Back to December 2025 Industry Update

December 2025 Industry Update: Truckload Demand

A boost in retail inventory shipments ahead of the Black Friday shopping event was not enough to drive growth in truckload volumes as overall demand continues to soften.

Key Points

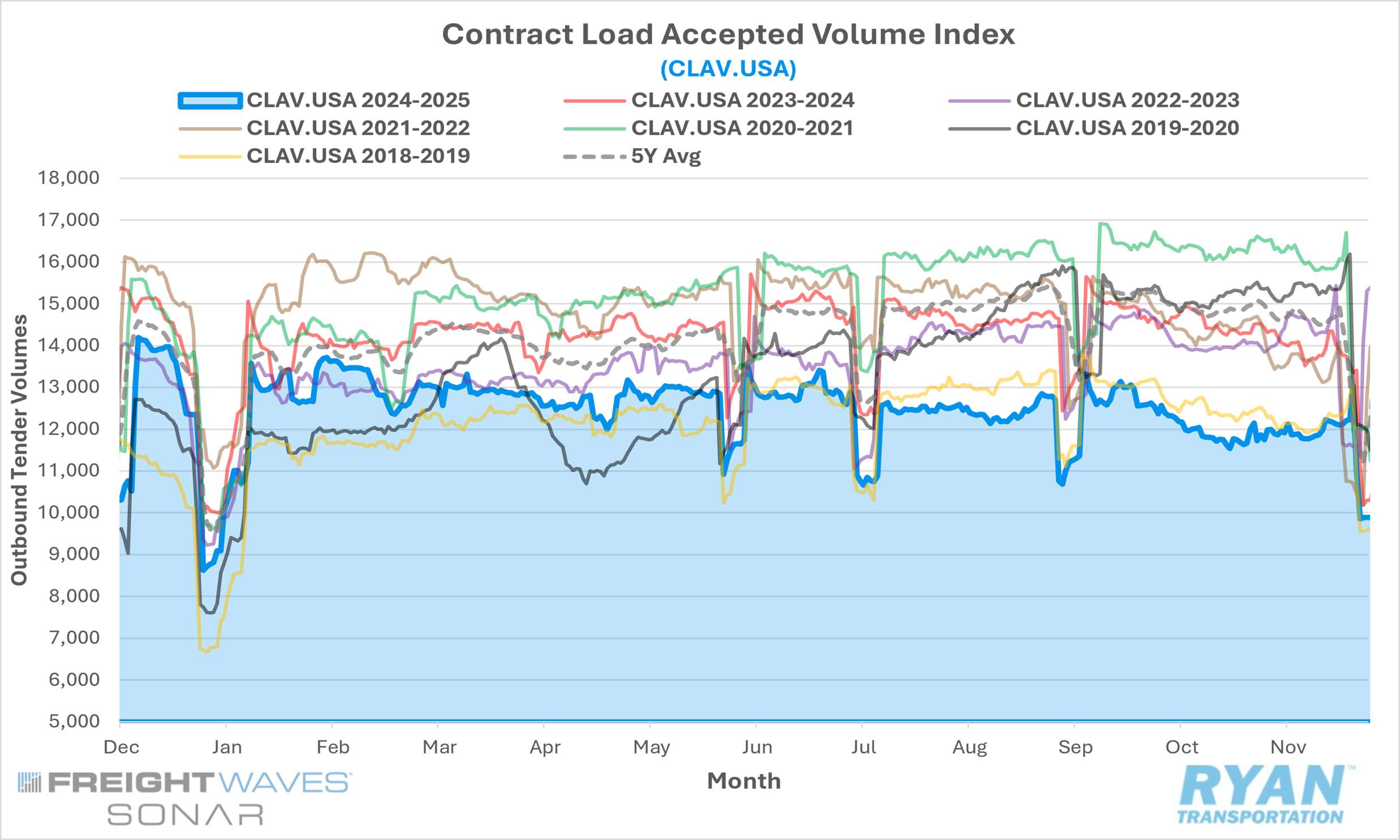

- The FreightWaves SONAR Contract Load Accepted Volume Index (CLAV.USA), a measure of accepted load volumes moving under contract across all modes, registered 1.3% lower MoM in November compared to October, dropping from 11,932.71 to 11,774.48.

