Back to December 2025 Industry Update

December 2025 Industry Update: Truckload Rates

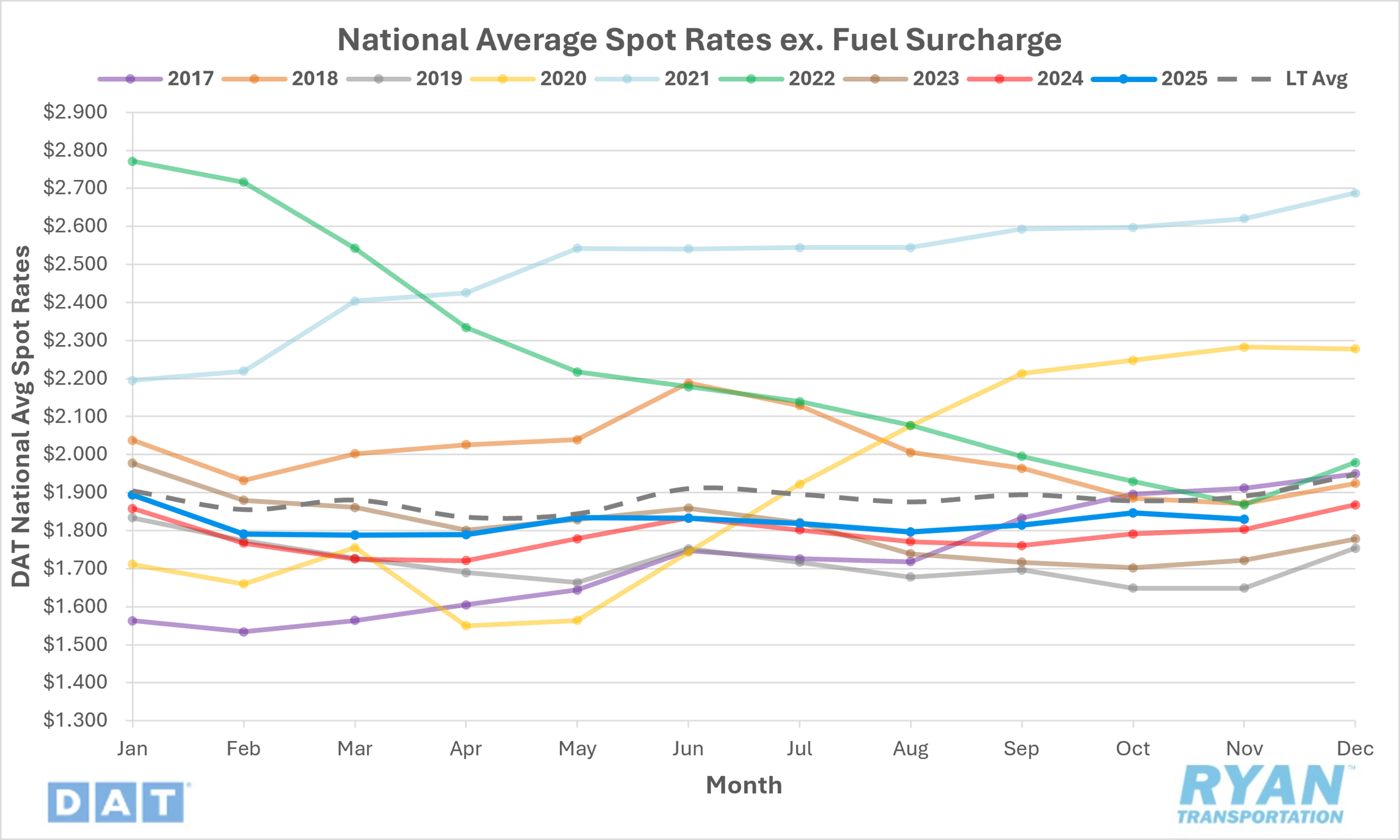

Average spot rates fell in November despite a late-month rally ahead of Thanksgiving.

Spot Rates

Key Points

- The national average spot rate, excluding fuel, declined 0.9% MoM, or just under $0.02, to $1.83 in November.

- Average linehaul rates were up 1.5% YoY compared to November 2024 and remained 3.3% below the long-term (LT) average.

