Back to August 2025 Industry Update

August 2025 Industry Update: Reefer

The refrigerated sector registered the strongest performance of the three major modes as rates increased moderately amidst a boom in demand.

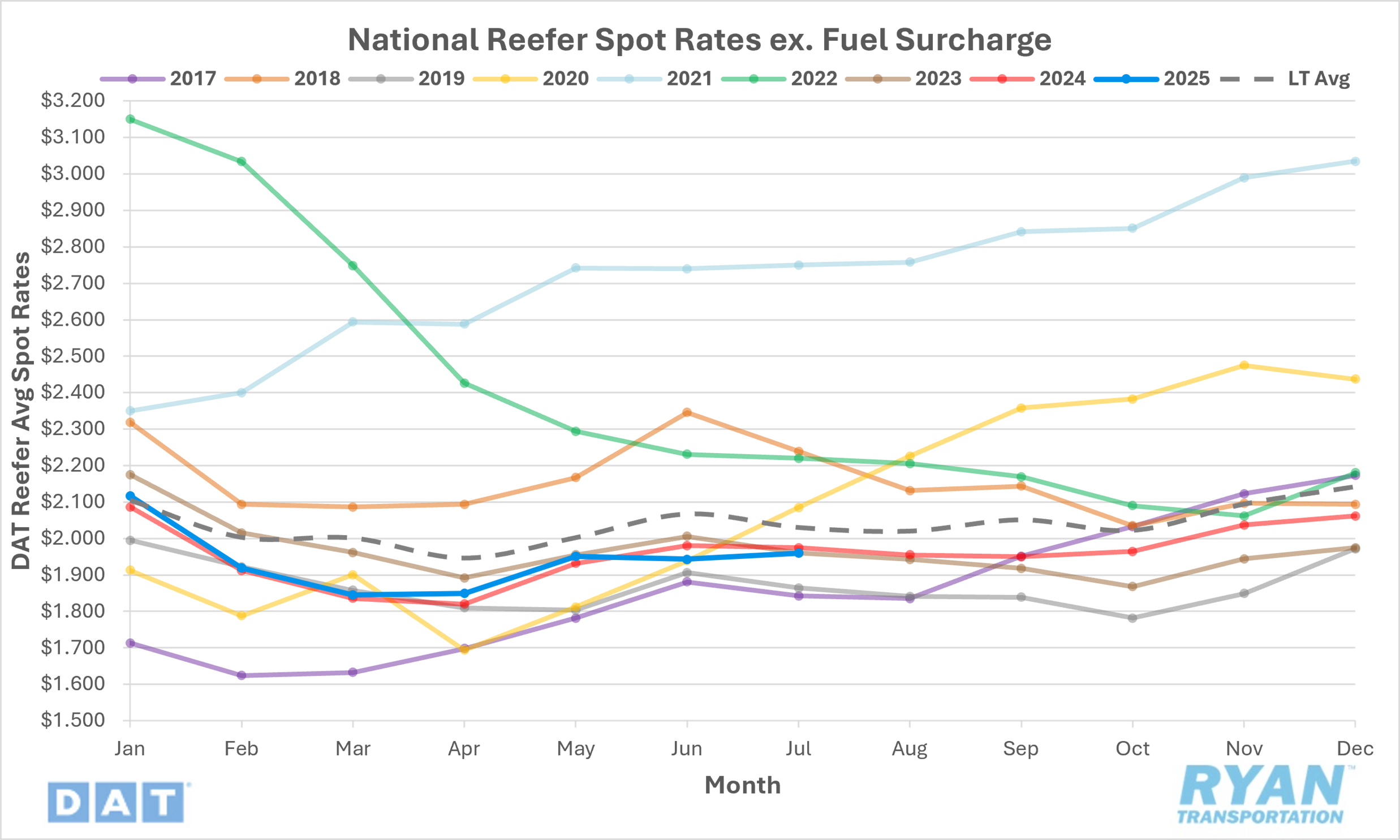

Spot Rates

Key Points

- The national average reefer spot rate, excluding fuel, increased 0.9% MoM, or just under $0.02, in July to $1.96.

