Back to February 2026 Industry Update

February 2026 Industry Update: U.S. Economy

Main Takeaways

- Strong gains in new orders and production pushed the domestic manufacturing sector into expansion territory for the first time in a year.

- Consumer remained resilient in January, with spending elevated compared to the previous year but disproportionately driven by higher-income households.

- Final Q3 2025 U.S. GDP estimates reflected robust growth, driven by strong consumer spending and business investment, with preliminary Q4 2025 GDP forecasts indicating annualized growth of 3.7%.

Summary

U.S. manufacturing activity strengthened notably in January, supported by post-holiday inventory replenishment that drove solid gains in new orders and production. At the same time, tariff-related cost pressures continued to elevate input prices and weigh on employment, contributing to the Federal Reserve’s decision to pause further interest-rate cuts as it balances persistent inflation against a softening labor market. Despite broader economic uncertainty, the final estimate of U.S. real GDP growth in Q3 2025 was revised modestly higher, to 4.4% annualized, underpinned by resilient consumer spending and increased business investment.

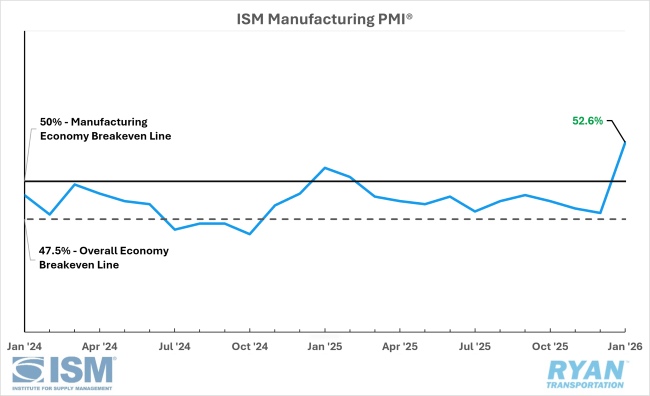

United States ISM Manufacturing PMI

Key Points

- Domestic manufacturing activity returned to expansion in January for the first time in a year, according to the latest ISM® Manufacturing PMI® Report. The headline PMI® rose to 52.6%, its highest reading since August 2022, and marked only the third expansionary print over the past 39 months.

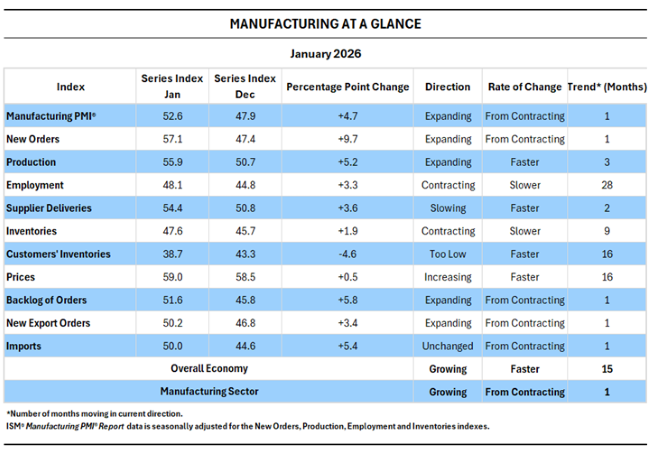

Manufacturing at a Glance

Key Points

- All five major subindexes contributing to the Manufacturing PMI® improved in January, led by outsized gains in New Orders and Production. Supporting indicators also strengthened, with Customers’ Inventories moving further into “too low” territory and order backlogs continuing to build. However, price pressures remained elevated and the Employment index stayed in contraction.

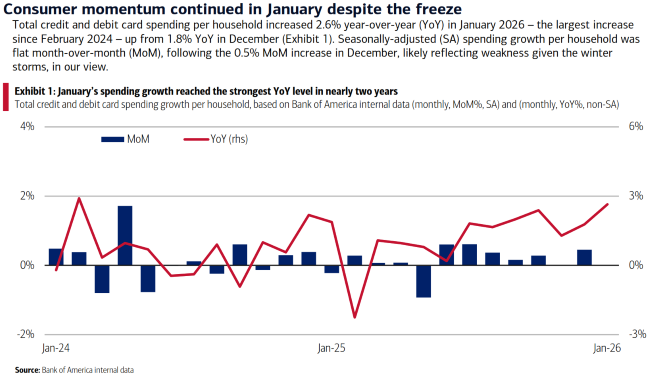

Bank of America Consumer Checkpoint, Total Card Spending

Key Points

- Household spending was flat sequentially in January on a seasonally adjusted basis but increased 2.6% YoY compared to January 2025, marking the strongest annual growth since February 2024. Spending gains continued to be disproportionately driven by higher-income households, which rose 2.5% YoY, while lower- and middle-income households posted more modest growth of 0.3% and 1.0%, respectively.

Outlook

Looking ahead, the rebound in domestic manufacturing is a constructive signal but warrants caution, as January activity can be influenced by post-holiday restocking and potential pull-forward of orders amid temporary stability in trade conditions. The durability of this improvement will depend on sustained progress in regulatory clarity and interest-rate conditions that can support longer-term capital investment. While GDP data released to date for 2025 point to relatively robust growth, persistent shifts in trade dynamics complicate interpretation. Moreover, the sustainability of that growth is increasingly uncertain as consumer spending — the primary driver of recent economic expansion — faces headwinds from a cooling labor market and decelerating wage growth among middle- and lower-income households.