Back to August 2025 Industry Update

August 2025 Industry Update: Truckload Capacity Outlook

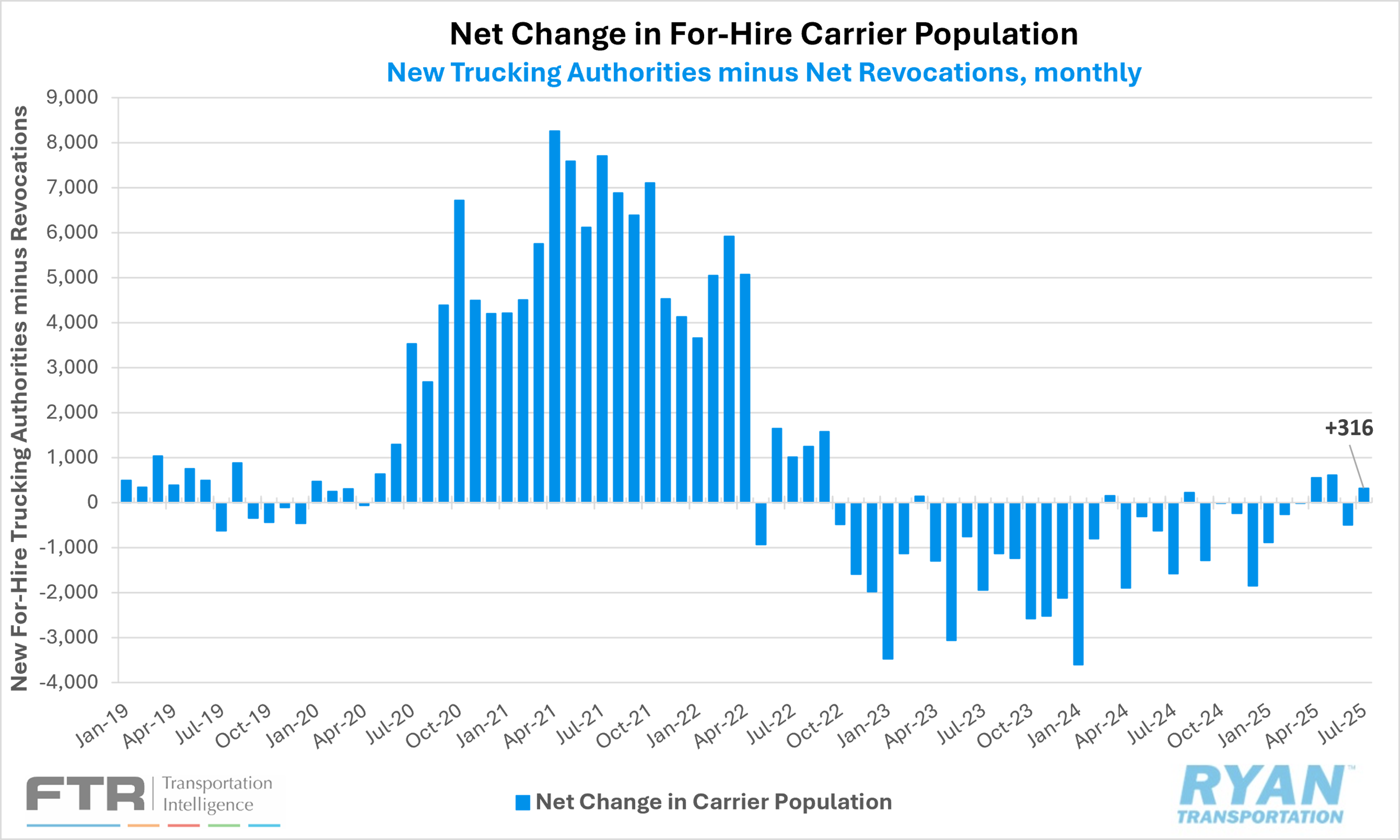

The for-hire carrier population registered moderate expansion in July as net revocations plummeted while new entrant levels stabilized.