- On an annual basis, average reefer spot linehaul rates were down 0.8% YoY and were 4.2% below the LT average.

- Initially reported average reefer contract linehaul rates rose 0.3% MoM in July and were down 0.2% YoY compared to July 2024.

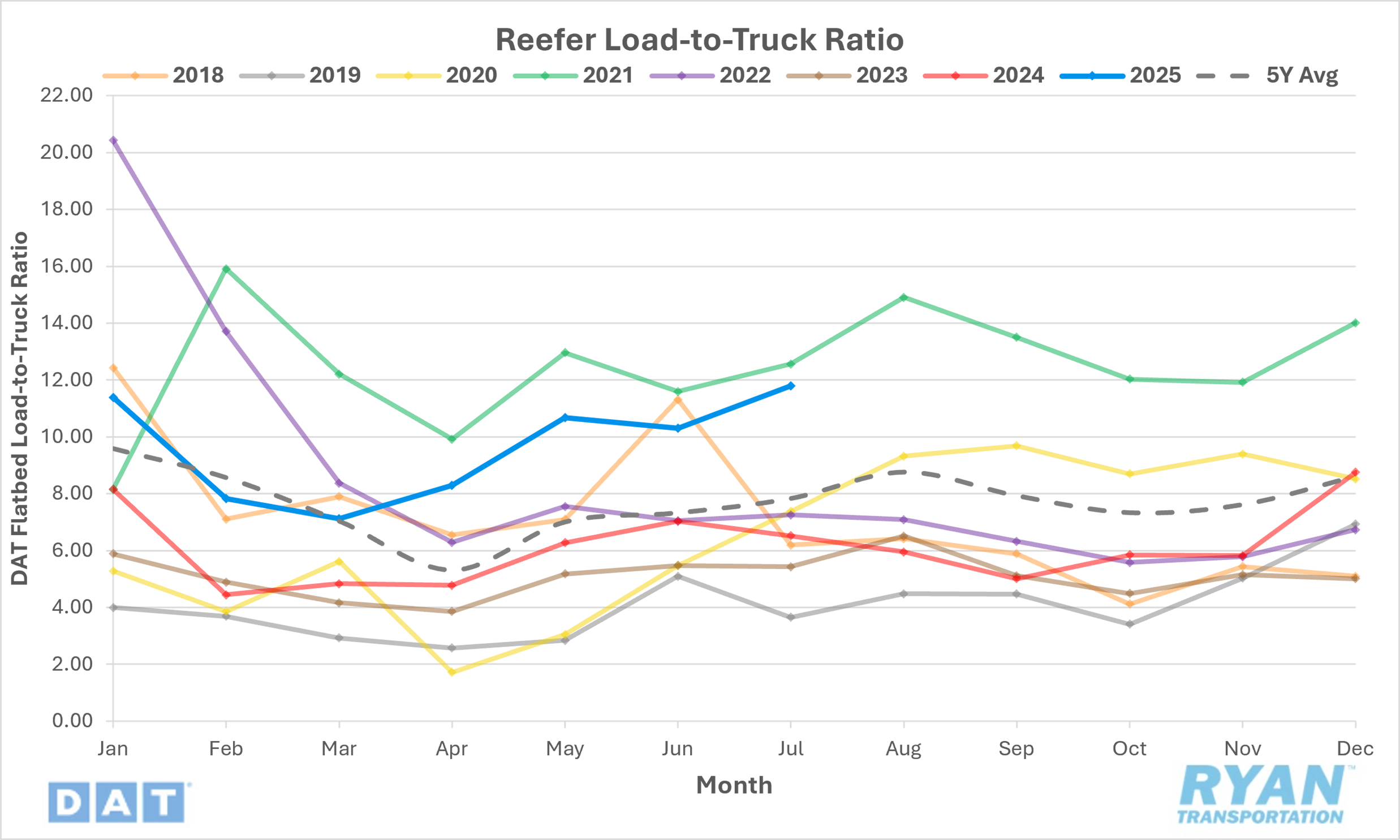

Load-to-Truck Ratio

Key Points

- The reefer LTR increased 14.6% MoM from 10.30 in June to 11.80 in July.

