Back to July 2025 Industry Update

July 2025 Industry Update: Dry Van

The dry van sector registered moderate gains in both spot rates and demand in June but were well below the historical average for the month.

Spot Rates

Key Points

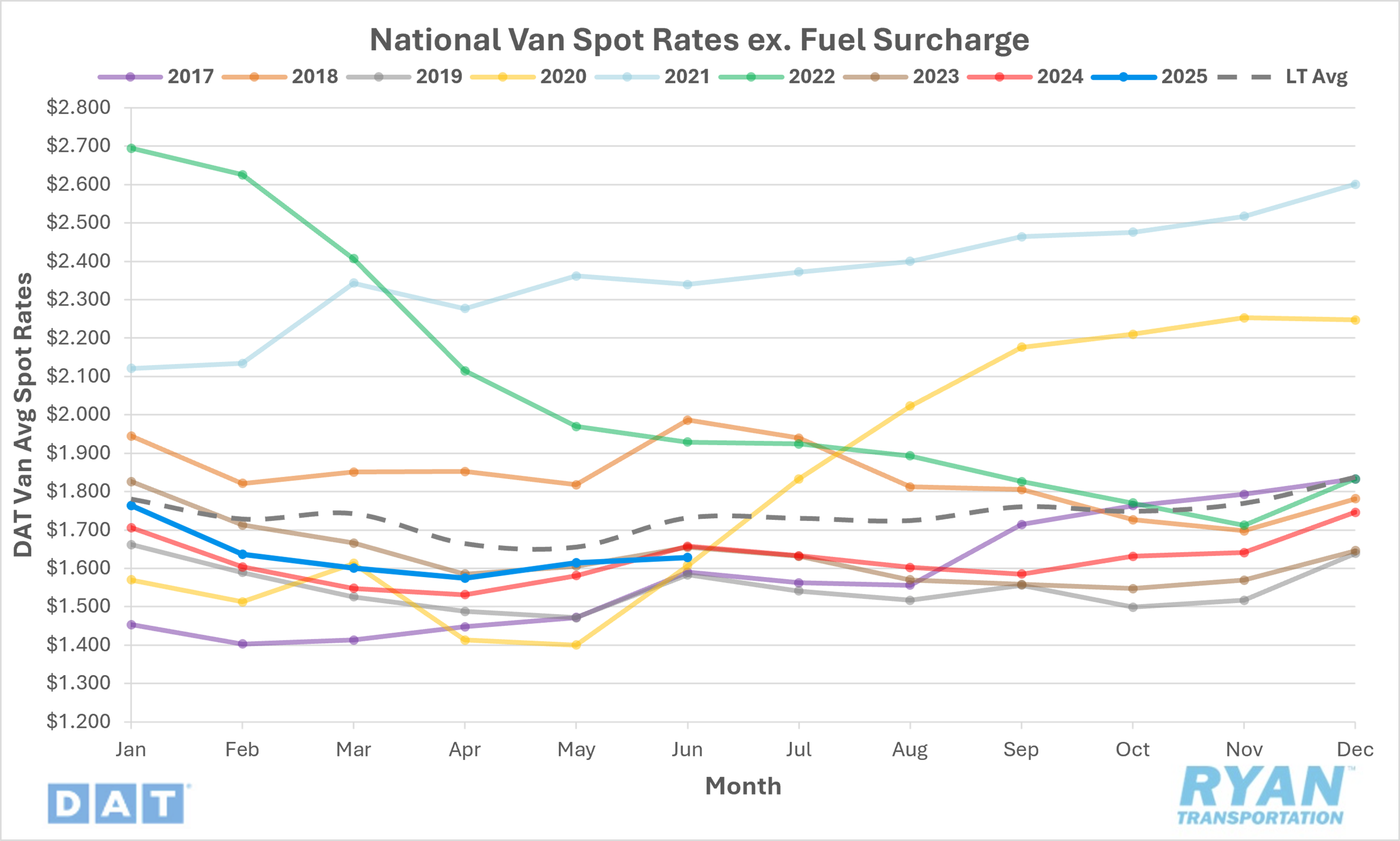

The national average dry van spot rate excluding fuel increased slightly by 0.8% MoM, or just over $0.01, to $1.63.