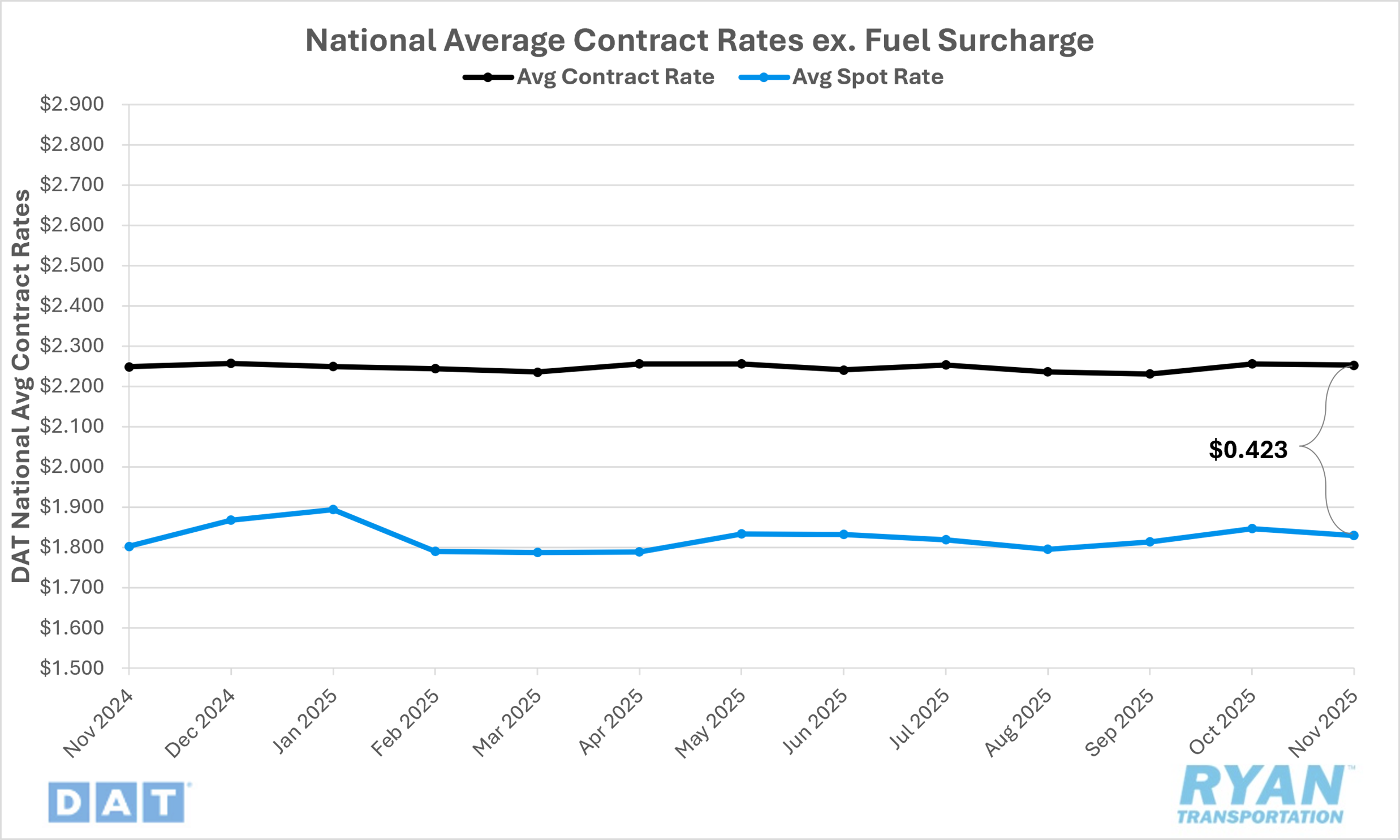

Contract Rates

Key Points

- Initially reported average contract rates, exclusive of fuel, were relatively unchanged in November, dropping 0.1% MoM, or by a fraction of a cent.

- On an annual basis, initially reported average contract linehaul rates were up 0.2% YoY compared to November 2024.

- The contract-to-spot spread registered just over $0.01 higher MoM in November, rising from $0.409 to $0.423.

Summary

Following two consecutive months of gains in September and October, national average spot rates excluding fuel reverted to negative territory in November. The nearly $0.02 MoM decline sharply underperformed typical seasonal patterns, which historically reflect an average increase of just over $0.01 for the month. Despite the unseasonal downturn, average spot linehaul rates continued to trend above prior-year levels, with November marking the fifth consecutive month of YoY gains and the 15th such increase in the past 16 months — interrupted only briefly by a return to 2024 parity in June. On a weekly basis, spot rate fluctuations between the first and second halves of the month reflected a clear split between holiday effects and seasonal dynamics. Through the first half, spot rates registered steady sequential declines before surging by $0.05 WoW in the final week of November, representing the second-largest WoW gain recorded YTD, trailing the $0.10 spike observed in June during the CVSA International Roadcheck week.

In the contract market, initially reported average linehaul rates were largely unchanged MoM in November, following their strongest monthly gain of the year in October at roughly $0.03. With minimal movement last month, national average contract rates excluding fuel remained elevated on a YoY basis for the fifth consecutive month. However, the positive annual spread narrowed to its smallest margin since October 2024. Given the sharper decline in spot rates relative to contract rates, the contract-to-spot spread widened by just over $0.01 MoM in November after two consecutive months of contraction.

Why It Matters

Following an uncharacteristic surge in October, the unseasonal decline in spot rates in November further reinforced the view that the front-loading of imports ahead of tariff deadlines earlier in the year effectively shifted traditional peak-season shipping forward. Yet, even with this temporal pull-forward, the softer rate environment in November remained somewhat unexpected given the month’s historical pattern of moderate seasonal strength.

