Back to December 2025 Industry Update

December 2025 Industry Update: Truckload Capacity Outlook

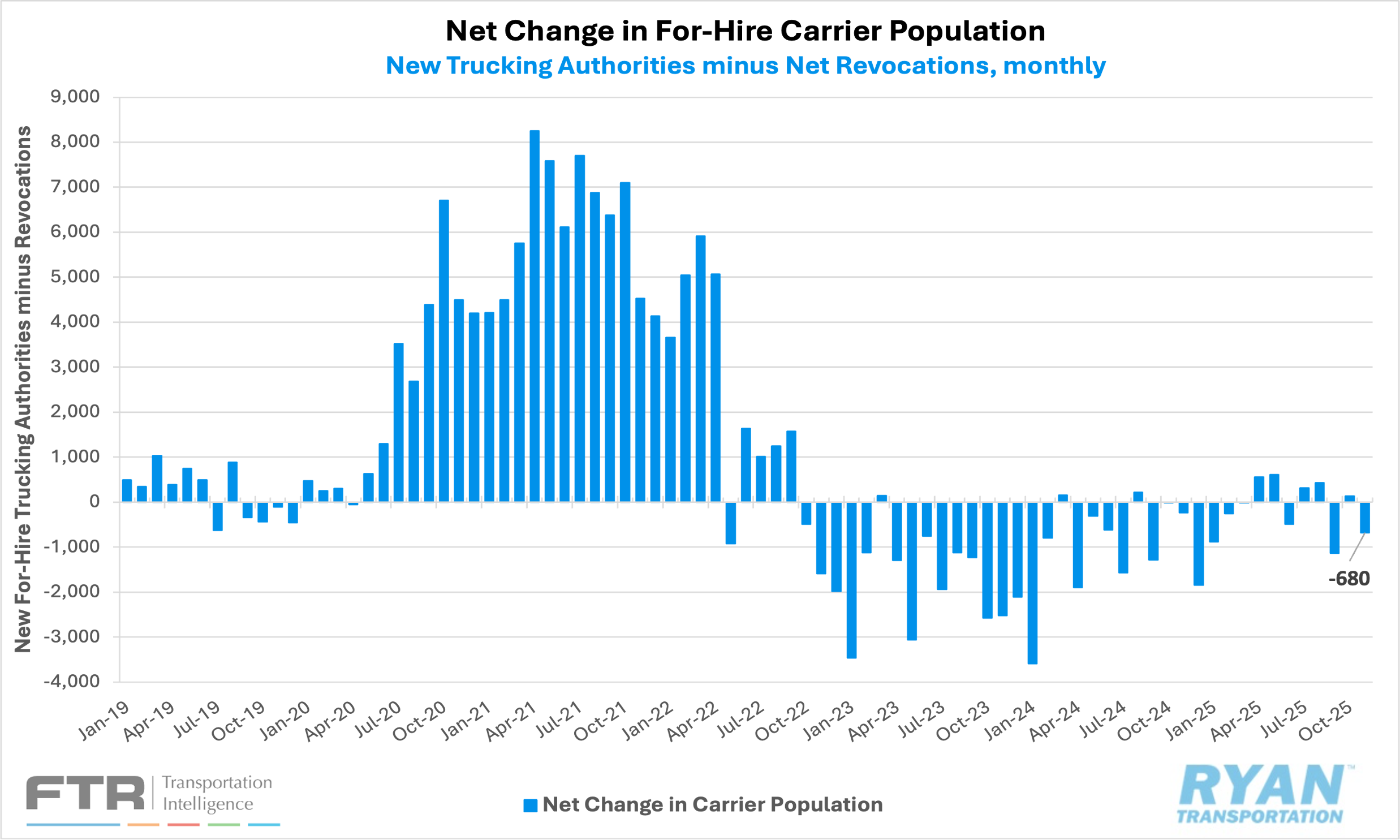

The for-hire carrier population contracted sharply in November, driven by a lower number of new entrants.

