Back to October 2025 Industry Update

October 2025 Industry Update: Truckload Demand

Overall demand continued to weaken in September, driven by ongoing elevated inventory levels and lost market share to the rail sector.

Key Points

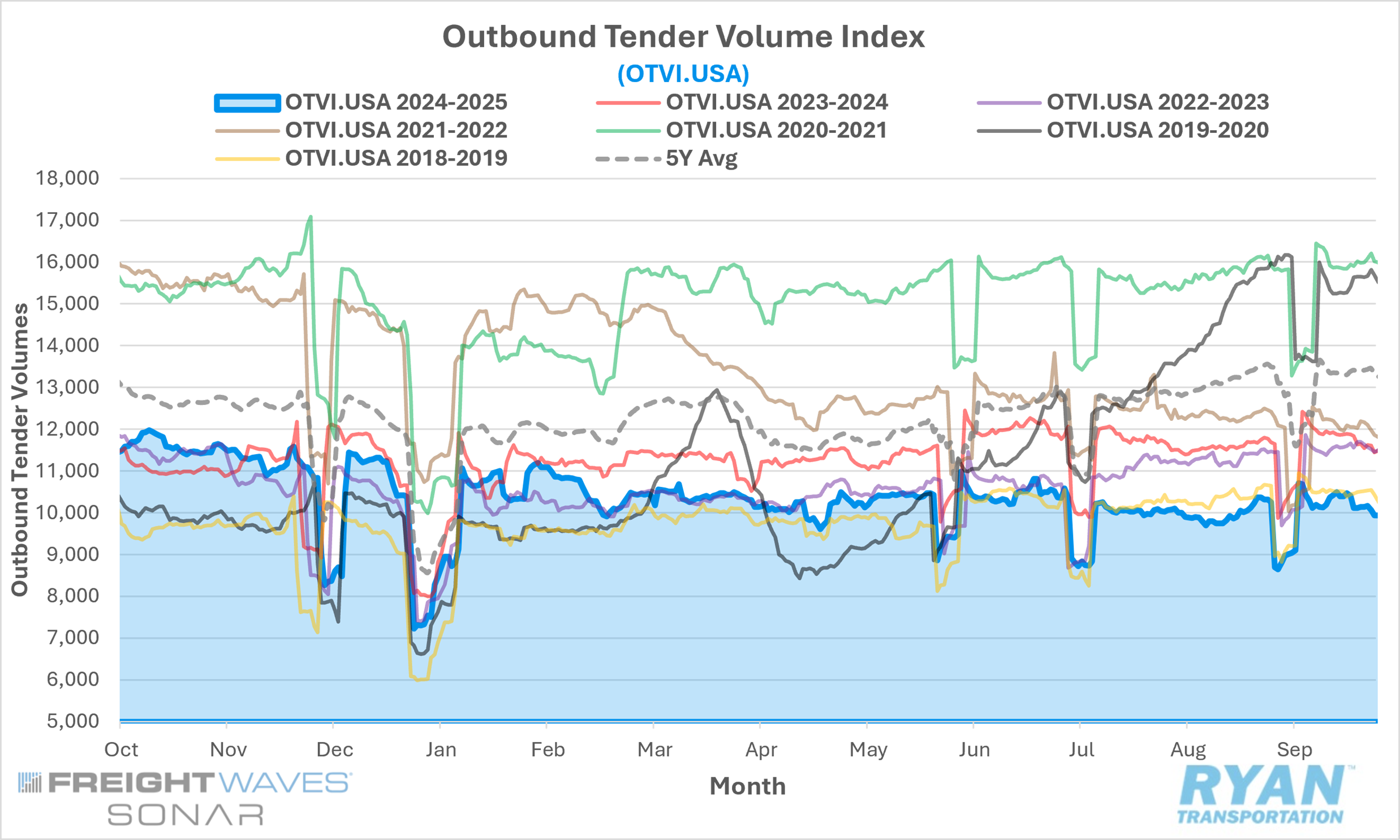

The FreightWaves SONAR Outbound Tender Volume Index (OTVI.USA), a measure of contracted tender volumes across all modes, registered a 3.1% decline MoM in September, dropping from 10,261.28 at the end of August to 9,936.00.

The monthly average of daily tender volumes in September declined 0.3% MoM compared to August, falling from 9,990.29 to 9,962.31.

