Back to August 2025 Industry Update

August 2025 Industry Update: Flatbed

The flatbed conditions continued to soften further as housing activity weakened, leading to a decline in both rates and demand levels.

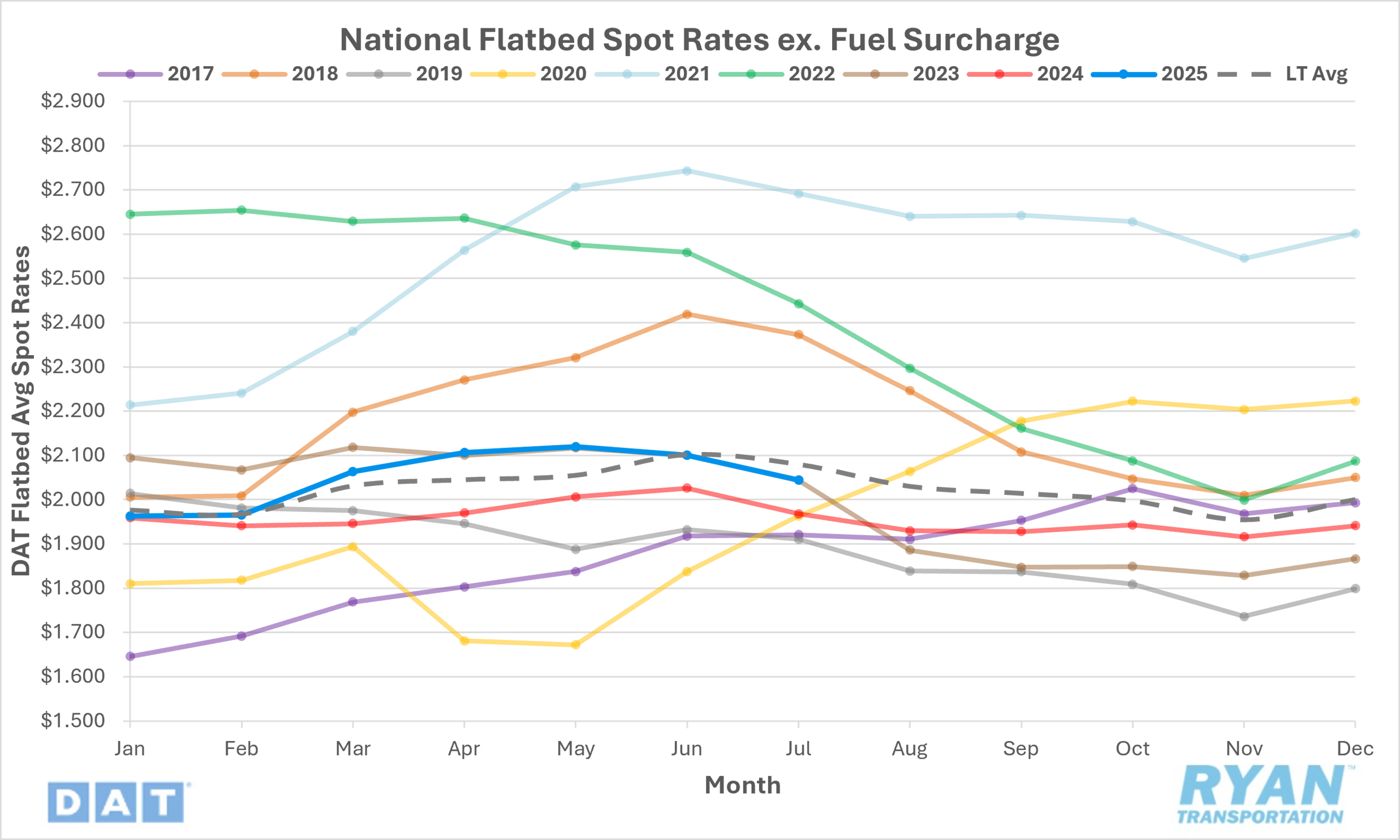

Spot Rates

Key Points

- The national average flatbed spot rate, excluding fuel, declined 2.7% MoM, or roughly $0.06, in July to $2.04.

