Back to November 2025 Industry Update

November 2025 Industry Update: Reefer

Average reefer rates increased further in October, driven by shifting seasonal harvesting cycles and strong produce imports.

Spot Rates

Key Points

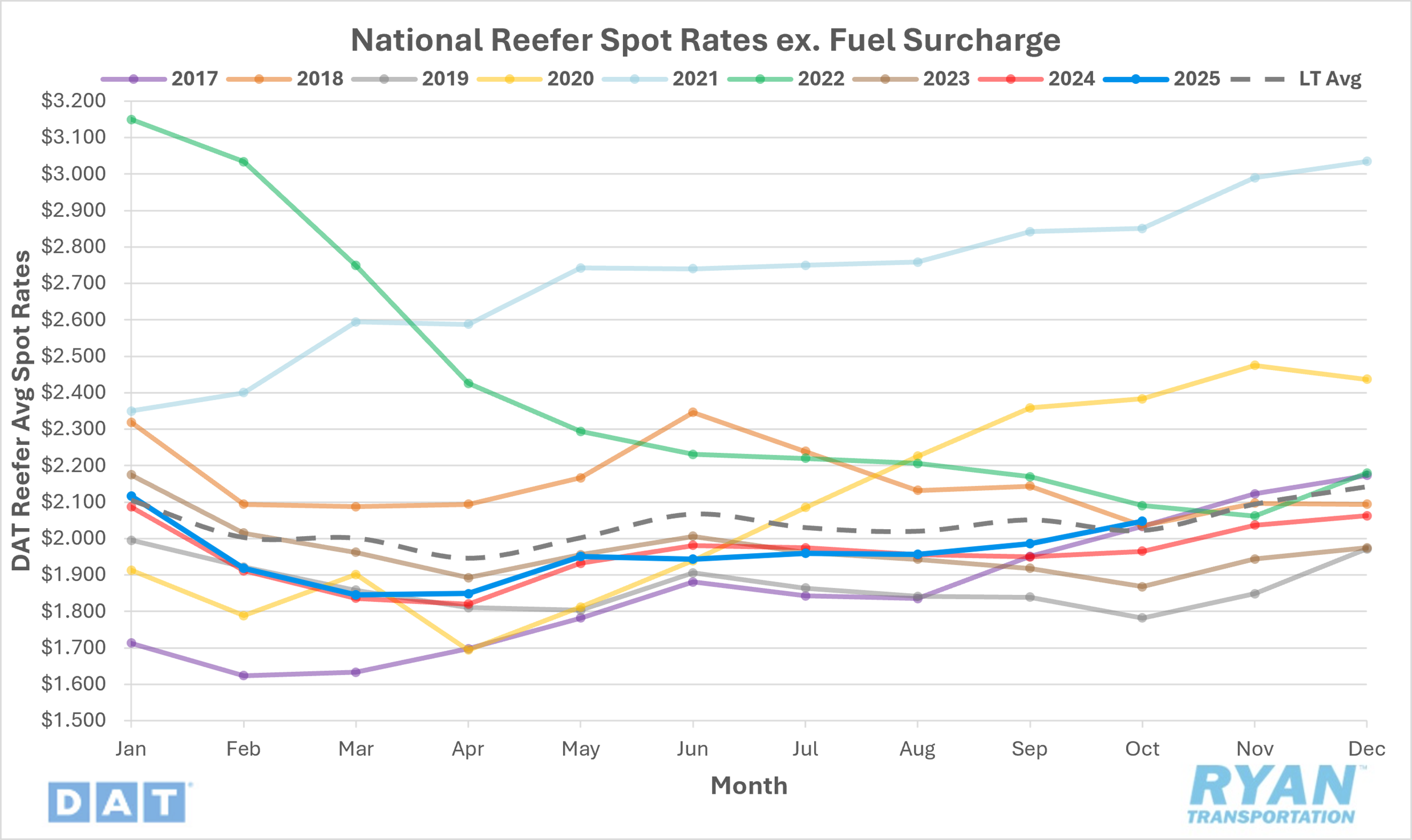

- The national average reefer spot rate, excluding fuel, increased 3.1% MoM, or just over $0.06, to $2.05 in October.

- On an annual basis, average reefer linehaul rates were up 4.2% YoY and were 0.4% higher compared to the LT average.

- Initially reported average reefer contract rates, absent a fuel surcharge, rose 1.8% MoM and registered 1.9% higher YoY compared to the same time last year.

Load-to-Truck Ratio

Key Points

- The reefer LTR increased 3.1% MoM in October, rising from 10.95 in September to 11.29.

- Compared to October 2024, the reefer LTR was 93.0% higher YoY and was 54.0% above the 5-year average.

- DAT load board data for October recorded a 6.6% MoM increase in load post volume, while equipment postings were up 3.4% MoM.

Market Conditions

Reefer Summary

Reefer market conditions strengthened in October, driven largely by seasonal agricultural demand and expanding produce import volumes. The Pacific Northwest fall produce season — anchored by apples, pears, potatoes and other storage crops — continued to generate significant freight pressure, with Christmas tree shipments adding a short-lived but substantial surge in late October. The overlapping seasonal harvest cycles led to tighter capacity conditions and elevated rates across much of the region. Meanwhile, at the southern border, McAllen experienced notable long-haul reefer rate inflation despite being in its off-peak season, with YoY rate gains reaching nearly 70% on West Coast lanes due to tight capacity, heightened enforcement activity and Mexico-sourced produce volume concentrated through the Pharr trade corridor.

Reefer demand was further supported by strong import programs, particularly the Peruvian blueberry season, which peaks between September and November and generates thousands of refrigerated truckloads through major U.S. ports, led by Philadelphia and Port Hueneme. Domestic crop cycles also contributed to elevated activity: potato shipments remained the country’s highest-volume refrigerated commodity, with early season shipments ramping up in September and October ahead of peak demand in November, which draws a significant amount of truck capacity, putting significant upward pressure on spot rates. Similarly, the pumpkin harvest season added incremental load pressure across key producing states that include Illinois, California, Indiana, Pennsylvania, Michigan and Washington.

Despite the strong relative performance of the reefer sector in October, broader growth was likely constrained by the federal government shutdown, which resulted in the suspension of Supplemental Nutrition Assistance Program (SNAP) benefits. Several major states, including Florida and New York, announced that November allotments would be suspended beginning November 1, a development that likely influenced purchasing decisions during the final week of October. Historically, the reefer spot market experiences a 17% increase in end-of-month load posts around Halloween as shippers clear docks and move final perishable shipments; however, DAT reported that load post volumes actually declined this year, falling by just over 14%.