Compared to September 2024, average daily tender volumes were down 13.5% and were 23.5% lower than the 5-year average.

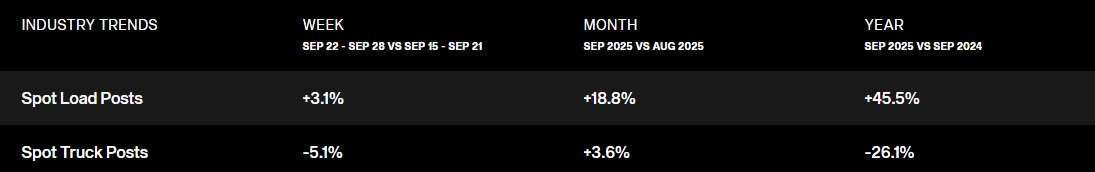

Spot market activity rebounded in September, rising 18.8% MoM compared to August and registering 45.5% compared to the same time last year.

The Cass Transportation Index Report, a measure of U.S. freight activity that tracks shipment volumes and expenditures across all domestic transportation modes, registered higher across both shipments and expenditures in September on a monthly basis by 2.5% and 5.1%, respectively, while annual comparisons were mixed, with shipments registering 5.4% lower YoY and expenditures increased 2.2% YoY.

Summary

Following the uptick in demand levels observed in August ahead of the Labor Day holiday, outbound tender volumes remained largely unchanged MoM in September, easing slightly from the prior month. Relative to historical patterns, the 0.3% MoM decline outperformed the typical seasonal average decrease of 1.1% for the month. However, as is customary following major holidays, the post-Labor Day slowdown in shipping activity weighed on the monthly average for daily tenders. When adjusted for seasonality and excluding post-holiday distortions, tender volumes rose 3.0% MoM in September, outperforming the seasonally adjusted historical average increase of 2.2% for the same period.

Despite this outperformance, freight demand continues to lag prior-year levels, marking the 10th consecutive month of YoY declines. On a quarterly basis, average tender volumes in Q3 2025 fell for the fourth consecutive quarter, down just over 3% from Q2 2025 and 13.8% below Q3 2024, bringing activity to its lowest quarterly average since Q4 2019. By equipment type, September volumes reflected a 1.7% MoM increase in dry van tenders, offset by declines of 4.1% in flatbed and 0.6% in refrigerated tenders. On an annual basis, both dry van and refrigerated volumes remain well below prior-year levels — down 14.5% and 14.0%, respectively — while flatbed volumes continue to outperform, up 10.8% YoY.

The latest Cass Transportation Index Report reflected growth in freight volumes in September despite evidence of broader weakening in overall demand levels. According to the report, shipment volumes rose 2.5% on a nominal basis and were up 1.5% when adjusted for seasonality, reversing the 1.5% decline recorded in August. The report suggests that the surge in import activity in July and August to circumvent higher tariffs is likely responsible for propping up truckload volumes in September. However, while the tariff reprieve resulted in a boost to volumes, they are also expected to lead to volume declines and further degradation in rates as price increases reduce affordability and impact consumer spending.

Why It Matters

The ongoing softness in freight demand continues to inhibit meaningful tightening across the market. Although the week leading up to the Labor Day holiday provided a temporary boost — with the OTVI rising 6.5% WoW compared to a historical average increase of roughly 2% — those gains had largely reversed by mid-September. The rebound proved short-lived as post-holiday normalization and broader macroeconomic headwinds continued to weigh on overall freight activity.