- Annual comparisons of average flatbed spot linehaul rates reflected a 3.9% increase YoY compared to July 2024 but remained below the LT average by 2.1%.

- Initially reported average flatbed contract linehaul rates registered 0.2% lower MoM in July but were up 1.4% YoY compared to July 2024.

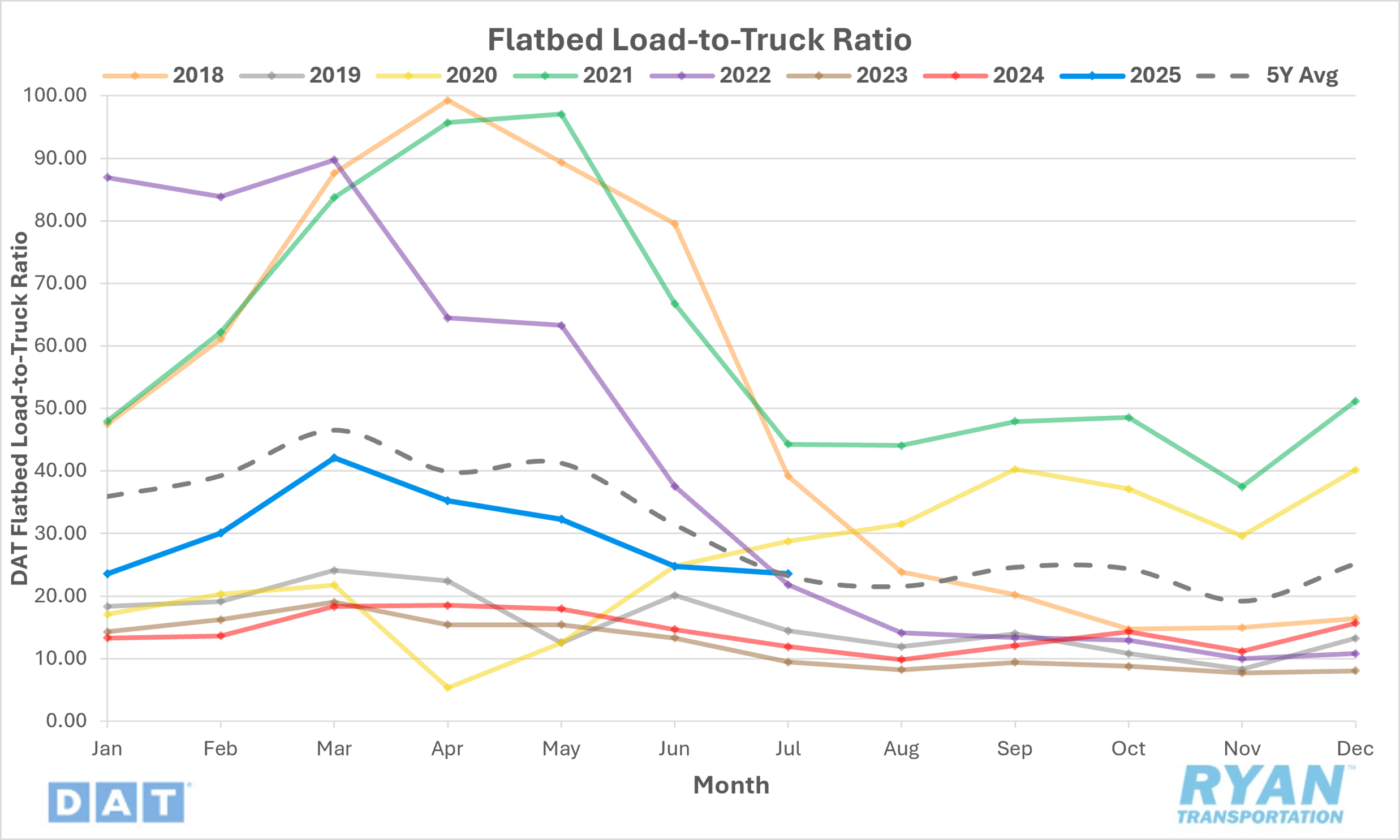

Load-to-Truck Ratio

Key Points

- The flatbed LTR declined 4.9% MoM in July, dropping from 24.77 in June to 23.55.

