Back to December 2025 Industry Update

December 2025 Industry Update: Economy

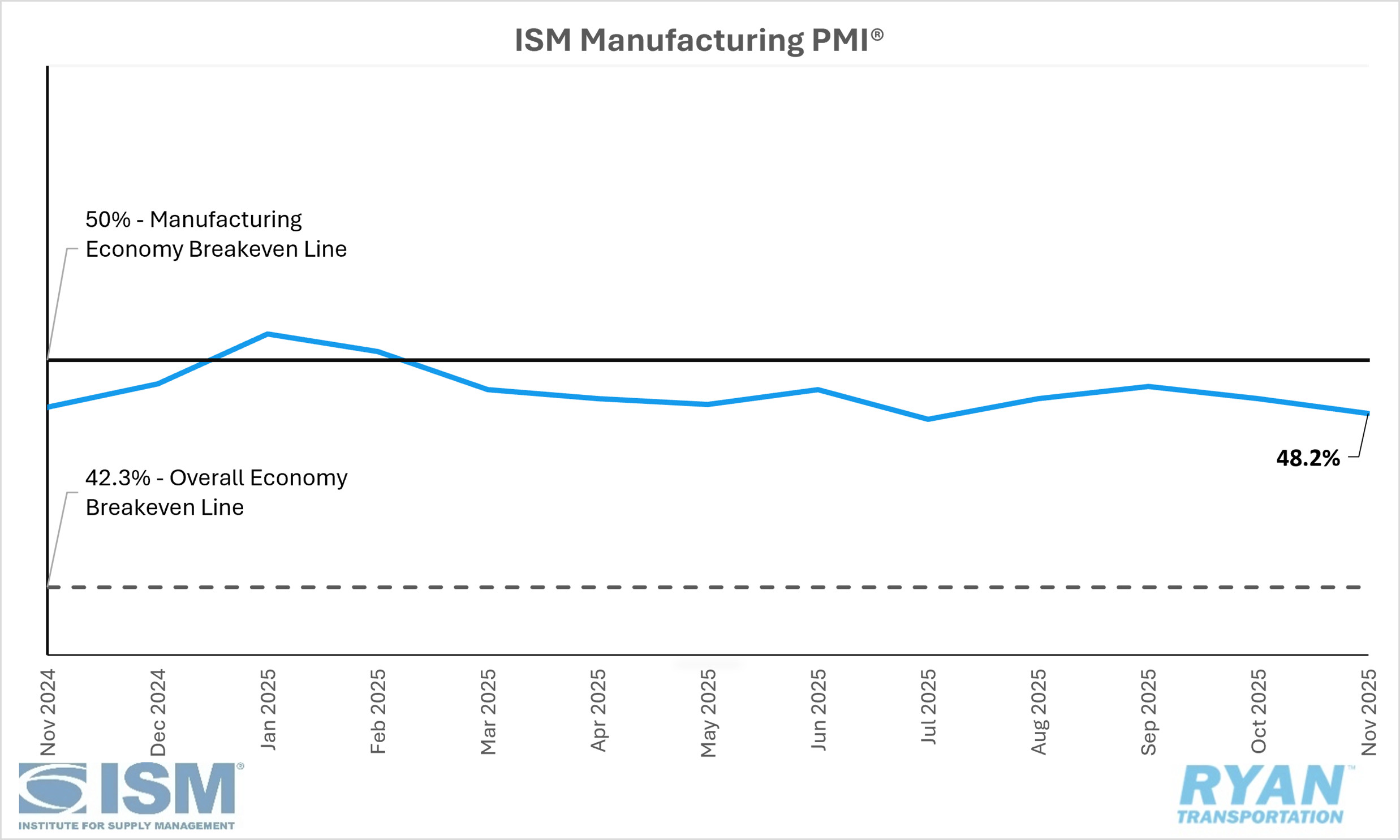

Domestic manufacturing activity contracted at a faster pace in November, driven by weakness in new orders and employment.

United States ISM Manufacturing PMI

Key Points

- The Institute for Supply Management® (ISM®) Manufacturing PMI® registered 48.2% in November, 0.5% lower than October’s reading of 48.2% and remains in contraction territory.

- The New Orders Index registered 47.4% in November, 2.0% lower compared to October’s reading of 49.4%, moving deeper into contraction territory.

