Back to January 2026 Industry Update

January 2026 Industry Update: Truckload Rates

- Average spot rates surged to their highest levels in more than two years and outpaced gains in contract rates to narrow the contract-to-spot spread to its lowest level since the start of the downturn.

Summary

Overall spot rates surged in December alongside a pronounced increase in tender rejection rates, as winter weather disruptions, seasonal demand pressures and reduced driver availability during the holidays combined to materially tighten market conditions. Monthly gains in average spot rates were the largest ever recorded for December, lifting spot linehaul rates to their highest level since August 2023 and pushing them above the long-term average for the first time in more than two and a half years. Strength in the spot market also exerted upward pressure on the contract market, with average contract rates posting their largest MoM increase since November 2023. However, the magnitude of the spot rate rally outpaced gains in the contract market, narrowing the contract-to-spot spread to a new cycle low.

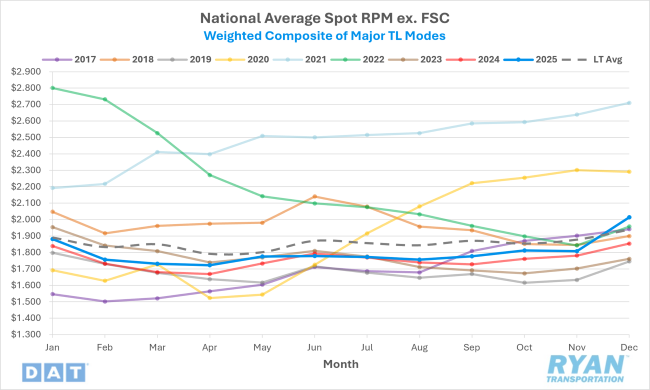

DAT National Average Spot Rates excl. FSC

Key Points

- Average linehaul spot rates surged nearly $0.21 MoM in December, driven largely by sharp gains early in the month. The 11.4% MoM increase pushed spot rates to their strongest YoY position since February 2022, with rates averaging $0.16 higher than December 2024 levels. As a result of the December rally, average spot linehaul rates moved 3.8% above the long-term average for the first time since May 2023.

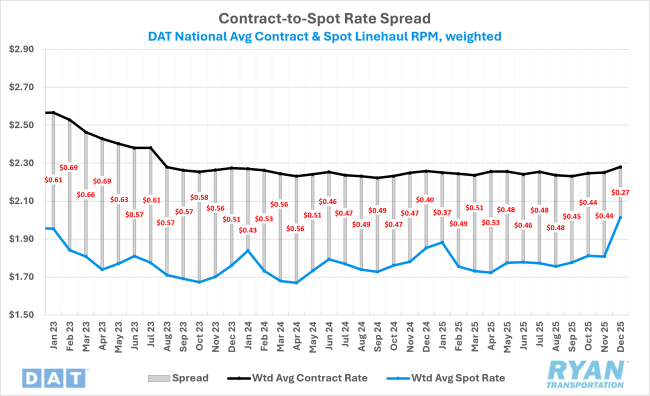

DAT National Average RPM Contract vs. Spot

Key Points

- Average contract rates increased by just under $0.04 MoM in December, bringing average contract pricing in line with December 2024 levels. Despite the improvement, the outsized strength in spot rates materially compressed the contract-to-spot spread, which narrowed to approximately $0.27 after remaining within a $0.35 to $0.45 range for most of the year.

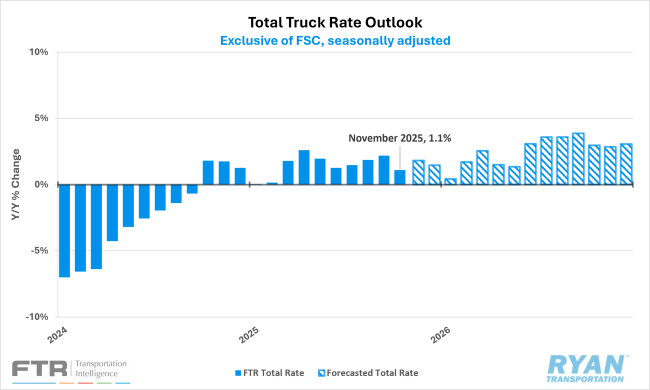

FTR Total Truck Rate & Outlook

Key Points

- In its latest outlook, FTR revised its 2026 total truckload rate forecast upward by 60 basis points, increasing projected growth from +1.9% YoY to +2.5%. The upward revision was driven primarily by a stronger outlook for spot rates, which were revised higher from +2.5% YoY to +3.6%. According to FTR, the improvement in spot market expectations also supported a modest upward revision to contract rates, with forecast growth increasing from +1.7% YoY to +2.0%. By equipment type, refrigerated rates are expected to lead in 2026 with total rate growth of +3.9% YoY, followed by dry van rates at +2.3% YoY and flatbed rates at +2.1% YoY.

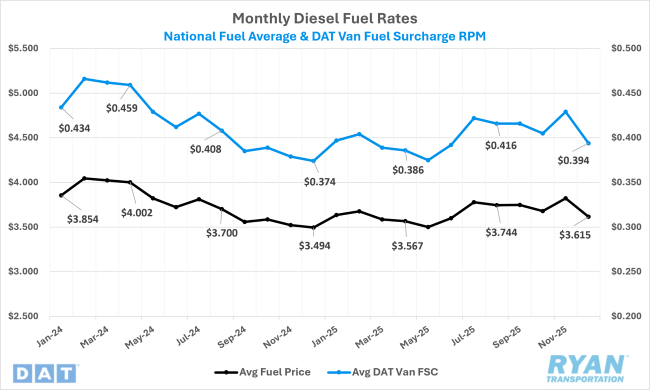

DAT Fuel Trends

Key Points

- Average fuel prices exhibited heightened volatility in the final two months of the year after remaining relatively stable for much of 2025. According to the U.S. Energy Information Administration (EIA), the national average retail diesel price declined by approximately $0.21 per gallon in December following a $0.14 per gallon increase in November. Looking ahead to 2026, the EIA expects rising global oil inventories to exert downward pressure on petroleum prices, forecasting an 8% YoY decline in average diesel prices.

Outlook

Following the holiday period, spot rates are expected to retreat from their peak-season highs, though to a structurally higher floor supported by the strength observed in December. Rates should generally track in line with historical seasonality at the start of 2026 but will remain vulnerable to temporary spikes driven by winter weather disruptions and short-term demand surges. In contrast, contract rates are likely to remain relatively stable in the near term as the annual truckload RFP cycle continues across much of the industry. However, the increased spot-market volatility seen in late 2025, combined with ongoing structural and behavioral shifts in capacity, may prompt shippers to prioritize service reliability over cost — particularly in high-density lanes —supporting moderate contract rate gains later in the year. Absent a meaningful demand catalyst, the potential for sustained, broad-based growth remains limited.

Back to January 2026 Industry Update