Back to November 2025 Industry Update

November 2025 Industry Update: Flatbed

Flatbed rates improved moderately in October despite further deterioration in freight volumes.

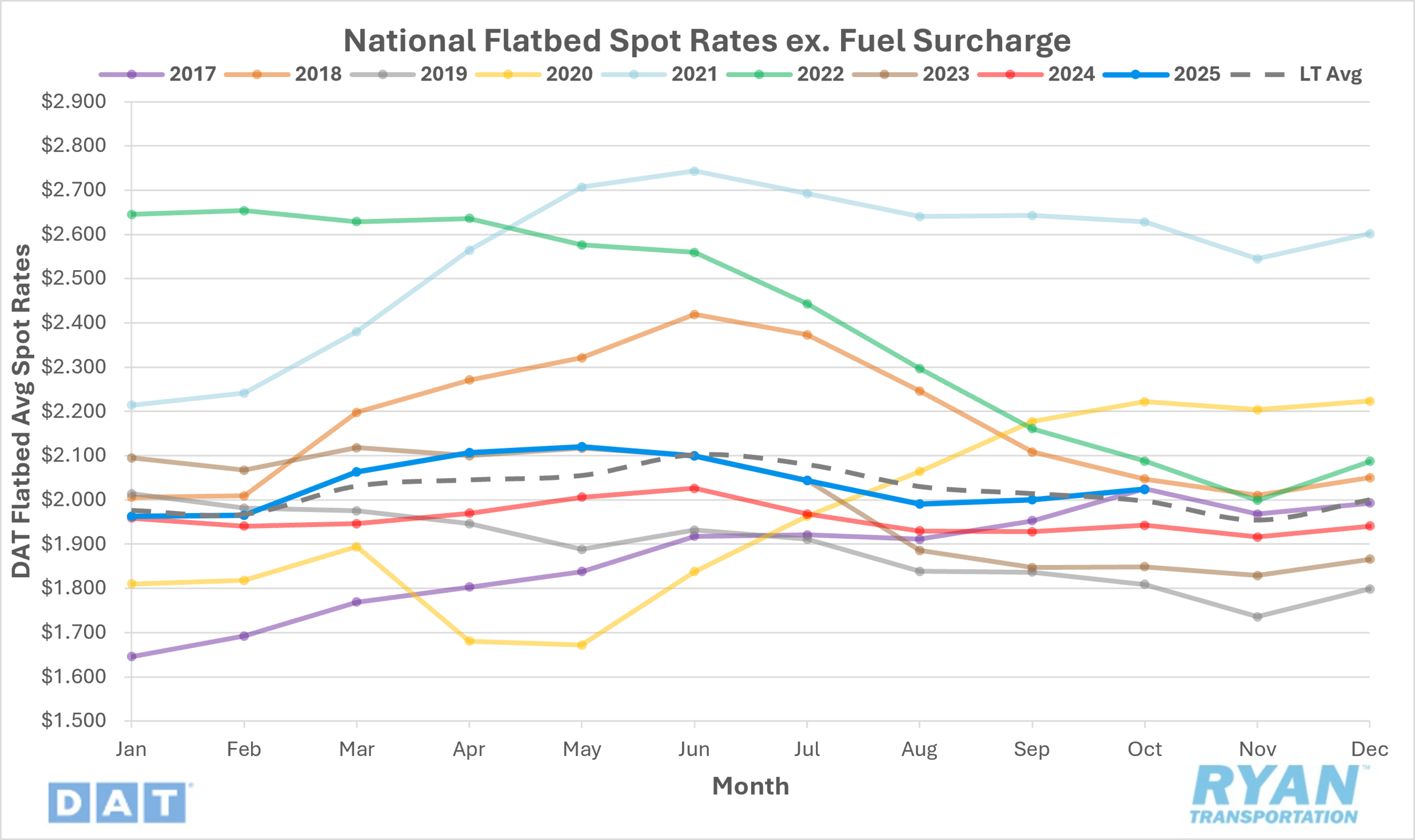

Spot Rates

Key Points

- The national average flatbed spot rate, excluding fuel, rose 1.2% MoM, or just over $0.02, to $2.02 in October.

- Compared to October 2024, average flatbed linehaul rates are up 4.2% YoY and 0.9% above the LT average.

- Initially reported average flatbed contract linehaul rates, excluding a fuel surcharge, registered 1.3% higher MoM and were up 1.6% YoY compared to the same month last year.

