Back to December 2025 Industry Update

December 2025 Industry Update: Flatbed

The flatbed sector continued to struggle in November as both rates and demand declined.

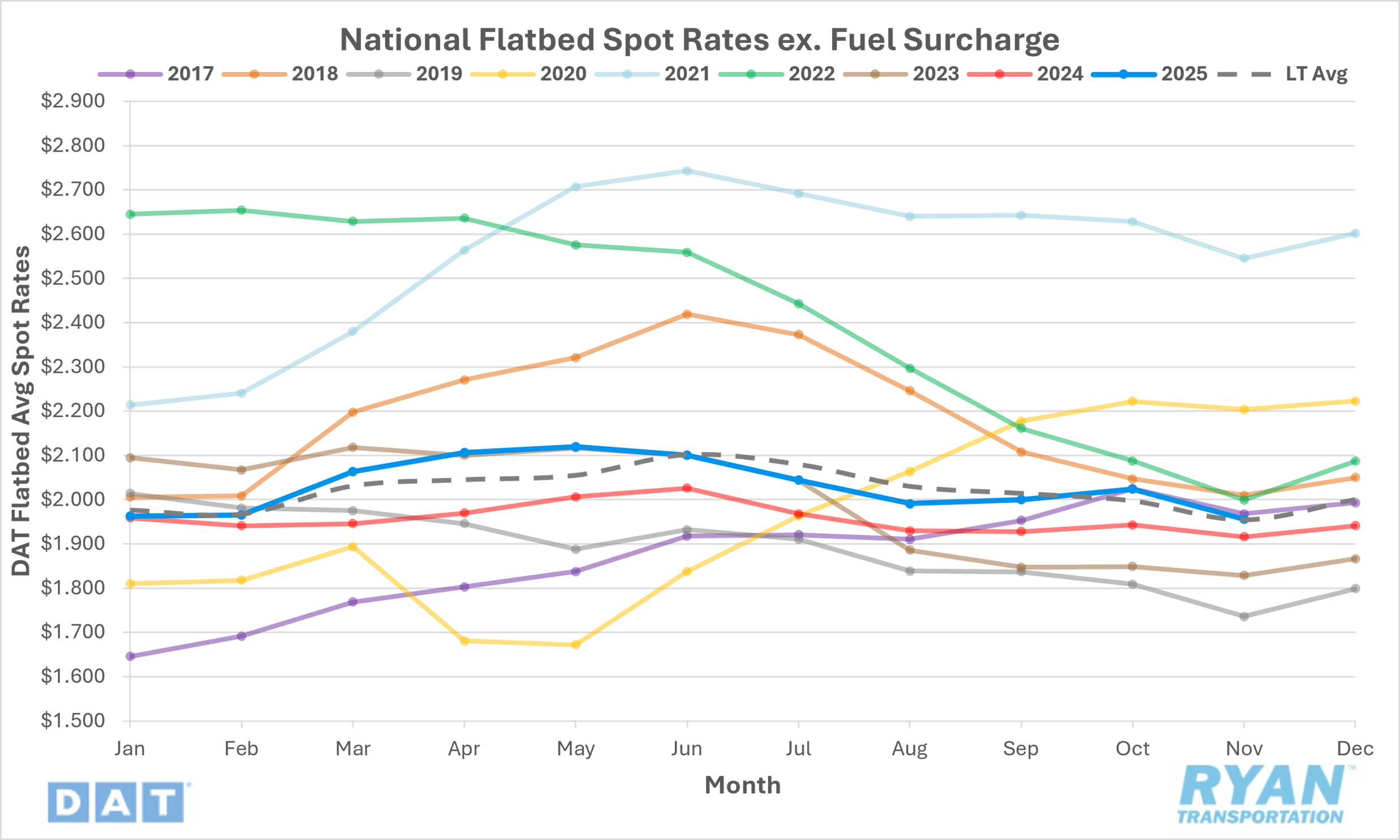

Spot Rates

Key Points

- The national average flatbed spot rate, excluding fuel, declined 2.9% MoM, or just under $0.06, to $1.97 in November.

- Compared to November 2024, average flatbed linehaul rates are up 2.6% YoY and are up slightly on the LT average by just 0.3%.

- Initially reported average flatbed contract rates, exclusive of a fuel surcharge, registered a 1.8% MoM decline in November and are 0.8% below the same month in 2024.

