Back to August 2025 Industry Update

August 2025 Industry Update: Intermodal

Intermodal volumes rebounded from a weak June while carload traffic continued to grow as rates deteriorated further.

Spot Rates

Key Points

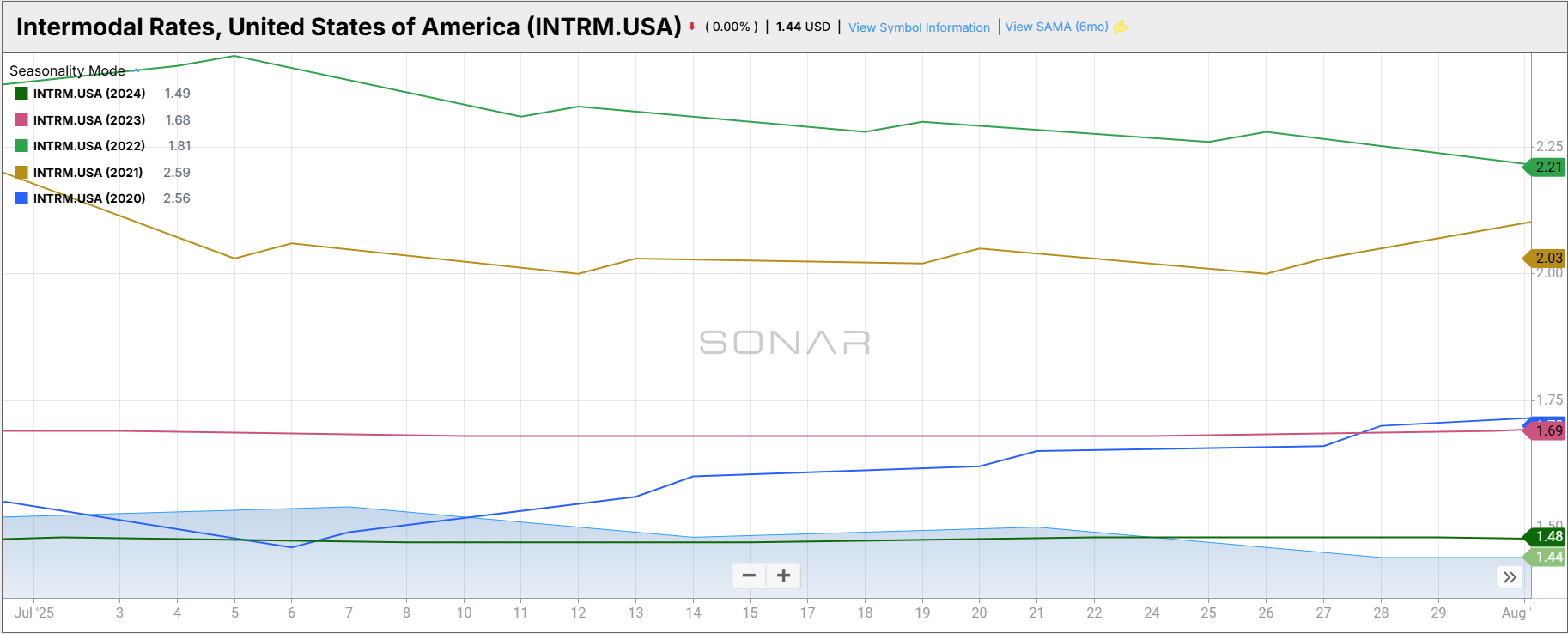

- The FreightWaves SONAR Intermodal Rates Index (INTRM.USA), which measures the average weekly all-in door-to-door spot rate for 53’ dry vans across most origin-destination pairings, declined by 5.3% MoM, or $0.08, in July to $1.44.

- Compared to July 2024, intermodal spot rates were down 2.7% YoY and were 21.0% below the 5-year average.