Key Points

- Total net revocations, a measure of total authority rejections minus reinstatements, declined by over 750 carriers MoM in July, dropping from 5,502 in June to 4,747 in July, according to FTR’s preliminary analysis of the Federal Motor Carrier Safety Administration (FMCSA) data.

- Per FTR, the number of newly authorized for-hire trucking firms increased in July with the FMCSA authorizing 5,063 new for-hire carriers, 55 more than the 5,502 new authorizations recorded in June.

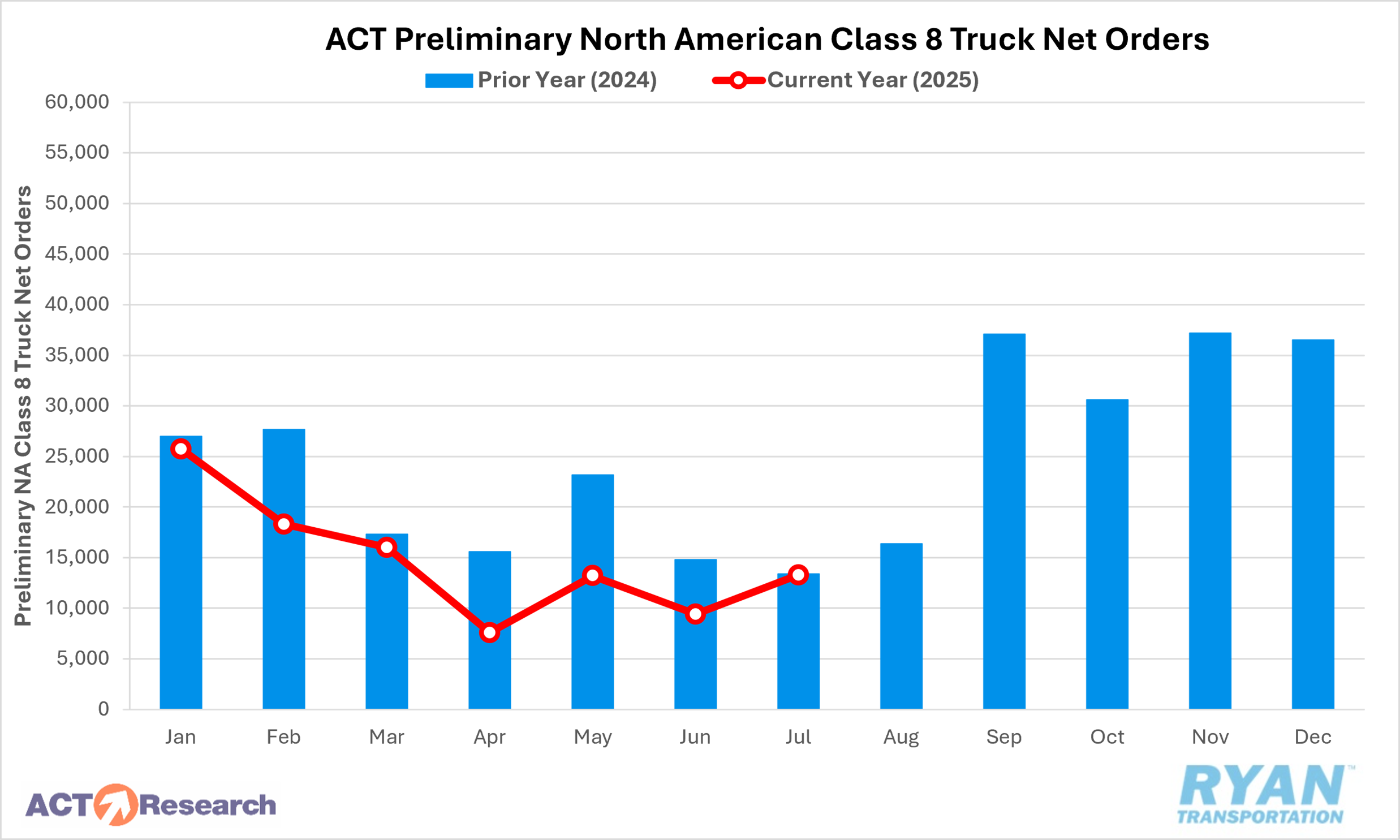

- Preliminary North American Class 8 net orders increased in July on a monthly basis while annual comparisons were lower with estimates ranging from 12,700 units as reported by FTR and 13,300 units according to ACT Research.

Summary

Following a net decline of approximately 500 carriers in June, the for-hire trucking population expanded in July for the third time in the past four months, increasing by 316 carriers MoM, according to FTR’s latest analysis. The moderate increase was primarily attributed to significant shifts in net authority revocations. After surging by nearly 1,100 carriers in June, net revocations fell sharply in July, dropping by more than 750 carriers, the largest MoM decline since January. As noted in last month’s report, the elevated revocation figure in June was likely distorted by a calendar anomaly, as the FMCSA processes the majority of revocations on Mondays, and June contained five such days. The total number of revocations in July — approximately 4,750 — aligned closely with the monthly average of just over 4,800 carriers observed during the first half of the year, reinforcing the likelihood that June’s spike was timing-related rather than structural.

Meanwhile, new carrier entrants have stabilized over the past three months, with average monthly fluctuations equating to a net change of just 22 carriers. Despite this recent steadiness, the number of new entrants remains elevated relative to trend, exceeding the average recorded during the first half of 2025 by roughly 350 carriers and surpassing the 2024 monthly average by over 425 carriers. Based on FTR’s analysis, there still remains roughly 89,000, or 35%, more authorized for-hire carriers in the market compared to levels before the pandemic.

