Back to February 2026 Industry Update

February 2026 Industry Update: Truckload Rates

Main Takeaways

- Average spot rates climbed to their highest levels in over three years as Winter Storm Fern delayed conditions from normalizing.

- Contract rates ticked higher for the fourth straight month, driven by upward pressure from surging spot rates, while the gap between the two narrowed to its lowest level since 2022.

Summary

Spot rates continued to climb in January, as residual holiday effects early in the month and late-month winter weather disruptions delayed a return to more normalized market conditions. With a second consecutive month of sequential gains, average spot rates reached their highest level since June 2022. The sustained strength in the spot market has continued to put upward pressure on contract rates, lifting them to their highest level in nearly three years. However, contract rate increases have continued to lag the sharper gains in spot pricing, compressing the spread between the two to its narrowest level since the market downturn began in March 2022.

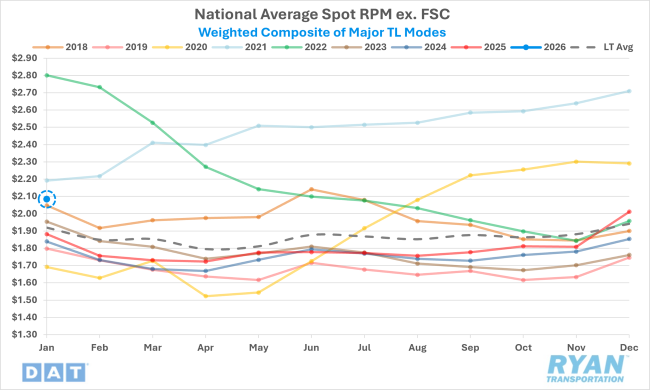

DAT National Average Spot Rates excl. FSC, Weighted Composite Index

Key Points

- Following one of the largest sequential increases on record in December, total average spot rates across all modes rose an additional 3.6% MoM in January, driven by holiday-related disruptions early in the month and capacity constraints stemming from Winter Storm Fern later in the period. On an annual basis, spot rates were 10.8% higher than January 2025 levels and remained 7.8% above the long-term average.

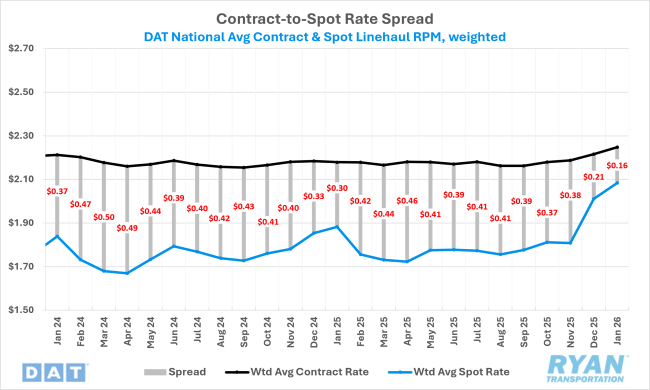

DAT National Average RPM Contract vs. Spot

Key Points

- Total initially reported average contract rates across all modes posted a second consecutive monthly increase in January, rising 1.4% MoM and 3.2% YoY compared to January 2025. Despite the continued firming in contract pricing, sustained strength in spot rates compressed the contract-to-spot spread to just over $0.16 from $0.21 in December. This left contract rates only about 8% above spot levels after averaging a 20 – 25% premium throughout 2025.

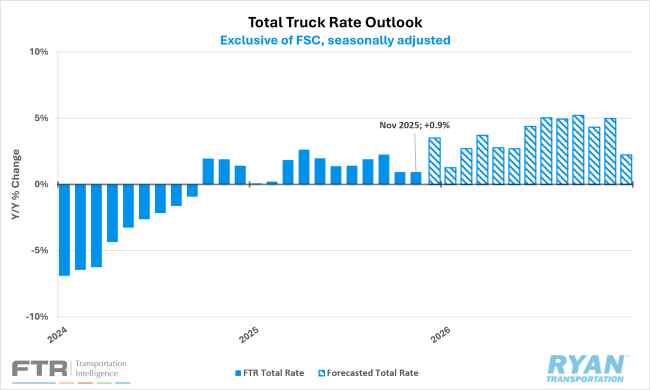

FTR Total Truck Rate & Outlook

Key Points

- In its February 2026 outlook, FTR revised its 2026 total truckload rate forecast sharply higher, increasing expected growth to +3.7% YoY from the prior +2.5%. The revision was driven primarily by a significantly stronger spot rate outlook, raised to +6.5% YoY from +3.6%, while the contract rate forecast increased more modestly to +2.3% YoY; by equipment type, refrigerated rates saw the largest upward revision to +6.5% YoY, followed by dry van rates rising 160 bps to +3.9% and flatbed rates increasing 90 bps to +3.0%.

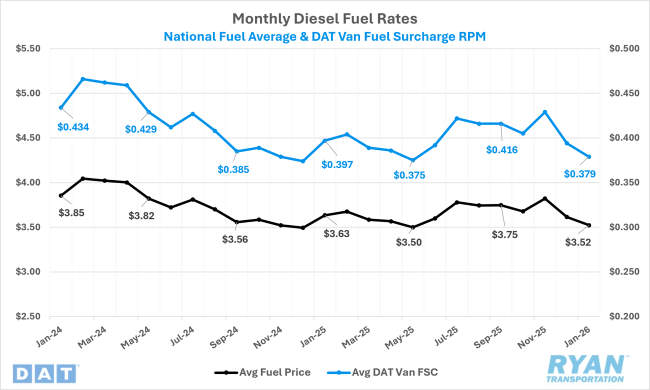

DAT Fuel Trends

Key Points

- Average fuel prices declined for a second consecutive month in January, falling $0.09 from December’s average and running $0.11 lower YoY compared to January 2025, according to the U.S. Energy Information Administration (EIA). In its latest Short-Term Energy Outlook, the EIA revised its 2026 diesel price forecast lower, now projecting a 10.7% YoY decline, down from its prior estimate of an 8.2% decrease.

Outlook

Winter Storm Fern had a meaningful impact on rate dynamics at the end of January, as average spot rates had already retreated approximately 6% from their holiday-driven peaks in the two weeks preceding the storm —before tightening conditions reignited upward pressure. Absent additional winter weather events or short-term demand shocks, spot rates are expected to normalize in the coming months and realign with historical seasonality, albeit from a materially higher floor than observed at the same time in 2025.

In the contract market, with the annual RFP cycle nearing completion, the recent volatility and elevated spot rate environment are likely to support incremental near-term increases in contract pricing as routing guides are finalized. Looking ahead, shippers are expected to continue prioritizing network resilience and service reliability — particularly in high-density lanes — as leaner inventory strategies and spot market sensitivity to disruptions reinforce the strategic value of dependable carrier partnerships.