Back to November 2025 Industry Update

November 2025 Industry Update: Dry Van

Dry van rates continued to trend higher in October despite weakening demand levels.

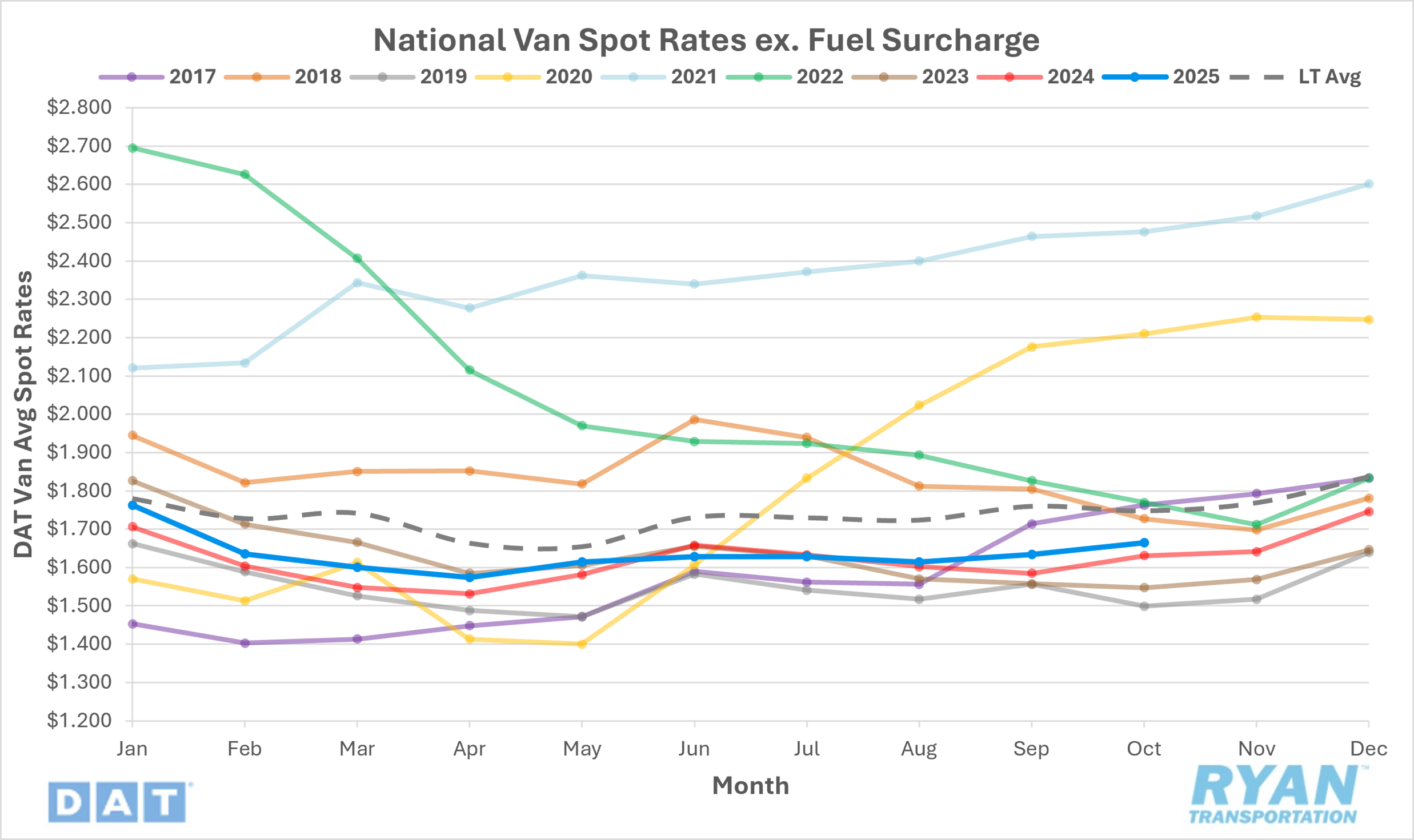

Spot Rates

Key Points

- The national average dry van spot rate, excluding fuel, rose 1.9% MoM, or just over $0.03, to $1.67 in October.

- Compared to October 2024, average dry van spot linehaul rates were up 2.1% YoY but were 5.1% below the LT average.

- Initially reported average dry van contract rates, exclusive of a fuel surcharge, rose 0.5% MoM in October and were up 0.2% YoY.