In October, spot rates spiked amid heightened regulatory scrutiny surrounding immigration enforcement and cross-border compliance issues — including English Language Proficiency (ELP) requirements, restrictions on non-domiciled CDL issuance and cabotage enforcement. However, the market reaction proved short-lived, as those concerns largely subsided entering November, allowing excess capacity and muted demand conditions to reassert themselves. Spot rates did climb again in the latter half of the month as retailers moved to position inventory ahead of Black Friday and seasonal capacity disruptions emerged. While the magnitude of these late-month gains was comparable to the prior two years, the more abrupt nature of the increases has been emblematic of the 2025 truckload market. Many industry participants entered the year expecting that the steady upward trajectory in spot rates observed late in 2024 signaled a fundamentally improving market. Instead, this year’s pattern of brief, opportunistic rate spikes suggests carriers remain reluctant to raise prices absent clear necessity or favorable short-term leverage.

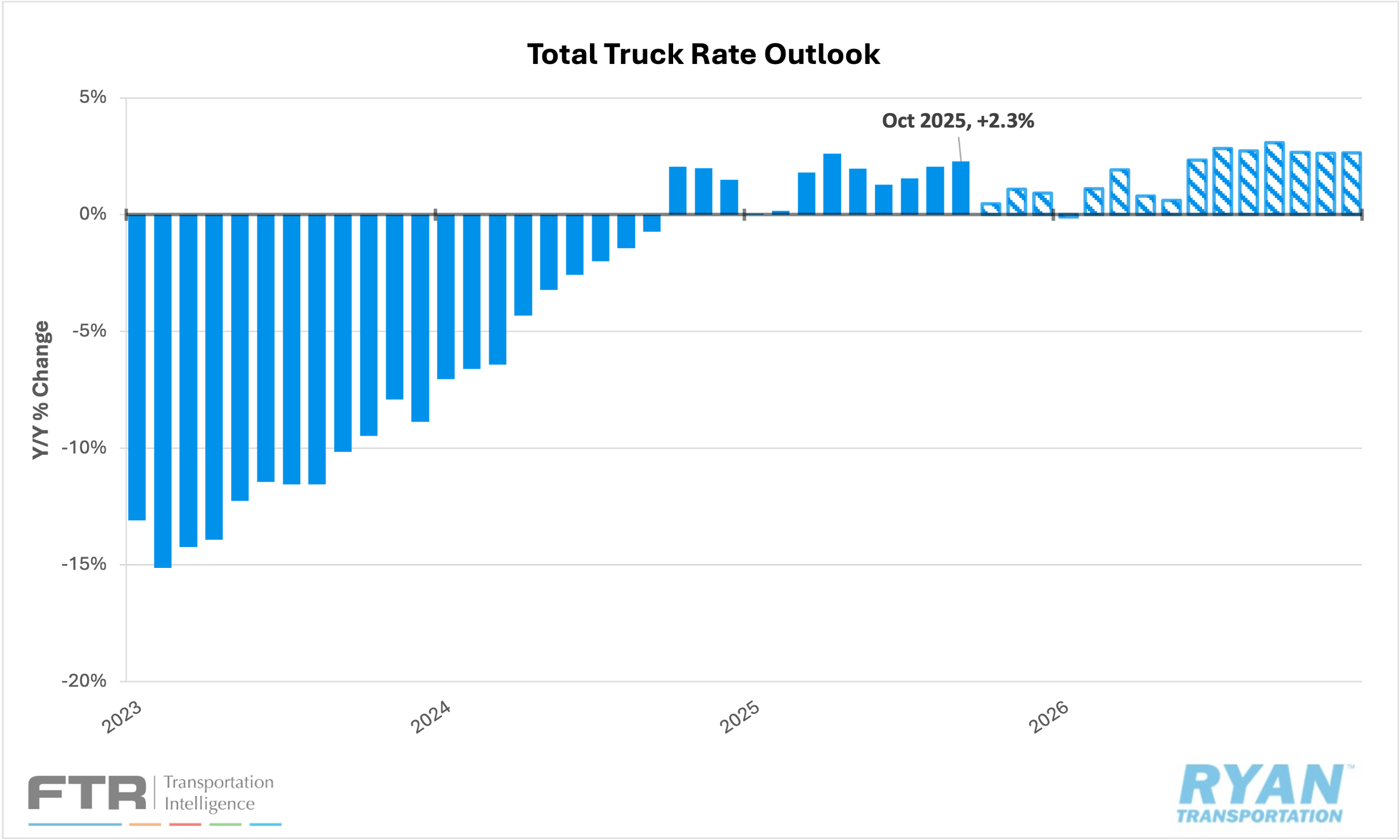

In its latest forecast, FTR raised its total truckload rate outlook for both 2025 and 2026 by 10 basis points, with 2025 projected to rise +1.3% YoY (up from +1.2%) and the 2026 outlook increasing to +1.9% YoY (from +1.8%). The firmer guidance reflects stronger-than-expected spot rate performance in October. At the equipment level, however, the revisions were uneven: the refrigerated sector saw the most significant upward revision for 2026, rising from +2.6% to +3.2% YoY, while the dry van outlook remained unchanged and the flatbed forecast rose modestly from +1.5% to +1.7% YoY.