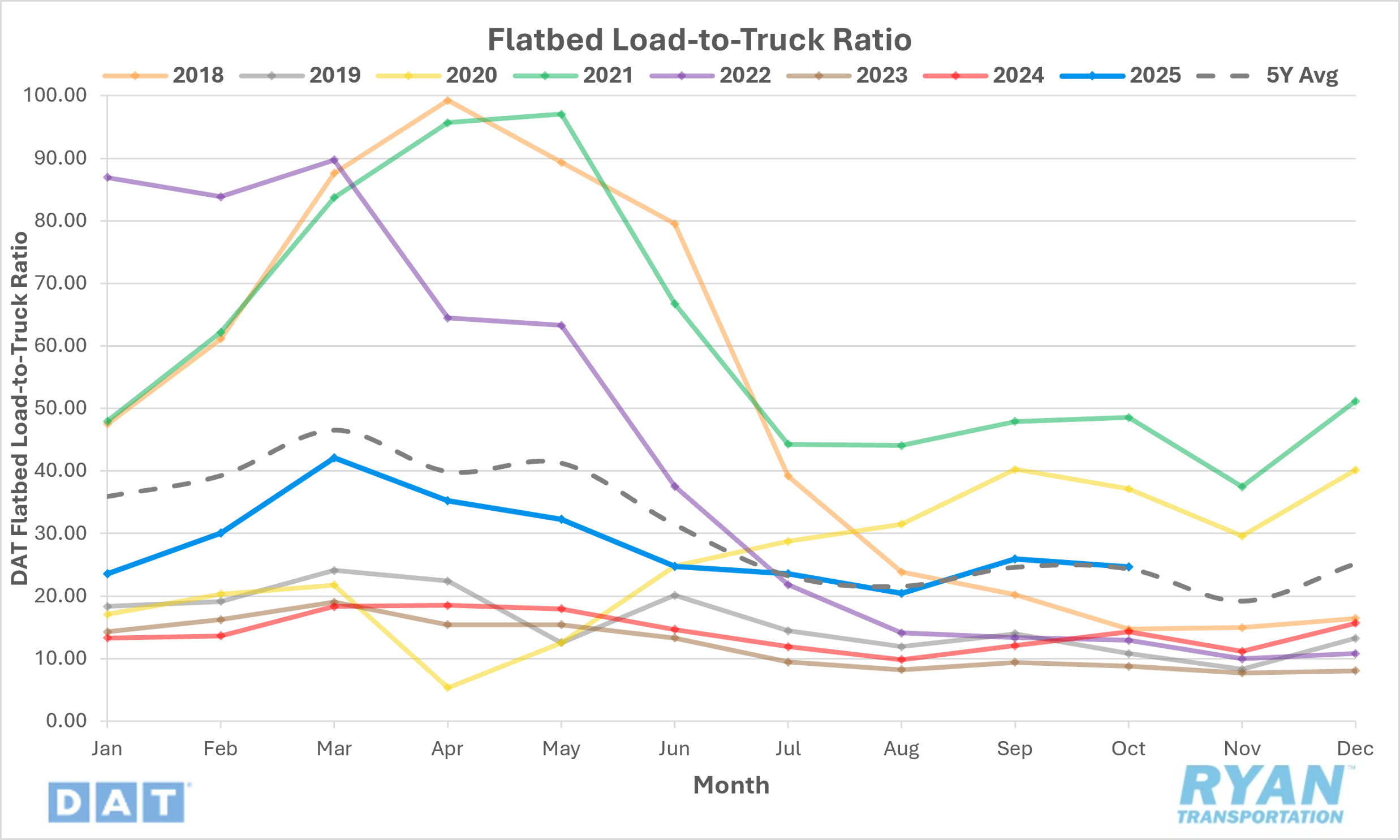

Load-to-Truck Ratio

Key Points

- The flatbed LTR declined by 4.8% MoM in October, dropping from 25.93 in September to 24.69.

- Compared to October 2024, the flatbed LTR continued to trend above year-ago levels, registering 72.5% higher YoY and was 1.4% above the 5-year average.

- According to DAT, flatbed load post volumes rose 1.4% MoM in October while equipment posts increased 6.5% MoM.

Market Conditions

Flatbed Summary

Flatbed market performance in October was shaped by a mix of strengthening and weakening demand indicators across key industrial and construction sectors. The rapid expansion of data center construction — now generating approximately $41 billion in annual spending — continued to provide a strong foundation for flatbed utilization, driving elevated spot activity and oversized-load demand even as traditional industrial sectors softened. This has helped offset the impact of declining manufacturing backlogs, which have remained below the ISM’s 50-point threshold for much of 2024 and have weakened further since March due to tariff-related uncertainty. At the same time, energy-related flatbed demand continued to contract, with the Permian Basin rig count falling to its lowest level since 2021 and West Texas-bound flatbed loads down 40% YoY. These trends highlight a shifting freight mix in which technology-driven construction is increasingly compensating for weakness in more cyclical sectors such as oil, agricultural machinery and traditional manufacturing.

Housing-related freight demand, another key contributor to flatbed volumes, also showed signs of pressure. Delays in federal reporting due to the government shutdown limited visibility into single-family housing starts, but third-quarter earnings from Home Depot and Lowe’s indicated continued softness in large-scale remodeling activity, with homeowners favoring smaller, less capital-intensive projects. This has weighed on lumber shipments and related building-material flows. Conversely, reefer-alternative commodities such as onions provided some seasonal support, as shippers increasingly relied on flatbeds from August through November due to cost advantages and favorable handling characteristics.

Unlike the dry van and reefer segments, which typically benefit from retail-driven and holiday-related demand in the fourth quarter, flatbed activity tends to follow a more stable and predictable seasonal pattern. As construction activity naturally tapers off heading into year-end, external pressures on flatbed rates are limited, and pricing generally softens through mid-December before the brief year-end spike. Nevertheless, weather-related disruptions remain a key operational consideration, with hurricane season extending through November and early winter storms posing risks across northern markets.