Back to December 2025 Industry Update

December 2025 Industry Update: Reefer

Average rates in the refrigerated sector continued to climb amidst lower demand.

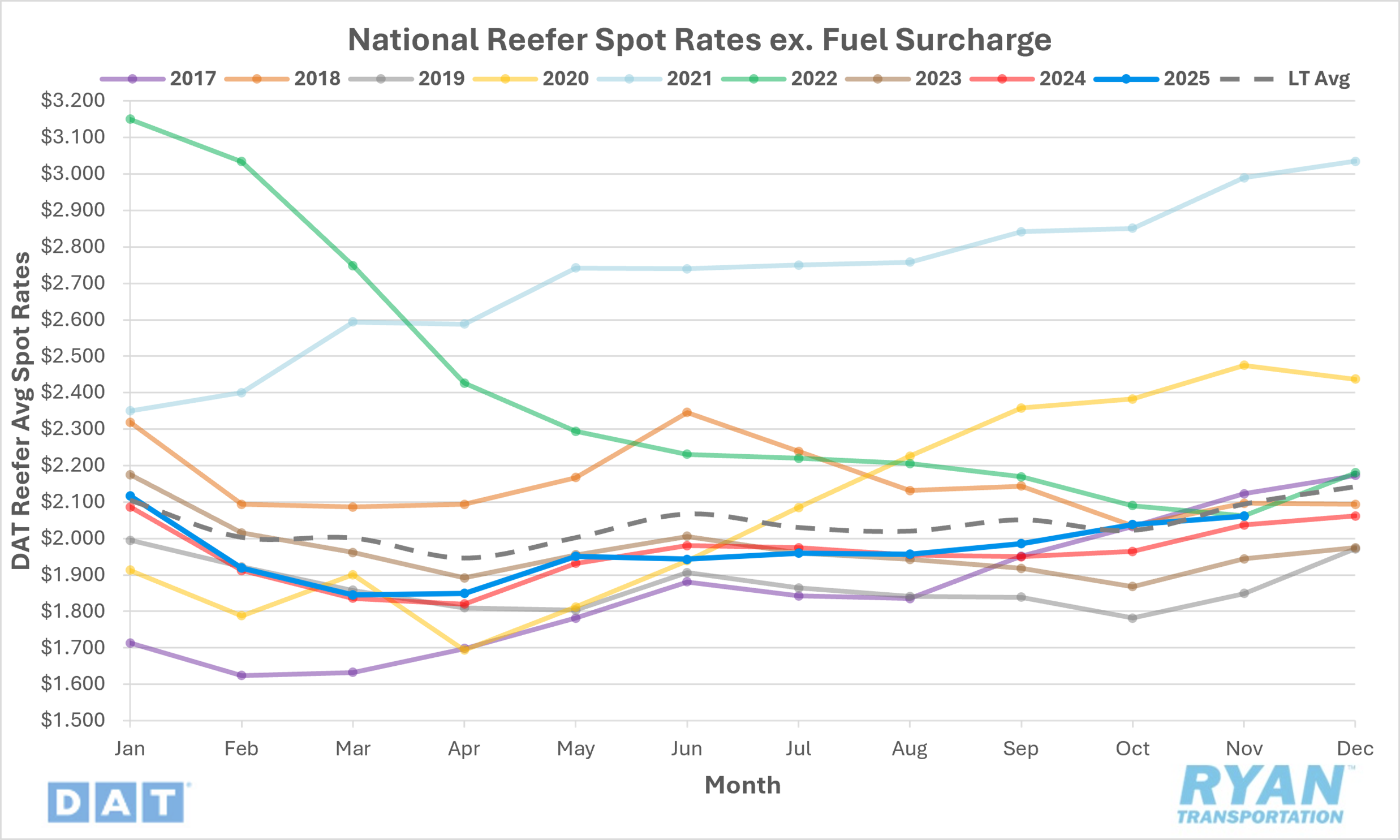

Spot Rates

Key Points

- The national average reefer spot rate, excluding fuel, increased 1.7% MoM, or just over $0.03, to $2.07 in November.

- On an annual basis, average reefer linehaul rates were up 1.7% YoY but were 1.5% below the LT average.

- Initially reported average reefer contract rates, absent a fuel surcharge, rose 0.6% MoM and registered 1.1% higher YoY compared to the same month last year.