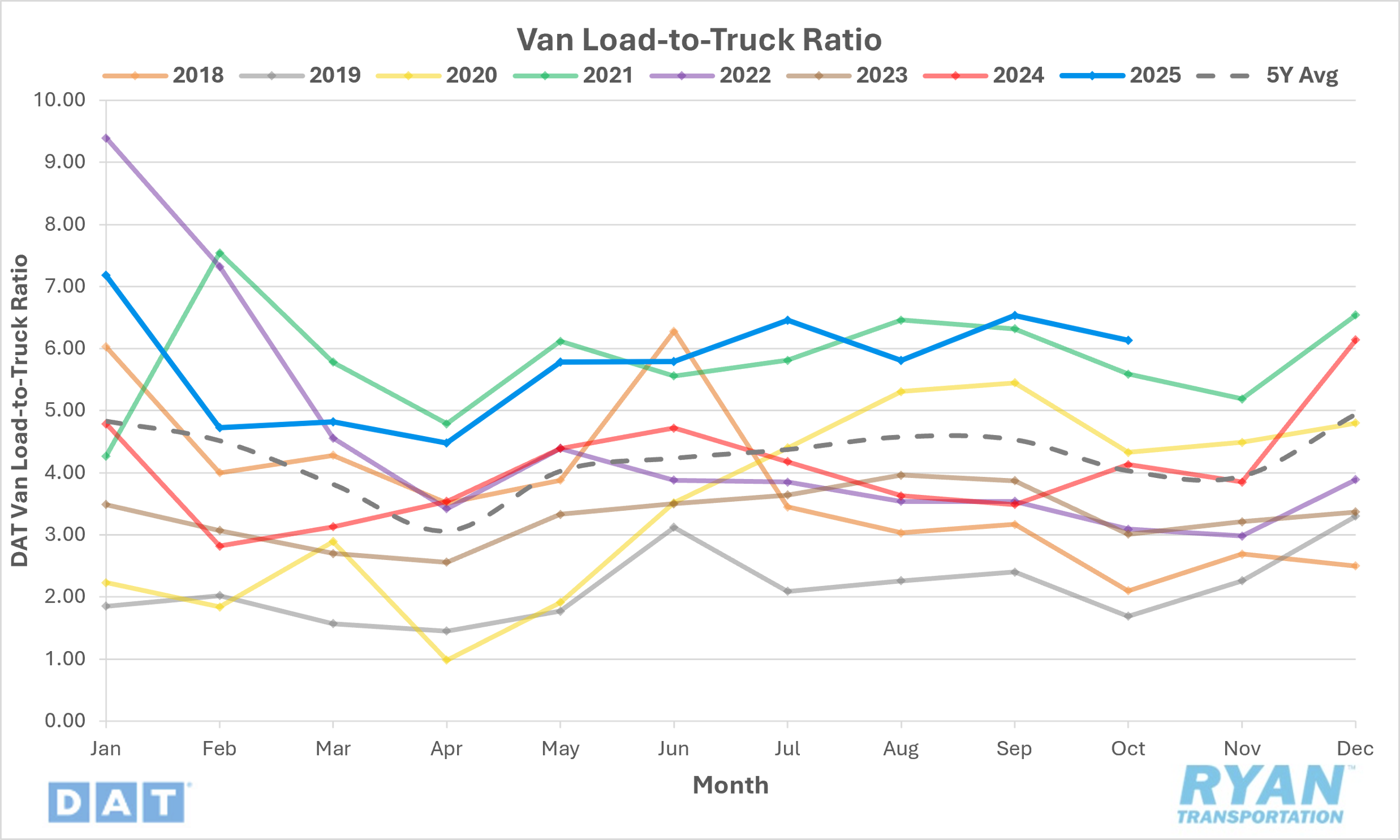

Load-to-Truck Ratio

Key Points

- The dry van load-to-truck ratio (LTR) declined 6.1% MoM in October, dropping from 6.53 in September to 6.13.

- Compared to the same time last year, the dry van LTR remained elevated by 48.4% YoY and was 52.1% above the 5-year average.

- According to load board data collected by DAT Freight & Analytics, dry van load posts increased 1.5% MoM while truck postings for dry vans were up 8.1% MoM.