- Compared to November 2024, average tender volumes were down 13.3% YoY and 16.5% lower than the 5-year average.

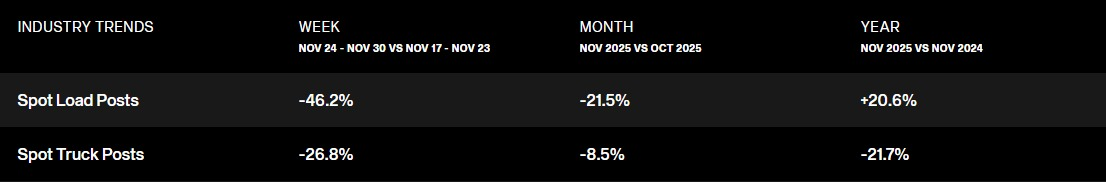

- Spot market activity weakened further in November, dropping 21.5% MoM from October but remaining elevated on an annual basis, up 20.6% YoY from November 2024.

Summary

Despite occurring during what is traditionally considered peak retail shipping season, freight demand continued to deteriorate in November, according to data from the FreightWaves SONAR CLAV Index. Following an unseasonably sharp contraction in October, average tender volumes extended their downward trend for a third consecutive month, pushing the monthly average to its lowest level since April 2020. Even so, November marginally outperformed historical seasonality, as the 1.3% MoM decline was notably better than the typical 4.8% decrease for the month. Weekly tender activity, however, was more volatile than in October, highlighted by a brief resurgence in the back half of the month when volumes climbed nearly 10% ahead of Thanksgiving before turning sharply lower. Despite these fluctuations, the broader demand environment remains markedly weaker than in prior years, with contracted tenders posting a 12th consecutive annual decline, down 13.3% YoY and 14.7% on a two-year stack.

While overall freight volumes remain in search of a definitive floor, a widening divergence persists between short-haul and long-haul volumes. According to length-of-haul tender indexes from FreightWaves SONAR, short-haul freight demand — defined as loads under 100 miles — has steadily strengthened over the past year, reflecting increased downstream activity associated with retail distribution. In November, short-haul tenders rose 3.5% MoM and stood 8.6% above levels recorded during the same period in 2024. Conversely, long-haul volumes, representing shipments over 800 miles and typically tied to inventory replenishment and elevated import flows, continued to contract, declining 2.2% MoM and 26.4% YoY. This pattern reflects the current shift towards downstream inventory positioning at the retail level and continued weakness in replenishment volumes as shippers anticipate muted import volumes and exercise caution through the end of the year.

Why It Matters

With 2025 nearly in the rearview, it has become evident that the year has consistently represented a further deterioration from ongoing soft conditions that defined 2024, suppressing the recovery momentum that had appeared to form in the final months of last year. In a typical market, October functions as the starting point for seasonal truckload demand, supported by holiday inventory building, late-season produce activity and a pre-Black Friday surge that ultimately leads to volumes peaking in November. This year, however, those seasonal forces have been largely absent, causing the market’s transition out of the prolonged freight recession to stall.

