Back to December 2025 Industry Update

December 2025 Industry Update: Intermodal

Rail performance was mixed in November as carload volumes increased while intermodal shipments fell.

Spot Rates

Key Points

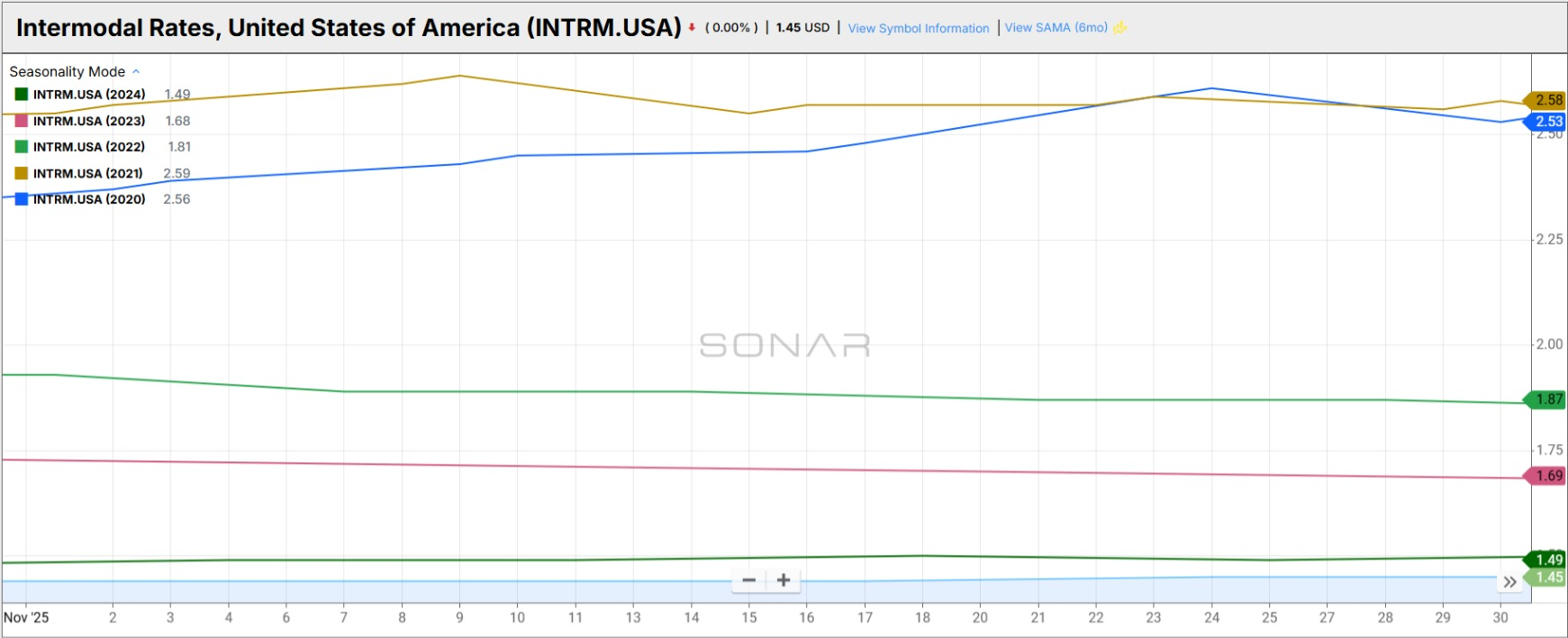

- The FreightWaves SONAR Intermodal Rates Index (INTRM.USA), which measures the average weekly all-in door-to-door spot rate for 53’ dry vans across most origin-destination pairings, increased slightly in November, rising 0.7% MoM, or $0.01, to $1.44.

- Compared to November 2024, average intermodal spot rates were down 3.4% YoY and were 28.9% below the 5-year average.

