Back to August 2025 Industry Update

August 2025 Industry Update: Economy

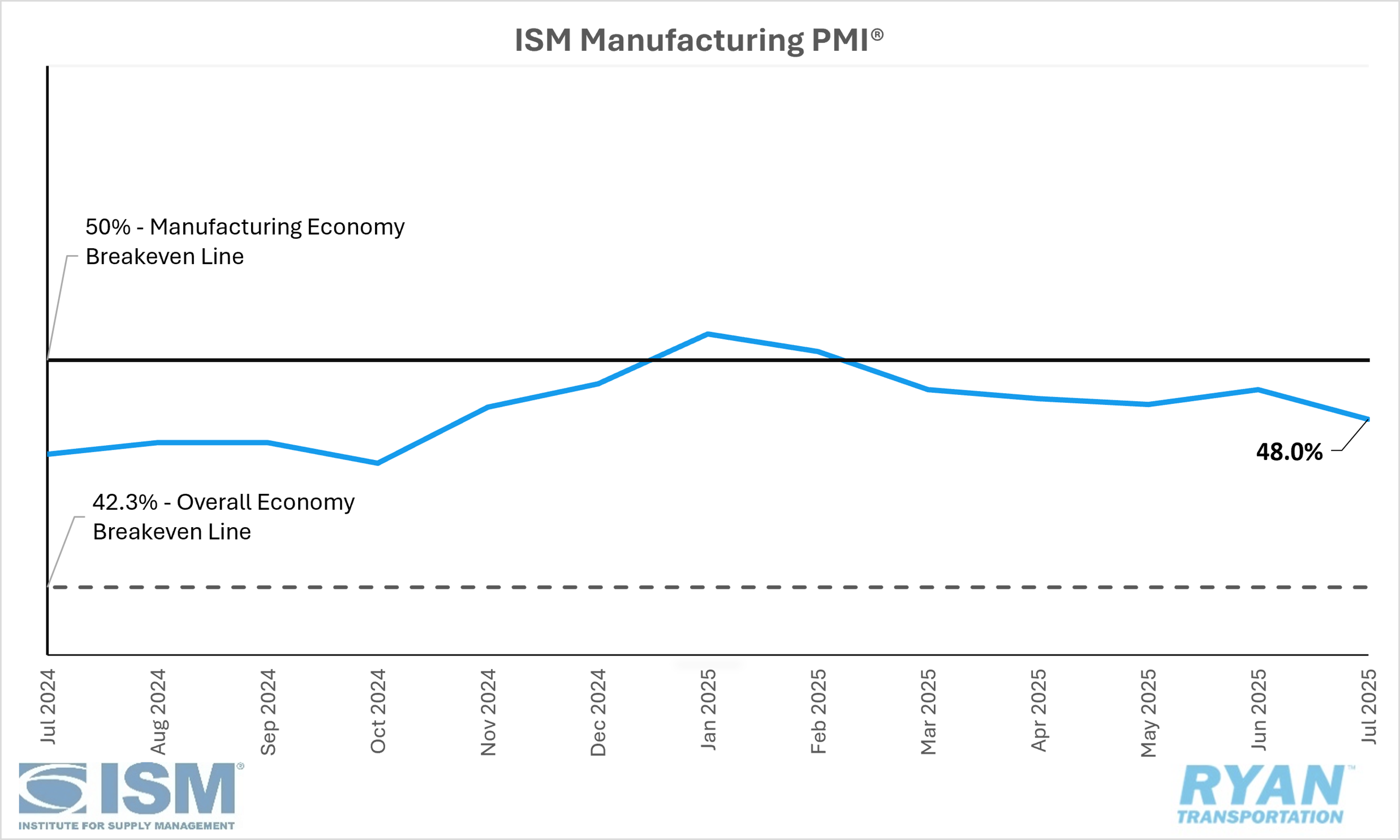

The ISM® manufacturing index contracted at a faster rate as demand remains weak leading to further contraction in employment.

United States ISM Manufacturing PMI

Key Points

The Institute of Supply Management® (ISM®) Manufacturing PMI® registered 48.0% in July, 1.0% lower than June’s reading of 49.0% and remaining in contraction territory.

The New Orders Index contracted at a slower rate in July compared to June, rising 0.7% from 46.4% to 47.1%.

The Production Index moved further into expansion territory, rising 1.1% from 50.3% recorded in June to 51.4%.

