Back to January 2026 Industry Update

January 2026 Industry Update: Intermodal

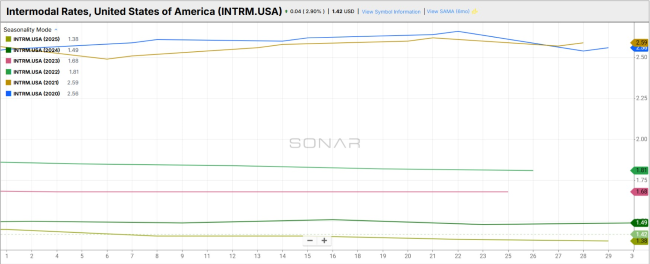

FreightWaves SONAR Intermodal Rates Index (INTRM.USA)

Key Points

- Intermodal spot rates trended lower in December compared to November and were $0.11 lower YoY compared to December 2024. When carriers look to protect capacity for contractual shippers, spot rates typically spike, so the lack of movement continues to suggest that capacity remains readily available.

FreightWaves SONAR Initially Reported Average Contract Base RPM (IMCRPM1.USA)

Key Points

- Initially reported intermodal contract rates remained depressed in December, driven by ample available capacity and continued weakness in the truckload market. With intermodal bid season underway, the chance of rates rising substantially remain limited absent any significant change in truckload conditions.

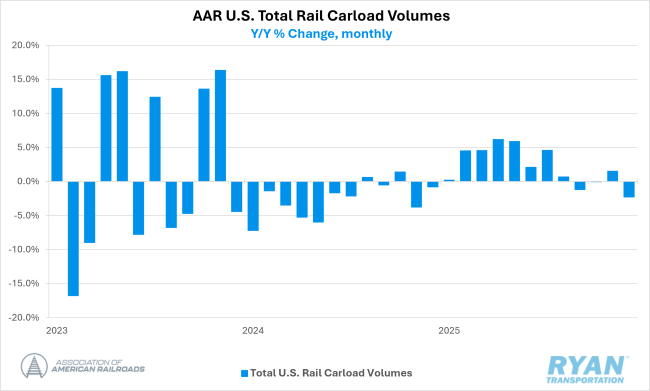

Association of American Railroads (AAR) Total U.S. Rail Carload Volumes

Key Points

- Total U.S. rail carload volumes fell 2.3% YoY in December for the third decline in the last four months of the year, driven by declines in 13 of the 20 major carload categories tracked by the AAR. However, total domestic carload volumes for all of 2025 were up 1.5% YoY compared to 2024, the largest annual increase since a 6.6% gain in 2021.

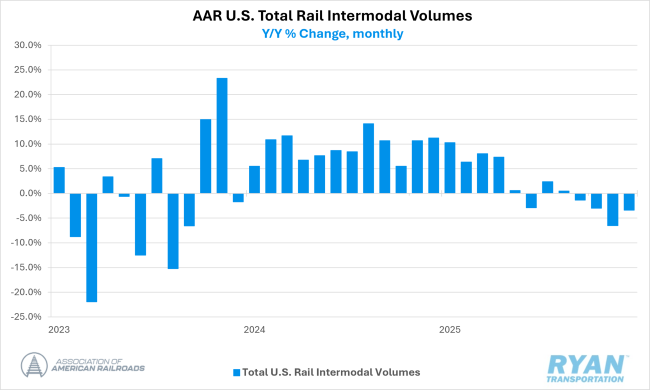

Association of American Railroads (AAR) Total U.S. Rail Intermodal Volumes

Key Points

- Total U.S. rail intermodal shipments continued their streak of declines in December, dropping 3.4% YoY compared to December 2024, while overall container and trailer volumes for 2025 were up 1.5% YoY compared to total 2024 volumes.