Back to July 2025 Industry Update

July 2025 Industry Update: Economy

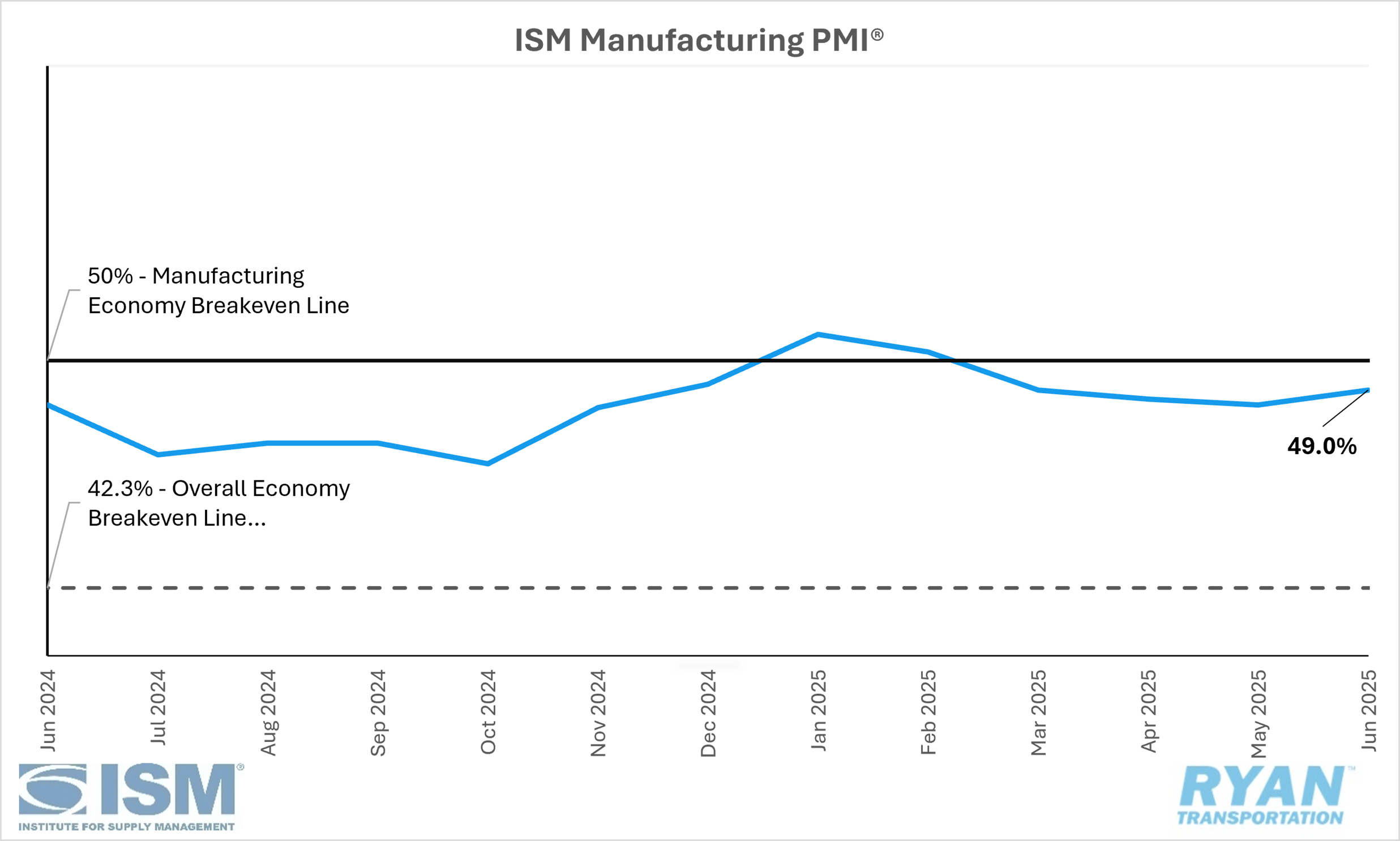

The ISM® manufacturing index improved marginally but remained in contraction as new orders remained weak while production increased.

United States ISM Manufacturing PMI

Key Points

The Institute of Supply Management® (ISM®) Manufacturing PMI® registered 49.0% in June, 0.5% higher than May’s reading of 48.5% and remaining in contraction territory.

The New Orders Index contracted at a faster rate in June compared to May, dropping 1.2% from 47.6% to 46.4%.

