Back to January 2026 Industry Update

January 2026 Industry Update: Truckload Demand

- Spot market activity surged while contract volumes benefitted from seasonal influences but overall remain weak.

- Elevated inventory levels throughout the year contracted sharply in December as shippers moved product further down the supply chain closer to customers and reduce year-end tax burdens.

- Import bookings continued trending lower in December, registering 15% below 2024 levels and 9% lower than 2023 levels.

Summary

Truckload freight demand outperformed expectations in December relative to earlier fall trends but continued to trail levels observed over the prior two years. Consistent with late-November patterns, strength in contract volumes was concentrated in local and short-haul movements. This was driven largely by retailers drawing down inventories to replenish shelves following robust consumer spending during major promotional events such as Amazon Deal Days and Black Friday. At the same time, winter weather disruptions across the Northwest, Mountain states and Midwest, combined with reduced driver availability due to holiday time off, temporarily tightened capacity conditions. These dynamics collectively supported a broad-based increase in spot market volumes through the final month of the year.

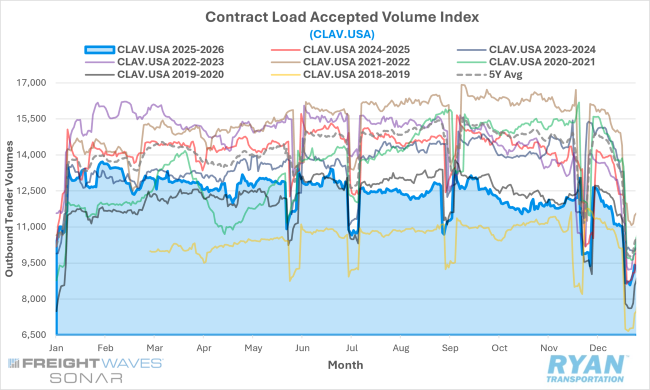

SONAR Contract Load Accepted Volumes Index (CLAV.USA)

Key Points

- Load volumes accepted under contract, as measured by the FreightWaves SONAR CLAV Index, accelerated early in December following the post-Thanksgiving slowdown. This narrowed the YoY deficit to 9.4% below 2024 levels from the 13 – 17% shortfall observed earlier in the fall.

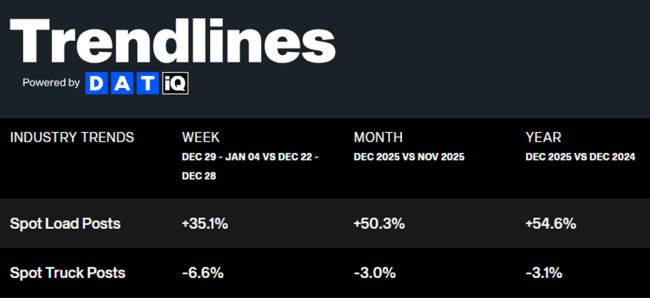

DAT Trendlines

Key Points

- According to load board data from DAT, peak seasonal demand, rising tender rejections and widespread winter weather disruptions drove a sharp increase in spot market volumes, while available equipment postings declined.

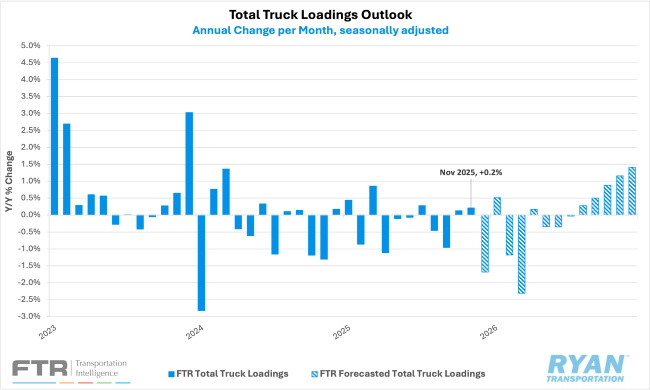

FTR Total Truck Loadings Outlook

Key Points

- FTR revised its 2026 total truck loadings forecast downward in its latest report, now projecting growth of just +0.1% YoY, reduced from the prior estimate of +0.4%, primarily due to softer expectations for food and paper-related freight. The firm also lowered its 2025 outlook, revising total loadings from previously forecasted growth of +0.6% YoY to a decline of -0.3%.