The average dry van spot linehaul rate was down 1.8% YoY compared to June 2024 and was 6.2% below the LT average.

Initially reported average dry van contract linehaul rates were essentially flat in June, rising by just 0.1% MoM and are 0.5% lower YoY compared to June 2024.

Load-to-Truck Ratio

Key Points

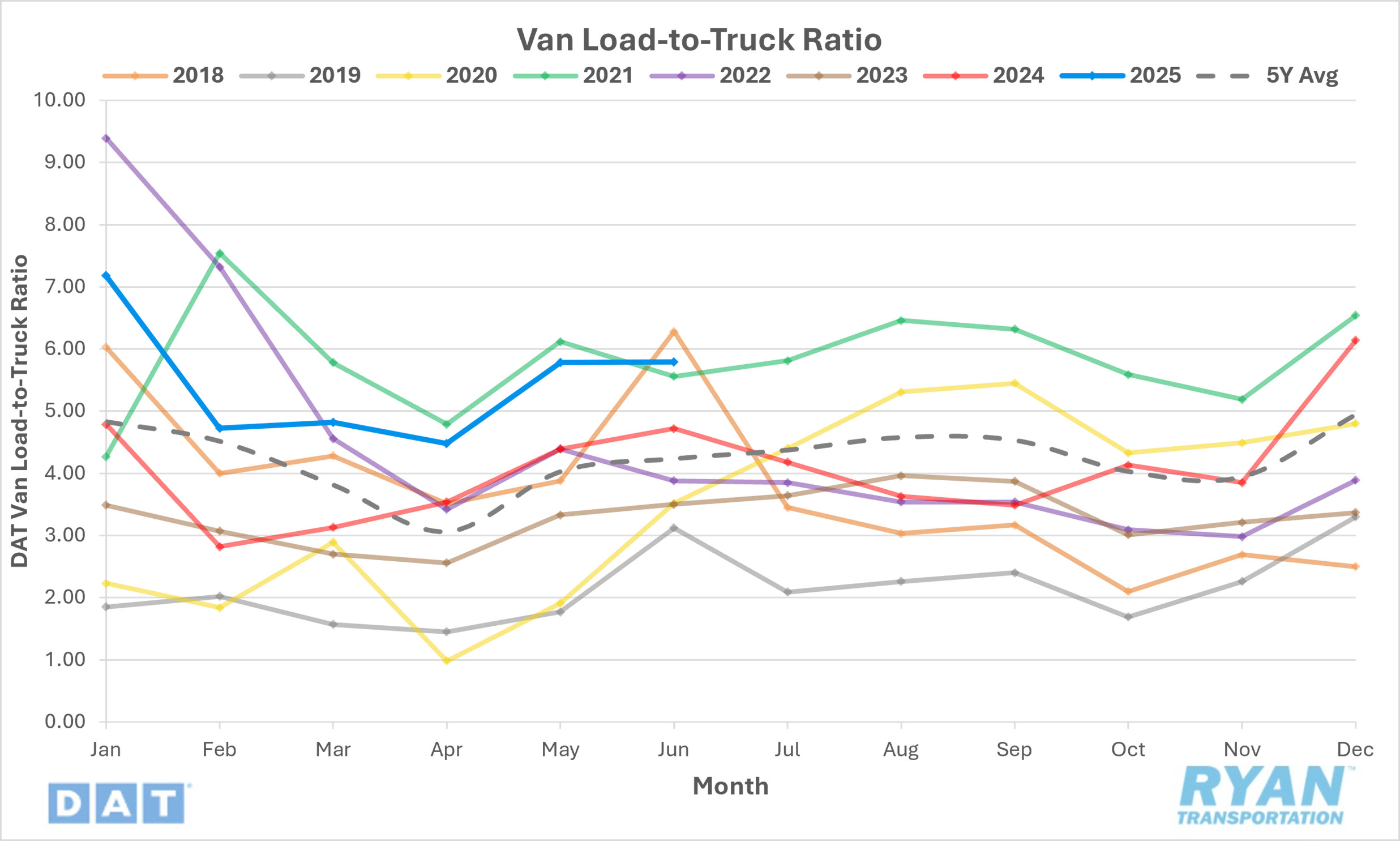

The dry van load-to-truck ratio (LTR) rose slightly by 0.2% MoM, increasing from 5.78 in May to 5.79 in June.