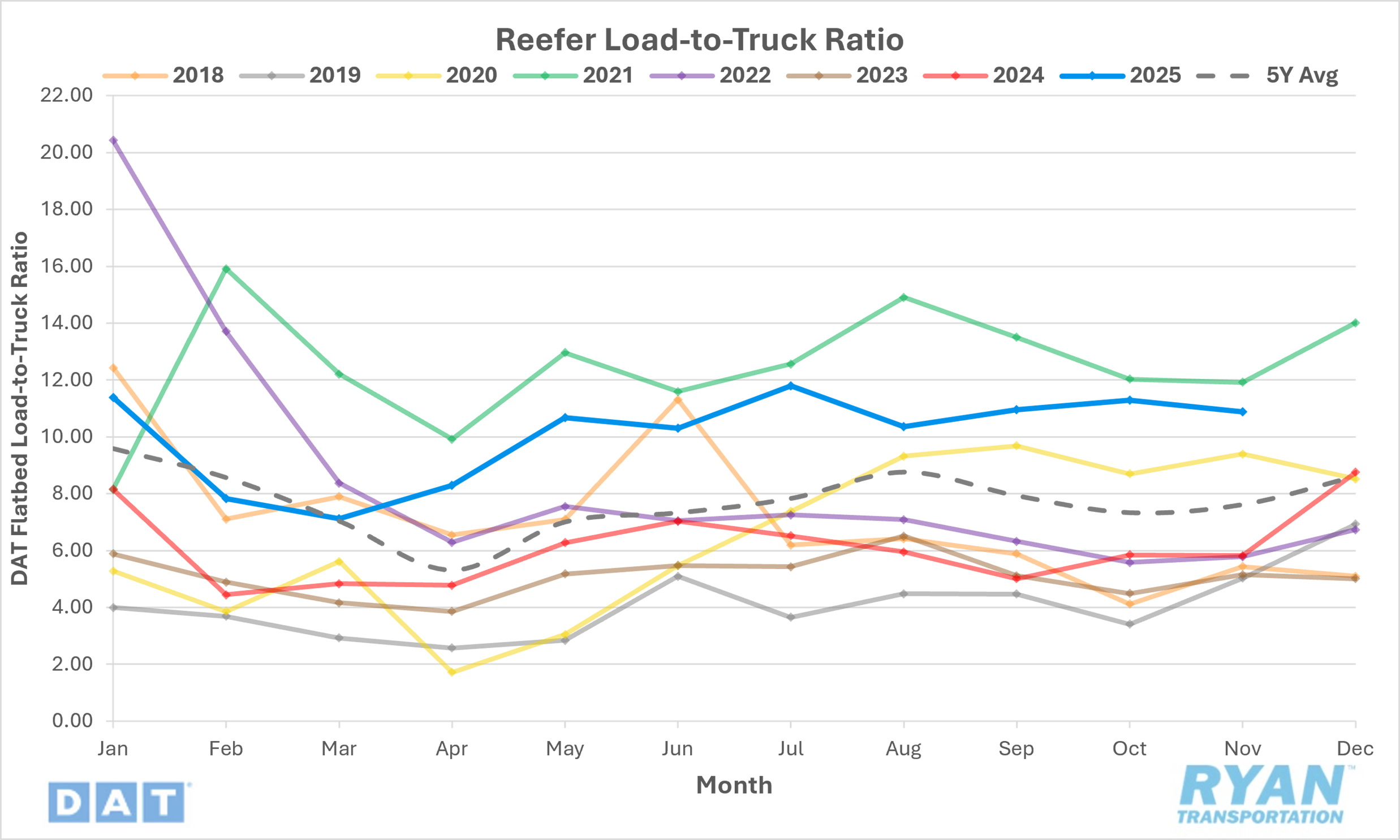

Load-to-Truck Ratio

Key Points

- The reefer LTR declined 3.6% MoM in November, falling from 11.29 in October to 10.88.

- Compared to November 2024, the reefer LTR was roughly 87% higher YoY and nearly 43% above the 5-year average.

- DAT load board data for November registered a 14.6% MoM drop in load post volumes, while equipment posts fell 11.3% MoM.

