Back to August 2025 Industry Update

August 2025 Industry Update: Dry Van

Dry van rates remained flat compared to June despite a sharp increase in demand.

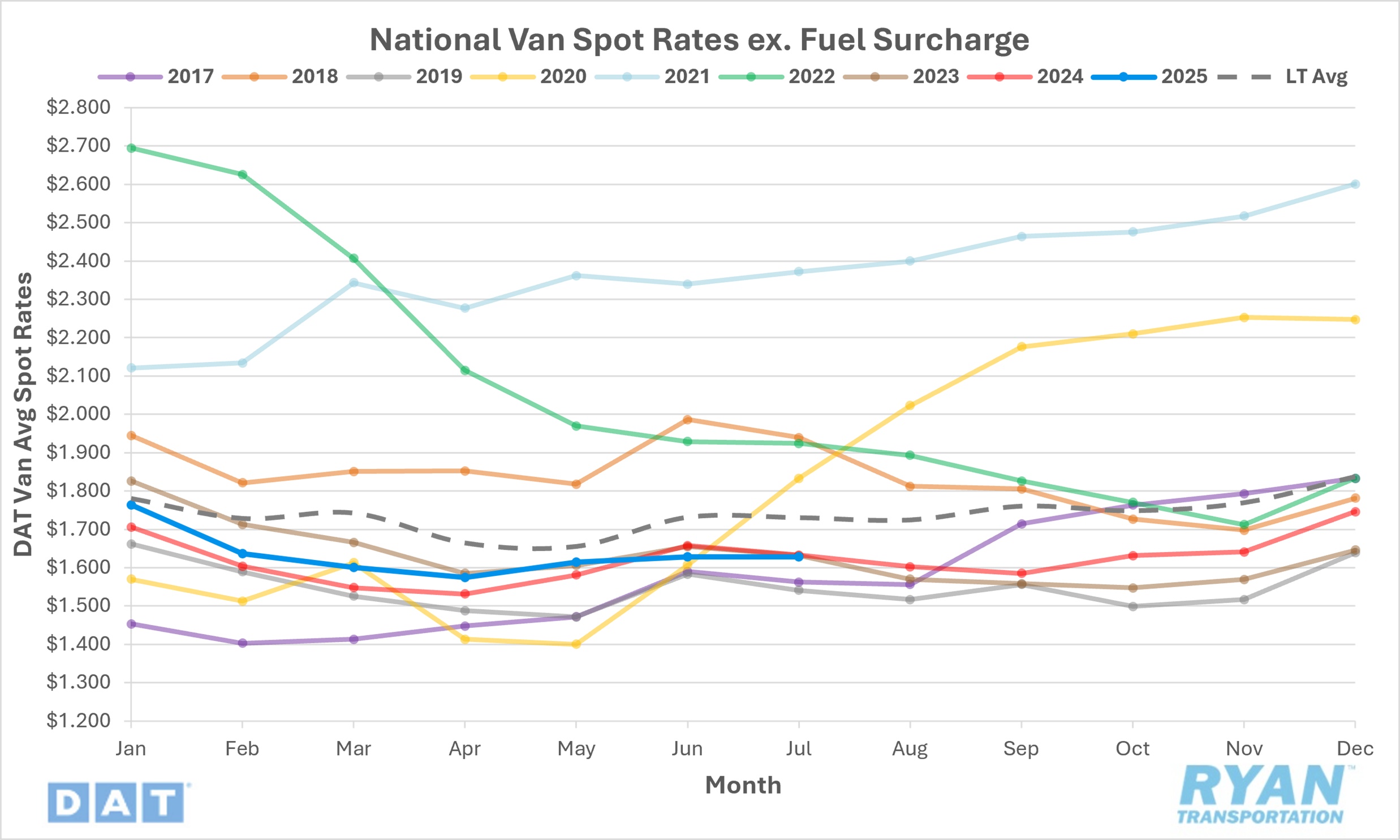

Spot Rates

Key Points

- The national average dry van spot rate excluding fuel was flat MoM in July at $1.63.

- Compared to July 2024, average dry van spot linehaul rates were down 0.2% YoY and 6.3% below the LT average.

- Initially reported dry van contract rates excluding fuel remained flat MoM in July compared to June and were higher compared to July 2024 by 0.8% YoY.

