Back to August 2025 Industry Update

August 2025 Industry Update: Truckload Demand

Freight activity remained weak due to rising inventories and shifting modal preference by shippers.

Key Points

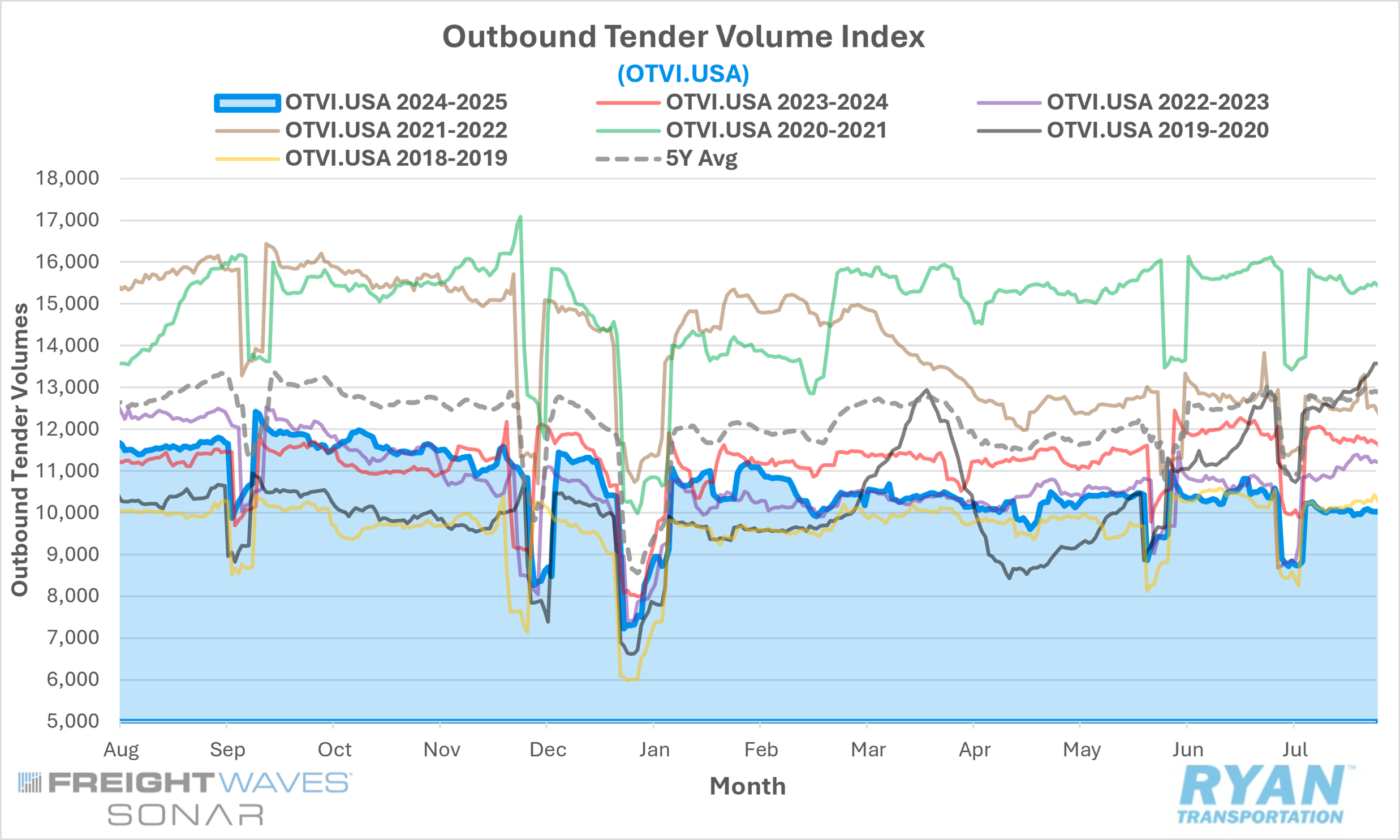

Mid-month comparisons of the FreightWaves SONAR Outbound Tender Volume Index (OTVI.USA), a measure of contracted tender volumes across all modes, registered a 2.1% decline MoM in July compared to June, dropping from 10,309.89 to 10,089.27.

The monthly average of daily tender volumes in July declined 5.9% MoM compared to June, falling from 10,437.13 to 9,817.00.

Compared to July 2024, average daily tender volumes were down 14.1% YoY and were 20.6% below the 5-year average.