Key Points

- Total net revocations, a measure of total authority revocations minus reinstatements, declined by 343 carriers MoM in November, dropping from 4,870 in October to 4,527, according to FTR’s preliminary analysis of the Federal Motor Carrier Safety Administration’s (FMCSA) data.

- Per FTR, the number of newly authorized for-hire trucking firms declined sharply in November, with the FMCSA authorizing roughly 3,850 new carriers, compared to just over 5,000 in October.

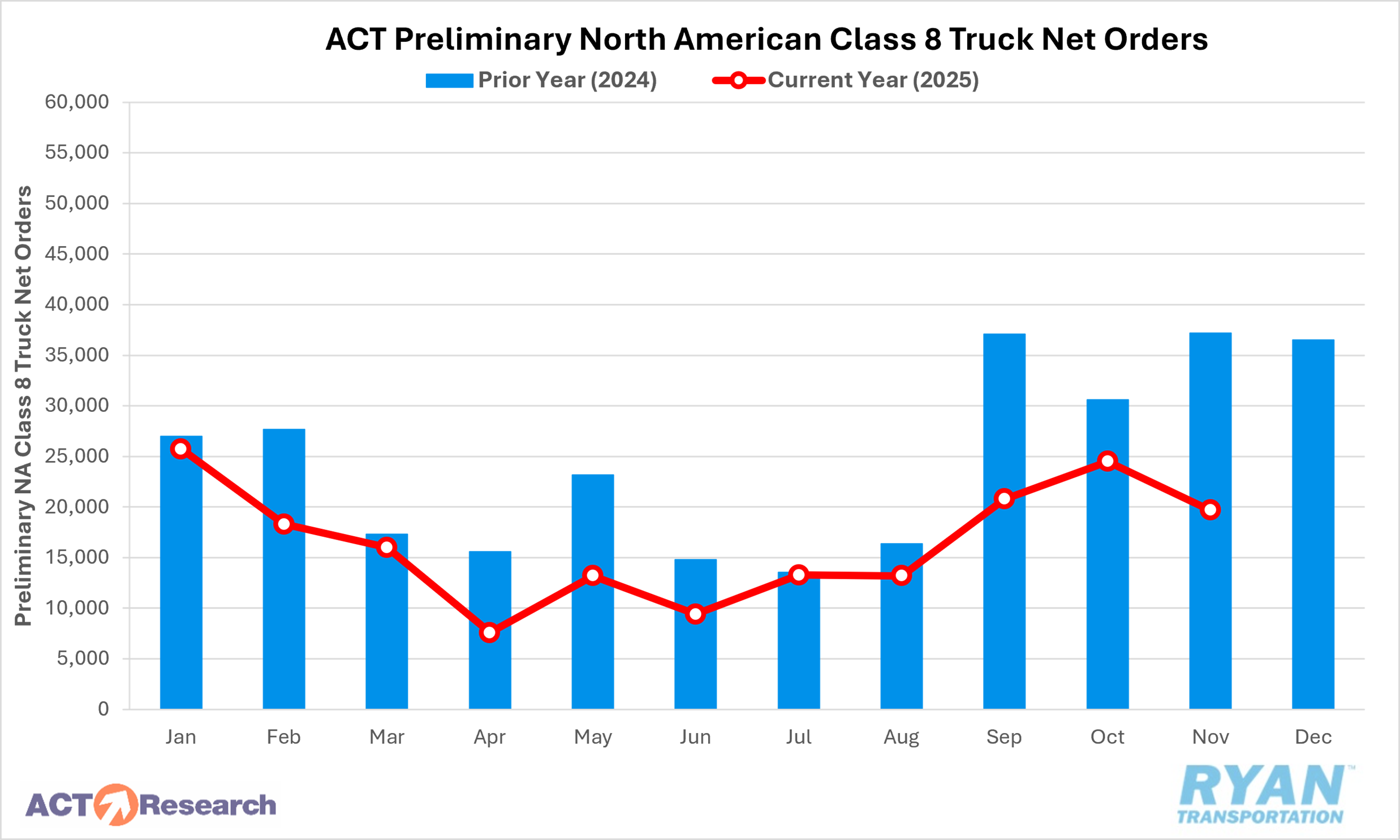

- Preliminary North American Class 8 net order estimates ranged from 19,700 units, as reported by ACT Research, and 20,200 units per FTR in November, with both estimates lower YoY by 47.0% and 44.2%, respectively.

Summary

After stabilizing and edging modestly higher in October following a sharp contraction in September, the for-hire carrier population recorded its third-largest month-over-month net decline of the year in November, falling by 680 carriers. The decline was driven primarily by a sharp slowdown in new carrier formations, as the 3,847 new for-hire authorities granted by the FMCSA represented the lowest monthly total since December 2024 and January 2025, according to FTR’s analysis. When excluding those months — which are typically seasonally depressed due to year-end holiday effects — November marked the weakest pace of new carrier additions since May 2020.

At the same time, authority revocations net of reinstatements also declined on an unseasonal basis, registering their lowest level since May of this year. FTR noted that the only other month since February 2022 with fewer net revocations occurred in February 2025. Despite November’s contraction, the for-hire carrier base remains historically elevated. As of December 1, FTR estimates the U.S. had approximately 344,766 authorized for-hire carriers, nearly 88,000 — or 34.2% — above the pre-pandemic level recorded in February 2020.

On the equipment side, preliminary North American Class 8 net order estimates declined in November after posting gains in the prior two months. According to FTR, orders fell approximately 17% MoM, while ACT Research reported a steeper decline of roughly 20% MoM. Annual comparisons remained firmly negative, extending the streak of year-over-year declines to eleven consecutive months. FTR reported that the roughly 20,200 units ordered in November were well below the 10-year average of 28,910 units for the month. Looking ahead, FTR expressed concern regarding the early trajectory of the 2026 order cycle, noting that cumulative net orders from September through November are tracking 36% lower YoY.

