Back to January 2026 Industry Update

January 2026 Industry Update: Truckload Supply

- The for-hire truckload carrier population recorded its largest magnitude decline since January as authority revocations surged while new entrants remained stable.

- Equipment orders rebounded following months of weak ordering activity as carriers look to replace aging fleets and lock in current pricing before expected increases in 2027.

- Payroll employment in the trucking sector remained flat in December bringing the net change in preliminary estimates to a decline of 3,500 jobs in the sector for all of 2025.

Summary

Winter weather and typical seasonal disruptions tightened capacity conditions in December, driving tender rejection rates to their highest levels since 2022 while holiday- and retail-driven volumes lifted load-to-truck ratios across the major truckload modes. Despite these pressures, excess supply conditions continued to search for equilibrium as the for-hire carrier population declined sharply and payroll employment remained near a two-year low. Meanwhile, the rebound in equipment orders appeared more opportunistic in nature rather than indicative of a structural shift in demand, reflecting selective fleet behavior amid continued uncertainty surrounding the broader market outlook.

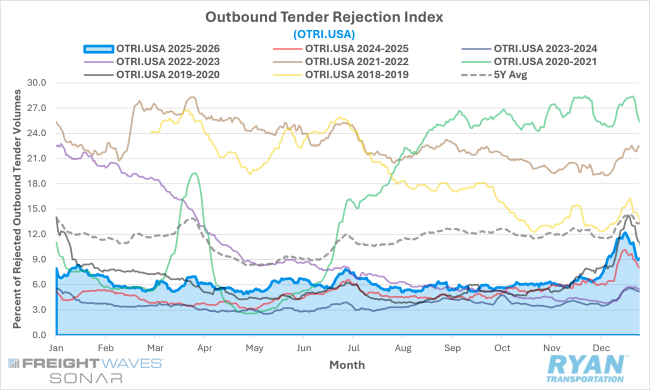

SONAR Outbound Tender Rejection Index

Key Points

- Tender rejections escalated sharply in December, climbing steadily throughout the month and peaking at 12.2%, the highest level recorded since early April 2022. On an annual basis, rejection rates were 163 basis points higher than in December 2024 and stood 4.9% above levels observed on a two-year stack, underscoring the pronounced tightening in capacity conditions during the month.

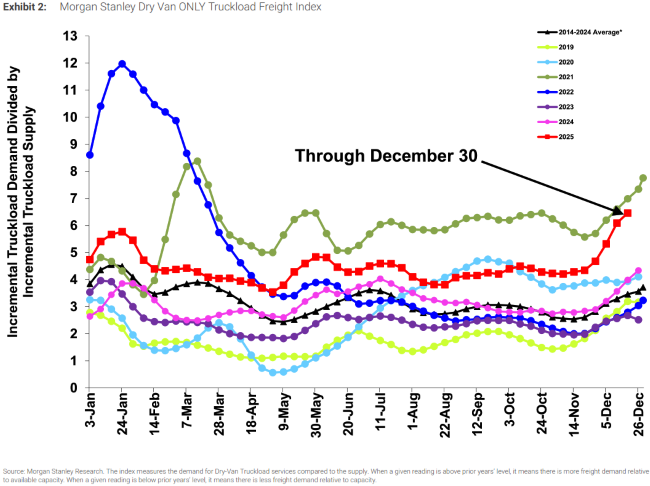

Morgan Stanley Truckload Freight Index

Key Points

- The Morgan Stanley Truckload Freight Index (MSTLFI) increased further and closed the year at its largest positive deviation from seasonality in 2025. This was driven entirely by a pronounced outperformance in the supply component while demand remained roughly in line with historical norms. Reefer and flatbed indices also rose sequentially, with reefer consistently outperforming seasonality and flatbed performance mixed — strong early in the month before underperforming toward year-end.

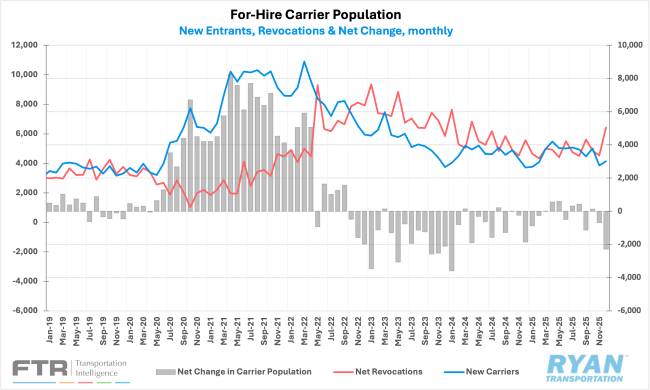

New Authorities, Net Revocations & Net Change in For-Hire Carrier Population

Key Points

- The for-hire carrier population contracted sharply in December, declining by 2,287 carriers and marking the largest monthly reduction since January 2024, driven primarily by a surge in revocations net of reinstatements. Despite the pullback, industry capacity remains elevated, with active for-hire authorities still roughly 86,000 higher — more than 33% above pre-pandemic levels.