Volumes

Key Points

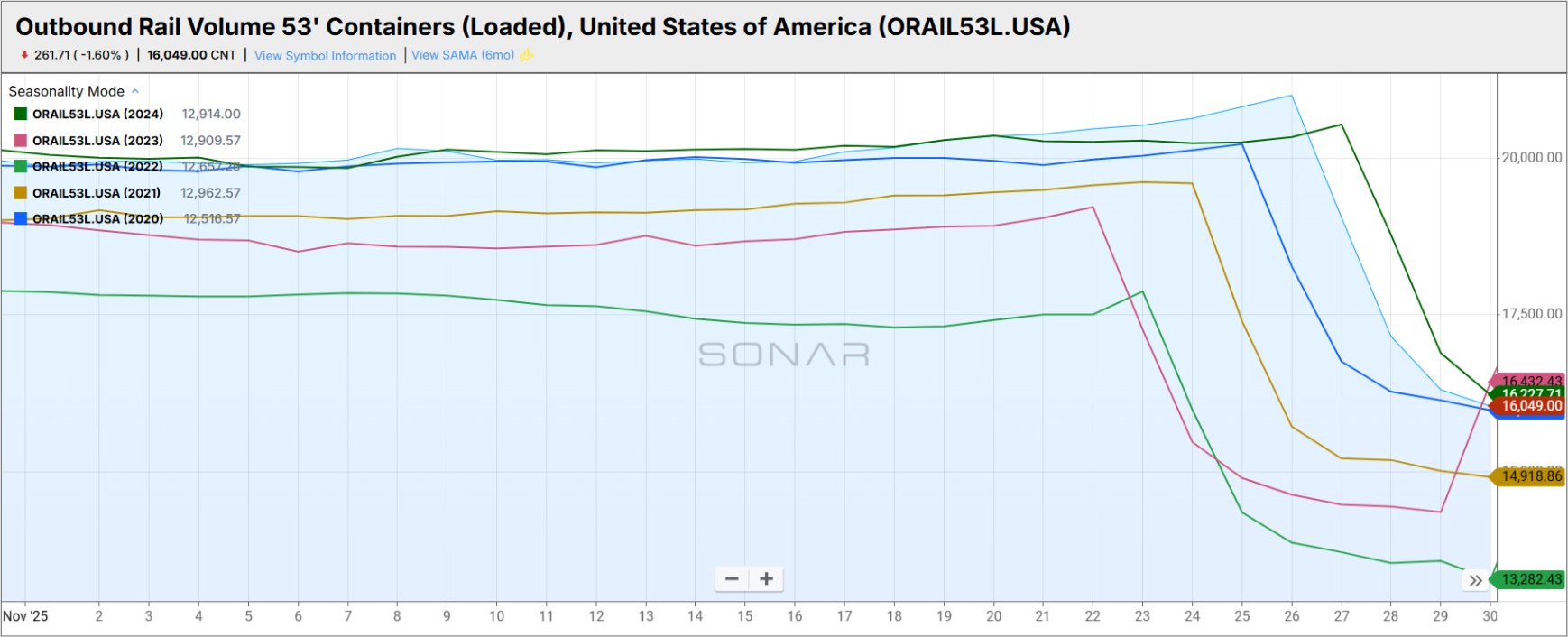

- The average total loaded volumes for 53’ containers for all domestic markets, measured by the FreightWaves SONAR Loaded Outbound Rail Volume Index (ORAIL53L.USA), rose slightly by 0.5% MoM in November, increasing from October’s average of 19,660.18 to 19,757.77.

- Average loaded domestic rail volumes for 53’ containers in November were down 0.5% YoY compared to November 2024 and were 6.9% above the 5-year average.

Intermodal Summary

Following broad weakness across the rail sector in October, activity in November was mixed, with modest improvement in carload traffic offset by continued softness in intermodal volumes. According to the latest Rail Industry Overview from the Association of American Railroads (AAR), total U.S. rail carloads increased 1.5% YoY in November compared to the same month in 2024, with 9 of the 20 major carload categories posting annual gains. Average weekly U.S. rail carload originations totaled 220,075 units during the month, marking the third-lowest monthly weekly average recorded in 2025. While the absolute level of activity remained subdued, the AAR noted that November volumes are typically depressed due to the Thanksgiving holiday. On a year-to-date basis, total carload traffic is up 1.8% YoY compared to the same period in 2024, representing an increase of nearly 193,000 carloads.

In contrast, intermodal shipments — which are more closely correlated with consumer demand and international trade — declined sharply in November, falling 6.5% YoY compared to 2024 levels. Despite the sustained weakness observed in recent months, year-to-date intermodal volumes remain 1.9% higher YoY through November. According to the AAR, much of the remaining annual growth in intermodal traffic during the second half of 2025 reflects strength earlier in the year, as volumes through May 2025 were up 6.7% YoY relative to the first five months of 2024. This divergence underscores the deceleration in intermodal momentum as the year progressed, particularly amid softer import activity and more cautious consumer demand.