Volumes

Key Points

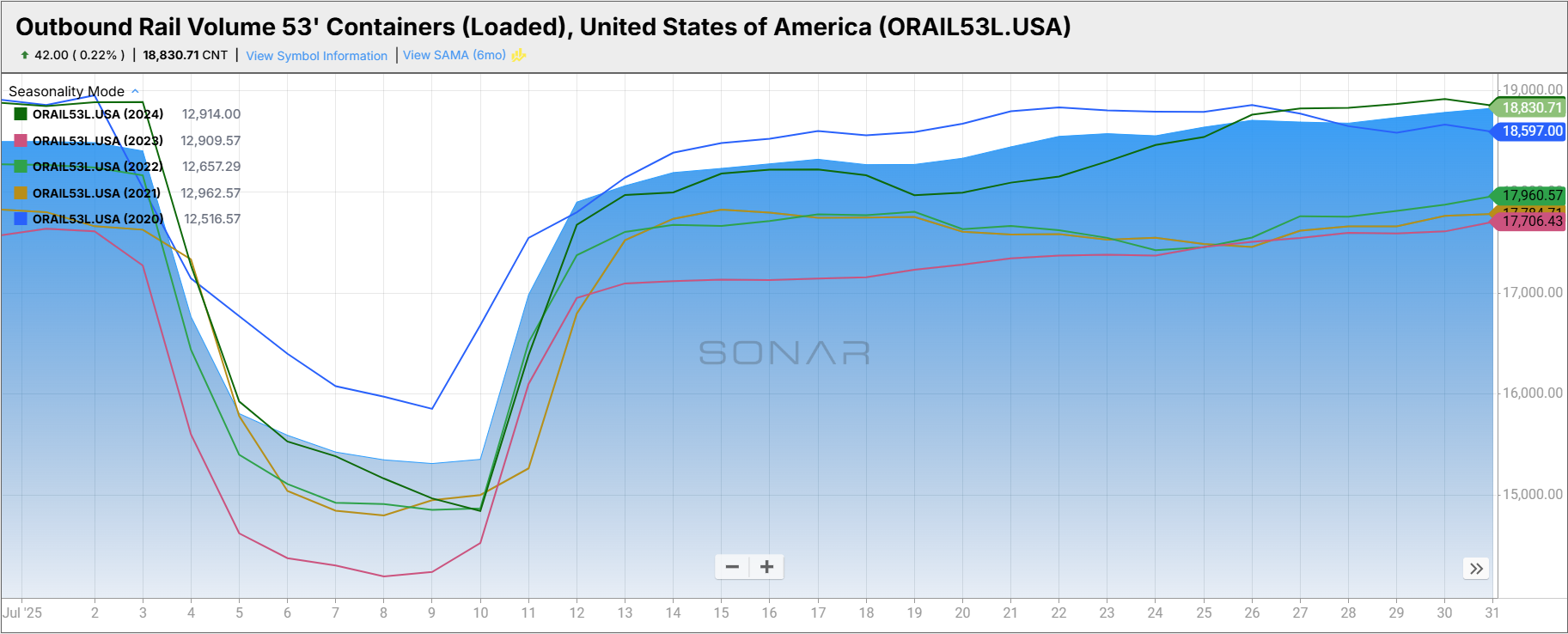

- Total loaded volumes for 53’ containers for all domestic markets, measured by the FreightWaves SONAR Loaded Outbound Rail Volume Index (ORAIL53L.USA), increased 1.8% MoM, rising from 18,500.57 at the end of June to 18,830.71 at the end of July.

- Loaded domestic rail volumes for 53’ containers in July were down 0.1% YoY compared to July 2024 but were 3.6% higher than the 5-year average.

Intermodal Summary

Following the mixed performance in June — when intermodal volumes declined for the first time in 22 months while carload activity demonstrated resilience — both rail segments posted YoY gains in July. According to the latest report from the Association of American Railroads (AAR), U.S. intermodal volumes rebounded, increasing 2.4% YoY and reversing the 2.9% YoY decline recorded in June. Weekly intermodal originations averaged 270,175 units, the second-highest July total on record, trailing only July 2018. Year-to-date, U.S. intermodal volumes were up 4.7%, or approximately 371,000 units, compared to the same period in 2024.

Carload activity also strengthened, with total U.S. carloads rising 4.6% YoY in July, marking the fifth consecutive annual increase. 15 of the 20 carload commodity groups tracked by the AAR reported annual gains — the highest breadth of growth since December 2023. Average weekly carload originations totaled 224,568 units in July, the highest level for the month since 2019. Through the first seven months of 2025, total carload volumes are up 2.8%, or approximately 186,000 units, compared to the same period last year.

Despite the rebound in volumes, rail pricing remains under pressure. Intermodal contract rates ended July 1.9% lower YoY and were 7.7% below the five-year average. In the spot market, the $0.09 MoM increase recorded in June was nearly erased in July. Given that intermodal spot rates are often used by carriers to safeguard contracted capacity, the persistence of rates below both prior-year levels and the five-year average suggests there is currently little incentive for carriers to prioritize protecting contract allocations.