Back to August 2025 Industry Update

August 2025 Industry Update: Fuel

Average diesel prices continued to rise as historically low global inventory levels pushed futures markets higher.

Key Points

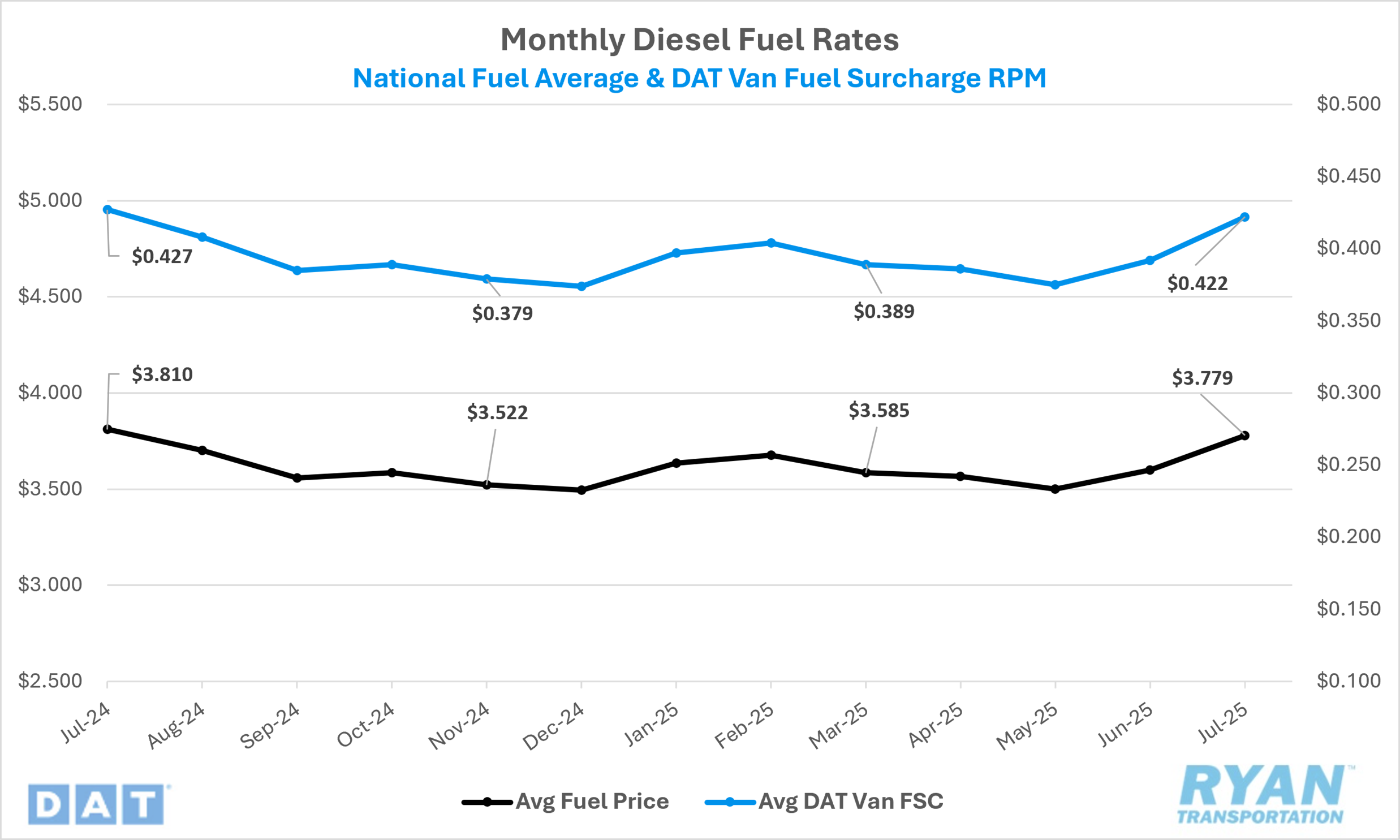

- The national average price of diesel surged in July, rising 5.0% MoM, or $0.18, to $3.779.

- Compared to July 2024, diesel prices were down 0.8% YoY, or just over $0.03.

- Builds on U.S. Commercial Crude Inventories outpaced draws in July by 7.7M barrels (bbls) for the weeks ending July 4 and July 25.

Summary

The national average price of diesel rose for the second consecutive month in July, extending the upward momentum that began in June. Following a $0.10 MoM increase in June — which ended a three-month streak of declines — the benchmark retail diesel price surged by $0.18 MoM in July, the largest monthly gain since February 2024. While prices remain below prior-year levels, July’s sharp increase narrowed the YoY deficit to its smallest margin since March 2023, when annual comparisons first turned negative.

On a weekly basis, the Department of Energy (DOE)/Energy Information Administration (EIA) benchmark diesel price posted consistent gains throughout most of the month. After climbing by just over $0.03 during the first two weeks, prices advanced by more than $0.05 WoW in the third week — marking the sixth increase in the past seven weeks — and reached $3.812 per gallon, the highest level since mid-July 2024. However, the rally stalled in the final week, with prices edging down by less than $0.01 WoW, closing the month nearly $0.08 higher than where they began.

Why It Matters

Despite persistently weak market fundamentals in the global oil sector, the steady increase in average fuel prices during July was unexpected. Following the stabilization of futures markets in late June — driven by the avoidance of a worst-case escalation in the Israel-Iran conflict — market conditions appeared poised to turn more bearish. Supply continued to exceed demand as OPEC+ announced plans to add 548,000 barrels/day to the market beginning in August, an unexpected increase from the 411,000 barrels/day it had already been incrementally adding in recent months. This production increase came despite the International Energy Agency’s (IEA) latest monthly report forecasting global demand growth of only 720,000 barrels per day for the remainder of 2025.

However, the persistence of higher oil futures through July, despite the ongoing supply glut, was primarily driven by diesel market dynamics rather than crude fundamentals. Between June 2 and July 21, benchmark crude prices on the CME Commodity Exchange rose 7%, climbing from $64.63 per barrel to $69.21. Over the same period, ultra-low sulfur diesel (ULSD) prices surged 22.7%, increasing from $2.0445 per gallon to $2.5092 per gallon.

Industry analysts attribute diesel’s outsized gains to historically low global inventories, which are well below both last year’s levels and the five-year seasonal average. U.S. diesel stockpiles have fallen to their lowest level for this time of year since 1996, according to Bloomberg. Contributing factors include reduced imports of Venezuelan and Mexican Mayan crude — both rich in distillates ideal for diesel production — as well as new sanctions on Russia, a key diesel exporter. While U.S. production has increased, it remains insufficient to meet current demand due to the predominance of lighter crudes from domestic wells, which yield less diesel when refined.

Looking ahead, the inventory shortfall is likely to intensify during the colder months as heating oil demand rises. Since diesel and heating oil are derived from the same distillate stream, increased heating oil production will further constrain diesel availability, increasing the risk of sustained price pressure. This dynamic could place considerable financial strain on smaller carriers unable to pass through higher fuel costs to customers, further influencing capacity attrition in the trucking market.