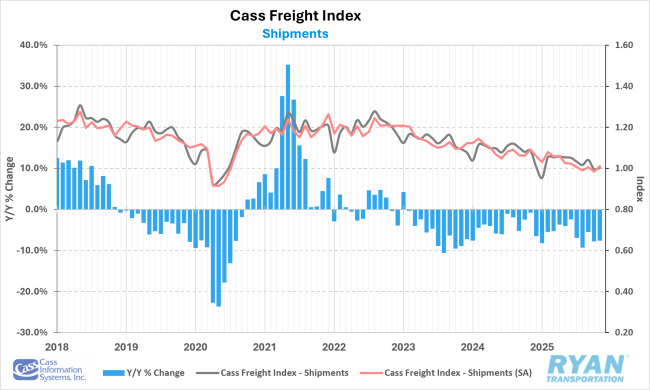

Cass Freight Index Shipments Forecast – December 2025

Key Points

- The shipments component of the Cass Freight Index declined 7.6% YoY in November despite a 2.7% seasonally adjusted MoM increase. While the report noted that early holiday consumer spending data points to the potential buildup of pent-up demand, ongoing tariff-related cost pressures are expected to continue elevating prices and constraining affordability in 2026, likely weighing on overall shipping activity.

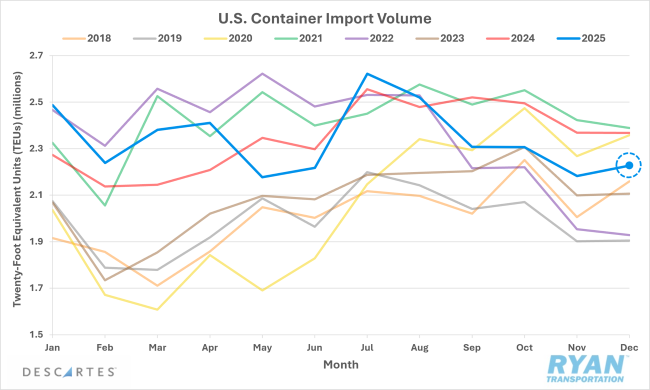

Descartes U.S. Container Import Volumes

Key Points

- Total U.S. container import volumes increased modestly by 2% MoM in December, though they remained 5.9% lower YoY compared to 2024 levels. The subdued annual performance reflects the lingering effects of early-year import front-loading, ongoing trade and policy uncertainty and continued shifts in global sourcing strategies, all of which have restrained growth.

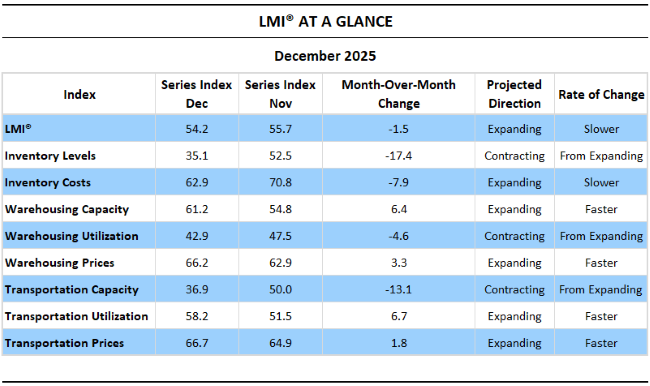

LMI® AT A GLANCE

Key Points

- Inventory Levels and Warehousing Utilization both fell to record lows in December, as firms accelerated the movement of goods downstream toward consumers and actively reduced elevated inventory positions accumulated throughout much of 2025. These actions were largely driven by efforts to mitigate year-end tax exposure and rising inventory carrying costs, prompting companies to offload excess stock ahead of year-end.

Outlook

Trade policy is expected to remain the central focus heading into 2026 as uncertainty persists, particularly given the Supreme Court has still yet to rule on the legality of the IEEPA tariffs. Import demand remains subdued, while shippers have increasingly shifted toward leaner, just-in-time inventory strategies, placing greater strain on carrier networks and heightening the importance of capacity reliability. Looking ahead, the prospect of higher average tax refunds and the potential for additional interest rate cuts could help sustain consumer spending and provide incremental support to the housing and industrial sectors, potentially serving as the long-awaited catalyst for a broader demand recovery.

Back to January 2026 Industry Update