Back to February 2026 Industry Update

February 2026 Industry Update: Intermodal

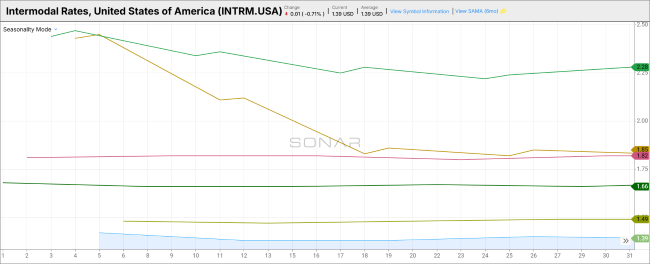

FreightWaves SONAR Intermodal Rates Index (INTRM.USA)

Key Points

- Intermodal spot rates, as measured by the FreightWaves SONAR INTRM Index, continue to suggest capacity remains readily available and remain $0.11 below year-ago levels.

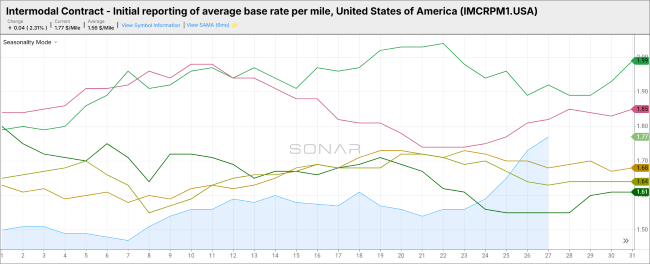

FreightWaves SONAR Initially Reported Average Contract Base RPM (IMCRPM1.USA)

Key Points

- Initially reported intermodal contract rates remained depressed in January, reflecting ample available capacity and continued competitive pressure from a weak truckload market. As intermodal bid season progresses, carriers are emphasizing improved service reliability and the sustained 20 – 30% cost advantage versus dry van rates in many core lanes as justification for higher pricing. However, the primary counterbalance remains excess capacity, with several large multimodal carriers signaling no material change in their bid strategies this year, suggesting that any upside to intermodal contract rates is likely to be limited.

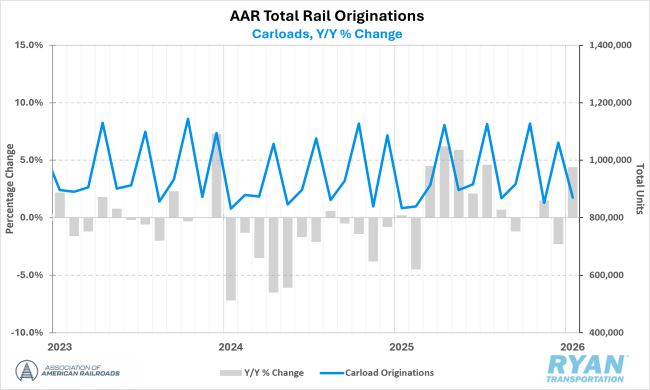

Association of American Railroads (AAR) Total U.S. Rail Carload Volumes

Key Points

- Total U.S. rail carload volumes increased 4.4% YoY in January 2026, ending a three-month streak of declines. The gain was driven by expansion in 12 of the 20 major AAR-tracked commodity categories — most notably grain, coal and industrial products — which more than offset a pronounced contraction in automotive shipments.

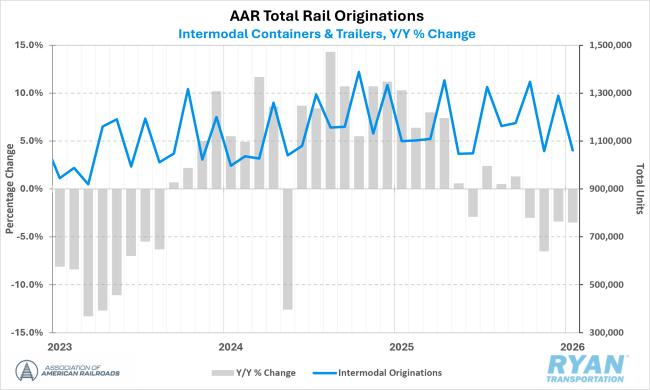

Association of American Railroads (AAR) Total U.S. Rail Intermodal Volumes

Key Points

- Total U.S. rail intermodal shipments declined 3.5% YoY in January, marking the fifth consecutive month of annual contraction. Volumes continued to be pressured by subdued port activity, softer consumer goods demand and abundant truckload, which have sustained competitive pricing dynamics.