Back to February 2026 Industry Update

February 2026 Industry Update: Truckload Demand

Main Takeaways

- Following a strong December, contract volumes appeared more volatile to start the year, retreating throughout much of the month before a pre-storm pull forward in activity led to a boost at the end of the month.

- Spot volumes continued to surge in January, driven by capacity disruptions from the holidays early in the month and Winter Storm Fern late in the month.

Summary

Overall truckload demand modestly underperformed, though it remained largely in line with typical January seasonality and continues to trend materially below levels recorded over the past two years. Following the pronounced inventory drawdown ahead of the holidays that supported localized and short-haul movements, January saw a relative improvement in longer-haul shipments as replenishment activity shifted upstream in the supply chain.

While spot market volumes received a notable boost from Winter Storm Fern late in the month, contract volumes were also supported as shippers accelerated freight to avoid weather-related disruptions and truckload networks captured incremental share from intermodal amid heightened service urgency. However, the largest beneficiary of both the winter storm and the prolonged, widespread cold weather this winter has been the refrigerated sector, as temperature-sensitive commodities requiring protection from freezing have driven reefer demand to its highest level since the markets' peak in January 2022.

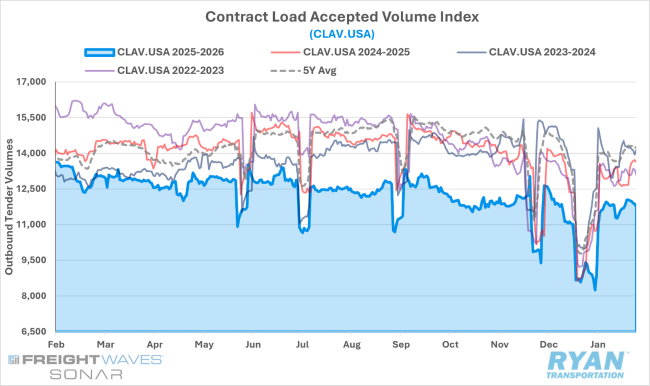

SONAR Contract Load Accepted Volumes Index (CLAV.USA)

Key Points

- Following the post–New Year’s slowdown, contract load volumes, as measured by the FreightWaves SONAR CLAV Index, rebounded near pre-holiday levels and peaked late in the month amid disruptions caused by Winter Storm Fern. Despite the recovery in activity, annual comparisons deteriorated, with the CLAV Index registering a 12.1% YoY decline in January after narrowing sequentially throughout Q4 2025 and nearly 18% below on a two-year stack.

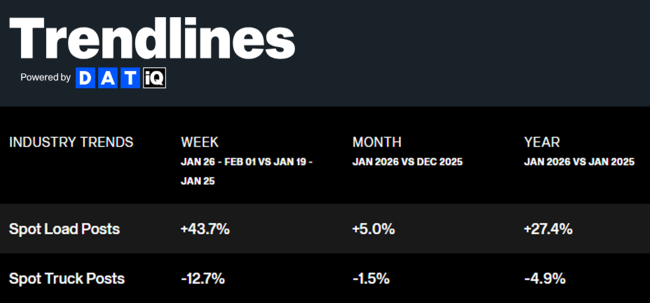

DAT Trendlines

Key Points

- According to DAT load board data, spot market volumes increased sequentially for the second consecutive month in January, extending their year-over-year streak to 12 consecutive months.

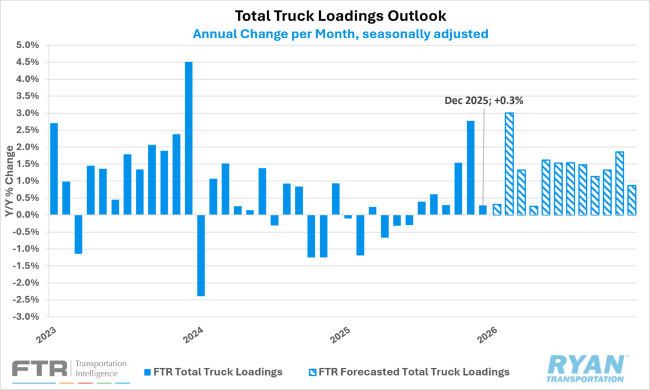

FTR Total Truck Loadings Outlook

Key Points

- FTR revised its 2026 total truck loadings outlook upward to +1.3% YoY from the prior forecast of +0.1%, driven by stronger growth in food loadings and an improving outlook for packaged goods and paper volumes. The firm also upgraded its 2025 forecast, revising total loadings from a previously expected decline of -0.3% YoY to modest growth of +0.3%.