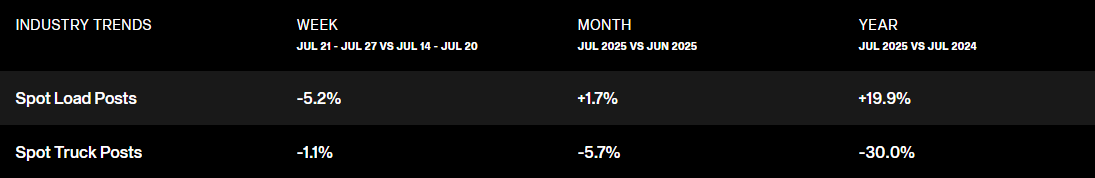

Spot market activity increased in July, rising 1.7% MoM and remaining elevated on an annual basis by 19.9%.

The Cass Transportation Index Report, a measure of U.S. freight activity that tracks shipment volumes and expenditures across all domestic transportation modes, reflected consistent monthly declines across both metrics in July of 0.2% and 1.2% MoM, respectively, while annual comparisons were mixed with shipments declining 2.4% YoY and expenditures increasing 2.6% YoY.

Summary

After registering moderate gains in May followed by overall stability in June, truckload volumes deteriorated in July, continuing to underperform relative to historical seasonal expectations. Average daily tender volumes declined 5.9% MoM — substantially below the typical seasonal average decline of 1.6% for July. After adjusting for the distortions created by the post–Fourth of July lull in shipping activity, the performance gap widened further, with adjusted tender volumes falling 3.5% MoM against a historical seasonal increase of 1.4%.

On a YoY basis, the divergence between current and prior-year volumes continued to expand. Tender volumes in July 2025 were 14.1% below July 2024 levels, deepening from the 12.1% decline observed in June and marking the largest annual deficit since July 2023. This further deterioration has pushed the FreightWaves SONAR OTVI back to levels comparable with those seen during the 2019 industry-wide freight recession. In fact, July’s average tender volumes were only 0.1% higher than the same month in 2019 and marked the lowest monthly average since May 2020, during the height of the COVID-19 pandemic.

Equipment-type segmentation in July reinforced the overall softness in freight demand. Dry van volumes declined 7.4% MoM, reefer volumes fell 5.2% MoM, and flatbed volumes dropped 6.8% MoM. Annual trends were similarly weak, with dry van volumes down 16.3% YoY, reefer volumes down 13.2% YoY, while flatbed volumes were a relative bright spot, rising 6.7% YoY.

Further reinforcing the broad-based softness in freight activity, the latest Cass Transportation Index Report showed that the shipments component of the index declined 0.2% MoM in June, both on a nominal and seasonally adjusted basis. On a YoY basis, shipments fell 2.4% in June, following a 4.0% decline in May. The report highlighted that under typical seasonal conditions, shipment volumes would be expected to decline by 5% YoY and noted that the recent increase in U.S. imports may provide some support to volumes in the months ahead, potentially mitigating further downside risk to seasonal norms.

Why It Matters

Despite the temporary easing of trade tensions between the United States and China in late June — resulting in a fresh wave of pre-tariff import activity — the truckload sector remained entrenched in a prolonged freight recession in July, with volumes showing no meaningful signs of recovery. The persistent weakness continues to be driven by a modal shift in shipper preference away from over-the-road (OTR) carriers in favor of rail and private fleet alternatives. This shift has been further compounded by elevated inventory levels across the supply chain and broader economic contraction, particularly in the manufacturing and construction sectors.

The July release of the Logistics Managers’ Index (LMI) offered further evidence of these pressures, with the overall index falling 1.5 percentage points MoM to 59.2%. This decline was largely attributable to a deceleration in Inventory Costs, which dropped 9.0 percentage points to 71.9% — a decline likely linked to a concurrent 4.2-point reduction in the Inventory Levels Index. However, the LMI data revealed a notable divergence between upstream and downstream segments. Smaller, upstream firms — many of which occupy the “middle mile” of supply chains as distributors, wholesalers and logistics providers — reported continued expansion in inventories. In contrast, larger, downstream retailers reflected contraction as they adhered to just-in-time (JIT) inventory strategies to mitigate carrying costs. Much of the inventory build among smaller firms stems from frontloaded import volumes designed to circumvent pending tariffs, which have yet to fully flow downstream.

