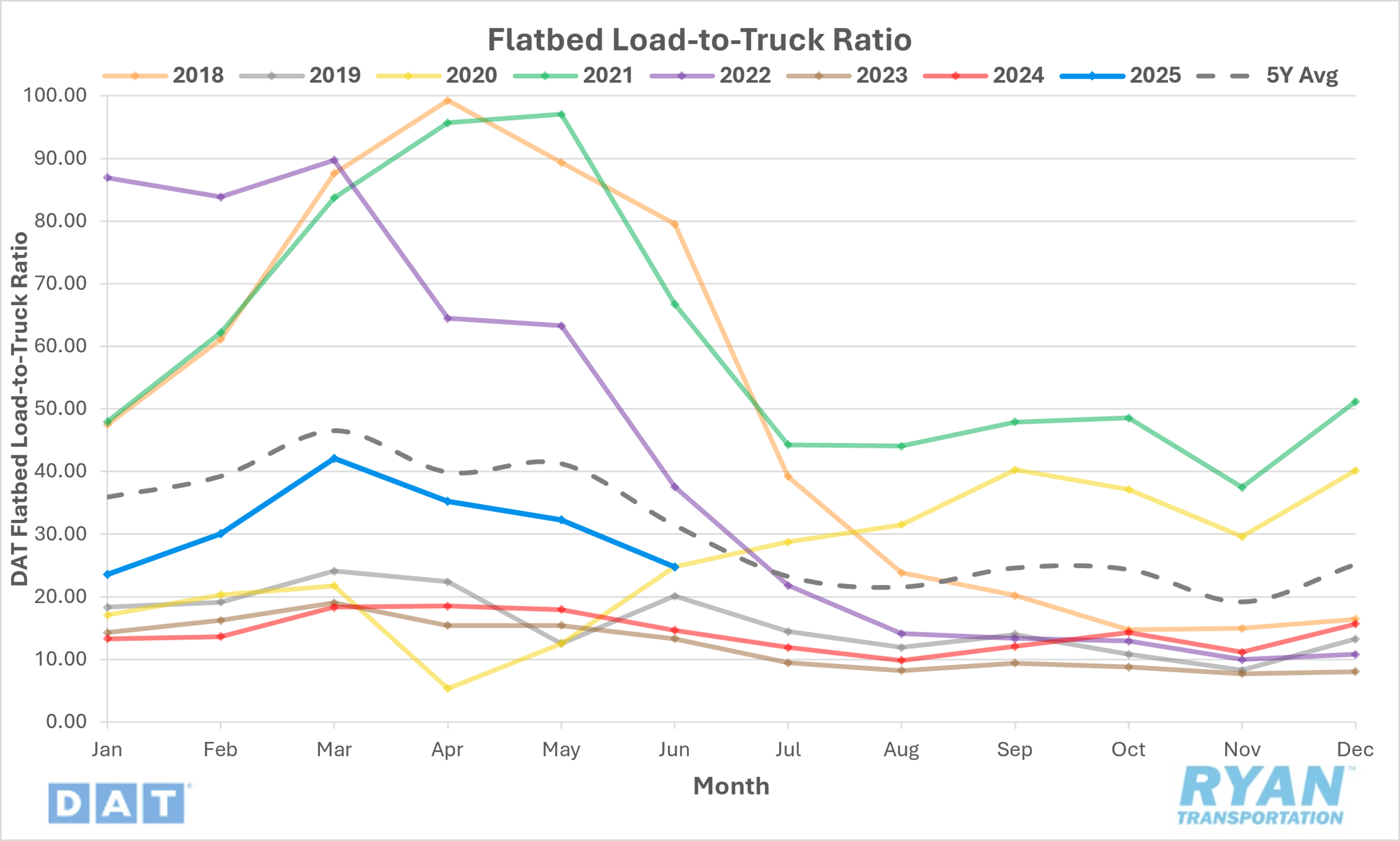

Load-to-Truck Ratio

Key Points

The flatbed LTR fell sharply in June by 23.2% MoM, falling from 32.25 in May to 24.77.

Compared to June 2024, the flatbed LTR remained elevated by 69.1% YoY but was 21.1% below the 5-year average.

According to DAT, flatbed load posts were down 19.2% MoM in June while equipment posts registered 5.2% higher MoM.

Market Conditions

Summary

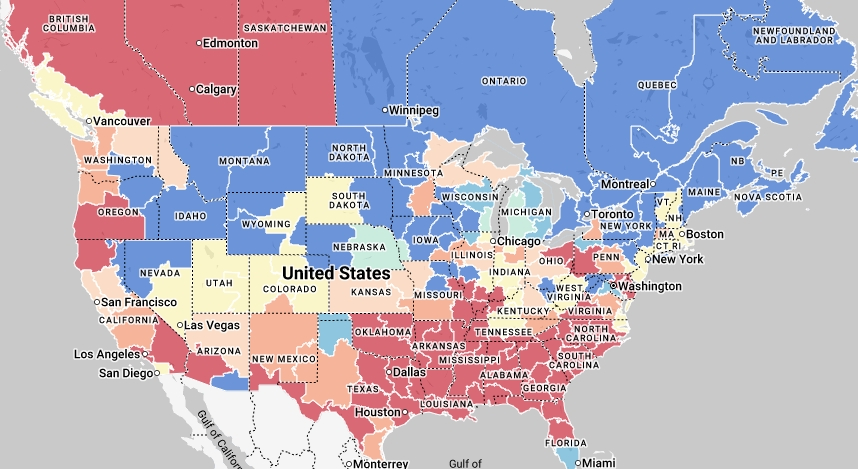

Flatbed remains the strongest modal segment supported by construction, infrastructure, and project cargo demand in Texas, Alabama, and Georgia, as well as housing demand, infrastructure and energy-related projects along the Gulf Coast. For the second straight quarter, truck ton-miles rose, supported by strong demand in chemicals, construction materials (wood, minerals and steel), and machinery. Despite stable demand, spot flatbed pricing is capped due to ongoing manufacturing weakness, high input costs and broad tariff uncertainty. There is also ample capacity available, limiting upward rate pressure, but rates could fall if industrial demand weakens further.

According to the most recent data by the Association of Equipment Manufacturers, U.S. agricultural equipment sales dropped sharply through April, with tractors down 13.3% YTD and combines down 48.3%. Tariff risks and inflation are delaying capital purchases as nearly 60% of imported agricultural equipment are intermediate parts, raising cost risks. The tariffs on steel and aluminum announced June 1 could increase manufacturing input costs, pressure Midwest flatbed lanes hauling industrial goods and trigger regional reshoring shifts, realigning demand for flatbed carriers.

The official start of the Atlantic hurricane season on June 1 introduces the potential for elevated flatbed demand later in the summer and into the fall, driven by disaster relief and reconstruction efforts. According to the National Oceanic and Atmospheric Administration’s (NOAA) latest outlook, the 2025 season is expected to be above average, with a projected range of 13 to 19 named storms. Last year, in the aftermath of Hurricane Helene, regional flatbed load posts in the Southeast surged 14% WoW, driving the flatbed LTR to its highest level in more than three years. Simultaneously, outbound freight volumes in markets directly affected by the storm declined 17% WoW, while spot rates rose by $0.08 WoW. Beyond hurricane-related disruptions, the northern U.S. and Midwest are expected to soak up flatbed capacity with larger machinery shipments during the warmer months.