Compared to June 2024, the dry van LTR was up 22.7% and was 36.7% higher than the 5-year average.

According to load board data collected by DAT Freight & Analytics, both load and equipment post volumes were down in June, declining 2.9% and 3.0% MoM respectively.

Market Conditions

Summary

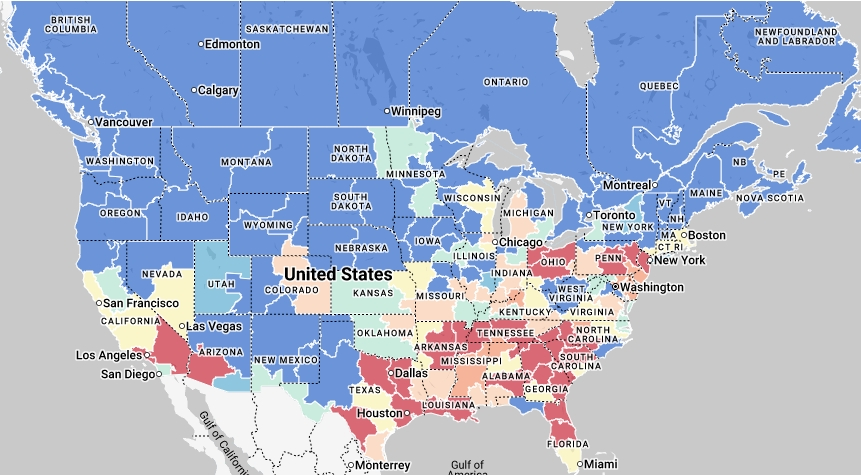

Dry Van volumes between Los Angeles and Phoenix are up 30% YoY with more growth expected. Arizona is the top U.S. state for foreign trade zone employment and a key transshipment point for imports from Asia. Phoenix is becoming a preferred logistics hub due to its infrastructure, including interstates, rail, and airport access, as well as access to over 86 million people within a one-day truck drive. Many companies use foreign trade zones to delay tariff payments and improve cash flow—for this, Arizona is also a top warehouse market and semiconductor hub.

American Trucking Associations’ For-Hire Truck Tonnage Index most recent report showed U.S. freight tonnage fell in April 2025 (-0.3% MoM), continuing the decline from March. The Dry Van market is stabilizing seasonally but is still weak with spot rates stable but not rising, putting pressure on contract rates. Some analysts expect a Q3 import surge followed by flat volumes for the remainder of 2025. Due to many shippers front-loading imports to avoid tariffs, the early peak season is now not September, and late-year volumes are likely to be flat. Shippers are being cautious, reducing investments and hiring, and the oversupply of trucks continues to suppress broker and carrier margins.

With the potential for a surge in import activity during the third quarter followed by a possible softening of demand in the fourth quarter, shippers are expected to focus on maintaining pricing leverage—particularly in scenarios where inventories are already elevated due to front-loading. This will likely be facilitated through adjustments in procurement and supply chain strategies, including the continued use of private fleets and intermodal service providers, especially where warehouse capacity remains constrained. Such shifts are expected to exert continued downward pressure on overall truckload demand, with the dry van segment likely to be disproportionately affected. In response, carriers may increasingly reposition assets toward high-growth freight corridors—such as Los Angeles to Phoenix, Houston to Dallas, and Savannah to Atlanta—further contributing to regional capacity imbalances and sustaining volatility in pricing dynamics.