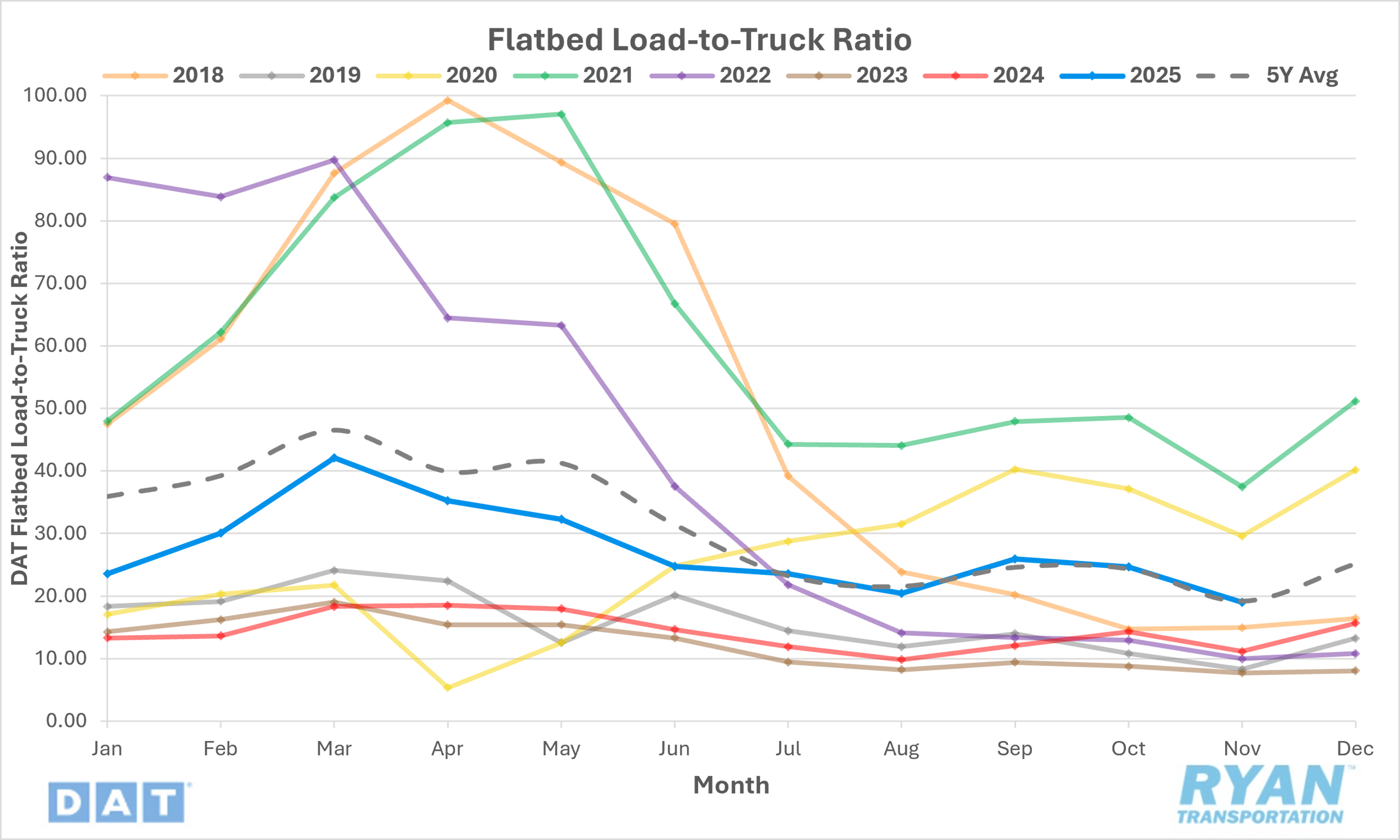

Load-to-Truck Ratio

Key Points

- The flatbed LTR fell by 23.1% MoM in November, dropping from 24.69 in October to 18.99.

- Compared to November 2024, the flatbed LTR continued to trend above year-ago levels, rising 70.6% YoY, but was 1.0% below the 5-year average.

- According to DAT, flatbed load post volumes declined 34.1% MoM in November while equipment posts fell 14.4% MoM.

Market Conditions

Flatbed Summary

Flatbed demand continued to benefit from select agricultural and specialty movements, even as broader industrial indicators softened. Seasonal onion shipments remained a notable source of steady volume, with shippers favoring flatbeds over refrigerated equipment due to cost efficiency, durability of the commodity and favorable handling characteristics in colder weather. From August through November, a meaningful share of onion volumes moved via flatbed, providing incremental support as other agricultural segments weakened. High-visibility specialty freight, such as the U.S. Capitol Christmas Tree transport, underscored the sector’s role in handling oversized and unique loads. However, these moves remain symbolic rather than volume drivers.

Conversely, underlying fundamentals tied to manufacturing and heavy equipment continued to weigh on flatbed performance. Agricultural equipment sales declined sharply in higher-margin categories, signaling reduced demand for oversize and overweight freight amid persistent uncertainty surrounding trade policy, input costs, and farm profitability. Manufacturing conditions also deteriorated, with the ISM Manufacturing PMI falling further into contraction territory in November as new orders and backlogs declined. These trends limited consistent industrial freight opportunities and reinforced a bifurcated flatbed market — supported by niche agricultural and specialty demand, yet constrained by soft capital spending and subdued manufacturing activity heading into year-end.