The Production Index moved into slight expansion territory, rising 4.9% from the 45.4% recorded in May to 50.3% in June.

The Employment Index registered 45.0% in June, 1.8% lower than May’s reading of 46.8%.

The Supplier Deliveries Index fell 1.9% to 54.2% in June, down from May’s reading of 56.1%.

The Inventories Index remained in contraction territory, registering 49.2% in June, 2.5% higher than the 46.7% recorded in May.

Summary

Domestic manufacturing activity contracted for the fourth consecutive month in June, though at a slower pace compared to May. According to the latest Manufacturing ISM® Report on Business, the Manufacturing PMI® increased by 0.5 percentage points, primarily supported by improvements in inventory levels and production activity. With respect to the broader economy, June marked the 62nd consecutive month of expansion following a single month of contraction in April 2020. Historically, a Manufacturing PMI® reading above 42.3% is considered consistent with overall economic growth.

Demand indicators remained mixed in June. Both the New Orders and Backlog of Orders indices contracted at a faster rate than in May, while the pace of contraction in the Customers’ Inventories and New Export Orders indices slowed. New orders have now declined for five consecutive months and continue to trend below the 12-month moving average of 48.4%. According to the ISM® report, survey respondents cited ongoing weakness in demand, with a 1-to-1.7 ratio of positive to negative comments regarding near-term outlook. Despite this, the continued reading of the Customers’ Inventories Index in "too low" territory was highlighted as a positive signal, indicating inventory levels that may support future production increases.

On the output side, the Production and Employment indices together contributed a net positive impact to the Manufacturing PMI® for the second consecutive month. The upward movement was largely driven by the Production Index, which entered moderate expansion territory for the first time in four months. However, the gains in production remain fragile amid weak order volumes and ongoing declines in new orders. Meanwhile, the Employment Index moved further into contraction, reflecting continued workforce reductions. Survey data revealed a 1-to-3.2 ratio of hiring to staff-reduction comments, with layoffs remaining the predominant method of workforce adjustment. This acceleration in layoffs signals an increased urgency among manufacturers to align staffing levels with current and anticipated demand conditions.

Among the six largest manufacturing industries—Chemical Products; Transportation Equipment; Computer & Electronic Products; Food, Beverage & Tobacco Products; Machinery; and Petroleum & Coal Products—four reported growth in June. These included Petroleum & Coal Products, Computer & Electronic Products, Machinery, and Food, Beverage & Tobacco Products, up from just two sectors reporting growth in May.

Why it Matters:

Despite June’s headline Manufacturing PMI® reading of 49.0% exceeding consensus expectations and registering a modest improvement over May, underlying details in the report continued to raise concerns, as has been the case in recent months. While the ISM® data included a handful of encouraging indicators, a closer examination reveals several cautionary and potentially adverse signals for the near-term outlook of domestic manufacturing.

The most notable area of concern stemmed from the unexpected strength in the Production Index. In the prior month’s report, Susan Spence, MBA, Chair of the ISM® Manufacturing Business Survey Committee, flagged production levels as vulnerable, citing unfavorable trends in imports, backlogs and inventories. All three indices remained in contraction territory again in June, which casts doubt on the sustainability of the recent increase in production. Spence suggested the June gains were likely driven by front-loaded activity related to the temporary suspension of tariffs. This interpretation is supported by a 7.5% increase in the Imports Index and a 2.2% rise in the Customers’ Inventories Index, which, while still in “too low” territory, may indicate that end customers are beginning to restock.

Spence cautioned that these trends, however, are unlikely to continue without a meaningful recovery in new orders. With the New Orders Index remaining in contraction and backlogs continuing to erode, the foundation for sustained production growth remains weak. Rising input costs present an additional challenge, as the Prices Index increased for the ninth consecutive month, reaching its highest level since 2022. In response, many manufacturers appear to be focusing on cost containment measures, most notably through headcount reductions—reflected in the continued decline of the Employment Index.

One particularly concerning data point identified in the June report was the sharp increase in the share of manufacturing gross domestic production classified in "strong contraction"—defined as an industry-specific PMI® at or below 45%. That share rose to 25% in June, up from just 5% in May. Of particular note is the performance of the Chemical Products industry, the largest contributor to manufacturing GDP, which reported a PMI® of 43.5% and an Employment Index of 39%. Given its role as a key supplier to 17 other manufacturing sectors, Spence emphasized the significance of this development, characterizing Chemical Products as a bellwether for the broader manufacturing economy.