The Employment Index registered 43.4% in July, a 1.6% decline from June’s reading of 45.0% and dropping deeper into contraction territory.

The Supplier Deliveries Index registered 4.9% lower in July compared to June, dropping from 54.2% to 49.3%.

The Inventories Index contracted further in July at 48.9%, a 0.3% drop from the 49.2% reading in June.

Summary

U.S. manufacturing activity contracted for the fifth consecutive month in July, with the pace of decline accelerating from June. According to the latest Manufacturing ISM® Report on Business, the Manufacturing PMI® fell by 1.0 percentage points, led by declines in the Supplier Deliveries and Employment Indexes. From a broader economic perspective, July marked the 63rd consecutive month of overall expansion following a single month of contraction in April 2020, as a PMI® reading above 42.3% over time is generally consistent with economic growth.

On the demand side, conditions showed limited improvement. The New Orders and Backlog of Orders indexes contracted at slower rates, while Customers’ Inventories and New Export Orders contracted at slightly faster rates. Despite this moderate progress, demand remains subdued, reflected in the 1-to-1.4 ratio of positive to negative panelist sentiment on near-term conditions. The New Orders Index registered 47.1%, remaining below its 12‑month average of 48.3% and continuing its streak of sub‑50 readings since the 24‑month expansion ended in May 2022. A notable shift occurred in the Customers’ Inventories Index, which fell 1.0 percentage points to 45.7%, moving from “about right” to “too low” territory — typically a positive sign for future production.

The output components were mixed in July. The Production Index expanded for a second consecutive month, albeit modestly, while the Employment Index contracted for the sixth straight month, with a 1‑to‑2 ratio of hiring to staff reduction comments. ISM® survey respondents indicated that layoffs remain the primary tool for managing headcount, highlighting the ongoing uncertainty in near‑ to mid‑term demand. At 43.4%, the Employment Index recorded its lowest level since June 2020 when the index registered 42%.

Among the six largest manufacturing sectors — Chemical Products; Transportation Equipment; Computer & Electronic Products; Food, Beverage & Tobacco Products; Machinery; and Petroleum & Coal Products — none reported growth in July, down from four reporting growth in June.

Why It Matters

After a gradual improvement in June, the ISM® Manufacturing PMI® unexpectedly declined in July, falling deeper into contraction territory and significantly undershooting the consensus forecast of 49.5%. The domestic manufacturing sector continues to face considerable headwinds, with persistent uncertainty surrounding trade regulations and elevated interest rates weighing heavily on output and sentiment. Tariff concerns again dominated survey responses, as panelists highlighted heightened challenges in forecasting duty payments, calculating cost savings and managing strategic sourcing. While the current administration’s global tariff policy was initially intended to protect U.S. manufacturers from foreign competition, that objective has yet to materialize in the data, as new orders remain weak, production remains fragile and manufacturers continue to focus on trimming headcounts. ISM® CEO Thomas Derry emphasized that a meaningful recovery is unlikely without more stable and predictable conditions in the trade and regulatory environment.

The underlying details of July’s PMI® report were largely disconcerting, punctuated by only a few moderately positive indicators. The most notable red flag was the breadth of contraction across the sector, with 79% of manufacturing GDP in decline — up sharply from 46% in June — and 31% in strong contraction (PMI® of 45% or lower), up from 25% the prior month. The Employment Index plunged to 43.4%, its lowest level since June 2020, mirroring the federal jobs report released at the start of the month. On the positive side, production demonstrated resilience, rising 1.1% from June and remaining in expansion territory, although that trend appears unsustainable if new orders, backlogs and inventories continue to contract. Additionally, the Customers’ Inventories Index slipped into “too low” territory, which could signal eventual support for replenishment and future production activity.

Although July’s PMI® results echoed the broadly negative sentiment of recent months, they coincided with a suite of softer macroeconomic data, including a weaker‑than‑expected federal jobs report with downward revisions to prior months, a decline in U.S. construction spending, and a slight uptick in consumer sentiment that remains historically low. Collectively, this wave of weaker economic indicators has increased market speculation that the Federal Reserve may consider an interest rate cut at its September meeting. While any loosening of monetary policy would likely stimulate capital investment in manufacturing, firms are likely to remain cautious, as sustained improvement will depend not on assumptions but on tangible policy shifts — both in interest rates and in the clarity and stability of U.S. trade policy.