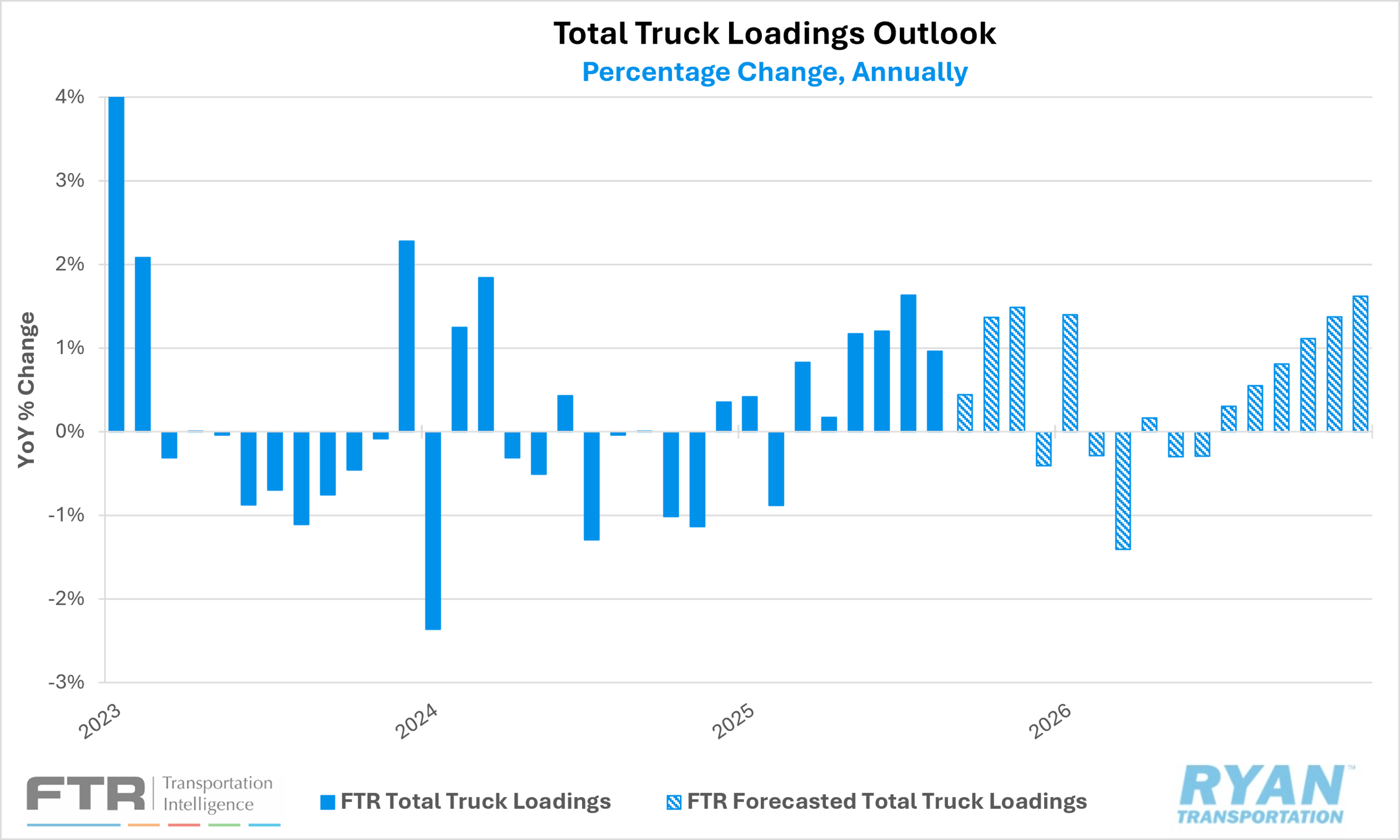

Looking ahead, the fourth quarter typically brings a rebound in truckload volumes following the post-produce season lull; however, early indicators suggest that seasonal recovery may be muted this year. The most significant drag on the for-hire truckload market remains the ongoing contraction in the manufacturing sector. The renewed decline in new orders reported in September’s ISM® Manufacturing PMI® indicates that industrial-sector freight demand is likely to remain subdued in the near term. Compounding this challenge are expectations for weaker import volumes through the remainder of the year. Many shippers accelerated inbound shipments ahead of tariff deadlines earlier in 2025 — activity that would typically occur in September and October — resulting in elevated inventory levels and a more cautious stance on replenishment orders.

According to the latest Logistics Managers’ Index (LMI®), inventory expansion slowed in September, with the Inventory Levels Index declining 3.1% MoM to 55.2%. Despite the slower rate of growth, inventory costs remain elevated, suggesting continued downstream movement of goods as retailers position inventory closer to end consumers ahead of the holiday season. However, transportation utilization remains notably weak. The LMI® Transportation Utilization Index registered 50.0% in September, indicating no net growth and marking the lowest reading ever recorded for the month. This figure stands well below the long-term September average of 65.1%, underscoring the absence of the typical pre-holiday momentum that traditionally characterizes late-year freight activity.