Why It Matters

After months of showing tentative signs of stabilization, the sharp decline in new trucking authorities in November offered a measure of optimism that capacity may finally be exiting the market in a more meaningful way. While the decline could ultimately prove to be an outlier, given that November’s figure was approximately 16% below the 10-year average for the month, it is increasingly plausible that carrier formation is being constrained by mounting pressure on foreign drivers as well as persistently elevated commercial insurance premiums. That said, changes in new authority counts do not provide a complete view of capacity dynamics, as they tend to reflect shifts in driver behavior rather than definitive expansions or contractions in the overall driver pool or effective trucking capacity. A more comprehensive assessment would require payroll employment data, which, due to the government shutdown, will not be available for November until December 16.

As discussed in the November 2025 Industry Update, many market participants continue to expect that heightened regulatory scrutiny, particularly targeting non-domiciled CDL holders and stricter enforcement of the English Language Proficiency (ELP) requirement, could materially alter supply dynamics in 2026 and reintroduce volatility into the spot market. However, a recent federal court of appeals decision placed a temporary stay on the FMCSA’s interim rule restricting CDL eligibility and renewals for certain non-citizens. While the court reviews the case, an estimated 200,000 affected drivers may continue to maintain and renew their CDLs, though the stay could be lifted within the next one to two months. Separately, the FMCSA announced the removal of approximately 3,000 CDL training providers from its Training Provider Registry (TPR) and issued warnings to an additional 4,500 providers regarding potential non-compliance with updated federal standards. Although these actions are intended to address so-called “bad actors” issuing CDLs without adequate training, the practical impact remains uncertain. As of December 1, the FMCSA’s TPR still listed more than 39,500 registered training locations nationwide, underscoring the challenge of translating enforcement actions into near-term capacity reductions.