- The Production Index registered 51.4% in November, 3.2% higher compared to October’s reading of 48.2% and a return to expansion territory.

- The Employment Index registered 44.0% in November, 2.0% lower compared to October’s reading of 46.0%.

- The Supplier Deliveries Index registered 49.3% in November, 4.9% lower than October’s reading of 54.6%.

- The Inventories Index registered 48.9% in November, 3.1% higher compared to October’s reading of 45.8%.

Summary

Domestic manufacturing activity contracted for the ninth consecutive month in November, accelerating from the pace recorded in October, as ongoing uncertainty surrounding trade policy continued to exert downward pressure across the sector. According to the latest ISM® Manufacturing PMI® Report, the headline index declined by 0.5 percentage points, driven by pullbacks in supplier deliveries, new orders and employment. The report highlighted the continuation of a recent pattern in which improvement in one subindex generates temporary momentum in another during the following month. Similar to how strengthening new orders in August contributed to higher production in September, the uptick in order backlogs in October supported an expansion in production levels in November. However, these production gains were insufficient to offset sharp declines in employment and new orders, ultimately resulting in a faster rate of overall PMI® contraction. From a broader perspective, November marked 67 consecutive months of economic expansion in the United States — excluding a single month of contraction in April 2020 — as a PMI® level above 42.3% is historically consistent with sustained economic growth over time.

Demand indicators were mixed, with contractions in two of the four demand subindexes — Backlog of Orders and New Orders — outweighing improvements in New Export Orders and Customers’ Inventories. The New Orders Index fell to 47.4%, below its 12-month average of 48.9%, with panelists’ commentary reflecting a 1-to-1.2 ratio of positive to negative sentiment, largely driven by tariff-related cost pressures and uncertainty. Despite further softening in demand, the Customers’ Inventories Index continued to contract and remained in the “too low” range, a condition generally supportive of future production.

Output components, measured by the Production and Employment indexes, also presented a mixed picture but collectively contributed a positive 24-basis-point impact to the overall PMI® calculation, as gains in production outpaced deeper declines in employment. Survey responses indicated a 1-to-1 ratio of positive to negative sentiment regarding production levels while employment conditions deteriorated further, with 67% of panelists reporting an ongoing focus on headcount reduction rather than hiring. Layoffs and the decision not to backfill open positions remained the primary workforce management strategies.

Among the six largest manufacturing industries — Chemical Products; Transportation Equipment; Computer & Electronic Products; Food, Beverage & Tobacco Products; Machinery; and Petroleum & Coal Products — three reported growth in November (Computer & Electronic Products; Food, Beverage & Tobacco Products; and Machinery), up from two in October.

Why It Matters

Following a modest 0.4 percentage-point improvement in September, the November ISM® Manufacturing PMI® declined to 48.2%, marking the second consecutive month of accelerating contraction and undershooting the consensus estimate of 48.8%. The latest report continued to highlight many of the same structural challenges that have persisted throughout recent months — namely, weakening demand, a softening labor market and elevated input costs, all of which have been influenced or exacerbated by ongoing volatility in U.S. trade policy.

According to Susan Spence, MBA, Chair of the ISM® Manufacturing Business Survey Committee, current tariff policies have not produced the intended reshoring effects and, in many cases, have had the opposite impact by compressing margins across the manufacturing value chain. Survey panelists indicated that many firms remain reluctant to relocate sourcing or production to the United States due to macroeconomic uncertainty and the fact that, even under the prevailing tariff regime, overseas sourcing often remains the more cost-effective option. Spence further noted that the magnitude of tariff impacts has overshadowed other potentially supportive economic developments, including recent interest-rate cuts and ongoing momentum in artificial intelligence investment, neither of which has meaningfully shifted manufacturing conditions. Even the presence of the federal government shutdown, which might normally feature prominently in survey commentary, was comparatively muted as tariff-related concerns continue to dominate respondents’ sentiment.

According to ISM® reporting, the domestic manufacturing sector is likely to remain on its current trajectory in the near to mid-term, as no meaningful indicators of sustained improvement have yet emerged. The recent pattern —where isolated, one-month gains in individual subindexes produce temporary boosts in subsequent months — has lacked the durability necessary to catalyze a broader recovery. As Spence emphasized, a sustained increase in the New Orders Index over a period of at least three consecutive months would be required before any meaningful rebound in production or indications of a manufacturing recovery can be credibly expected.