On the equipment side, preliminary North American Class 8 truck orders posted a substantial MoM gain in July but continued to underperform on a YoY basis, according to estimates from both ACT Research and FTR. ACT Research reported that orders increased 41.4% compared to June but remained 1.9% lower than July 2024 levels. FTR similarly noted a 42% sequential increase, with YoY orders down approximately 7%, marking the seventh consecutive month of annual declines. According to FTR, Class 8 truck orders remained well below the 10-year average for July (19,974 units), and total order intake for the 2025 cycle (September 2024 through July 2025) is now tracking 15% below the same period last year.

Why It Matters

While the calendar irregularity in June contributed to a sharper-than-expected decline in authority revocations in July, the ongoing stabilization in new entrants — resulting in a net increase in the for-hire carrier population — remains a headwind to the timeline for recovery from the current supply-driven industry recession. It is important to note, however, that changes in the number of operating authorities do not necessarily equate to meaningful changes in total capacity. The vast majority of motor carriers are small fleets or independent owner-operators, and many newly authorized carriers previously operated as leased drivers or company employees. As such, growth in the for-hire carrier count does not inherently translate into an expansion of the driver pool.

That said, fluctuations in carrier population remain a useful gauge for identifying structural and behavioral shifts within the trucking market — particularly among smaller operators and independent drivers — though they represent only a subset of broader supply-side dynamics. According to the latest Bureau of Labor Statistics (BLS) report, for-hire trucking companies added 3,600 payroll jobs in July, following downward revisions to June’s preliminary estimates. On a YoY basis, payroll employment in the trucking sector rose 0.4%, the strongest annual gain since March 2023. This marks a reversal from the trend observed between May 2023 and April 2024, when annual comparisons were consistently negative.

More granular BLS data, available through June, show greater volatility in long-distance general freight truckload employment. Payrolls in this segment declined by 2,200 jobs MoM in June after adding 3,200 jobs in May. On an annual basis, employment in long-distance general freight trucking increased 0.1% in June, up 0.4% from February 2020 levels, indicating a market that remains stable but not materially expanding.