Back to January 2026 Industry Update

January 2026 Industry Update: U.S. Economy

- Domestic manufacturing activity contracted at a faster pace in December while demand indicators improved slightly but still remain in contraction territory.

- Holiday spending increased 4.7% YoY as overall card spending grew on both a monthly and yearly basis in December.

Summary

Domestic manufacturing activity continued to contract in December, with the PMI® falling to its lowest reading of the year amid sustained pressure on new orders. The share of manufacturing GDP in contraction and strong contraction rose further, reaching 85% and 43%, respectively, underscoring the breadth of weakness across the sector. In contrast, the initial estimate of U.S. real GDP for Q3 showed its strongest growth in two years, expanding at an annualized rate of 4.3% following a 3.8% increase in Q2 2025, driven primarily by resilient consumer spending and a continued pullback in imports. Within the housing sector, single-family housing starts declined in October to their lowest level since May 2020, while new home sales edged slightly higher in November but remained well below historical norms, signaling ongoing fragility in residential construction activity.

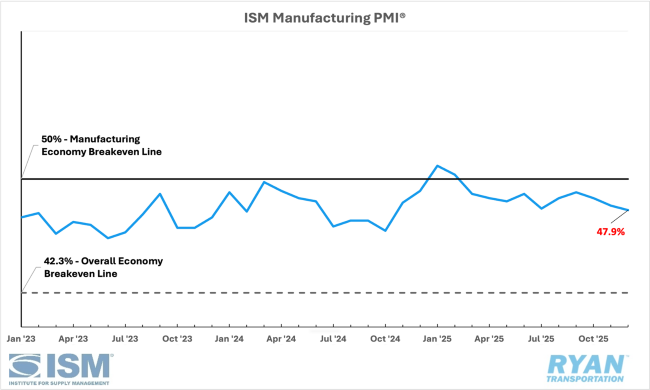

United States ISM Manufacturing PMI

Key Points

- Domestic manufacturing activity remained in contraction territory in December, according to the latest Institute of Supply Management® (ISM®) Manufacturing PMI® Report. The headline PMI® reading of 47.9 signaled an acceleration in the pace of contraction relative to November’s 48.2 reading and fell short of the consensus expectation of 48.3.

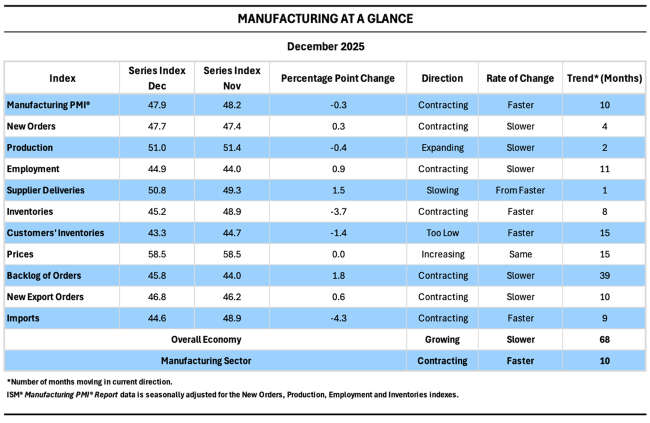

Manufacturing at a Glance

Key Points

- Demand indicators showed modest improvement in December but remained firmly in contraction territory, while the Customers’ Inventories Index moved further into “too low” territory — an outcome that is typically viewed as supportive of future production growth. Of the six largest manufacturing industries, only Computer & Electronic Products registered expansion during the month.

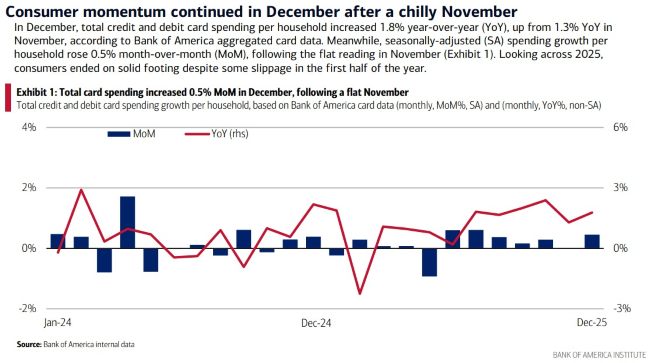

Bank of America Consumer Checkpoint, Total Card Spending

Key Points

- Household spending increased 0.5% MoM in December and was 1.8% higher YoY, according to Bank of America’s most recent Consumer Checkpoint report. The acceleration in spending was disproportionately driven by higher-income households, which recorded 2.4% YoY growth in December, compared to just a 0.4% increase among lower-income households.

Outlook

The implications of trade policy in 2026 remain central to the manufacturing sector’s recovery outlook, as the pace of business investment will largely depend on improved regulatory clarity and the cost of capital. With inventory levels substantially drawn down following the holiday season, restocking activity could support stronger import demand in the first quarter, though tariff-related cost pressures risk exacerbating inflation and weighing on affordability in the year ahead. Offsetting these headwinds, higher tax refunds in 2026 may bolster discretionary spending across income cohorts, potentially sustaining consumer demand despite the more cautious tone reflected in recent forecasts and survey data.