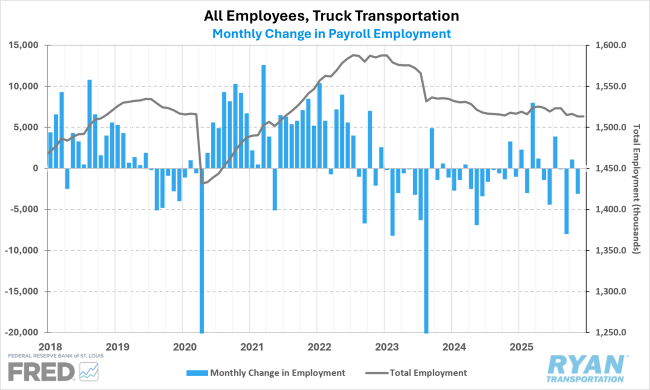

Truck Transportation Payroll Employment

Key Points

- Payroll employment in the for-hire trucking sector was flat MoM in December on a seasonally adjusted basis, following upward revisions to October and November that added a combined 3,700 jobs, according to preliminary Bureau of Labor Statistics estimates. Despite these revisions, the sector shed approximately 10,000 jobs between September and December, with the final two months of 2025 registering the lowest seasonally adjusted employment levels since June 2021.

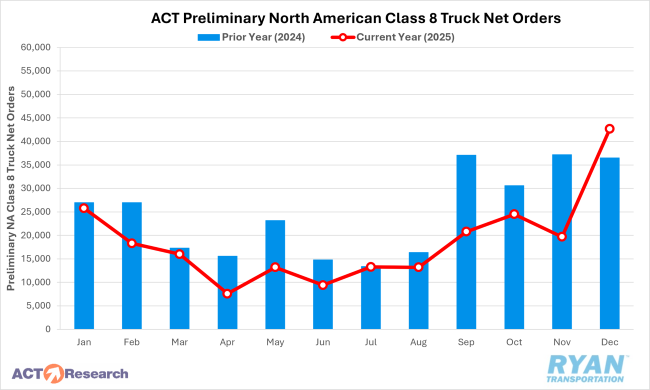

Preliminary North American Class 8 Tractor Net Orders

Key Points

- Class 8 truck orders surged in December to their highest level since October 2022, with preliminary estimates from ACT Research and FTR more than doubling November levels and registering 17 – 21% higher YoY compared to 2024. FTR attributed the increase to improved policy clarity around tariffs and emissions, while ACT Research cited a strengthening economic backdrop, aging fleets and the anticipated cost of technology changes expected in 2027 as key drivers.

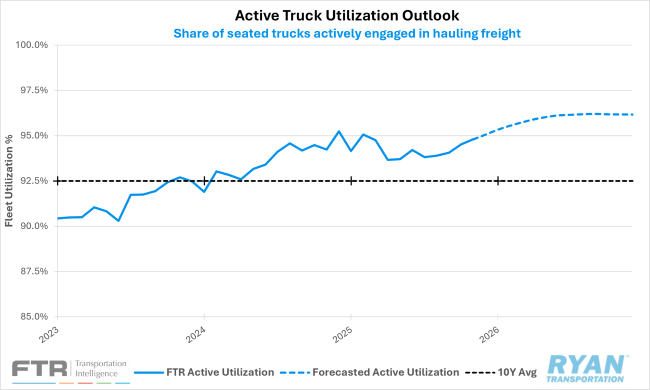

FTR Active Truck Utilization

Key Points

- FTR’s outlook for active truck utilization remains largely unchanged, with utilization expected to exceed 95% in early 2026 and peak modestly above 96% around early 2027.

Outlook

While major holiday-related disruptions are largely behind the industry, winter weather events continue to pose a risk to capacity availability, particularly in early January as drivers return to the road and networks normalize following holiday repositioning. As the market enters the seasonally weakest demand period, additional contractions in truckload supply are likely, due to rising insurance premiums and heightened regulatory enforcement related to non-domiciled CDL holders and English Language Proficiency requirements.

Back to January 2026 Industry Update