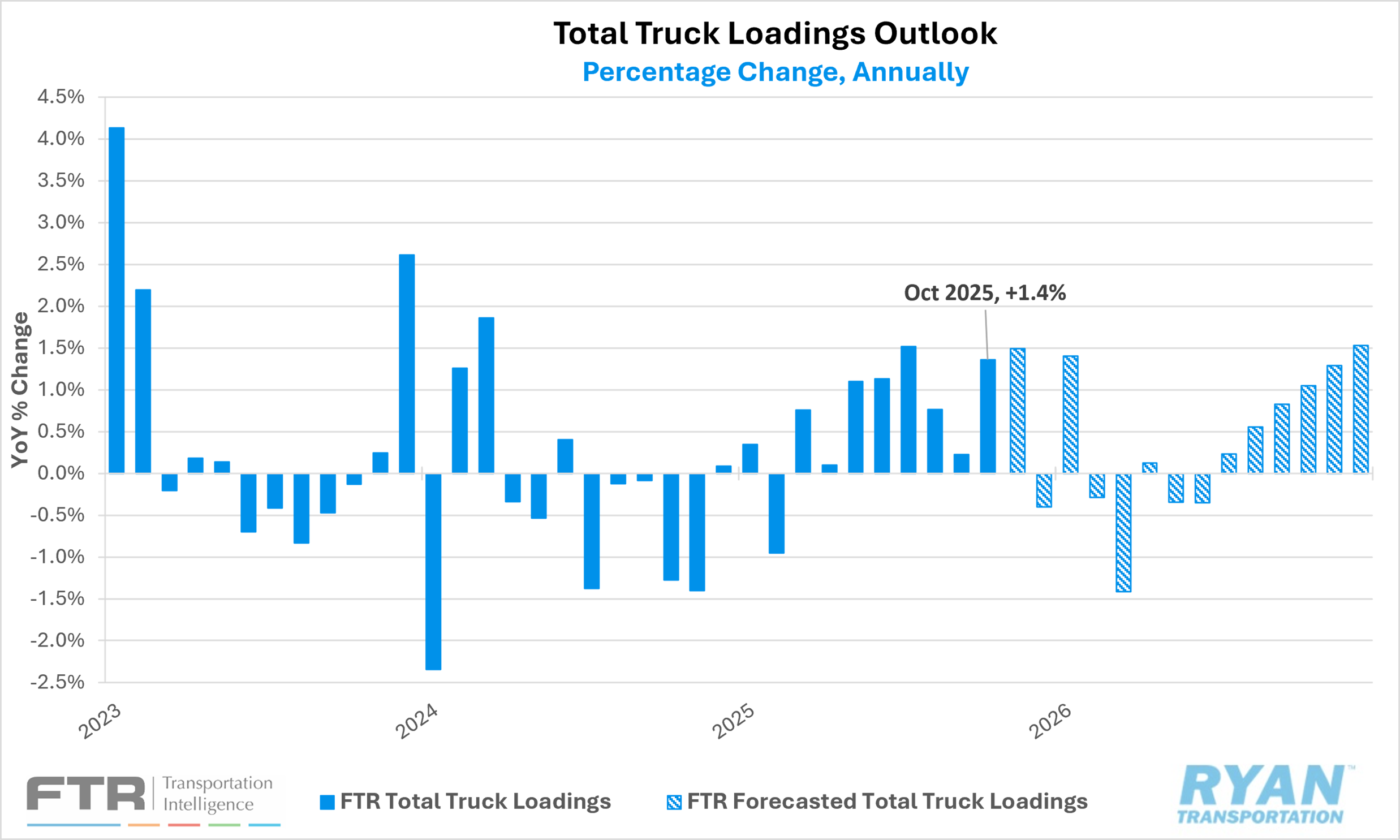

Industry sentiment remains divided regarding the timing of a broader demand rebound, but the continued weakening of freight volumes in November has shifted the near-term outlook meaningfully more pessimistic, with many stakeholders now anticipating another subdued holiday season. Forecasts for 2026 are still unsettled, with some expecting a turn earlier in the year driven by supply-side rebalancing, while others anticipate a later recovery given ongoing weakness in the manufacturing sector. Both perspectives carry weight, and a return to full normalization will likely require contributions from each. Historically, supply-side corrections alone have not been sufficient to support sustained growth; past upcycles have required a corresponding demand catalyst to restore market equilibrium.

The latest release of the Logistics Managers’ Index (LMI) offers additional context for why inventories are expected to trend lower, at least in the near term: the cost of holding goods remains exceptionally high. Inventory Cost expansion eased modestly in November, declining 2.4% MoM to a still-elevated reading of 70.8%. Any value above 70.0% is considered a robust rate of expansion, and every month of 2025 has remained above this threshold. These elevated cost pressures — layered on top of tariff volatility and rising input prices — have significantly constrained firms’ inventory strategies and are likely to influence both the volume and composition of imports in the months ahead. As a result, expectations for future Inventory Levels have become increasingly muted heading into 2026.