- Compared to July 2024, the flatbed LTR was 98.1% higher YoY and registered 1.4% above the 5-year average.

- According to DAT, flatbed load posts were down 5.0% MoM in July while equipment posts fell by 0.1% MoM.

Market Conditions

Flatbed Summary

In May and June 2025, U.S. single-family homebuilding experienced mixed signals, with a slight rise in May giving way to an 11-month low in June. High mortgage rates, economic uncertainty and elevated inventories have dampened buyer demand, prompting builders to cut prices and reduce new construction plans. Tariffs on key building materials like lumber, aluminum and steel have further increased costs, compounding challenges for the housing sector. This slowdown has significantly reduced freight-intensive housing starts and permits, signaling weaker construction-driven freight demand. The Federal Reserve’s decision to maintain interest rates in the 4.25%-4.50% range reflects ongoing caution in the broader economy, while homebuilder sentiment has dropped to its lowest point in over two years. These housing headwinds are likely to keep residential freight activity muted through Q3 2025.

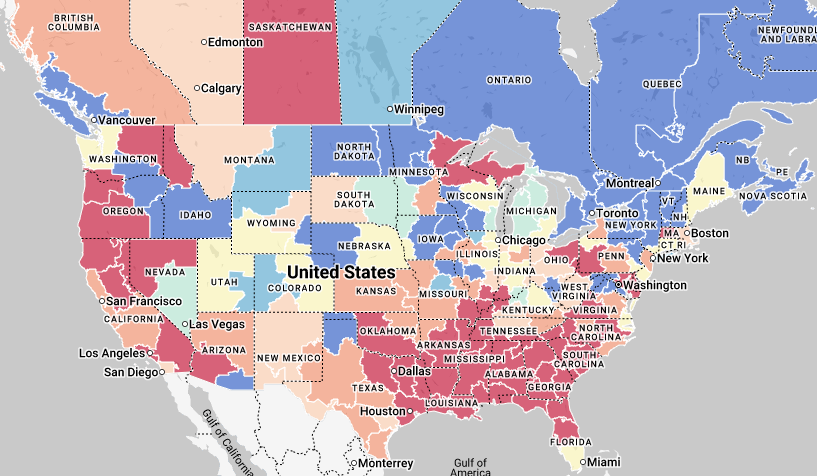

The freight and manufacturing sectors mirrored this volatility, with trucking tonnage slipping 0.1% in May and manufacturing contracting for the fourth straight month in June. Tariffs and geopolitical instability have disrupted orders and pushed up input costs across multiple industries, including metals, chemicals and transportation equipment. Seasonal demand spikes, such as “pallet season” in agriculture, continue to strain logistics and drive temporary cost increases for both pallets and reefer capacity. Energy, housing and industrial freight remain the primary demand drivers, but Section 232 tariff increases — particularly on steel, aluminum and related goods — are creating regional freight imbalances, notably in the Midwest and Gulf Coast. Business investment in equipment has slowed sharply, with uncertainty over tariff policy causing many companies to delay capital spending. This softening in manufacturing and equipment orders adds further pressure to freight volumes and capacity utilization.

Flatbed rates in July reflected a loss of momentum as early spring strength gave way to softer industrial activity and uneven construction demand. Although infrastructure-related projects are providing some stability, weak manufacturing output, sluggish private-sector investment and tariff-driven cost uncertainty continue to limit growth. Ample capacity and tepid industrial sentiment suggest flatbed pricing will remain range-bound into Q3, with only a potential upside if public infrastructure execution accelerates. Shippers are keeping budgets tight and shortening planning horizons, while carriers are prioritizing margin preservation over chasing volume. Without a rebound in manufacturing orders or a surge in construction activity, the flatbed market will likely face continued stagnation through late summer.