- Compared to July 2024, the reefer LTR was 81.0% higher YoY and was 50.7% higher than the 5-year average.

- DAT load board data for July recorded an 18.1% increase MoM while equipment posts rose 3.1% MoM.

Market Conditions

Reefer Summary

In 2024, Americans spent $8.5 billion on hot dogs and sausages, with Los Angeles leading consumption at over 27 million pounds — nearly 650 refrigerated truckloads — far outpacing New York and Dallas. Dodger Stadium alone sells 2.5 million hot dogs each season, and nationwide consumption reached over 2 billion pounds, the equivalent of 47,000 reefer truckloads. While LA dominated hot dog sales, New York led sausage consumption. At the same time, KPMG’s Consumer Pulse Summer 2025 report shows a shift toward cautious, cost-conscious spending driven by inflation, declining incomes and tariff concerns. Nearly 4 in 10 households report income drops, with 69% of consumers eating more at home to save money. This shift is reducing restaurant traffic and could impact food service-related freight demand.

Agricultural hubs remain critical to reefer freight, with Fresno producing 60% of the world’s raisins — over 300,000 tons annually, or 14,000 truckloads — and Kern County supplying 80% of U.S. carrots, totaling more than 30,000 truckloads. However, produce truckload volumes have been declining, partly due to the “Ozempic effect,” where GLP-1 medications are reshaping diets toward lower-calorie, fresher foods. Users of these medications consume 16–39% less food annually, potentially cutting national food and beverage truckload volumes by 2%, or 450,000 loads each year. Packaged food demand is also slipping, with sales down 4–5% over two years. This presents both challenges for traditional freight patterns and opportunities in health-focused, fresh-produce shipping. Food retailers are adapting with smaller, healthier product assortments to align with shifting consumption trends.

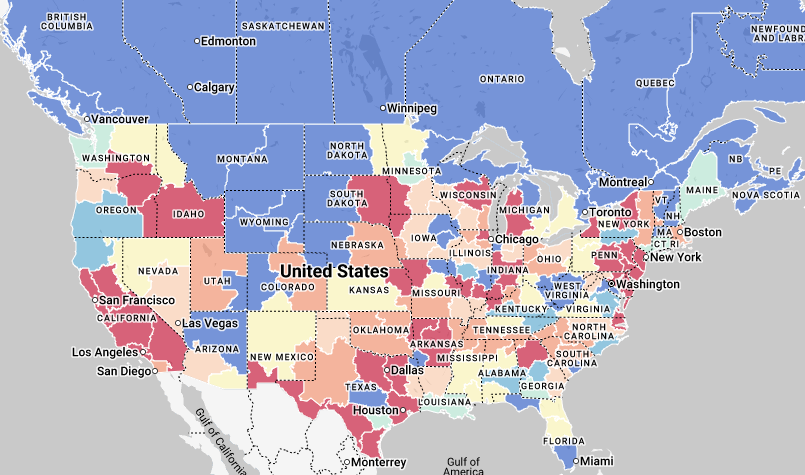

In July 2025, the reefer market showed modest resilience compared to dry van and flatbed segments, supported by grocery, healthcare, and CPG demand. While spot and contract rates plateaued, capacity availability improved slightly, and trailer costs — affected by tariffs — kept new equipment orders low, helping support rate stability. Seasonal produce from the Pacific Northwest, California and Florida kept certain lanes tight, particularly Nogales and McAllen for cross-border flows. Contract rates stayed flat YoY, with shippers holding a cost-sensitive stance and carriers facing elevated costs. Conditions are expected to ease post-July as harvests wind down, though macroeconomic headwinds and changing consumer habits will limit upward pricing movement. Overall, reefer freight remains a relatively stable but competitive segment going into Q3 2025.