Market Conditions

Reefer Summary

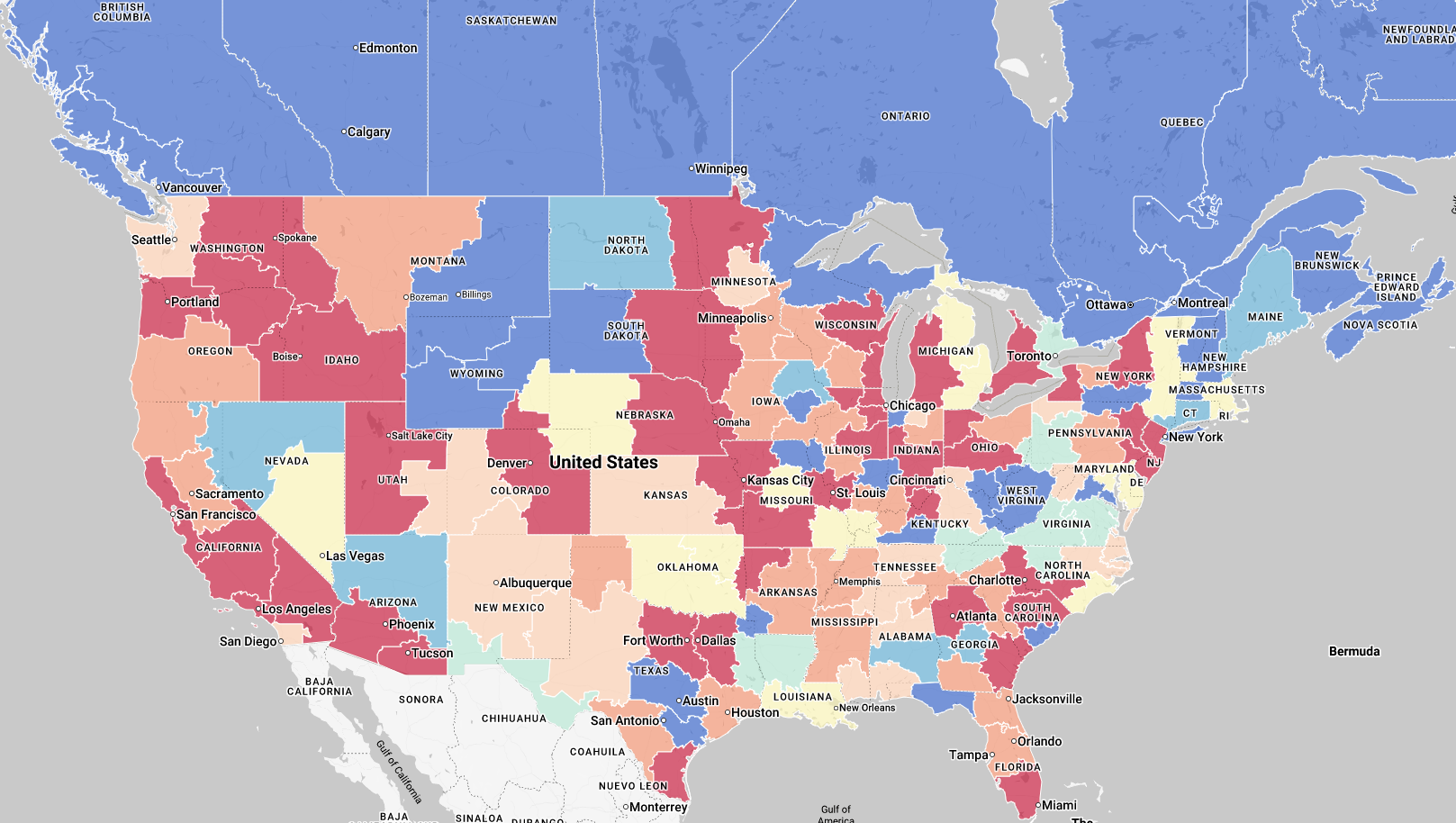

Refrigerated market conditions in November were shaped by a mix of soft downstream demand and pronounced seasonal freight surges. Foodservice fundamentals remained challenged, as the Restaurant Performance Index (RPI) improved modestly in October, rising 0.4% MoM from September to 99.8, but remained in contraction territory for the fourth consecutive month. According to the report, despite a net increase in same-store sales in October, restaurant operators reported lower customer traffic for the ninth consecutive month and subdued expectations for overall economic conditions during the next six months. These conditions continued to weigh on baseline refrigerated volumes tied to restaurants and distributors. However, this softness was partially offset by strong, time-sensitive seasonal movements, particularly the Pacific Northwest Christmas tree harvest, which drove a sharp but concentrated increase in reefer and dry van demand ahead of Thanksgiving and pushed spot rates higher in the region.

Import-driven activity further tightened reefer capacity across key gateways. The South American produce season accelerated outbound volumes from the Port of Philadelphia, where reefer loads were running 16% above last year and spot rates averaged $2.25 per mile as shippers competed to move high-value perishables. Along the southern border, the resolution of late-November protests triggered a rapid catch-up surge of delayed Mexican produce, straining cold chain capacity and compressing loading windows. These dynamics were compounded by localized enforcement actions in California, which kept westbound rates from South Texas elevated despite some post-peak easing.