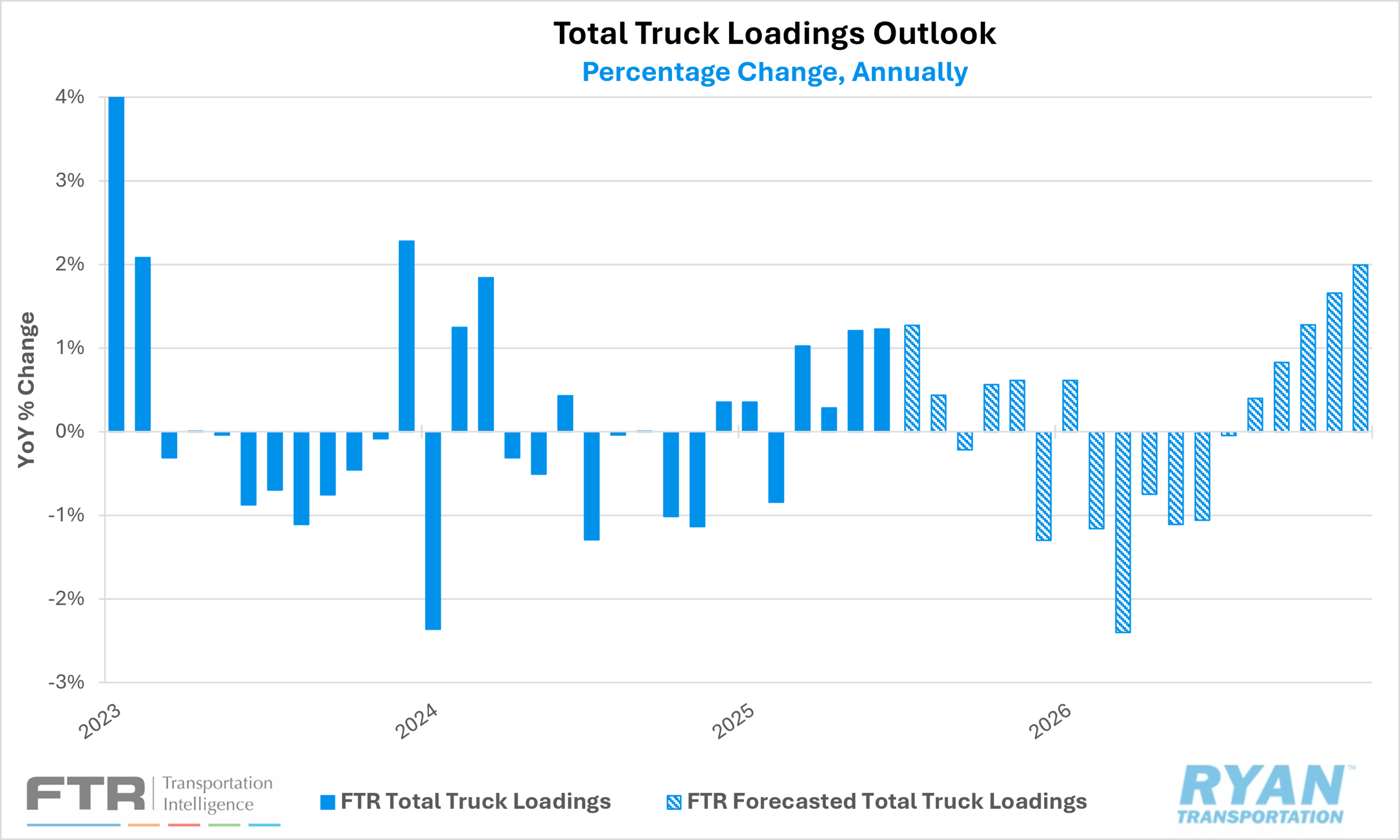

In its August 2025 Trucking Update, FTR modestly revised its full-year outlook for total truck loadings, projecting a 0.4% YoY increase, up slightly from the prior forecast of 0.2%. The upward adjustment was largely supported by stronger-than-expected construction-related activity. Within the modal breakdown, dry van loadings are now forecasted to decline 0.8% YoY in 2025, a marginal improvement from the previously expected 0.9% decline, while flatbed loadings are projected to grow 2.2%, an upward revision from the prior 1.7% forecast.

While outlooks remain mixed across industry stakeholders, there is little clarity regarding the timing of a meaningful upturn in the transportation market cycle. According to the Cass Transportation Index Report, forward visibility remains highly contingent on evolving trade policy, which has been notably volatile. On one hand, the recent wave of pre-tariff inventory building is expected to trigger a period of destocking, regardless of how trade negotiations unfold in the near term. On the other hand, the full downstream impact of tariffs has yet to materialize. As higher prices erode consumer purchasing power and real incomes, the negative implications for freight demand could intensify in the months ahead.