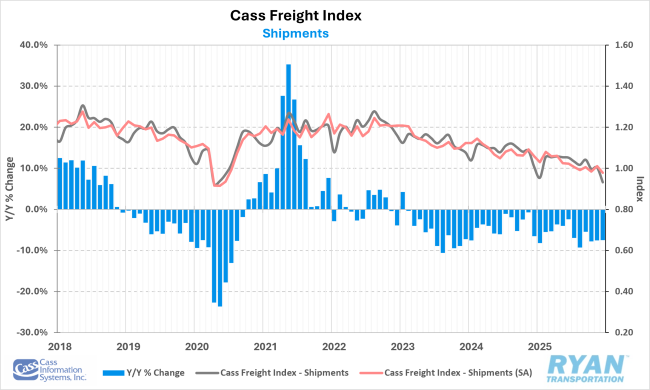

Cass Freight Index Shipments Forecast – January 2026

Key Points

- The shipments component of the Cass Freight Index declined 7.5% YoY in December, modestly underperforming the full-year decline of 6.1%. The report noted that multiple winter storms across the Midwest disrupted highway networks during the month, likely creating pent-up demand that subsequently surfaced in elevated spot market activity in early January.

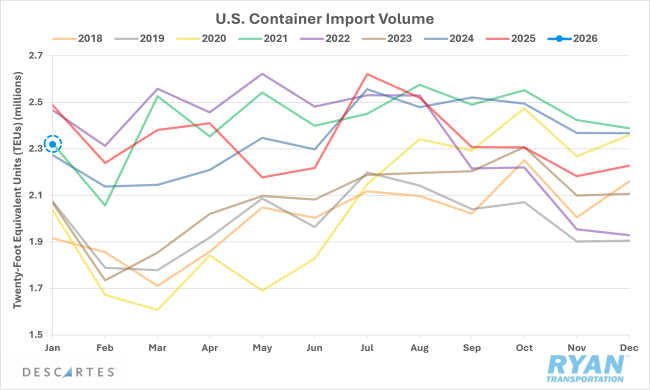

Descartes U.S. Container Import Volumes

Key Points

- Total U.S. container import volumes rose 4.1% MoM in January following December’s seasonal slowdown, but remained 6.8% below levels recorded in January 2025. Despite the annual decline, January volumes exceeded month’s historical average, suggesting a more normalized trade environment driven by steady underlying demand rather than tariff-related frontloading.

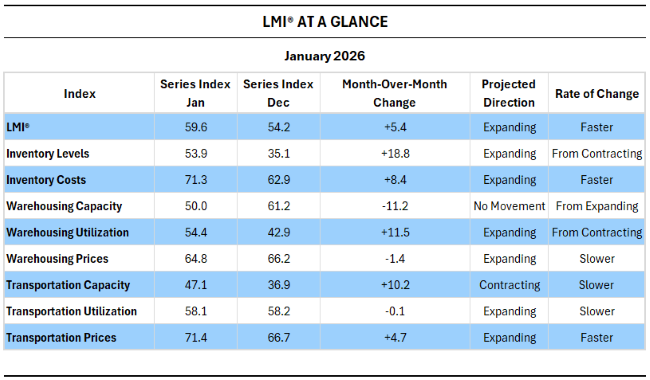

LMI® At a Glance

Key Points

- The January Logistics Managers’ Index (LMI®) recorded its fastest rate of expansion since May of last year, driven primarily by a resumption of modest restocking activity at the start of the year. According to the report, both Inventory Levels and Warehouse Utilization returned to expansion after sharp contractions in December. However, they remain slightly below historical norms for January as firms continue to prioritize lean inventories amid demand uncertainty and elevated cost pressures.

Outlook

Looking ahead, the demand outlook for 2026 remains uncertain, with several headwinds still in place, though upside risks cannot be ruled out. Ongoing trade policy volatility continues to weigh on business confidence. Despite the Supreme Court’s pending decision on the legality of the IEEPA tariffs, many analysts expect alternative mechanisms to preserve duties in some form, suggesting tariff-related cost pressures may persist. Decisions surrounding sourcing realignment and domestic investment will have meaningful implications for input costs, pricing and, ultimately, consumer spending, adding another layer of complexity to the demand trajectory.

While the recent rebound in domestic manufacturing and new orders offers a constructive signal for future production activity, durability will require sustained momentum over multiple months before it can be characterized as a true recovery. Additional support could emerge from improving macroeconomic conditions, targeted policy initiatives or fiscal tailwinds such as higher tax refunds. However, absent a clear demand catalyst, freight volumes are likely to remain largely dictated by seasonal patterns in the near term.

Back to February 2026 Industry Update