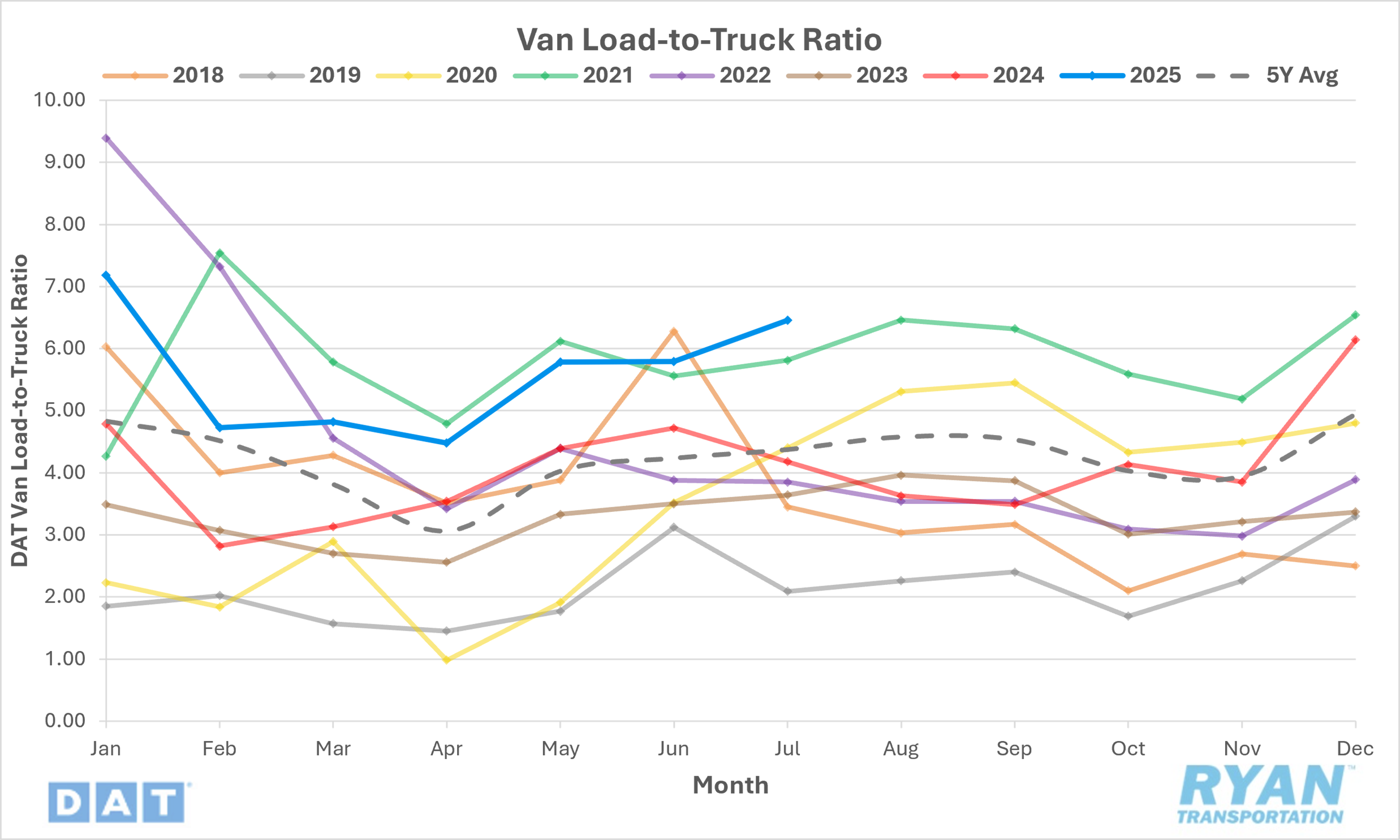

Load-to-Truck Ratio

Key Points

- The dry van load-to-truck ratio (LTR) surged in July by 11.6% MoM, increasing from 5.79 in June to 6.46 in July.

- Compared to July 2024, the dry van LTR was 54.5% higher YoY and 47.6% above the 5-year average.

- According to load board data collected by DAT Freight & Analytics, dry van load posts were up 6.6% MoM in July while equipment posts fell 4.5% MoM.

Market Conditions

Dry Van Summary

The U.S. truckload market remained soft through May 2025, with ACT Research’s Volume Index falling to 42.5 for a third month, driven by tariff-related disruptions, inflationary pressures and uncertain trade policy. Freight demand slowed following a Q1 shipment pull-forward, and while May saw a brief rate bump from DOT Roadcheck inspections, pricing quickly reverted to pre-event levels. High equipment costs — partly from tariffs on steel, aluminum and parts — are constraining fleet investment, with only 27% planning near-term equipment purchases. Driver availability remains stable thanks to higher wages and returning experienced drivers, but training investment is suffering due to poor profitability. The supply and demand balance remains loose, with falling volumes outpacing capacity cuts.

May’s ton-mile index (TTMI) dropped 0.6% from April, though still up 1% YoY, signaling a modest cooling in for-hire trucking demand. The decline was linked to weaker output in nonmetallic mineral products and construction-related wholesale sectors, reflecting a slowdown in single-family housing. Analysts expect continued pressure in the second half of 2025 as manufacturing orders stay weak and new tariffs take hold. By July, dry van truckload activity showed seasonal support but little pricing traction, with freight volumes still below replacement levels. Shippers’ cost-control focus is keeping contract rate growth minimal, and most fleets are prioritizing utilization and replacement over expansion.

Imports remain strong due to a 90-day tariff truce with China, extended to August 1, pushing volumes from multiple Asian countries higher — Vietnam (+52% YoY), Thailand (+51%) and India (+43%). However, this has not translated into proportional trucking demand, with outbound volume indexes relatively flat. If tariffs return after August, expect blank sailings and lower port throughput, especially on the West Coast, likely resulting in further weakness in shipping activity.