Market Conditions

Dry Van Summary

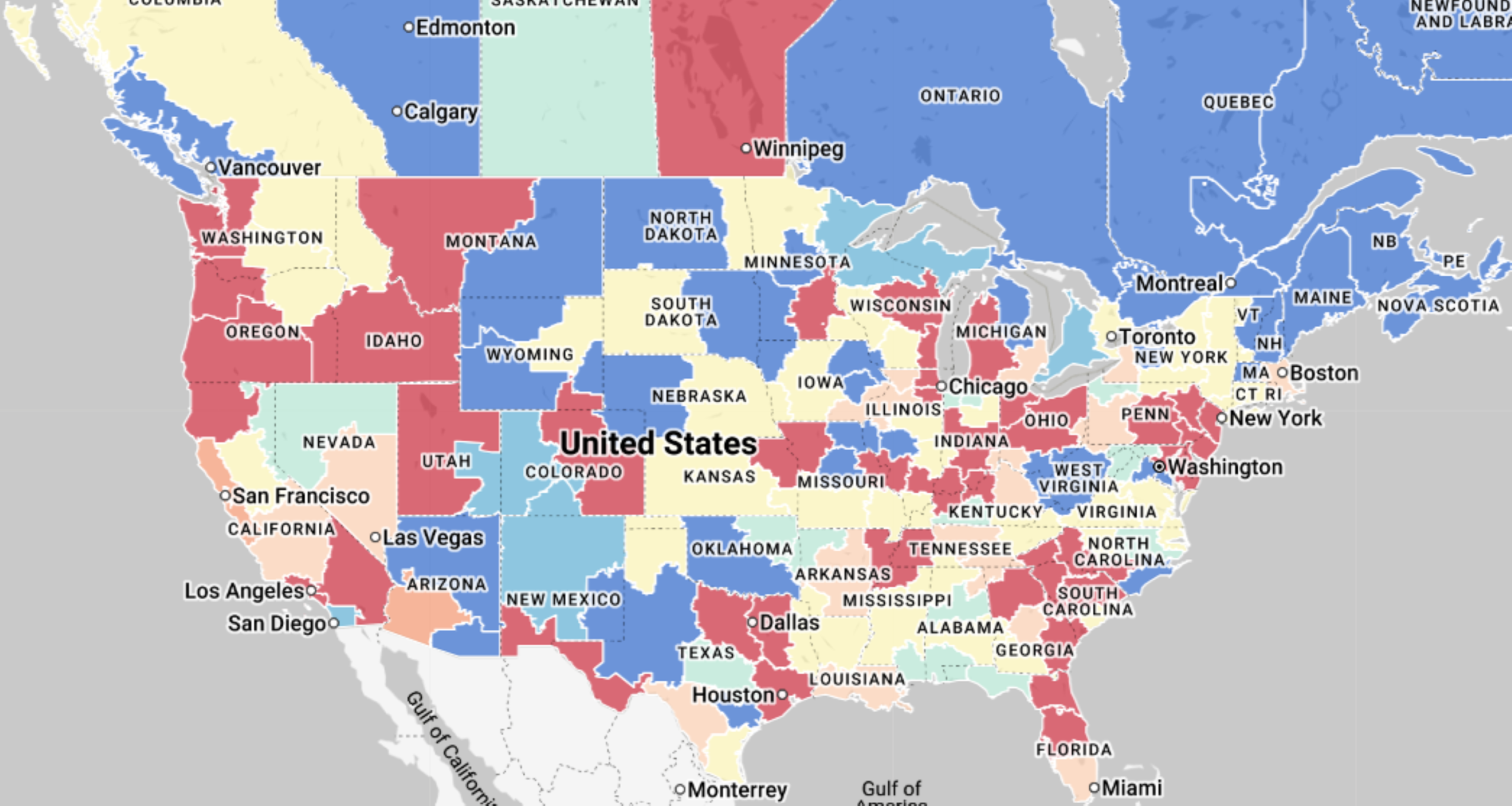

Despite softer demand in October as upstream freight indicators continue to deteriorate, average dry van spot rates rose for the second consecutive month, driven by capacity disruptions from the targeted federal enforcement on illegal immigration in the trucking industry. On the demand front, containerized imports, a key driver of domestic truckload volumes, are projected to fall below 2 million TEU for the remainder of the year, with October expected to decline 12.3% YoY following a weak September. This downturn, compounded by sharp declines in imports from China, signals reduced retail and manufacturing replenishment needs and limits opportunities for dry van carriers. At the same time, shippers are increasingly shifting freight to private fleets — now estimated to control 55% of truck capacity — which further constrains available contract and spot volumes for for-hire carriers.

Domestic trucking activity also reflected this weakening backdrop, with the ATA For-Hire Truck Tonnage Index falling 0.9% in September and remaining nearly 4% below its prior cycle peak. The October ISM Manufacturing PMI reinforced this trend, showing widespread order reductions and cancellations across industrial sectors and pointing to continued demand erosion for dry van carriers. Persistent trade-policy uncertainty and delayed capital investment have added additional pressure, particularly among machinery and transportation equipment shippers. Overall, dry van market conditions in October remained firmly in recessionary territory, with limited signs of a near-term recovery characterized by soft volumes, elevated private-fleet competition and ongoing downward pressure on spot rates as the industry approaches 2026 with limited signs of near-term recovery.